Navigating the complex world of umbrella funds can be likened to steering a ship through choppy waters. Just like a ship’s captain relies on accurate weather forecasting and instruments to chart a safe and time-efficient course, trustees, employee benefits consultants, financial advisers and employers (i.e. the decision makers) need access to the right financial tools and reports to make informed and effective decisions.

Allan Gray, in conjunction with GraySwan Consulting (GraySwan), set out to produce an easy-to-read, factual and independent survey to help decision makers compare default investment options across providers. The Umbrella Fund Default Investments Survey (the Survey) provides in-depth summaries and comparable performance data across umbrella funds’ default investment portfolios. In this article, Belinda Carbutt discusses how the Survey, available via the Allan Gray website, can help decision makers select default investment portfolios and assist them in fulfilling their ongoing fiduciary duties.

Charting smoother waters

Regulation 37 of the Pension Funds Act was legislated back in September 2017 to support retirement investors. This regulation requires trustees of retirement funds to offer “default investment portfolios” to support and protect the investors who may not have the desire and/or skill to develop and assess their own investment strategy. The intention of the regulation is to ensure that trustees act as diligent custodians of members’ investments, aligning investment strategies with members’ long-term needs.

There are currently over 100 registered umbrella funds available in South Africa, each offering at least one default investment portfolio – and in many cases multiple options are made available. Each default investment portfolio has its own nuanced characteristics. Meaningful comparison is thus a complex exercise. It can be a daunting task for decision makers to:

- Select an appropriate default investment portfolio that fits the needs of all their employees as this is not a one-size-fits-all exercise.

- Fulfil the ongoing fiduciary duties associated with monitoring and review. In the case of a retirement fund, fiduciary duties are obligations that sit with decision makers to act in the best financial interests of members and beneficiaries. Part of the duty is to periodically reassess their chosen product provider, the governance of their umbrella fund, the costs paid by members and the performance of their default investment portfolios.

The Survey seeks to support the fulfilment of these responsibilities.

Understanding the waters you are navigating

The Survey is published on a quarterly basis and is periodically expanded in terms of the number of participants and information provided. According to the December 2024 Survey, as per the Financial Services Conduct Authority’s latest Registered Active Funds report, the Survey reports on about 97% of the local umbrella fund industry (based on the assets under management of umbrella funds open to all advisers).

Key navigational pointers

The Survey guides decision makers in several areas, including those highlighted below:

-

Life-staging

Life-staging is a strategy that reduces a member’s exposure to risk assets as they approach retirement. Not all default investment portfolios apply life staging strategies and for those that do, the de-risking periods and profiles differ. The Survey summarises each default investment portfolios’ approach. -

Fee structures

Comparing fee structures across umbrella funds is complex as there is no universal fee methodology in South Africa. The Survey summarises the approach taken by each umbrella fund. -

Gross performance

To compare gross performance across the various umbrella funds, the Survey presents summarised historic performance in both tabular and graphic forms. -

Risk and return metrics

The Survey presents a range of volatility and return scatter plot graphs, generated to reflect various historic investment periods. These graphs highlight how much risk the various assets managers have taken on relative to other providers and the mean, to deliver performance (see below).

Performance at the cost of risk – interpreting the scatter plots

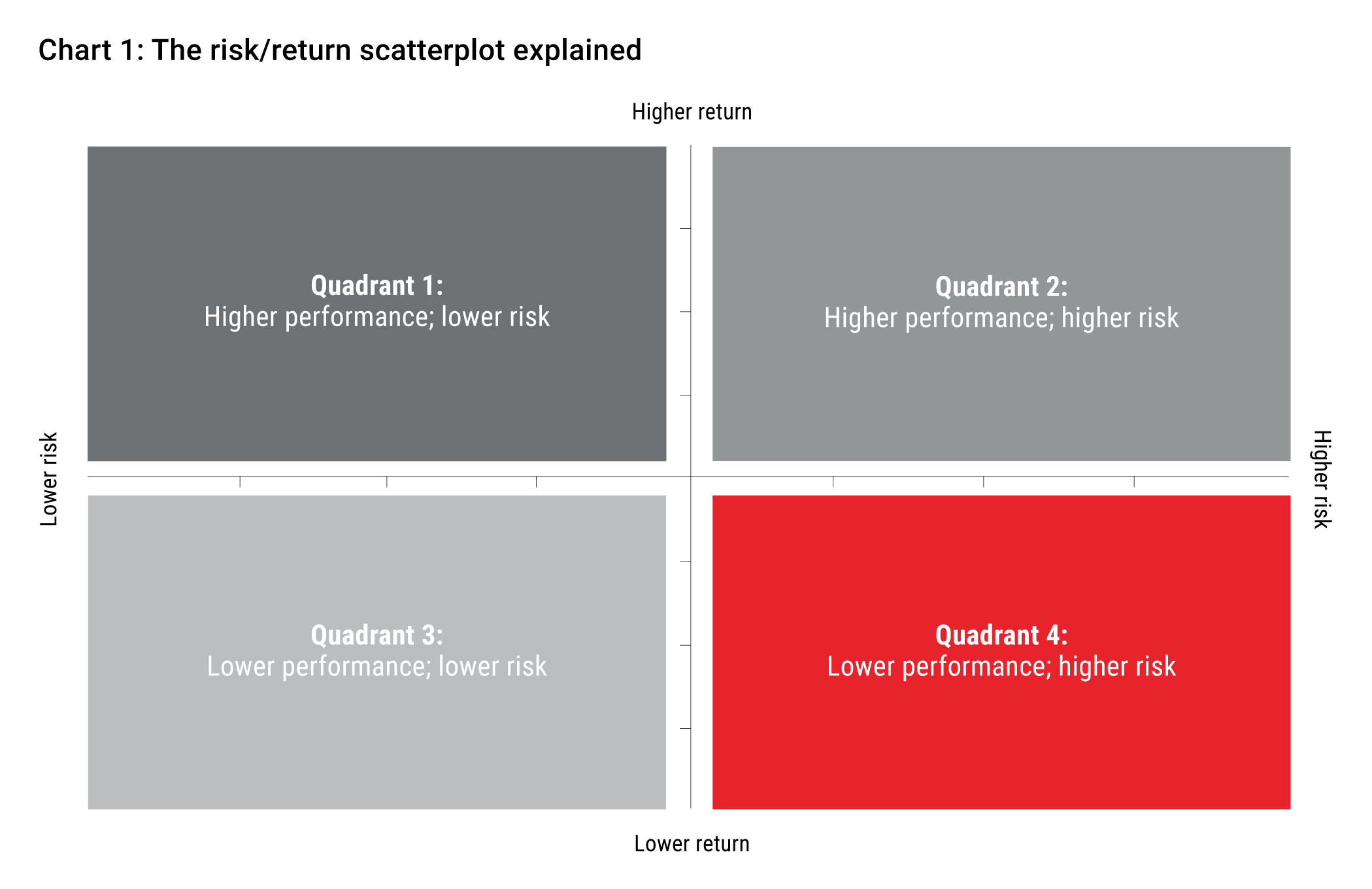

The simplistic 4-quandrant visualisation in Chart 1, which describes the conceptual interplay between risk and return, may be helpful when interpreting the volatility/return graphs included in the Survey.

The centre point represents the median. Ideally, a default investment portfolio in an umbrella fund aspires to be positioned above the horizontal axis (higher-than-average returns) and to the left of the vertical axis (lower-than-average risk/volatility). Therefore, Quadrant 1 is the sweet spot. Portfolios in this quadrant have higher-than-average returns with less-than-average risk for members. Conversely, portfolios in Quadrant 4 have the lowest returns and highest risk.

Portfolios in Quadrant 2 and Quadrant 3 have either lower risk or higher returns, but not both.

Over the 3-, 5- and 10-year timeframes, both of the Allan Gray Umbrella Retirement Fund’s trustee-approved default investment strategies (the Allan Gray default investment strategy and the Multi-manager default investment strategy) have occupied Quadrant 1, displaying higher-than-average returns with less-than-average risk for members than the mean.

Safe passage

Given the importance of upfront decision making, and the ongoing fiduciary duties associated with monitoring and review of decisions, the Umbrella Fund Default Investments Survey is a valuable tool for the decision maker’s toolkit. As mentioned, it is updated quarterly and made available via the Allan Gray website.

*GraySwan is an independent investment advisory company founded in 2010. The core team has been working together for more than 13 years and their collective investment experience exceeds 150 years. More information on the company can be found via the GraySwan website.