For some time now we have been saying that across asset classes, prices are high. Many of you may be wondering whether or not you should be making changes to your investments. Wanita Isaacs discusses the partnership required between you and your adviser on the one hand, and your investment manager on the other, in making a long-term success of investing, through different market cycles.

It's the role of investment managers to deliver the best returns they can within each unit trust's investment mandate

Regardless of current market or economic conditions, our role as investment managers is to select the combination of investments we believe will deliver the best return possible, within the appropriate level of risk for that unit trust. We do this by making judgments about expected risk and return and, since we take a valuation-based approach, by looking for investments that are priced lower than our estimates of their underlying value.

Over time, market prices tend to reflect underlying value. In particular, when markets are overvalued and eventually correct, the resultant negative performance can cause a permanent loss of wealth. In fact, buying undervalued investments has meant that most of our long-term outperformance across our unit trusts has come from preserving investors' capital during periods in which markets have delivered negative returns.

While there are always price differences for investments within an asset class, asset markets as a whole, for example the equity, property or bond market, can each be generally expensive at times. We are better able to find the best value investments in unit trusts, where the mandate allows us to invest in more than one kind of asset, such as our Balanced and Stable Funds. These unit trusts provide a 'solution' for investors by investing across different types of assets, to meet specific objectives. Managers can avoid expensive assets in either local or offshore equity markets - and if everything is expensive, they can retreat to cash. This saves investors having to switch.

The Balanced and Stable Funds' current positioning, illustrates this. Note that the net equity exposure of the Balanced Fund is at 55.8%, lower than its average since inception (62.7%). The Fund's offshore exposure is at its maximum, but almost half of this is hedged, i.e. insured against a fall in international share prices. A significant portion (14%) of the Fund's holdings is in cash, which means that we are able to take opportunities to invest in any of the Fund's asset classes if prices fall.

On the other hand, 'building block' unit trusts, such as our Equity and Money Market Funds, invest in a single asset class. Investors in these unit trusts have to build their own portfolios and decide how much to allocate to each asset class and when to switch or rebalance. We believe solution unit trusts do a better job than building block unit trusts for most investors over the long term.

It's your role to pick a unit trust that you understand and can stick with - based on the unit trust's objective and not its most recent performance

You need to stay invested in the unit trust you have chosen for long enough to benefit from it. But this means that you first have to choose one that you are able to stick with through different market cycles. Therefore, your role, with the assistance of a good, independent adviser if required, is choosing an appropriate unit trust offered by an investment manager whose approach you understand and with whom you can form an investment partnership.

'Appropriate' depends on your unique situation and preferences. The majority of investors prefer to hand over all the investment decision-making, including picking individual shares and other investments and deciding how much to invest in each asset class, to the investment manager. This normally doesn't cost any more in fees - and often costs less than making up your own diversified portfolio of unit trusts. Your unit trust choice should always be based on your investment objectives: your time frame and your ability to stomach risk, balanced with your need to grow your investment.

There are also some sophisticated investors who may not have the time to pick their own individual investments, e.g. stocks or bonds, but who are keen to make their own decisions about when to have more or less of their investment allocated to different asset classes. Some of these investors make good decisions, but on average, switching between unit trusts destroys value.

What should you do when asset prices are high?

There is a human tendency to chase, or run from, past performance by investing when an investment has done well, or switching or withdrawing after it has done badly. Both of these behaviours impact negatively on your returns. If you are (1) with a manager that you understand and trust, (2) in the right 'solution' unit trust and (3) have invested for your long-term needs, you shouldn't need to worry about high asset prices. However, you definitely should take the time to check and re-check that you are in the right solution unit trust for your long-term needs.

Make sure you are invested appropriately

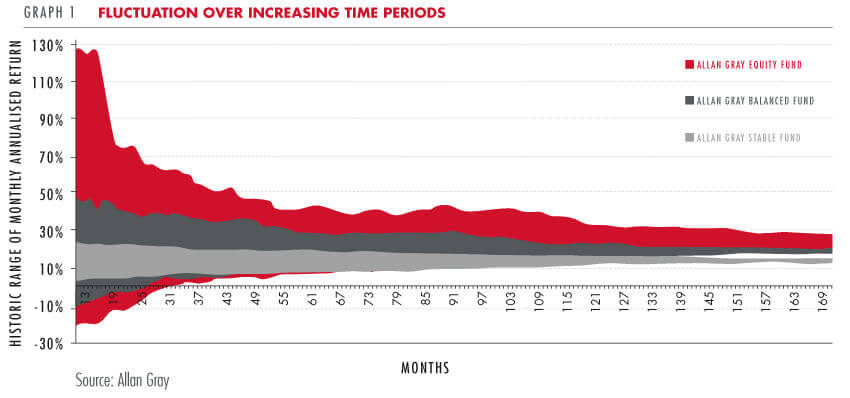

Graph 1 shows the historic range of returns experienced by investors who invested in the Allan Gray Equity, Balanced and Stable Funds, over different lengths of time, measured in months. The graph starts with a period of one year (12 months) - i.e. it shows the range of return outcomes experienced by investors that invested in each unit trust for a period of one year, and periods longer than a year. The red area shows that, historically, investors who have been invested in the Equity Fund for any period of up to 17 months could have experienced a wide variation of returns. As the length of time investors remained invested increased, towards the right of the graph, the range of returns decreased. For example, investors who were in the Fund for 30 months or more always received positive returns. The dark grey shows the narrower range of returns for the Balanced Fund and the light grey shows the more consistent return delivered by the Stable Fund over any time period.

Since benefiting from a unit trust's long-term return means experiencing its short-term return, make sure you are comfortable with what might be in store before you invest.