In the February 2022 Budget speech, the National Treasury announced significant changes to the framework that governs how much of South African retirement savers’ portfolios can be invested outside South Africa, opening the door for additional foreign exposure. This is positive for South African investors over the long term, as it allows for greater diversification and flexibility to benefit from the global opportunity set. But should you use the full allocation right now? Earl van Zyl investigates.

Retirement and local unit trust investors are now able to allocate up to 45% of their portfolios anywhere outside South Africa, from the previous offshore limits that allowed 30% outside Africa, plus 10% in Africa excluding South Africa (“ex-SA”), for a theoretical maximum of 40%. While the increase in the total allowed outside South Africa on paper is only five percentage points, in reality, most investors previously held less than 5% in Africa ex-SA. In practice, the recent change will mean that most investors can now invest an additional 50% of their portfolio offshore.

Why is offshore investing important?

Put simply, the ability to allocate to offshore markets presents long-term investors with an opportunity to better diversify the risk exposure of their investment portfolios and to enhance returns so that they reach retirement with a larger savings pot. Of course, diversification isn’t simply about going offshore; as with local investing, investors should consider blending asset classes that typically do not move in sync (i.e. their returns are not perfectly correlated) so that portfolio returns are protected when one asset class performs poorly and higher returns should come from other parts of the market, which should make it easier for investors to stay the course.

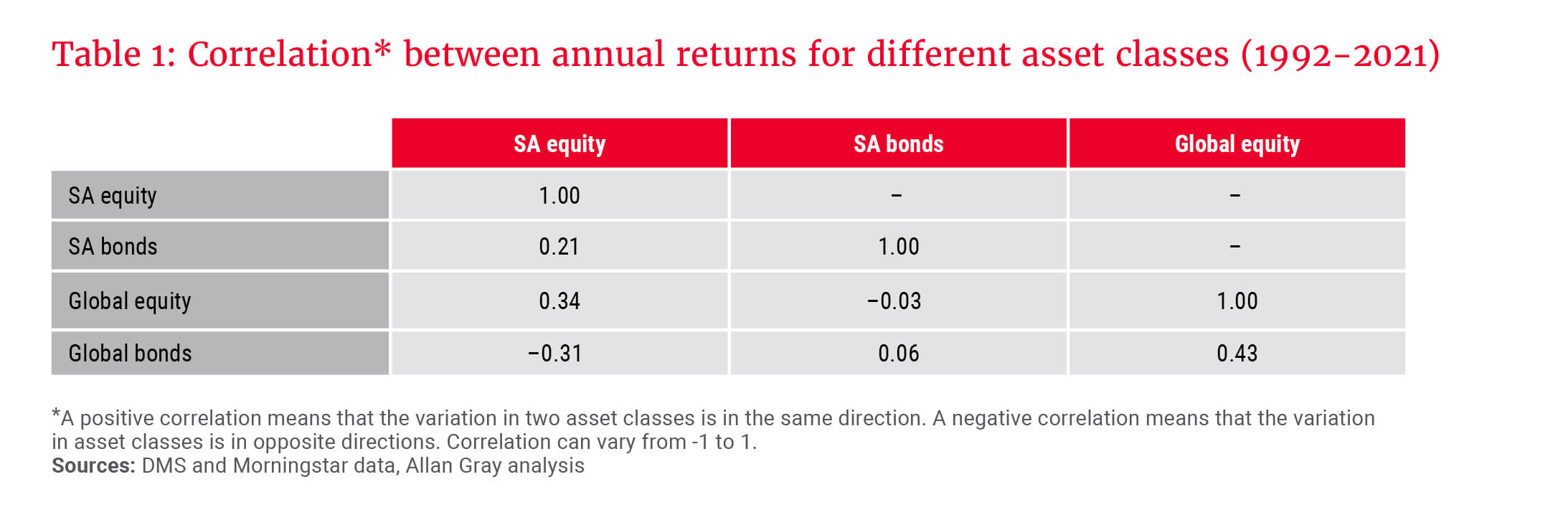

Table 1 shows the correlation between real returns for South African and global equities and bonds over the last 30 years.

Here we see that having a portfolio that is diversified across the major asset classes is likely to be a good approach over the long term, as no asset class is perfectly correlated with another, as one would expect. However, the key insight from this table is that there are benefits to allocating offshore both within one’s equity portfolio and one’s bond portfolio over the long term. South African equities and bonds had a low correlation with their global equivalents, and an even lower correlation across asset classes – e.g. South African equities had a correlation of 0.34 with global equities and -0.31 with global bonds.

From the discussion so far, we can say that diversification away from one’s home market is a valuable portfolio construction tool that most investors should be using.

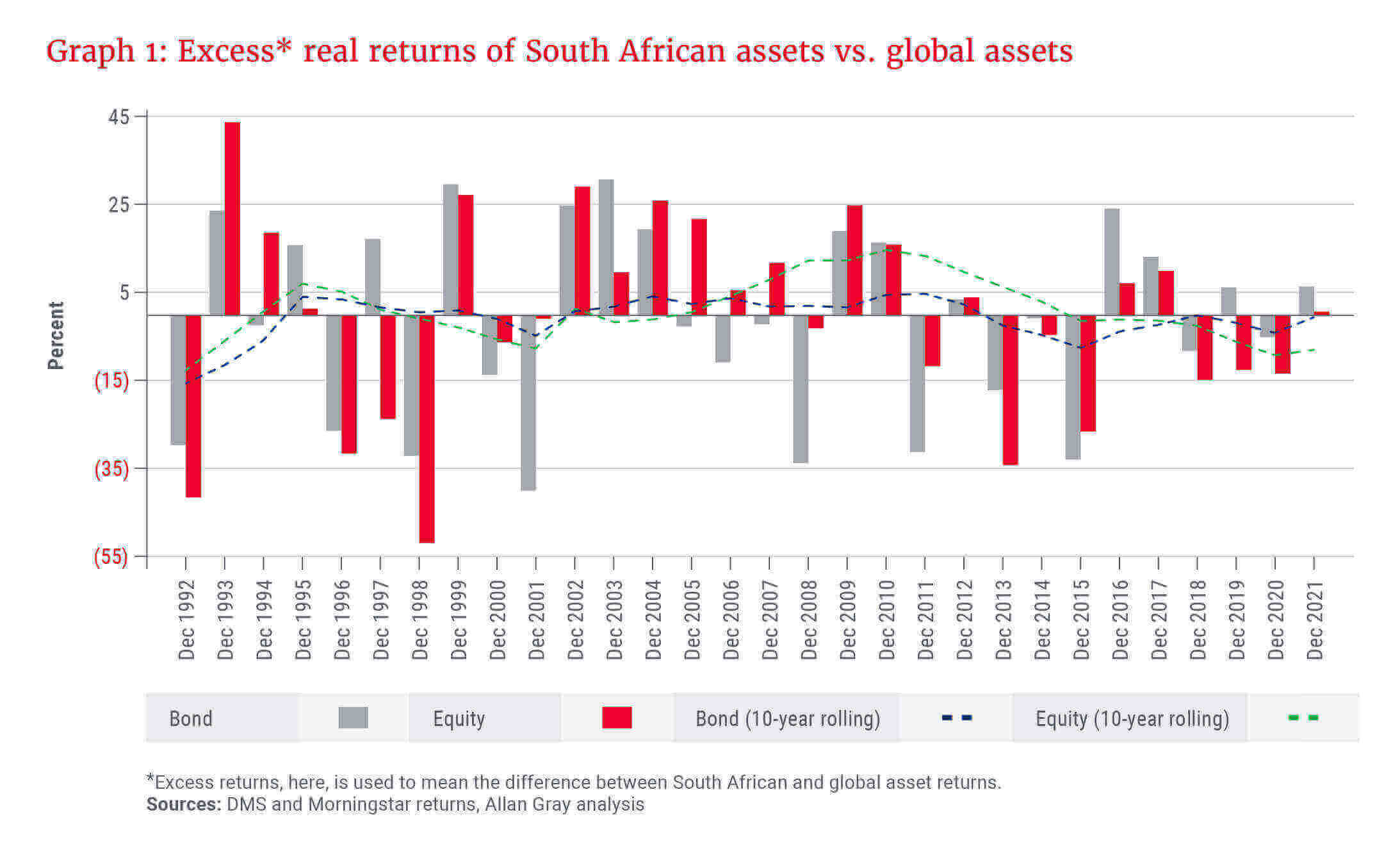

Graph 1 shows the difference (or excess) in annualised real returns (in rands) between South African and global asset classes delivered up to the end of 2021, summarised annually (bars) and over a rolling 10-year period (lines) for the last 30 years.

As the graph illustrates, excess returns are cyclical, with South African equities having generated sustained excess returns versus global equities from 1993-95, 2002-07, 2009-10 and 2016-17. Although excess returns in 2021 were 0.9%, over 10 years investors would still have been worse off by 8% per year had they invested only in South African equities versus entirely in offshore equities. Excess returns from bonds have been similarly cyclical, though within a narrower range over most of the period.

The outcome in equities excess returns over the last five years provides some evidence for the rhetoric in the media over the recent past about investing offshore rather than in South Africa. However, as we have already noted, investing is cyclical, and decisions today about how much of your portfolio should be invested offshore, and into which offshore assets, should not be made with simple extrapolations from the past into the future. Nevertheless, the long-term data bears out that investing offshore improves portfolio diversification over time and enhances the opportunity set for generating real returns.

How much should one invest offshore?

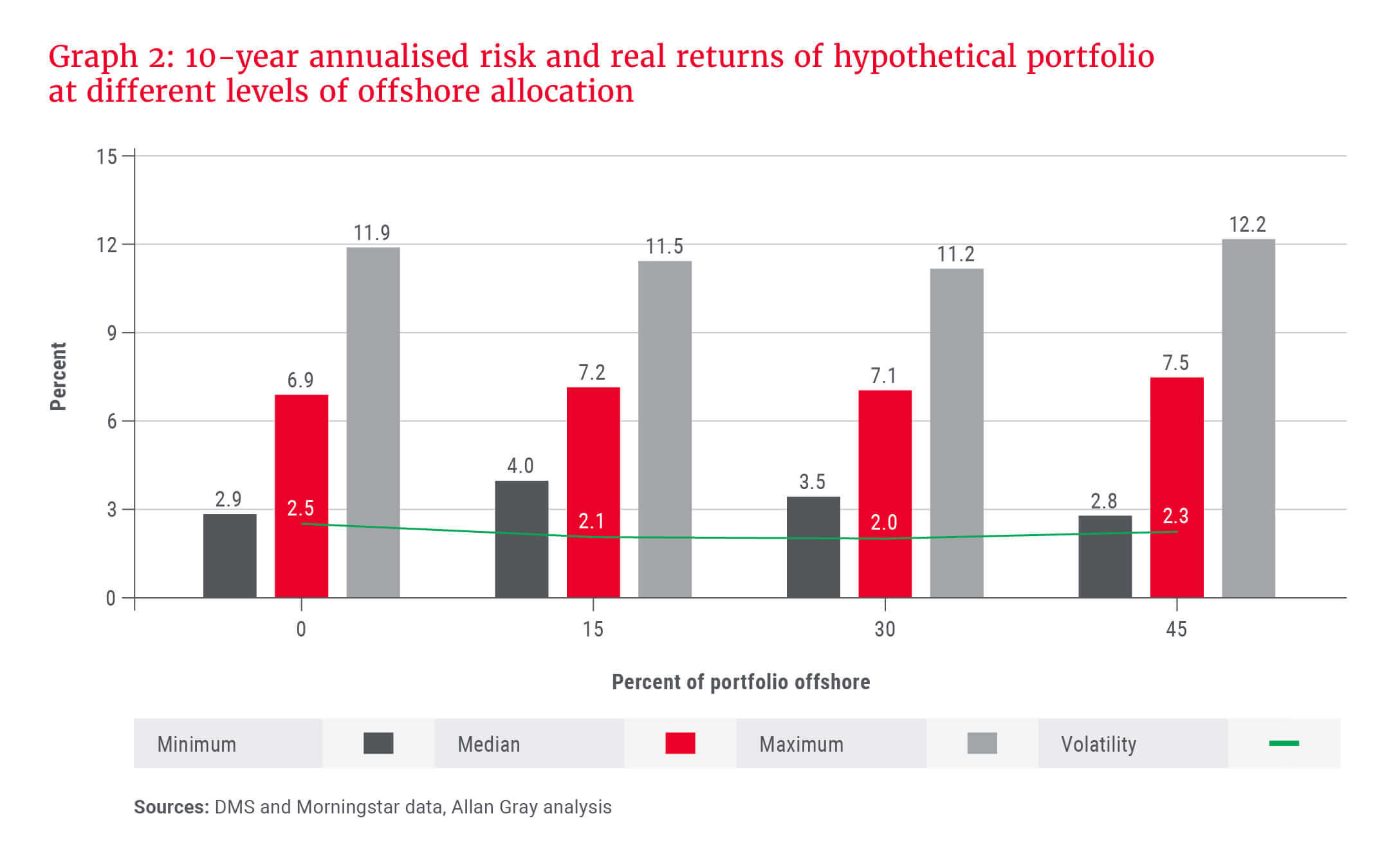

As with most questions in investing, the answer depends on your personal circumstances, risk appetite and required real return. For simplicity, we will illustrate the factors to consider, and the trade-offs to be made, using a simplified but representative multi-asset portfolio blend of 60% in equities and 40% in bonds, which would have delivered 10-year annualised real returns of 6.9% on average over the last 30 years if invested entirely in South African assets. We will assume that as the portfolio allocates more offshore, there is an equal allocation between equities and bonds offshore – that is, 30% offshore means that 30% of the equity portfolio and 30% of the bond portfolio is invested offshore.

Graph 2 illustrates that allocating a higher proportion of one’s portfolio offshore has a meaningful impact on the expected outcome of that portfolio in a number of ways. Firstly, the volatility of long-term returns of the portfolio reduces as one increases the offshore allocation from 0% to 30%, and increases again at an allocation of 45%. Secondly, the average 10-year returns available from the hypothetical portfolio increase with increasing levels of offshore allocation, although perhaps less than one might have expected given the underperformance of South African equities in the recent past. Finally, the range of return outcomes narrows at offshore allocations between 15% to 30%, but is higher both at 0% offshore as well as at 45% offshore.

These results indicate that offshore investing is not a simple matter of maximising your allocation to offshore assets. Rather, there are trade-offs that investors need to weigh up to determine what allocation best meets their investment goals and appetite for risk.

… there are trade-offs that investors need to weigh up to determine what allocation best meets their investment goals and appetite for risk.

Some readers may argue that negative excess returns of South African equities versus global equities over the last five years suggest that our simplified model is flawed; that perhaps South African investors should be using most of their offshore allocation for equities, rather than a similar blend of equities and bonds to the local component, especially as expected real returns from South African bonds today are extremely attractive in absolute terms and relative to global bonds.

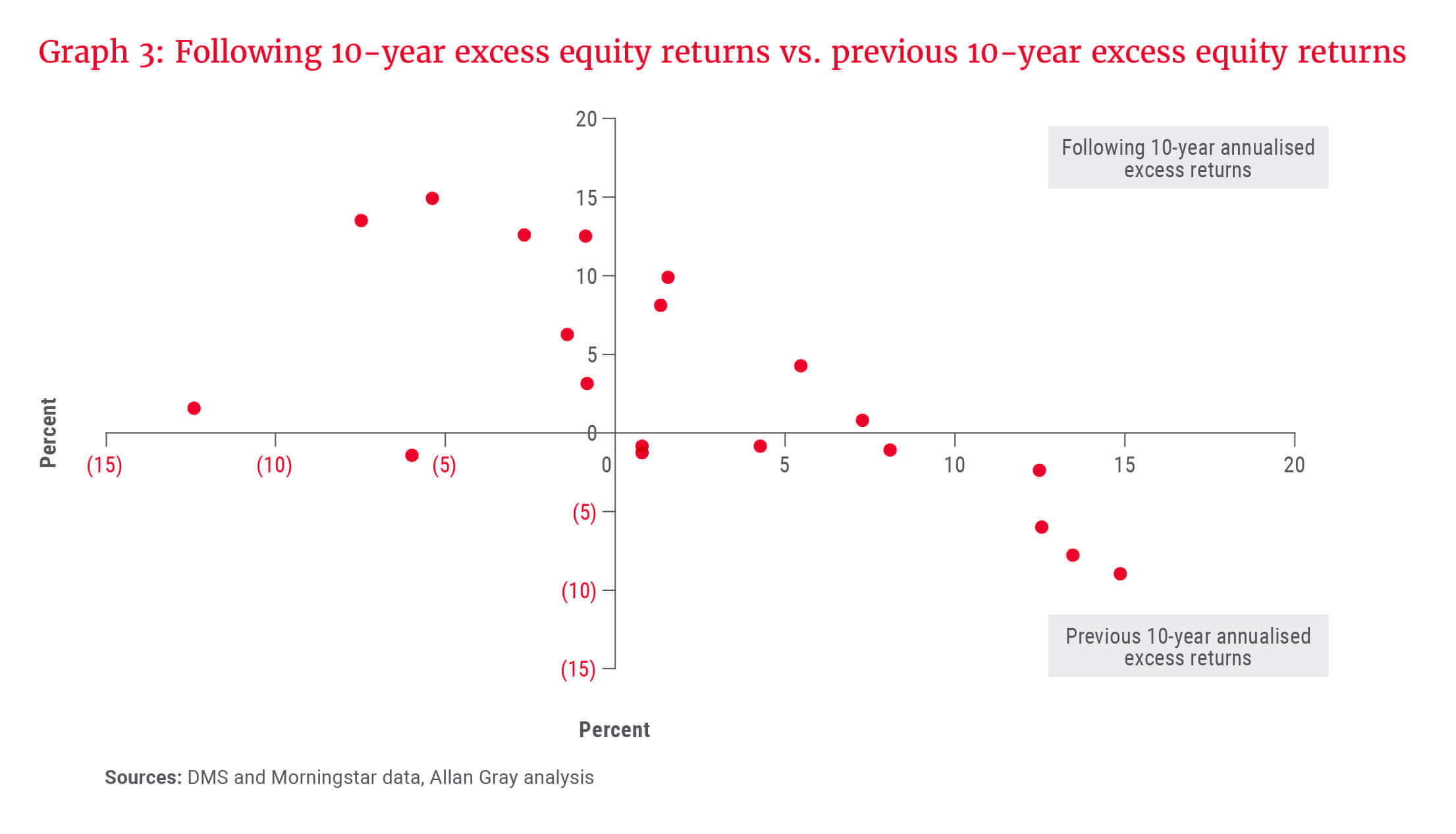

However, this argument would be dangerously reliant on the next 10 years looking like the last 10. In Graph 3, we plot the relationship between past (horizontal axis) and future (vertical axis) equities excess returns, again using data from the last 30 years.

The graph shows that there is strong evidence that when 10-year excess returns from South African equities versus global equities were negative, as they are today, the following 10 years most often – though not always – saw South African equities generating positive excess returns. This is another way to make the point that returns are cyclical, as are excess returns, and that periods of over- or underperformance are often followed by periods of under- and overperformance respectively.

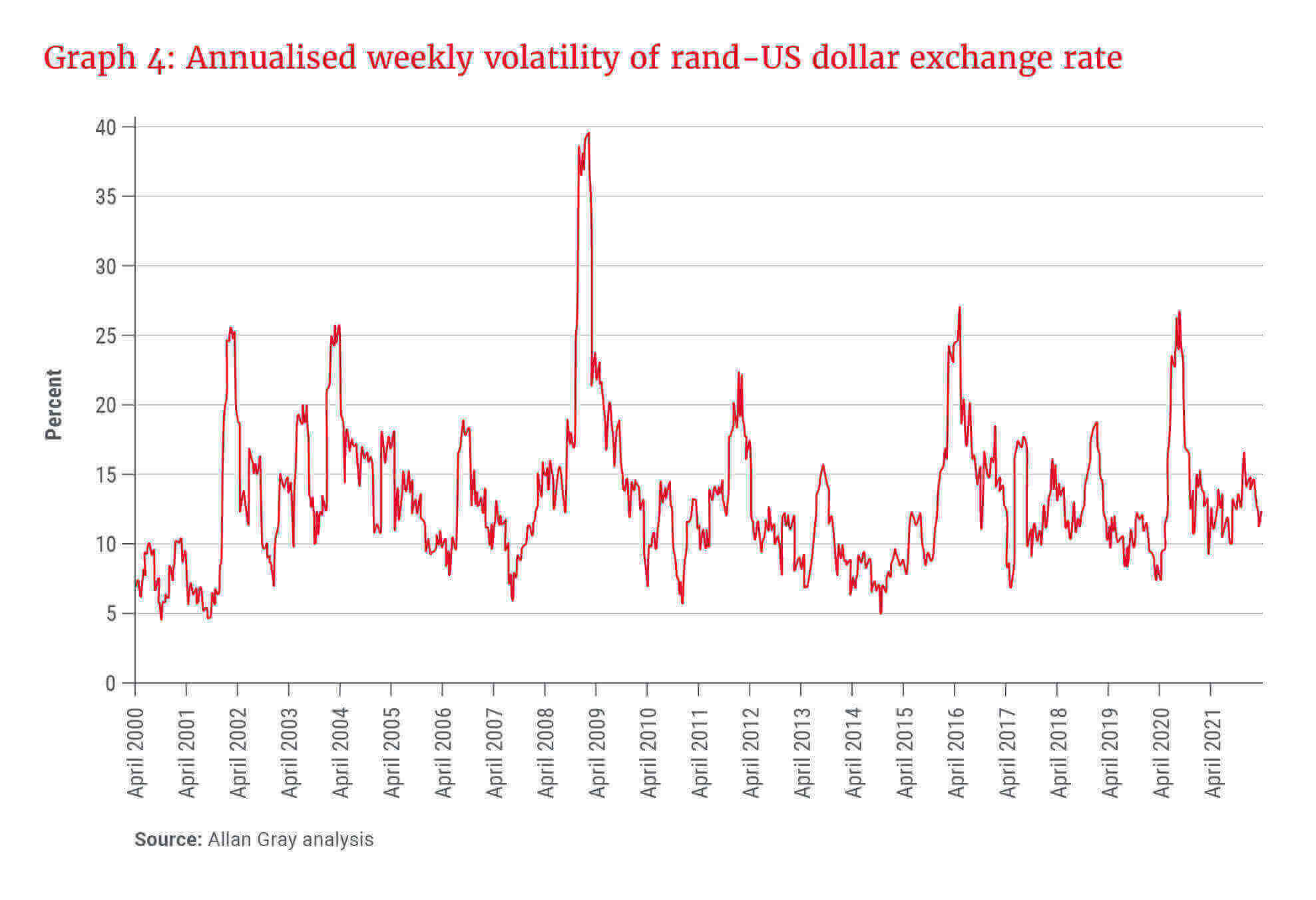

Another important factor to consider as you increase your offshore exposure is the volatility of the rand exchange rate versus those of global currencies. The rand is one of the most tradeable emerging market currencies, and also one of the most volatile. Graph 4 shows the volatility of the rand-US dollar exchange rate over the last 21 years. Although the average volatility over the whole time frame was 13%, there were periods when the volatility of the exchange rate was much higher, often coinciding with higher market volatility in general, which increases the volatility of the investment portfolio when investing in rands.

How to account for this risk will be different for investors contributing to their retirement portfolio, for example through monthly contributions, and those investors purchasing a living annuity at retirement and earning a monthly income in rands from their investment. This is not to suggest that you should try to avoid this currency risk. The risk and return data that we have already discussed includes the effects of exchange rate volatility. Rather, it is important to be aware that exchange rate volatility takes on increasing significance in your portfolio as you increase your allocation offshore and depending on whether you are contributing to your portfolio or drawing an income from your portfolio.

Key takeaways

Many clients have been asking whether or not to take full advantage of the increased offshore allocation now allowed under regulation. As discussed, the ideal level of offshore allocation over the long term depends on your specific circumstances and investment goals. A good, independent financial adviser can help you to work out what is the most appropriate exposure for you, and how this should vary depending on whether you are saving for retirement or are already in retirement and earning an income from your accumulated investments.

… the ideal level of offshore allocation over the long term depends on your specific circumstances and investment goals.

In managing Allan Gray’s Equity, Balanced and Stable funds, our investment team continues to assess this question, as they always have. We have been saying for some time that South African assets currently offer better value than many of their offshore counterparts, so we are not allocating more offshore simply because the regulations allow us to do so. Instead, our portfolio managers will continue to make decisions about the level of offshore exposure according to our assessment of where the best value can be found over the long term. Investing in an asset allocation fund that is appropriate for your risk appetite can take the pressure off you having to make your own decisions in this regard.