Step into the future to find out why you should save for retirement.

The South African government’s old age grant is around R1 900 per month. Could you live on that?

This amount is less than many of us currently pay towards our cars, or a monthly grocery shop, or a weekend getaway. Unless you think you can survive on this meagre amount, there is no time like the present to start saving for your retirement.

While retirement may seem like a goal too far in the future to affect you if you are under 30, or you may feel like you have missed the boat if you are over 40, our 10-part retirement savings series will answer the question of why you should save for retirement and aims to help you to get started – regardless of your age and life stage.

Is your future a priority?

Between bond or rent, car repayments, schooling and day-to-day survival, there are so many things competing for a piece of the salary pie it is no wonder that saving for retirement falls off the priority list. And once we are done with the monthly expenses, the needs and wants of our current selves take priority over our future selves. We are victims of our instant gratification culture.

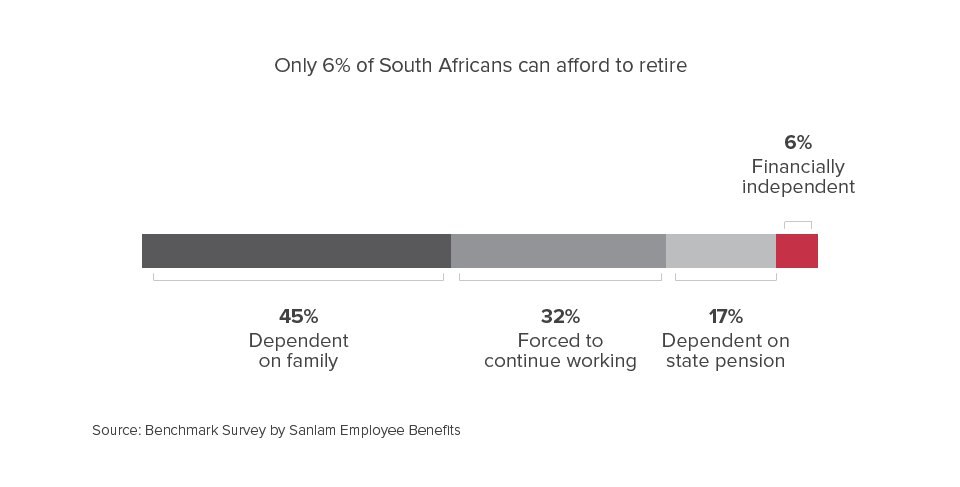

The local statistics are very scary: according to the Sanlam Benchmark Survey, only 6% of South Africans will be financially independent when they retire; the rest will depend on family or the state pension, as displayed on the graph.

Put yourself in the shoes of your future self

We tend to invest in our bodies and minds, following health and wellness advice, without appreciating the importance of directing some of this spend towards saving. Consider yourself in the future: older, but grateful that you exercised regularly and drank plenty of water and thankful that you took calcium to strengthen your bones and used lotions and potions to slow the ageing process. Imagine how grateful you will be if there is enough cash in your bank account to allow you to maintain your current standard of living when you are too old to work.

It is hard for all of us to have empathy for our ageing selves, but this seems to be particularly challenging for Millennials (i.e. anyone born between 1980 and 2000).

Goldman Sachs notes that tech-savvy Millennials are poised to reshape the global economy; they have a different set of priorities and expectations from previous generations. However, as many are encumbered with student debt, or still living with their parents and putting off marriage and parenthood, a distant goal like saving for retirement is very far off their radar.

If you fit into this age group it’s not all bad news: you are exercising more, eating smarter and smoking less. This is great – but makes it even more important to put saving on to the radar as your healthy ways are likely to promote longevity, meaning you are likely to live longer and have more years to provide for yourself post retirement.

Saving feels like giving money to a stranger tomorrow, rather than spending on ourselves today

One of the key barriers to saving for retirement (we will explore others in part 2 of the series) is that we find it very difficult to connect with our future selves on a personal level. Our behaviour reflects the fact that we see our future self as a stranger. Psychologists explain that, for people estranged from their future selves, saving is like a choice between spending money today or giving it to a stranger years from now.

How to empathise with your future self

One study found that participants who were exposed to a vision of their future selves allocated more than twice as much money to their retirement savings. Visualisation is a simple technique used by numerous achievers – from sportsmen to politicians. Its proponents claim that by visualising an outcome we see the possibility of achieving it and are more motivated to pursue our goals.

Spend a few minutes trying to visualise what you will look like in the future, and the life you hope to be living, before you make financial decisions.

This article forms part of a series that you can access here.

Find this article useful? Please let us know.