In February 2021, the National Treasury announced its intention to amend the retirement fund system in South Africa with the dual aim of creating limited access to retirement fund assets to help savers cope with short-term emergencies, and improving the preservation of retirement savings. The proposed new structure is called the “two-pot retirement system”. The goal of the new system is to allow access for those who need money to survive and to improve outcomes for pensioners. Richard Carter discusses the issues in the current system and explains how the proposed changes will aim to address these. You can also listen to a podcast on the subject, which is available here.

Under the current regime, if a member of an occupational pension or provident fund leaves their job, they are able to withdraw the full balance of their savings in the fund, subject to tax. Sometimes this money is desperately needed, especially when an employee is dismissed or retrenched and has no other source of income. However, even when changing jobs with no reduction in income, the vast majority of South Africans choose to cash out their pension or provident fund savings. While the funds may be going towards pressing and valid needs, the result is that most South Africans get to retirement with woefully little capital built up in their retirement funds and not much to fall back on in terms of other savings or assets.

COVID-19 highlighted the existing issues

The COVID-19 pandemic and associated lockdowns forced many around the world into economic hardship. Several countries responded with measures to supplement incomes so that people who were out of work could continue to provide for themselves and their families. In some instances, this included allowing people some form of access to their accumulated savings in their retirement fund accounts. Importantly, in most cases, these countries did not historically allow access to these funds prior to retirement, on retrenchment or resignation. This meant that there were meaningful assets accumulated and the exceptional access could be justified.

There were calls in South Africa to allow similar relief, but this didn’t make sense with full access already being available to pension and provident fund members on retrenchment or resignation.

This situation highlighted a twin problem: Retirement savings are inadequate, and access is skewed only to loss of employment; no access is available for other emergencies.

Overall, we believe that the proposed changes are a positive step towards meeting short-term needs and enhancing benefits at retirement.

Every past attempt to fix this problem by enforcing preservation of retirement savings has been met with resistance. The two-pot system is a bold attempt to address these issues.

So, what’s changing?

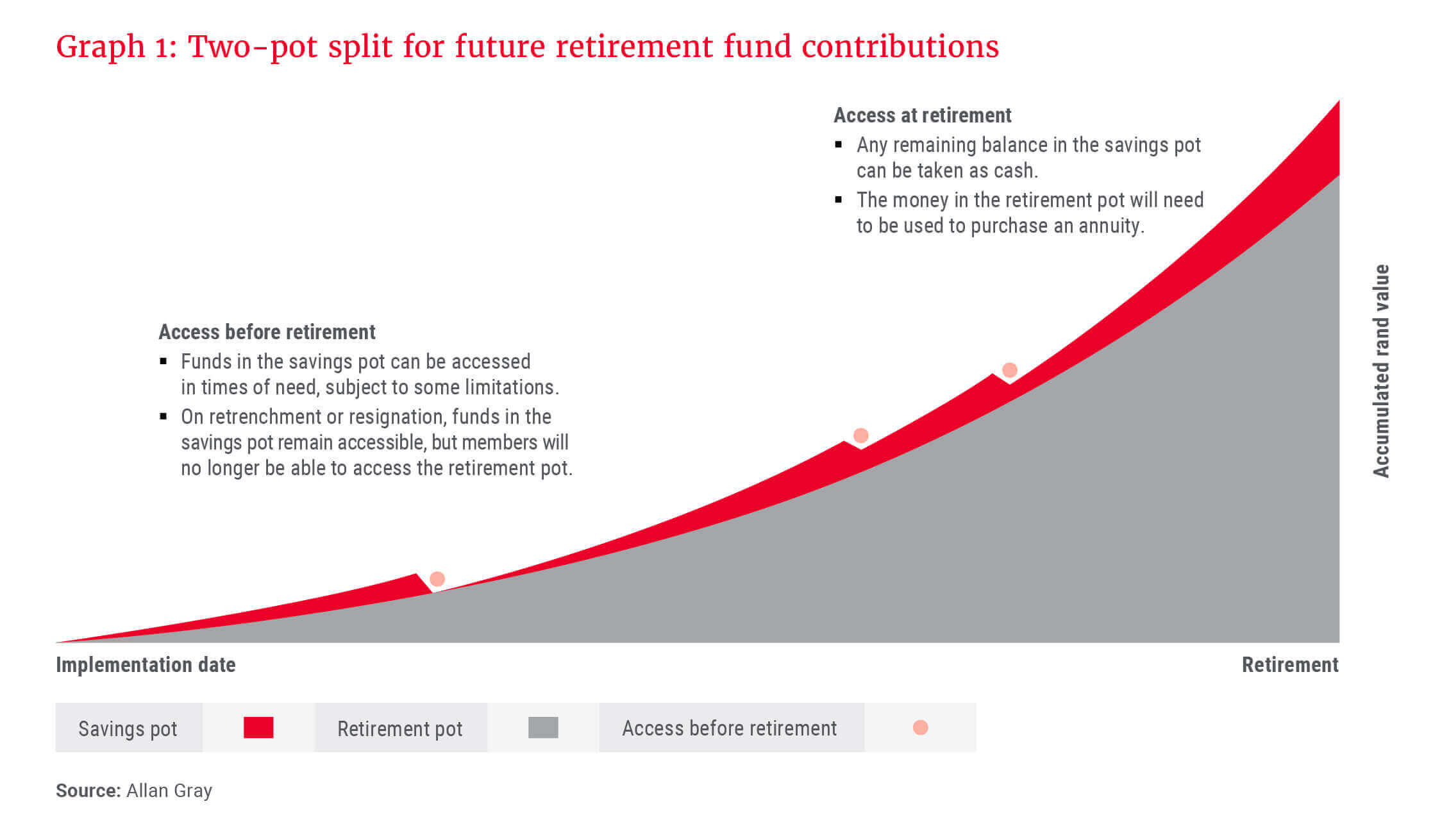

While some details are still in flux, from the implementation date of the new system (currently set for 2024), it will be compulsory for all retirement funds to split contributions received between two notional “pots”. One-third of contributions will be allocated to a pot that allows early access, currently called the “savings pot” (see Graph 1). The money in this savings pot will be available at any time, subject to some limitations (for example, a minimum amount which will need to be withdrawn and a maximum of one allowable withdrawal per rolling 12-month period). At retirement, whatever is left in this pot will be available as a cash lump sum. This means that, effectively, every withdrawal taken before retirement can be seen as an acceleration of the cash benefit available at retirement.

The other two-thirds of contributions will be allocated to a “retirement pot”. This portion will have to be used to purchase an annuity at retirement.

These changes will only apply to contributions made from the implementation date. Contributions made up until the implementation date, plus all growth on those contributions, will remain in the existing or “vested pot” and will still be subject to all the rules and entitlements that apply today.

Current rules that allow small balances to be taken in cash at retirement, rather than as an annuity, will continue to apply to the amounts that are subject to annuitisation, i.e. the new retirement pot and two-thirds of the vested pot.

How will retirement annuities be treated?

Because there is no employer relationship in a retirement annuity (RA), the member does not exit the fund when they lose or change their job. RAs currently provide no early access to funds. The changes contemplated will apply to RAs as well. This means that, in future, RA members will receive the same treatment as occupational fund members, including the envisaged rights of early access.

What about the tax?

We all know that one of the main reasons people use retirement savings vehicles is the tax break available on contributions. There is a genuine tax incentive, as all investment returns in a retirement fund are earned tax-free and, for most members, the tax rate paid on and in retirement is lower than the tax break received on contributions.

… if a member contributes to a retirement fund and then withdraws the money again, it will be tax-neutral … This should be a fairer system.

Currently, when a member withdraws funds before retirement, these are taxed according to a withdrawal tax table. When a member retires, the cumulative value of previous withdrawals is taken into account in working out the tax they will pay on any cash lump sum taken. With the new two-pot system, this will change. The current tax regime will still apply to the vested pot, but withdrawals from the new savings pot will instead be treated as additional income. This means that if a member contributes to a retirement fund and then withdraws the money again, it will be tax-neutral – the tax deduction received on the contribution will equal the tax paid on the withdrawal. This should be a fairer system.

What will the changes mean for the retirement landscape?

At first, very little – all accrued savings and rights up until the date of implementation will remain intact. For example, six months after implementation, a member will have six months’ worth of their contributions split into the two new pots. The smaller, one-third savings pot will start to build up gradually and a member can withdraw from this pot at any point. Over time, the amount in the two-thirds retirement pot will build up. For most people, for the first few years after the change, the bulk of their retirement savings will still be in the vested pot. As mentioned, this pot will continue to operate under the current rules.

As time passes, the amounts in the two new pots will grow and, slowly, the characteristics of the entire system will change. What will this look like? There will potentially be more frequent, but smaller withdrawals, i.e. less clearing out of all the member’s retirement fund savings. Gradually, there will be bigger overall balances at retirement, with smaller cash lump sums at retirement. In time, if the system is implemented as envisaged, average replacement ratios (the ratio of post-retirement income to preretirement income) for people retiring could double, resulting in better retirement outcomes for pensioners.

What are the risks?

The obvious drawback is the increased complexity in the system. Every set of changes is a layer on top of an already complex system. Increased complexity increases costs and risks, but also makes it harder for people to understand how everything works and do their own planning.

While we believe the changes will be an improvement, the test will be in how the system withstands another crisis. Will the requirement to preserve a minimum of two-thirds of what is saved make it through good times and bad?

Changing the rules around preservation and access to cash will not be a panacea; the retirement fund system cannot solve many of society’s pressing needs. While a robust savings pool should contribute to economic growth, it doesn’t by itself solve the unemployment problem: If people don’t even have jobs, how can they save for retirement?

What is still up in the air?

These proposals have been introduced in parliament and approved in principle; however, the legislation is still being considered and still needs to be finalised, taking into account the responses received during a period of public consultation. One of the most contentious issues is that of “seeding”. Seeding would involve allowing people to take some of the funds that have accumulated in their vested pot prior to the new system being implemented and to transfer those funds to the new two-pot system, thereby allowing some immediate access to historic funds. While there could be merit in allowing this, if the seeding is too generous, the cost in terms of leakage from what has been saved to date could be material.

While a robust savings pool should contribute to economic growth, it doesn’t by itself solve the unemployment problem: If people don’t even have jobs, how can they save for retirement?

With the previous round of changes, implemented on 1 March 2021, when the rules applying to pension and provident fund members were aligned, people over the age of 55 were excluded. The rules applying to this age group’s retirement savings remained in place, meaning that provident fund members who were over 55 on 1 March 2022 do not have to annuitise when they retire (see Upcoming changes to provident and provident preservation funds in our Quarterly Commentary of December 2020). It would make little sense for this group of people to now have to allocate two-thirds of their contributions to a pot which has to be annuitised at retirement, and so the intention is that this group will be excluded again, while being given the choice to opt in to the new system should they so wish.

Perhaps the most obvious thing still to be finalised is when it will all be implemented. As things stand, we are fairly certain that implementation will not be before 1 March 2024, but even that is ambitious, given the pending decisions and approvals.

Overall, we believe that the proposed changes are a positive step towards meeting short-term needs and enhancing benefits at retirement.

Visit this page to learn more about the two-pot retirement system.