South Africans on average change jobs about five to seven times during their working lives. More than two-thirds do not preserve their retirement savings when they change jobs. If you have been wise enough to preserve your savings, take heed before you decide to withdraw or retire from your preservation fund so you don’t get a tax shock, caution Carla Rossouw and Carrie Norden.

When you send a withdrawal or retirement instruction to your retirement fund, the administrators have to apply for a tax directive from the South African Revenue Service (SARS), which will indicate the amount of tax that needs to be deducted from the lump sum before it is paid to you.

SARS does not allow tax directives to be cancelled, so it is imperative to get to grips with the facts before you submit any instructions to Allan Gray.

Understand the cash lump sums you are allowed to take

There are different tax implications for withdrawal and retirement lump sums. If you are close to or above the age of 55 and you have not yet taken a once-off withdrawal from your preservation fund, it’s important to carefully consider the tax implications of each option before making any decisions.

SARS does not allow tax directives to be cancelled, so it is imperative to get to grips with the facts before you submit any instructions to Allan Gray.

Preservation funds allow members to take cash lump sums from their accounts, according to the following rules:

Provident preservation funds

- Before you retire, you can take a single full or partial withdrawal lump sum (if there aren’t any restrictions from the original fund).

- At retirement (which can occur any time after the age of 55), you can take a single full or partial lump sum. You must use any remaining amount to buy a product that can provide you with an income in retirement, such as a living annuity or guaranteed life annuity.

Pension preservation funds

- Before you retire, you can take a single full or partial withdrawal lump sum (if there aren’t any restrictions from the original fund).

- At retirement (which can occur any time after the age of 55), you can take a single lump sum. If the market value of your account/s in the fund exceeds R247 500 at retirement, this lump sum will be limited to one-third of the market value of the account/s you are retiring from. You must use any remaining amount to buy a product that can provide you with an income in retirement, such as a living annuity or guaranteed life annuity.

Understand the different tax implications of withdrawal and retirement lump sum benefits

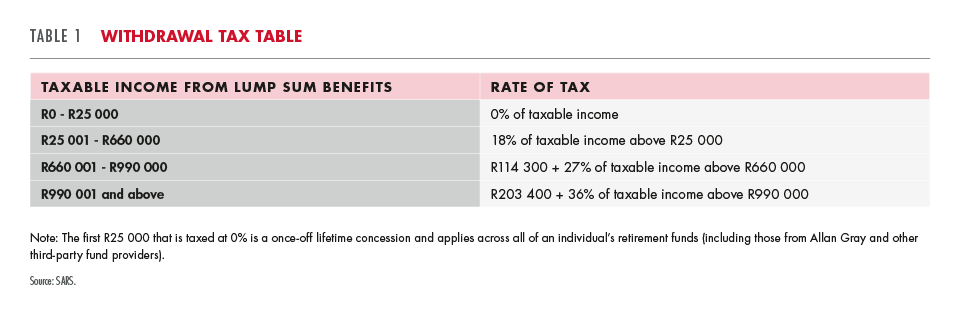

Any withdrawals you take from a preservation fund prior to retirement are taxed according to the rates shown in Table 1, with the first R25 000 taxed at 0%.

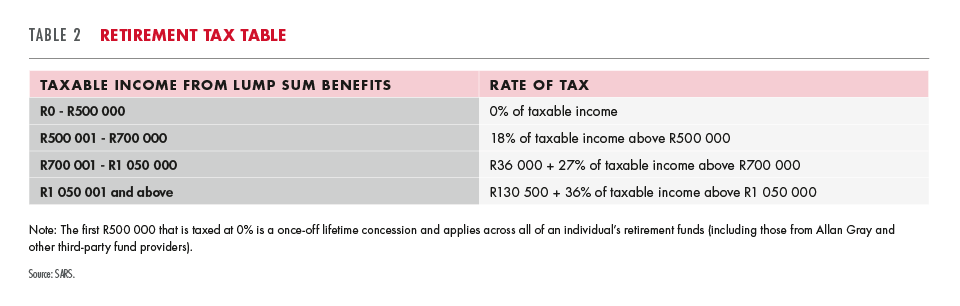

Retirement lump sum benefits are taxed according to the rates shown in Table 2. In this case the first R500 000 of such a lump sum is taxed at 0%.

Understand that previous lump sum benefits are taken into account

In applying the tax tables, SARS takes into account all previous withdrawal, retirement and severance payments received when calculating the tax that needs to be deducted from your lump sum benefit. These include:

- All retirement lump sum benefits (including death benefits) accruing from 1 October 2007

- All withdrawal lump sum benefits accruing from 1 March 2009

- All severance benefits accruing from 1 March 2011

In most cases you will be better off retiring from your preservation fund rather than taking a withdrawal.

Get a holistic picture of your tax situation

To obtain a tax estimate requires a holistic understanding of your previous lump sum benefits. It is worthwhile consulting a tax practitioner or contacting SARS to establish the probable tax impact before you decide to take a cash lump sum. If you have any tax-related disputes you need to contact SARS directly. Note that tax legislation requires your retirement fund to deduct tax according to the tax directive and pay it to SARS regardless of whether or not the dispute has been resolved.

Illustrative example

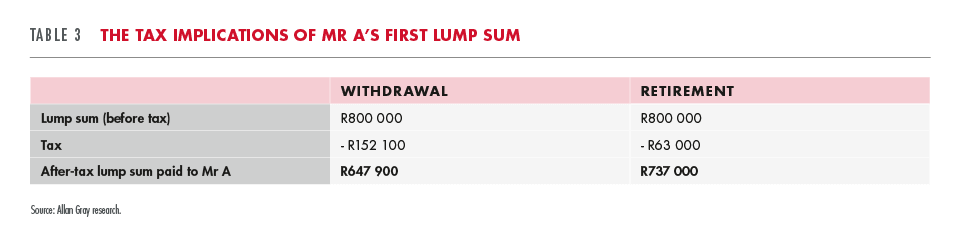

Mr A (aged 58) has an Allan Gray Provident Preservation Fund account with a market value of R800 000 and would like to take the full amount in cash. As he has not taken a previous lump sum from the account and he has reached the retirement age of 55, he can access the R800 000 either through a withdrawal or by retiring from the account.

We can use the rates in Table 1 and Table 2 to calculate the tax that will be deducted from Mr A’s lump sum should he choose to make a withdrawal or retire from the account. The results are shown in Table 3. Please note that this example assumes that this is the first time Mr A will receive a lump sum from a retirement product. If you have not taken any previous lump sums and you are over the age of 55 years, in most cases you will be better off retiring from your preservation fund rather than taking a withdrawal.