The process behind retirement fund death claims is challenging to understand and complex to execute. Sonja Smit discusses how to be better informed as a member, and how to prepare your dependants for what happens if you die prior to retirement.

The purpose of retirement funds is to save for retirement, but when members die prior to retirement, the purpose changes to provision for those who were dependent on the member at the time of their death.

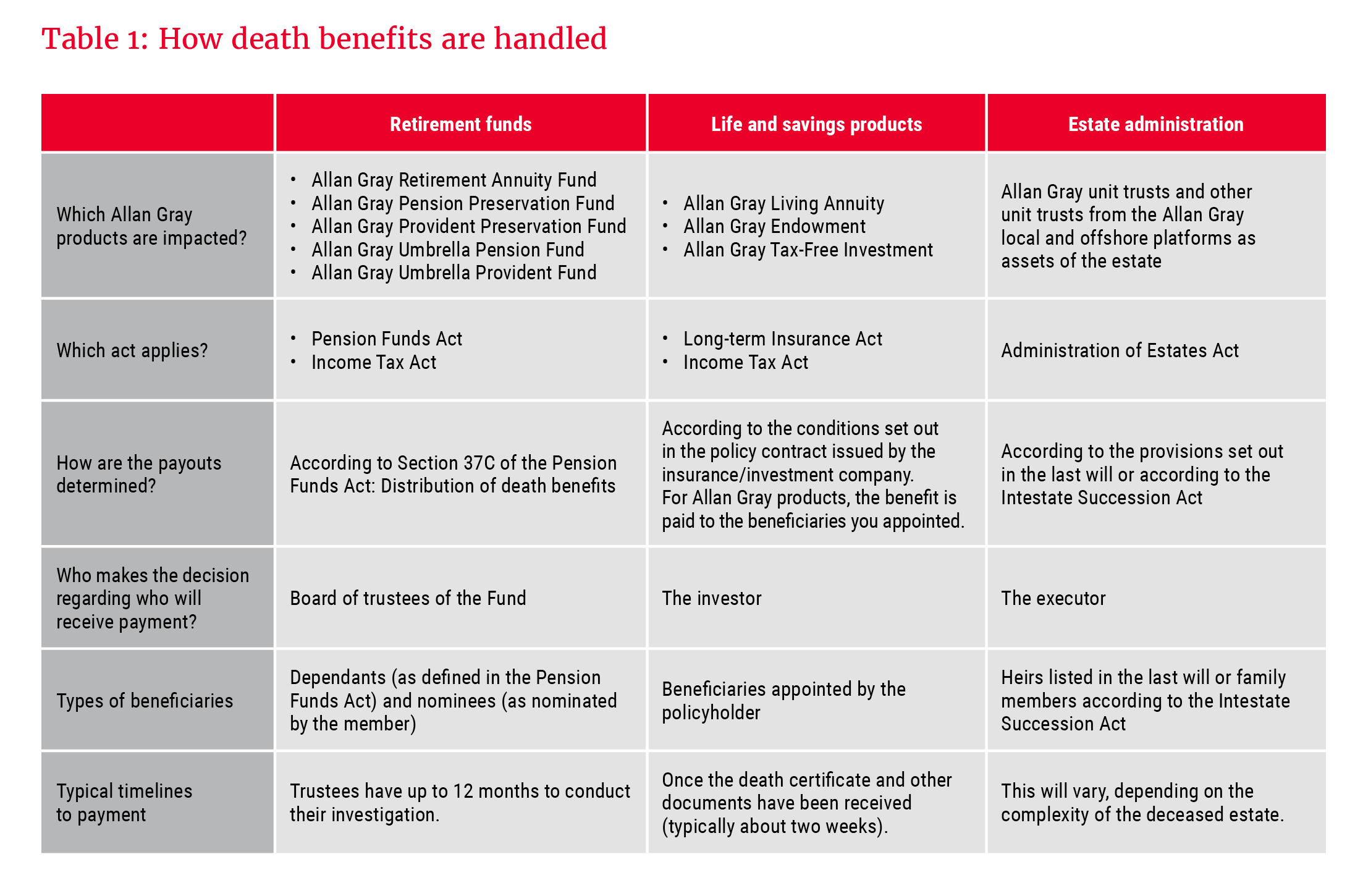

Retirement products are governed by the Pension Funds Act (“the Act”). Other savings products are governed by other legislation and are treated differently when the investor dies, as shown in Table 1. Every retirement fund has a board of trustees, which is responsible for making sure the fund is well governed and that members’ best interests are protected. One of the roles of the trustees is to ensure that a member’s benefit is distributed fairly if they die before they retire.

When it comes to distributing the death benefit, the Act gives preference to dependency. It defines dependants as spouses (which include permanent life partners), children (of all ages, including legally adopted children), anyone proven to have been financially dependent on the member at the time of their death, anyone entitled to maintenance (such as former spouses), as well as those who may in the future have become financially dependent on the member if the member had not died (such as a child born after the member’s death).

It is … important that members provide their fund with comprehensive details of their family circle and nominees, and keep the details up to date

A member may also nominate any natural person, trust or legal entity (nominee) in writing for a possible allocation of the death benefit. They may not nominate their estate.

Nominations are not binding on the trustees; rather, they are an expression of the member’s wishes. At Allan Gray, we apply nominations at membership level, and not at investment account level. For example, a member may have more than one Allan Gray Retirement Annuity Fund account, but the latest nomination received per retirement fund will apply across all investment accounts within that fund.

The fact that a party qualifies as a dependant or a nominee does not entitle them to receive all or a part of the death benefit. However, it does mean that they must be considered by the trustees when allocating the death benefit.

Duties of the trustees

When a member of a retirement fund dies, the Act requires the trustees to identify and trace all dependants and nominees, allocate the death benefit equitably, and decide on the method of payment. Trustees have at least 12 months to fulfil these duties.

Duty 1: Identify and trace all dependants and nominees

The first step trustees take in identifying and tracing a member’s dependants and nominees is to refer to any information the member provided via their application form or subsequent forms submitted. It is therefore important that members provide their fund with comprehensive details of their family circle and nominees, and keep the details up to date.

If contact details are unavailable or outdated, or there is conflicting information or a dispute, the investigation time will be extended. This may mean that dependants in need of this benefit will have to wait longer for payment.

Duty 2: Allocate the death benefit

Once dependants and nominees have been identified, the trustees must allocate the death benefit fairly. Their decisions are based on a number of factors, such as each party’s financial circumstances, their extent of dependency on the member on the date of their death, the nature of their relationship with the member, and the wishes of the member (as set out in their nomination).

If no dependants are found, but nominees (who are not dependants) are listed, the trustees must first establish whether the member’s estate is solvent (i.e. that it has enough money to settle its liabilities). If the estate is solvent, the benefit will be paid to the nominees according to the proportions stipulated by the member. However, if the estate is insolvent, the death benefit must firstly be used to settle the shortfall in the estate. The remaining benefit (if any) will then be paid to the nominees. Legally, the payment can only be made 12 months after the member’s death.

If a member has died of unnatural causes, the allocation of the death benefit will be delayed until it can be confirmed that the member’s death was not caused by any of the dependants or nominees.

If no dependants are found, and the member had not made any nominations, the trustees will pay the benefit to the member’s estate after the 12-month legal waiting period has lapsed.

Duty 3: Decide on the method of payment

The trustees must then decide how the money will flow to the beneficiaries (i.e. paid directly to a bank account held in their name, a natural/legal guardian, caregiver, trust or beneficiary fund).

Beneficiaries are entitled to choose whether to receive their benefit as a cash lump sum, use it to purchase a compulsory living or guaranteed life annuity, or a combination of the two.

For a minor beneficiary, or a major beneficiary who is not able to manage their own affairs, the election must be made by the person who is legally responsible for managing their affairs (i.e. their natural/legal guardian, administrator or curator).

Tax and payment

Lump sums from retirement fund benefits are taxed, so it’s a good idea to warn your beneficiaries about the tax implications. Beneficiaries may request a tax simulation before they complete their payment instruction forms. This will help them to understand the possible tax impact of their decision before they complete their election and payment instructions.

Once the retirement fund’s administrator has received the beneficiaries’ instructions, they will apply for a tax directive from the South African Revenue Service (SARS). SARS will issue a tax directive within 24 hours. It is important to make your beneficiaries aware that payment instructions and tax directives cannot be reversed.

The tax amount (if any) will be deducted from the beneficiaries’ lump sums and paid to SARS. The balance of the lump sums is then paid to the beneficiaries.

Keep your information up to date

Dealing with administration when a loved one has just passed away can be very stressful, and the legally prescribed process that trustees must follow, as described above, can take an extended period to complete. Providing comprehensive information about your family circle and nominations to your fund, and keeping this information up to date, will enable a quicker and easier investigation.

It is also worthwhile to consider making provision for your dependants through a product like a tax-free investment or endowment, which can provide liquidity to your dependants while the retirement fund process is wound up.