According to reports, more than R17bn lies potentially unclaimed in unit trusts and policies. Tim Molloy explains how you can ensure this doesn’t happen to your investments.

According to the Association for Savings & Investment South Africa (ASISA), their member companies united policyholders, beneficiaries and investors with assets worth R8bn in 2018. However, an estimated R17bn in almost 150 000 unit trusts and policies (excluding retirement funds) still needs to be united with legal recipients.

In some cases, investors have passed away and their beneficiaries are not aware of these investments. In other cases, investors may have emigrated and “abandoned” their accounts by not alerting the local company that they have left the country, or did not feel the rand value of the investment was worth the hassle to migrate the funds. It is also possible that some investors have forgotten about their policies and investments, either having lost track of these over time or as a result of diminished mental capacity.

Allan Gray has adopted the enhanced version of the ASISA Standard on Unclaimed Assets, which applies to long-term insurance and unit trust management companies, but not retirement funds. The Standard obliges companies to trace and remind investors of their benefits and assets following appropriate trigger events such as a policy reaching its maturity date, communication to an investor going undelivered, the investor reaching the age of 80, or a period of inactivity on the investment account.

an estimated R17bn in almost 150 000 unit trusts … still needs to be united with legal recipients

In many cases, investors are found alive and well and would like their policies and investments to remain in place. However, if all reasonable tracing efforts have been exhausted and contact has not been made, the investment will be categorised as “unclaimed”. This does not mean the provider can then take ownership of the assets; instead, the funds will be ring-fenced, and where the investor would bear the investment risk, such as in the case of unit trusts and market-linked life policies, Allan Gray will invest the unclaimed assets in line with reasonable expectations.

It goes without saying that no matter how much time has lapsed, providers are legally bound to honour a valid claim should the investor or their beneficiary come forward.

If you suspect you are due an unclaimed asset

If you are the owner of the investment or policy, you must contact the provider directly. It should be a relatively straightforward verification process to prove that you are entitled to the money.

If you are claiming funds from the investment or policy of a deceased person, you should contact the provider with that person’s identity number. Once the provider has confirmed that there is an unclaimed asset, you will be asked to provide documents to support your claim, such as a death certificate and proof that you are indeed a beneficiary.

The process will be more complicated if the investor is still alive, but suffers from diminished mental capacity and therefore cannot manage their investments. In this case, that person’s family or adviser can follow one of two processes: Apply to the High Court to be appointed as a curator, or apply to the Master of the High Court to be appointed as administrator of the incapacitated person’s affairs.

It’s a good idea to communicate with the provider via email so that you have a record of your progress.

When it comes to your assets, plan ahead

The first step to ensure that your loved ones inherit your money after your death is to write a will. A will is a legally binding document that communicates your wishes regarding your estate, which includes the money and assets you own at death. You can leave specific assets to certain individuals and/or entities, as well as name people and/or entities that will receive the remainder of your estate after debts, liabilities and bequests are settled.

If you haven’t written your will already, you can do so with the help of your bank, attorney or financial adviser, or by downloading a standard template. If you die intestate (without a valid will in place), a court will determine whom of your relatives receive your inheritance according to the Intestate Succession Act.

However, a will is just the start. Some investment products (such as retirement funds) are not bound by what you specify in your will. It’s a good idea to familiarise yourself with the claims process so you can plan accordingly for the needs of your loved ones.

no matter how much time has lapsed, providers are legally bound to honour a valid claim should the investor or their beneficiary come forward

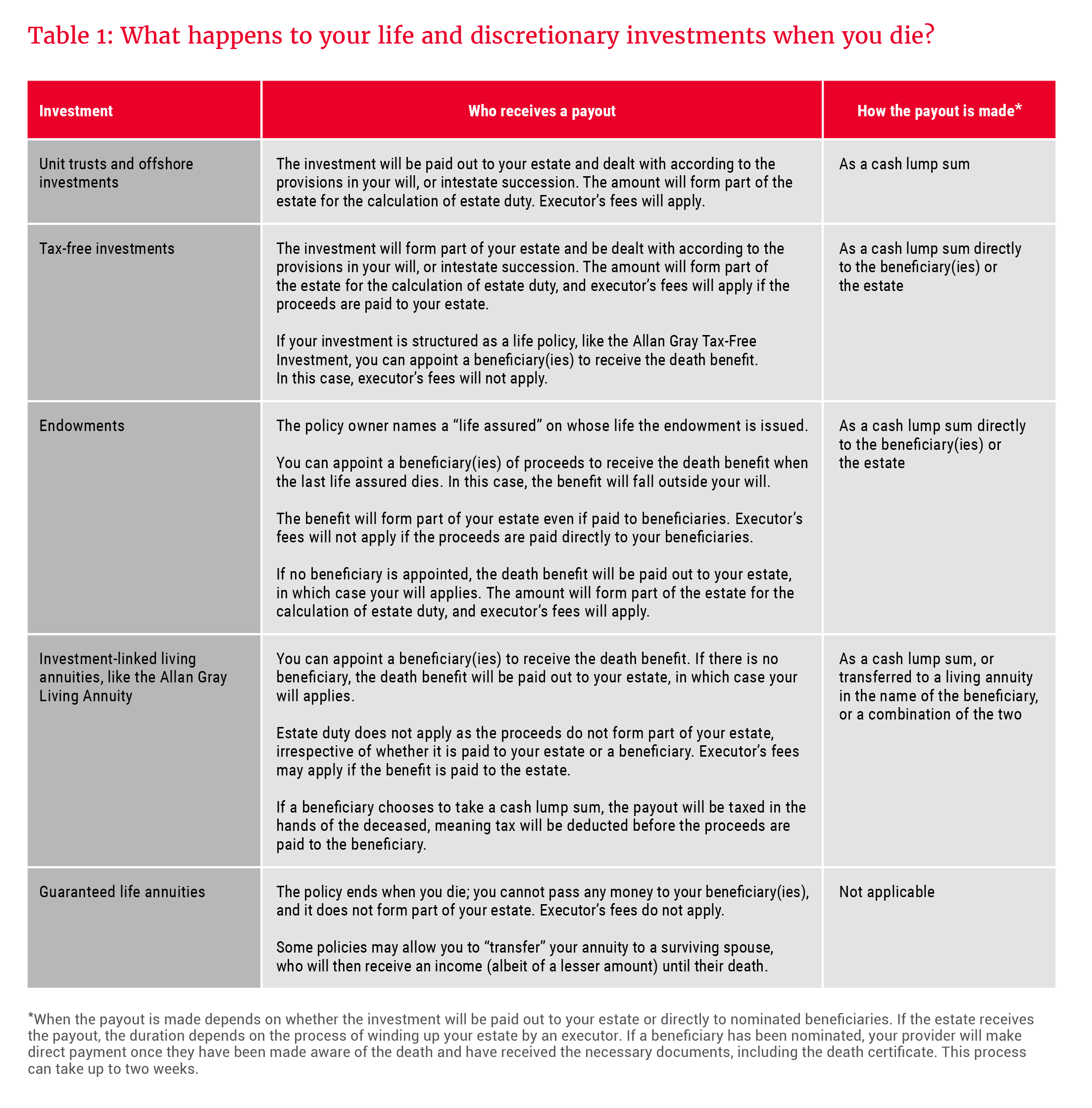

Retirement funds have the most complicated death claims process. You may nominate beneficiaries to receive the death benefit (payout) should you die before retirement, but this is not a guarantee that they will receive a payout as the trustees of the fund are obliged to consider your dependants — anyone who may have been financially dependent on you at the time of your death, or who will be in the future, such as an unborn child. Table 1 explains the death claims process for other investment products.

The benefits of a good financial plan in the event of your death

You should draw up a detailed plan to ensure your wishes for your investments, policies and estate will be honoured after death. However, a financial plan is only half the task; it is just as important to share your plan with your loved ones so that they understand what they will have to do in the event of your death. This is to ensure that the process is seamless and that there aren’t unnecessary delays.

You should also do the following:

- Keep a clear, updated record of all your investments and policies.

- Keep your providers up to date with the names and contact details of your beneficiaries across all your investments and policies to ensure speedy payment of the death benefit.

- Inform your heirs and beneficiaries that you have named them in your will, investments and/or policies, and make sure they have copies of all the necessary documents. It is also a good idea to include the details of your financial adviser and/or executor of your will to help your beneficiaries claim funds.

- If you are diagnosed with a disorder that results in impaired mental capacity, such as Alzheimer’s disease or another form of dementia, you should make appropriate plans regarding your investments and policies while you are still able to do so.