Tax and law are wrapped around every investment product. Knowing the rules can help you choose the right product for your needs.

The money you get from your investment is always impacted by taxes and legal restrictions before it gets to your pocket, so it is important to be aware of the structure of different investment products before investing in them. Investment products are containers that hold whatever assets you invest into, whether it is equities (or shares), property, bonds or cash.

Some investment products have tight lids, like retirement annuities, which restrict you from taking money out and others have loose lids, like unit trusts, but almost every time you dip your hand in to take some money so does the tax man.

Before you pick an investment product you should think about your circumstances and what will work best for you. Think about when you will need the money, what purpose it will serve and what returns you expect. Some of these needs will conflict with each other, so you must also prioritise your needs to find the right container.

I want flexibility more than anything else

Lungi is 23-years old and has just started her first job. She wants to save, but does not really have a goal in mind yet. It is most important to her that she has access to her investment at any time. She does not really understand how tax works, but is adamant that she wants to pay as little as possible to get better returns. She has no other investments, besides her company-sponsored pension fund.

If you have a vague idea of what you are investing for, you may not want to invest into a product that binds you in any way. For people who want flexibility there are two options: basic unit trusts and tax-free investments. Both allow you to withdraw your money at any time. Of the two, tax-free investments have more restrictions upon investing.

You may only invest R33 000 per year and R500 000 over a lifetime in a tax-free investment. If you exceed these limits you will incur a 40% penalty on the excess amount, but all income and dividends are tax-free and you pay no capital gains tax (CGT) when you withdraw.

When you invest in a simple unit trust you pay tax on interest, at your marginal tax rate, dividends, taxed at 20%, and capital gains when you withdraw from the unit trust. Forty percent of the capital gain is taxed at your marginal tax rate, but your first R40 000 per year is exempt. You may invest as much as you like and withdraw whenever you want to.

I want to avoid taxes, but still have access to my money in the future

Sharon is 42-years old and has done some investing in the past. Her last investment scheme promised her great returns, but when she withdrew she found that the taxman and her investment provider took the lion’s share of her gains. She wants to avoid paying taxes to help her get a better return and anticipates she may need the money in 15 to 20 years.

For the reasons mentioned above a tax-free investment is the obvious choice for paying less tax. But there are other options. If you can handle their restrictive rules and you are a high-income earner, endowments are an option worth considering. You can benefit from a favourable tax rate, but endowments have restrictive rules regarding contributions and withdrawals, and should only be considered if you are willing to lock your money in for five years or more. Retirement annuities have very favorable tax treatment and allow you access to your funds after the age of 55, which is not that long to wait for a 42-year old.

I want to save for retirement

Zolani is 34-years old and has no retirement savings. He has tried to invest for retirement before with unit trusts, but ultimately withdrew the money to put down a deposit for a car. He wants to make sure that this time he can’t do that.

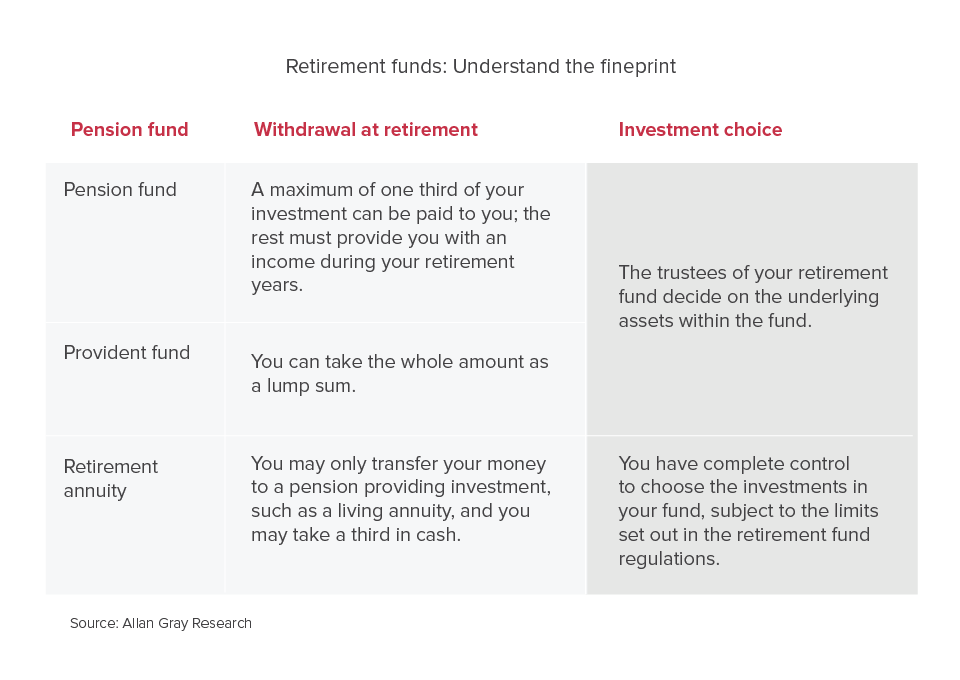

Retirement savings options are a broad topic, but briefly the options are pension funds, provident funds and retirement annuities. The first two are usually administered through your employer, but retirement annuities are personal investment vehicles (even when you have one with your employer). The tax efficiency of retirement products makes them a logical choice for most people saving for retirement and government offers generous tax incentives to encourage people to invest.

The important thing is to connect your needs with the appropriate products. Getting a product that avoids taxes but does not allow you to access your money when you need it will not help you in the long run.

If you need help making sense of the choices available to you a good independent financial adviser can help you work through them.

This article forms part of a series that you can access here.

Find this article useful? Please let us know.