We have written regularly about investor behaviour, noting how emotions can be our worst enemy. Driven by fear and greed, many investors buy high and sell low and tend to invest based on past performance. But what causes this counter-productive behaviour?

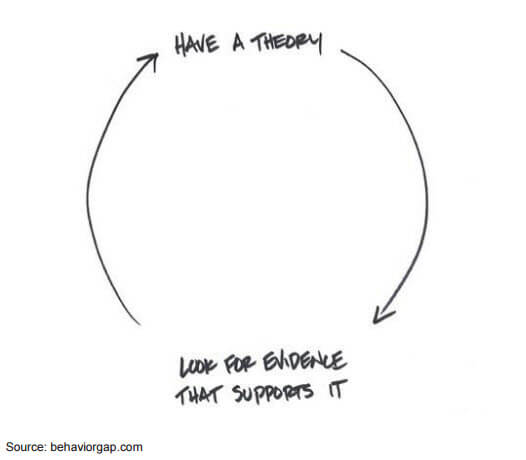

There are many different psychological theories and explanations, one of these being ‘confirmation bias’ – the tendency to gravitate towards news and opinions that confirm our own views. In our information overloaded world, novice investors and professionals alike can easily find evidence to support their own theories. With evidence in hand, we can justify our actions.

Confirmation bias can manifest itself in the newspapers we read, the websites we frequent and the people we listen to. Online we are deliberately manipulated by search engines, news sites and social media networks that are cleverly configured to deliver us just the information we are looking for, based on our historical behaviour. The result of this bias aggregated across the market often leads to misleading popular market sentiment.

What is to be done?

As we consume information daily, it may help to develop more self-awareness around our own biases, and a targeted strategy for consuming financial media. Many decisions about buying, selling and switching (or not switching) investments are informed by what we read, so it is worth examining how to filter this flow of information.

1. Separate the wheat from the chaff

If you are focused on a long-term goal, the short-term noise is just that - noise. Buying and selling based on everyday events and market moves may cause you to lock in losses that may have otherwise been avoided. There are some investors who time the market well, due to a combination of luck and skill but, on average, changing your investments in response to a change in your circumstances is a more rewarding strategy.

Generally, unit trust investors need not worry about how to respond to day-to-day events; your fund manager will take these into account, as necessary, during the research process. Similarly, if you use the services of a good, independent financial adviser they will adjust your overall portfolio as the long-term need arises.

There are only a few news events that should encourage you to check in on your unit trust:

- News about significant changes at your investment management company (e.g. your unit trust company abruptly changes its investment philosophy).

- News about changes to your specific funds (e.g. the benchmark, mandates or fee structure changes).

- News about legal changes that may have an effect on your investments (e.g. government changes legal restrictions on endowments or retirement funds).

- For the more sophisticated investor with niche investments, news about significant shifts in countries or industries (e.g. if you have a mining-specific unit trust and there is a change in laws around mining licences).

In most other cases, you should only consider making changes to your investment if your goals or personal circumstances change.

2. Challenge your world view

The ‘team of rivals’ approach can help you break out of your safe opinions. The idea is to actively seek alternative views and was used by Abraham Lincoln, who appointed his rivals to cabinet to challenge him. Reading and trying to understand viewpoints that differ from your own can give you fresh insights and leave you with a more holistic view of a situation.

3. Filter for facts

In theory, underneath the opinions and ideas you read in the media there should be a foundation built on facts; facts that you can follow back to their source. Reading the source material allows you to question the interpretation you are given with a deeper understanding. Always try to get the full picture rather than acting emotionally on the first story you read.

4. Watch out for weasel words and orphan opinions

Extraordinary claims are often delivered with words such as ‘likely’, ‘probably’, ‘virtually’, ‘almost all’ and ‘seems’. These words are designed to encourage you to believe the truth of a statement, which may, at its core, be baseless.

Another news trick is the use of orphan opinions such as: “Experts say …”. This should lead you to ask: which experts? In some cases the text may indeed quote an expert opinion; but more often than not the headline is selling the paper. In most cases, an opinion worth listening to will come from someone willing to put their name next to it.

Become critical about what you read, see and hear: don’t let confirmation bias snooker you. Reserve the right to react only after careful consideration.