There will always be ups and downs in the markets as much as in life. To deliver great long-term investment performance we believe a fund manager needs to commit to an investment philosophy, run a disciplined investment process and attract and retain a consistently skilled team. Zwelethu Nkosi explains why commitment counts in investing and the thinking behind our new television advert.

Our focus at Allan Gray is on creating long-term wealth for our clients. We buy shares on behalf of our clients when our research indicates that they are priced below their true worth and sell them when they reach our estimate of fair value. We apply this same investment philosophy regardless of market conditions and have been doing so since our founder, Dr Allan WB Gray, began managing money on behalf of clients in 1974.

Our unwavering commitment to our investment philosophy sets us apart from our competitors, and it is this theme of commitment that we wanted to highlight in our new TV ad. While the business of investing remains rational, we believe it is important to connect with our clients and potential investors on an emotional level, by using our advertising to tell human stories that resonate.

The Letter' continues our tradition of emotional storytelling, which over the years has become synonymous with Allan Gray's advertising. We also continue with the black and white visual style, making the advert recognisably Allan Gray.

WE INTEND THAT PEOPLE WATCHING THE AD WILL SEE PARALLELS WITH THE VALUES OF ALLAN GRAY

The television commercial

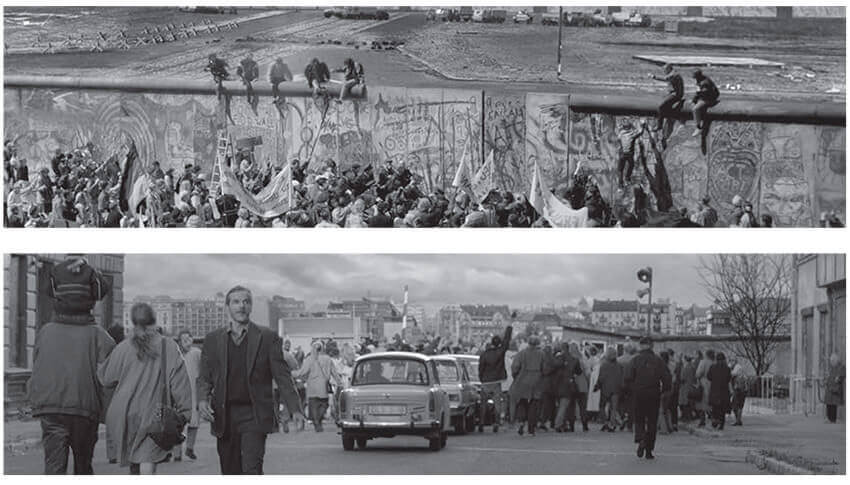

The ad portrays a simple story of two people in love, who have their commitment tested by a very long, forced separation. Through their story, conveyed through a letter we consider the persistence and resolve they exercised during their time apart. The narrative is set within the context of a real historic event. In bringing these events to life, authenticity was very important. We had to remain true to the time. Set in Germany in 1989, the Berlin Wall works as a visual representation of what had come between the two lovers.

The story opens up in our hero's living room. He is not a typical hero. We get a glimpse of the character - a man in his late forties. The book-laden shelves suggest that he is well read and smart. We get a sense that he is introverted; a thinker. His face conveys a vulnerability. His depth of character and believability draw us to his journey. His performance, although subtly conveyed, allows us to feel deeply. We want to know more.

The hero has lived with the letter for many years. The news of the wall falling triggers a reaction and he travels to the wall where he arrives as a crowd is tearing down a section. He seizes the opportunity and crosses into East Berlin. Through our hero we experience the extraordinary scenes of the wall collapsing. The overwhelming sense of chaos, confusion and elation is evident in the streets. The whole process is fraught with uncertainty; no one knows what is going to happen. The same goes for our hero: he does not know if his lover is married or has children.

The words of the letter are a separate story that runs concurrently to what we are seeing. In the last scene the words and the picture find each other. The chemistry between the protagonists is palpable. Their patience and commitment finally pays off.

While riddled with doubt and challenges, they never gave up on the one true thing they treasured most: their love for each other. The advert is a parable of what can be achieved when one stays committed over a long period of time. We intend that people watching the ad will see parallels with the values of Allan Gray and, in our fast-paced, quick results society, this story points to the particularly human value of patient commitment.

Commitment takes courage - in life and in investing

The nature of our investment philosophy means that, from time to time, our purchase or sale of shares will seem unconventional. If we like a share and the price is falling, and the investment case has not changed, we view this as an opportunity to buy more of the share. In fact, we get quite excited that we are getting a bigger discount. Similarly, we will sell a share when it reaches fair value.

When the general investment tide runs strongly counter to our actions, our short-term relative performance may well look disappointing. It is these periods that test our commitment to our philosophy and process - after all, clients do not question the way you do things when things are going well. But weaker periods often set the stage for a strong rebound in our performance when the markets revert to normal. This is the message we want to give to our clients. If you can hold tight through the rockier periods, you improve your chances of enjoying the rewards.

Our research indicates that investors in our unit trusts often do not enjoy the same return as the unit trusts themselves.

This is because they invest and disinvest at the wrong time. It is important to us that investors remain committed for long enough to enjoy the rewards of our philosophy - we have failed if there is no one invested in the unit trust to enjoy the returns when they come. As investment managers we see the importance of staying committed to our investment philosophy over the long term and we hope this inspires our investors to stay the course.

To watch the ad, please visit youtube.