In the finalised 2025 Budget speech, Finance Minister Enoch Godongwana announced the allocation of an additional R7.5bn to the South African Revenue Service (SARS) for the 2025/2026 fiscal year. SARS continues to commit to modernising its tax collection efforts in order to increase taxpayer confidence and convenience, as well as improve efficiency in its revenue collection. But what does this mean for South African taxpayers as they prepare for the upcoming tax-filing season? Tax manager Meagan Fraser answers some of the questions that may arise.

What does the reversal of the VAT increase mean for SARS this year?

For the majority of South Africans, the reversal of the proposed 0.5% VAT increase earlier this year provided a sense of relief in terms of their monthly budget. However, the loss of the anticipated revenue from this proposed increase resulted in a R75bn shortfall in the Budget. SARS is committed to ensuring that outstanding taxes are accurately and efficiently collected when due, and its efforts during tax-filing season will therefore be focused on taxpayer compliance and on collecting outstanding taxes where they become due.

Does this mean that I will need to pay more tax?

SARS can only collect tax that you are legally obligated to pay, and cannot collect more tax from you than you owe. As a taxpayer, you have the right to consistent and impartial application of the law, but you also have the obligation to submit timely, complete and accurate information to SARS. It therefore remains important to ensure you comply by filing your income tax return accurately and by the set deadline, as well as settling any outstanding taxes in full and on time.

What are the dates to diarise?

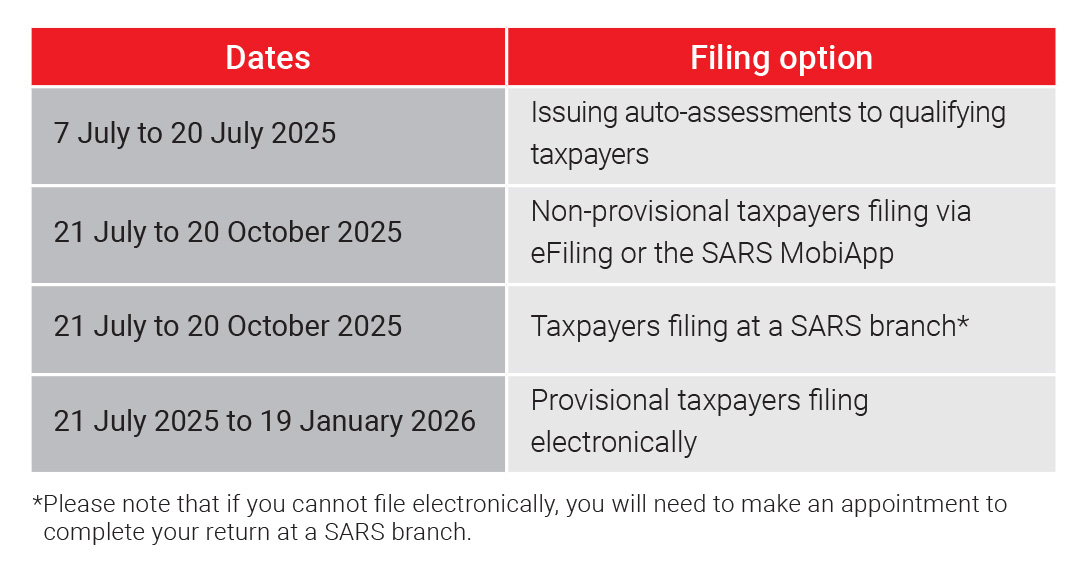

The 2025 filing season officially opened on 7 July 2025 and the notable dates are as follows:

How do I know whether I am required to file an income tax return?

If you would like to check whether you are required to submit a return, use the tool available on SARS’s website to confirm. The requirements for individual taxpayers are also included in the checklist below.

I moved to another country in the last tax year – am I still required to file a return?

It is important to remember that you will be taxed by SARS on your worldwide income for the period that you were considered a South African tax resident. Taxpayers who cease residency during the tax year are required to let SARS know by completing the “Registration, Amendments and Verification (RAV01) form” on eFiling and submitting the relevant supporting documents. The effective date that you were considered to have ceased your residency will be confirmed by SARS on a “Notice of non-resident tax status” form and will be included on your return.

For further clarity regarding the applicable taxes you may be liable for if you changed your country of tax residency, see Carla Rossouw’s article Understanding your tax obligations on leaving South Africa.

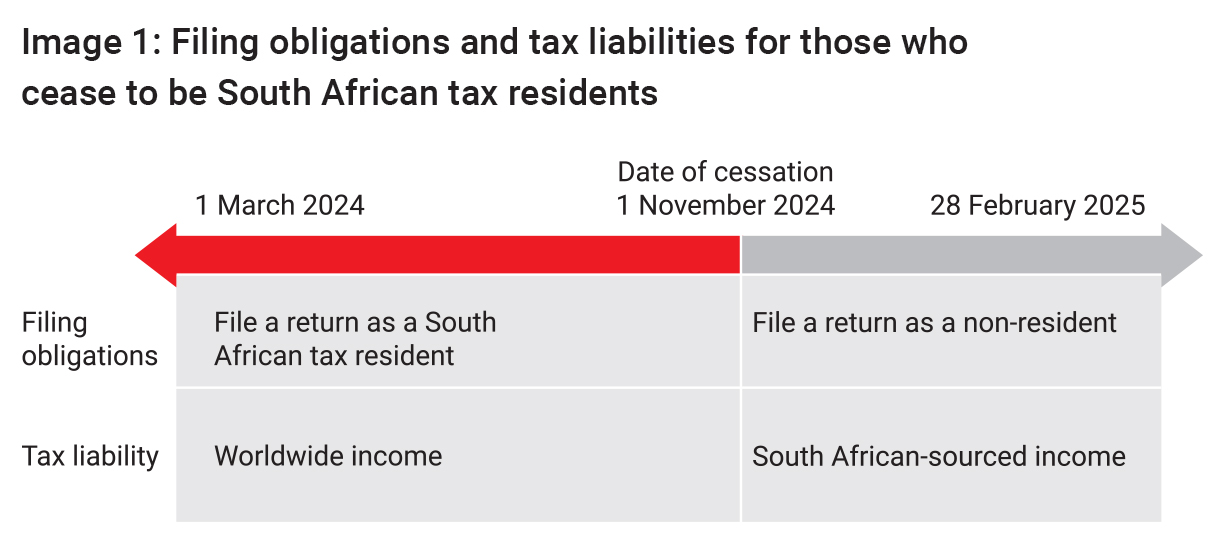

If the date that you ceased to be a tax resident falls within the 2024/2025 tax year, both the non-resident and South African resident sections in your return will be available to complete. It is important to ensure that you allocate the correct amounts to each section of the return based on the timing and nature of the income you received. For the portion of the tax year after the date you ceased to be a South African tax resident, you are only liable to pay tax on your South African-sourced income. See Image 1 for an example.

What does it mean to be automatically assessed?

Each year, SARS uses the data they have received from employers, financial institutions, medical aid schemes, retirement fund administrators and other third-party data providers to pre-populate amounts on behalf of taxpayers. The intention is both to improve the accuracy and verifiability of the amounts completed on returns, and to assist SARS in issuing estimated assessments for taxpayers who have relatively simple tax affairs.

SARS will notify you via SMS or email if you have been issued an auto-assessment, depending on your preferred communication channel on their records.

If you have been auto-assessed, it is important to ensure that the information SARS has populated in your return is both accurate and complete by cross-checking it against the tax certificates you have been issued by your various service providers. If you disagree with any amounts that have been pre-populated, you will need to query the amounts directly with the relevant third-party data providers and request that they resubmit the corrected information to SARS. To avoid delays, you can check via your eFiling profile whether an amount was submitted by your service provider. For more detail on how to access your third-party data certificates, see the How to view submitted third party data returns or data files via eFiling guide on the SARS website.

If you have any additional income or deductions that have not been pre-populated in your return, you will need to add the relevant information manually.

If you are issued with an auto-assessment which results in a refund being owed to you, SARS promises to make this payment within 72 hours of the assessment being issued to you. You should therefore ensure that your contact and bank details are up to date with SARS so that you receive the notification timeously and any refund due is paid to the correct bank account. It’s also important to verify the accuracy of your auto-assessment as soon as possible after receiving the notification.

I am a provisional taxpayer – will I also be auto-assessed?

SARS does not issue auto-assessments to provisional taxpayers as the norm. However, this year, SARS will identify eligible provisional taxpayers and contact them to give them the opportunity to receive an auto-assessment.

What documents do I need to submit to SARS when I complete my return?

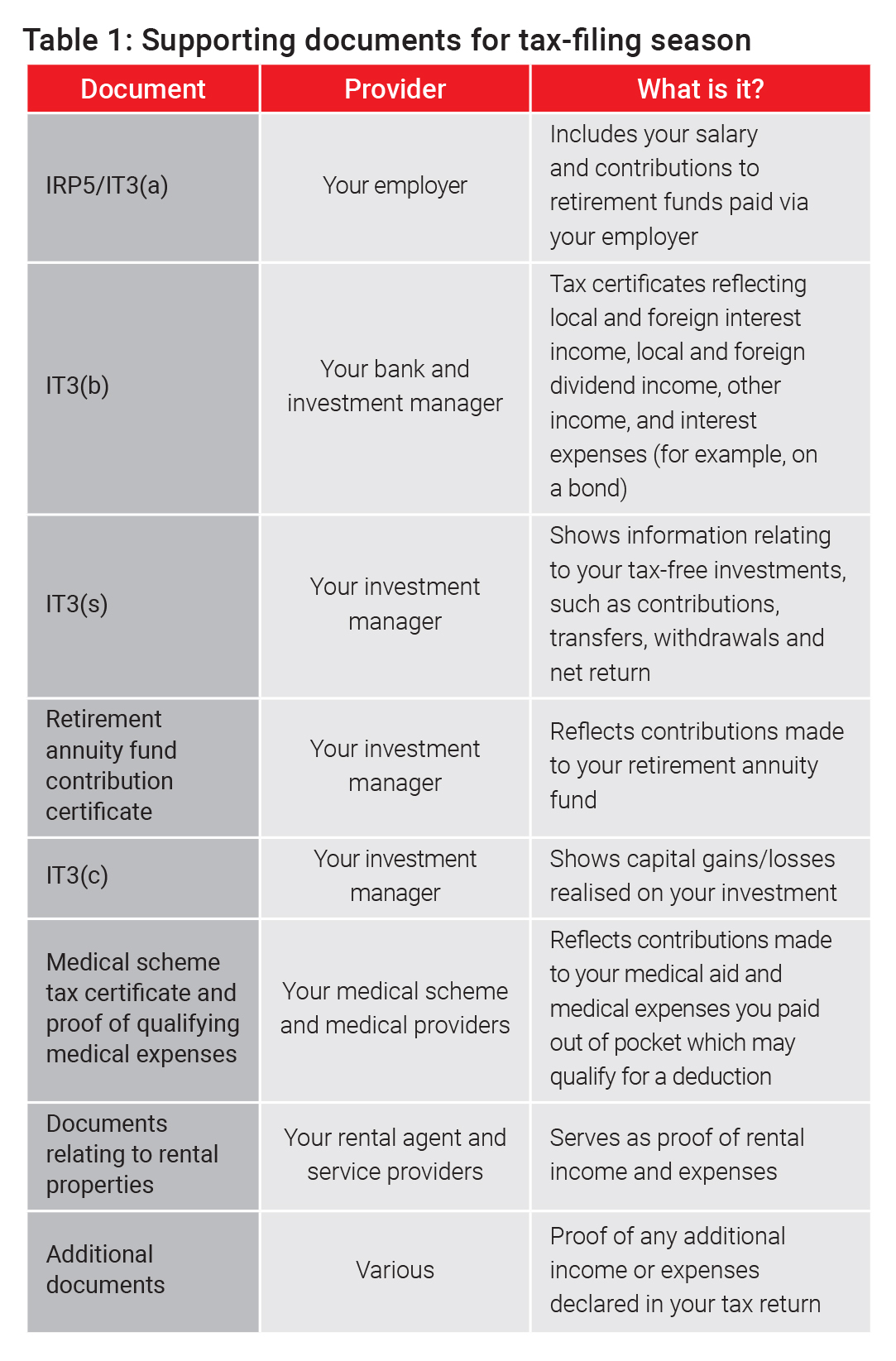

When you are preparing to file your return, or check your auto-assessment, it is important to ensure that you have all your relevant supporting documents ready. These include, but are not limited to, the documents listed in Table 1. In addition, you are required to keep copies of all supporting documents for five years from the date of submitting your return, as SARS may request these documents to verify the information you declared.

I earned income that SARS did not pre-populate on eFiling – can I file my return without it?

As a South African tax resident, you are required to pay tax on your worldwide income. This means that you are liable for income tax on all amounts you received, even if from a source outside South Africa. You therefore need to complete all income received on your tax return.

I have completed my return and the calculator says that I owe SARS money – what do I do?

Use the tax calculator button on eFiling to obtain an estimate of your assessment based on the information included in your return. If the result is not as you expected, you can go back into your return to ensure that all your information is correct. Remember to check that you have completed the “Form wizard” correctly upfront as this will determine which fields are made available to you, and ensure you have correctly completed all fields which relate to any deductions you are due (such as retirement fund contributions).

Once you are comfortable that the information in your return is complete and accurate, you may submit your return. If your assessment indicates that you owe money to SARS, you are required to pay SARS by the due date stipulated on your notice of assessment.

I withdrew from my retirement fund savings component in the last tax year – could that be why I owe SARS?

Any withdrawals made from your savings component would have been subject to tax at your marginal (highest) tax rate before being paid to you. However, SARS may have estimated your total taxable income based on your 2023/2024 return as that would have been the most up-to-date information on SARS’s records. Therefore, the tax that your service provider withheld and paid to SARS may not have been based on your full taxable income amount for the 2024/2025 tax year, resulting in a possible payment (or refund) being due.

How do I check if I have any outstanding returns from prior years?

You can ensure that your tax affairs are in order and up to date by using the “Compliance status” functionality on your eFiling profile. If you have outstanding returns, SARS charges non-compliance penalties for each month that your return is outstanding, and SARS may collect these penalties from appointed third parties such as your employer, your investment manager or directly from your bank account. Under certain conditions, you may apply for an extension to file your tax return within 21 days from 20 October 2025, but note that an extension does not waive late-filing penalties. SARS will therefore penalise taxpayers for any returns filed after the deadline, regardless of the circumstances.

Checklist to assess whether you need to file

If any of the following applies to you, you are required to file a tax return for the 2024/2025 tax year:

1. You are a South African tax resident who:

- Earned a taxable income above the tax thresholds (the amounts above which tax is payable according to the individual tax tables, based on your age on 28 February 2025); and/or:

- Earned capital gains or losses exceeding R40 000

- Carried on a business or trade (in or outside South Africa)

- Earned a foreign salary for work done as an employee outside South Africa

- Owned foreign currency or assets of more than R250 000 at any time during the tax year

- Earned income or capital gains from foreign currency or assets outside South Africa

- You are a non-South African tax resident who:

- Sold assets which are subject to capital gains tax in South Africa (for example, you sold South African fixed property or a right to fixed property, assets effectively connected to a South African permanent establishment, or shares in a company or a vested interest in a trust, if at least 80% of the value of the interest is in South African fixed property, and you hold at least 20% of the shares or rights of the company or trust).

- Received interest income from a South African source, and you were either physically present in South Africa for longer than 183 days in total during the 12 months before the interest was earned, or the debt from which the interest was earned relates to a permanent establishment in South Africa.

- Carried on a business in South Africa.

Not everyone is required to submit a tax return to SARS for the 2024/2025 tax year. You do not need to file if:

1. You were selected by SARS for auto-assessment, and you are comfortable that all your pre-populated information reflects correctly in SARS’s records to give effect to the auto-assessment.

2. You have no deductions to claim and only earned a salary or similar remuneration from one employer of R500 000 or less for the tax year, provided your employer correctly deducted employee’s tax for the period and declared this to SARS. For example, if you also earned rental income or had two employers during the tax year (if you changed jobs), you will need to file a return.

3. You only earned the following sources of income for the tax year:

- Interest income from a South African source (such as unit trusts) below the taxable thresholds (R23 800 for those under 65 years, and R34 500 for those 65 years and older on 28 February 2025)

- Amounts from a tax-free investment

- Lump sums from a South African retirement fund, where tax has been withheld based on a tax directive issued by SARS

- Dividends that are exempt from normal tax (if you were not tax resident in South Africa throughout the 2024/2025 tax year)