We have written at length about the perils of switching and trying to time the market, noting how investor behaviour plays an important role in investor returns. In addition, we also consistently speak about having a long-term investment objective underscored by a clear plan that guards against emotionally driven behaviour. This does not mean you should completely ignore your investment. If you have constructed your portfolio using a spread of asset classes, you need to check periodically whether market movements have caused the weightings in your portfolio to change dramatically.

An integral part of the investment process is allocating assets based on your objectives and ability to tolerate risk. With the help of your financial adviser, you need to work out what is the best combination of equities, cash, bonds, etc. to hold in your portfolio, and which fund managers to entrust with these assets. Over time, as one asset class (or asset manager) outperforms or underperforms so the weightings in your portfolio will adjust. It is therefore a good idea to periodically assess your asset allocation. If your weightings have moved outside of the scope of your risk tolerance, and your investment objectives have not changed, you may need to ‘rebalance’ to restore your original asset allocation.

Checks and balances

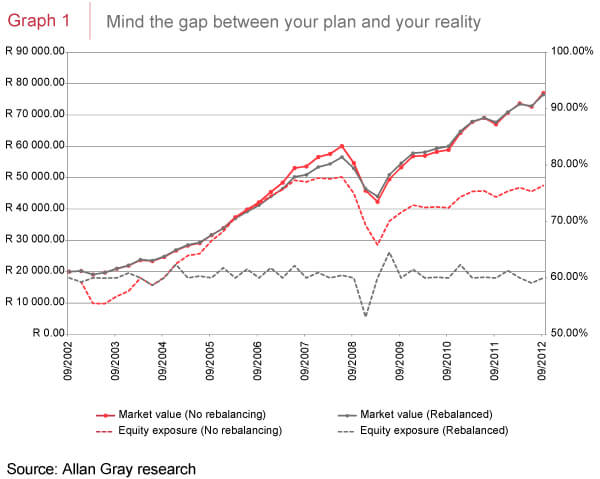

Graph 1 shows that a portfolio that is not rebalanced can change form quite dramatically over a period of time. This may change the riskiness of the investment and, therefore, how it meets your particular needs if the investment environment changes. The investor in our example began his/her investment with 60% in the FTSE/JSE all share index (ALSI) and 40% in the Short Term Fixed Interest Call Deposit Index (STEFI). Note that with no rebalancing, the equity exposure would have risen close to 80% over the first five years of the investment. The investment would have unwittingly morphed into something different from what was initially intended. This would have left the investor more exposed during the market crash in 2008 resulting in a loss of value of 27% for the unbalanced portfolio against 19% for the rebalanced portfolio.

All other things being equal, rebalancing has the convenient effect of selling asset classes that get more expensive and buying those that get cheaper. There are many different rebalancing strategies. A simple strategy may be to rebalance the portfolio after a certain time period, for example six months, as indicated by the grey line on the graph. Alternatively you could allow equities to range say 10% on either side of the original weighting of your portfolio, and rebalance at these points to the original weights. Different rebalancing plans will have different outcomes.

The alternative is to use an asset allocation fund

A simpler alternative to consistently rebalancing may be to invest in an asset allocation fund, for example a balanced fund, and let the fund manager do the work. Fund managers constantly assess which assets they believe offer the best long-term value and make their investment decisions based on their research, and according to their fund’s mandate. They also ensure that the weightings within the fund remain within the limits set by the fund’s mandate. One example is Regulation 28-compliant funds. These fund managers need to ensure that the fund’s assets fall within the limits stipulated by legislation (i.e. a maximum of 75% equities, 25% offshore, 25% property).

Your investment planning process should be based off a plan. Rebalancing talks to this plan and is an important discipline in maintaining a consistent approach to investing.

Allan Gray Proprietary Limited is an authorised financial services provider. The FTSE/JSE All Share Index is calculated by FTSE International Limited (‘FTSE’) in conjunction with the JSE Limited (‘JSE’) in accordance with standard criteria. The FTSE/JSE Africa Series is the proprietary information of FTSE and the JSE. All copyright subsisting in the FTSE/JSE All Share Index values and constituent lists vests in FTSE and the JSE jointly. All their rights are reserved. Collective Investment Schemes in Securities (unit trusts) are generally medium- to long-term investments. The value of units may go down as well as up and past performance is not necessarily a guide to the future. Unit trust prices are calculated on a net asset value basis, which is the total market value of all assets in the portfolio including any income accruals and less any permissible deductions from the portfolio divided by the number of units in issue. Allan Gray Unit Trust Management (RF) Proprietary Limited is a member of the Association for Savings & Investment SA (ASISA).