First published in October 2023.

There has been a lot of noise in the past few months about the changes that are being made to the South African retirement system and what those changes mean for retirement savings. However, these legislative amendments have not yet been finalised and some of the details for the so-called “two-pot system” may be adjusted. In part 2 of our Two-pot chapter, Jaya Leibowitz discusses what we know for now, following the release of National Treasury's latest draft response document on 25 October 2023, the publication of the Draft Revenue Laws Amendment Bill on 1 November and the parliamentary debates which followed.

Splitting contributions

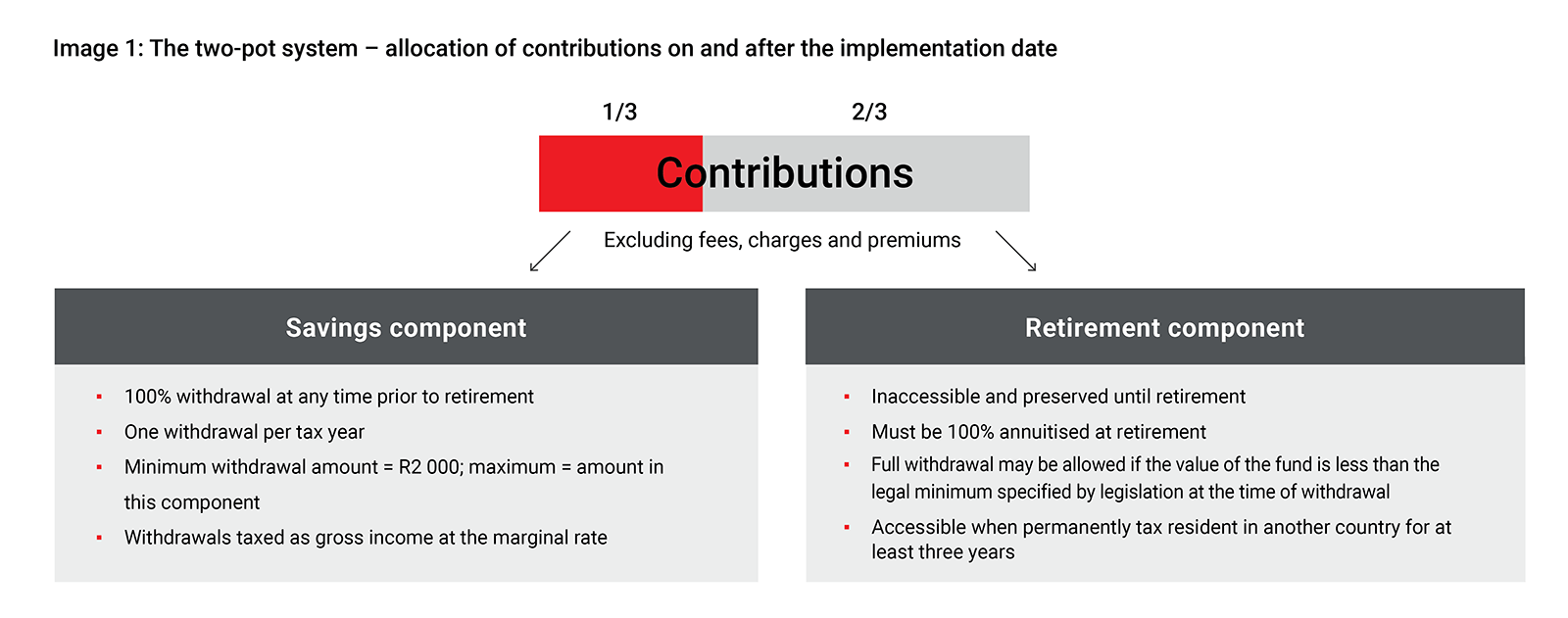

From the implementation of the new two-pot system, which National Treasury and Parliament's Standing Committee on Finance have agreed will be from 1 September 2024, rather than 1 March 2024 or 1 March 2025 as stated in the draft legislation, all contributions to provident, pension and retirement annuity funds, including the Allan Gray Retirement Annuity Fund and Allan Gray Umbrella Retirement Fund, will be split into two components: One-third of the contributions will be credited to a “savings component” and the remaining two-thirds will be credited to a “retirement component”, as shown in Image 1.

The savings component is intended to provide accessibility for members in the event of an emergency where no other funds are available. At any time prior to retirement, members will be entitled to access a withdrawal of up to 100% of the amount that has been accumulated in the savings component, subject to a minimum withdrawal of R2 000. This “savings withdrawal benefit” will be limited to one withdrawal per tax year. Importantly, the savings withdrawal benefits will be taxed at the member’s marginal income tax rate in the year of withdrawal. (For a better understanding of how this benefit may impact your retirement savings, please refer to The two-pot system and your savings withdrawal benefit.)

The retirement component will be inaccessible before a member retires. The total amount in this component must be used to purchase an annuity-providing product at retirement, such as a living annuity or guaranteed life annuity, which will provide the member with an income after they retire. The amount to the credit of the retirement component will only be accessible in cash in three instances: (1) if the member has ceased to be a South African resident for a continuous period of three years; (2) if the member left South Africa on expiry of a work or visit visa; or (3) if the amount in the member’s retirement and vested components in the fund are less than an amount prescribed by legislation (currently R247 500).

Existing retirement fund savings

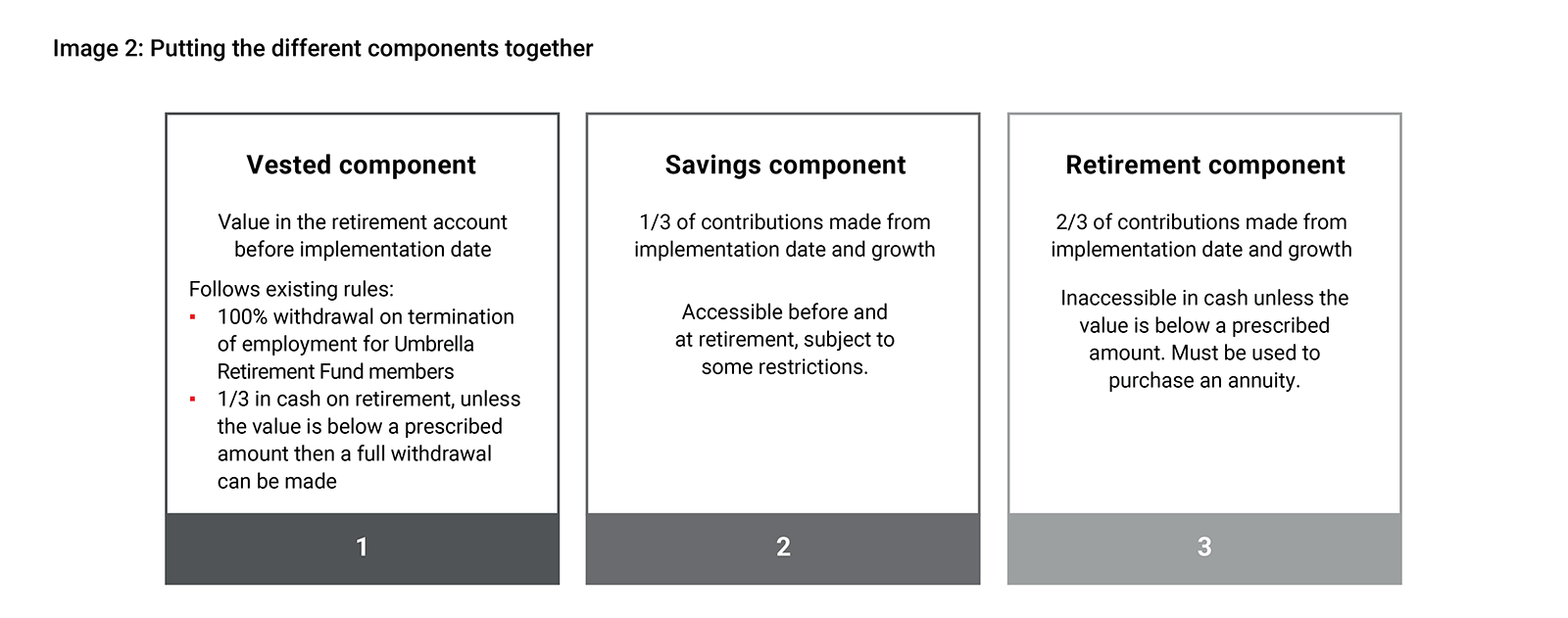

Any savings that a member has in a retirement fund immediately prior to the implementation of the two-pot system will be credited to a “vested component”, as shown in Image 2. The current rules that apply to the member’s savings will continue to apply to the vested component. Members will still be able to access withdrawal benefits and cash on retirement, subject to the current restrictions. These cash benefits will continue to be taxed in the same way as they are currently.

Members of provident funds who were 55 and older on 1 March 2021

Members of provident funds who were 55 or older on 1 March 2021 and have vested rights related to their ongoing contributions to that provident fund will be treated differently from other retirement fund members. These individuals will have a choice as to whether or not they want to participate in the two-pot system. The most recent draft of the legislation excludes these individuals by default. Where such a member does not actively elect to participate in the two-pot system, their contributions will continue to be credited entirely to the vested component and the current rules will continue to apply.

Immediate accessibility

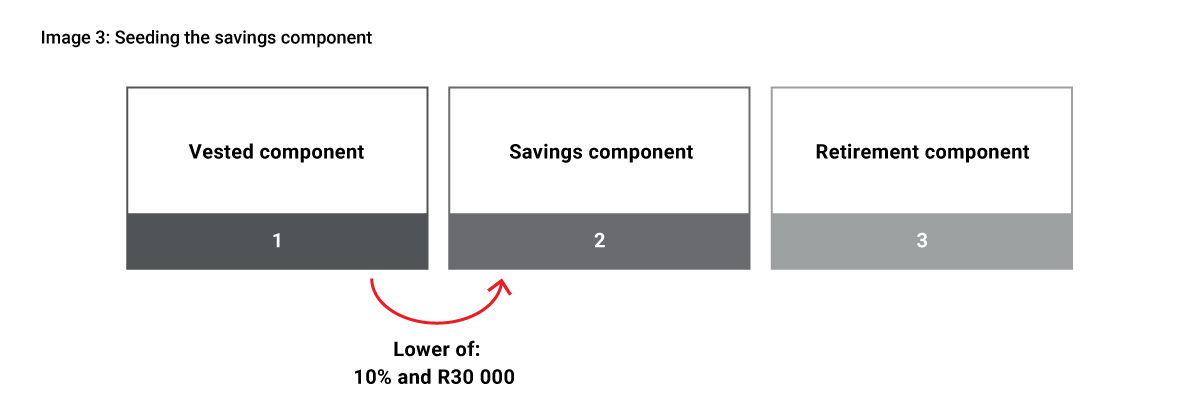

To give members who need it access to cash, 10% of the amount in a member’s vested component, subject to a maximum of R30 000, will automatically be transferred to their savings component on the implementation date of the two-pot system (see Image 3). Certain types of members, such as members of provident funds who were 55 and older on 1 March 2021 and do not elect to participate in the two-pot system (as discussed above), and certain types of retirement funds will be excluded from this automatic transfer.

Implementation date

Although National Treasury and Parliament have agreed on a start date of 1 September 2024, draft or final legislation confirming this date has not yet been published. Allan Gray is in the process of developing its systems and processes to cater to the new legislation from 1 September 2024 and will ensure that members who want to access a savings withdrawal benefit will be able to do so.

We have been engaging with National Treasury and the South African Revenue Service around the details of the changes that still need to be confirmed and finalised and will keep clients and advisers updated as new developments arise.

This article is part of our Two-pot chapter. You can access the full series here.

Visit this page to learn more about the two-pot retirement system.