Finance Minister Tito Mboweni delivered the Budget speech on Wednesday, 26 February. Below we highlight some of the 2020 Budget tax proposals that may impact investors. These changes come into effect on 1 March 2020, unless otherwise indicated.

Budget sees some tax relief

There were many predictions leading up to Budget day, ranging from a value-added tax (VAT) rate increase to continued bracket creep, but instead we saw no major tax increases and above-inflation adjustments to all tax brackets and rebates, which provides real income tax relief for individuals. There were no changes to the corporate tax rate or VAT rate. The government will, therefore, not raise additional revenue from tax proposals. Instead, the aim is to reduce government spending, which includes a reduction to the wage bill of roughly R160 billion.

What were the key changes?

The highlights from this year’s Budget are summarised below:

- There are above-inflation increases in the personal income tax brackets and rebates.

- The annual contribution limit for tax-free investments will be increased from R33 000 to R36 000 per tax year from 1 March 2020.

- The cap on the exemption of foreign remuneration earned by South African tax residents is increasing from R1 million to R1.25 million per tax year from 1 March 2020.

- No transfer duty is payable on the purchase of property up to the value of R1 million. This has been increased from R900 000 from the 2019/2020 tax year.

- The general fuel levy increases by 16 cents per litre, and the Road Accident Fund levy increases by 9 cents per litre on 1 April 2020. The carbon tax rate will increase by 5.6% for the 2020 calendar year.

- Excise duties on alcohol and tobacco will increase by between 4.4% and 7.5%.

- The plastic bag levy increases to 25 cents per bag.

The following applies for the period from 1 March 2020 to 28 February 2021:

Individuals and special trusts

An above-inflation increase has been made to the personal income tax brackets, which means that taxpayers earning above R205 900 will fall into the 26% tax bracket. The highest marginal tax rate for individual taxpayers remains unchanged at 45%. The personal income tax rates for the 2020/2021 tax year are listed below.

Tax thresholds

There has been an above-inflation increase to the tax-free thresholds for personal income taxes to the following:

- R83 100 for taxpayers younger than 65

- R128 650 for taxpayers age 65 to 74

- R143 850 for taxpayers age 75 and over

Rebates

The primary, secondary and tertiary rebates (deductible from tax payable) were increased to the following:

- R14 958 per year for all individuals

- R8 199 for taxpayers age 65 and over

- R2 736 for taxpayers age 75 and over

Medical tax credits

Monthly tax credits for medical scheme contributions were increased by 2.8% to the following:

- R319 per month per beneficiary for the first two beneficiaries

- R215 per month for each additional beneficiary

These increases are in line with the announcement in the 2018 Budget Review that the credit would be adjusted by less than inflation to help fund the roll-out of the National Health Insurance over the medium term.

Tax-free investments

The annual cap on contributions to tax-free investments has been increased from R33 000 to R36 000 from 1 March 2020 with the lifetime limit remaining at R500 000.

What has not changed?

Companies and trusts

The income tax rates for companies and trusts (other than special trusts) remain unchanged at 28% and 45%, respectively.

Interest exemptions

The local interest exemptions remain unchanged:

- The exemption on interest earned for individuals younger than 65 years remains R23 800 per annum.

- The exemption for individuals 65 years and older remains R34 500 per annum.

Foreign interest remains fully taxable.

Dividends tax

Dividends tax remains at 20% on dividends paid by resident and non-resident companies in respect of shares listed on the JSE.

Foreign dividends received by individuals from foreign companies (shareholding of less than 10% in the foreign company) are taxable at a maximum effective rate of 20%.

Interest withholding tax for non-residents

Interest withholding tax remains at 15% on interest from a South African source payable to non-residents. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Retirement lump sum taxation

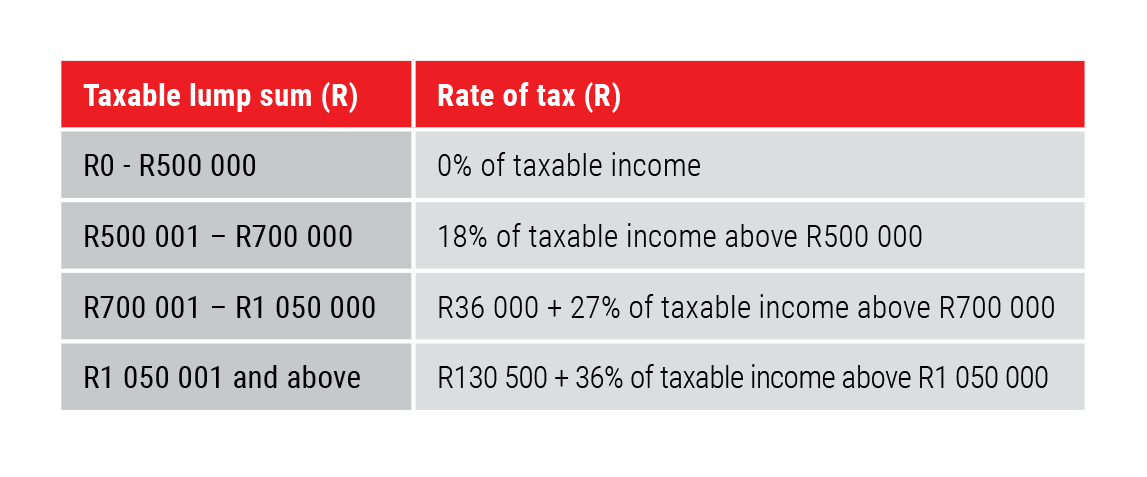

At retirement

The first R500 000 of a retirement lump sum remains tax-free. The table below illustrates how retirement lump sums will be taxed:

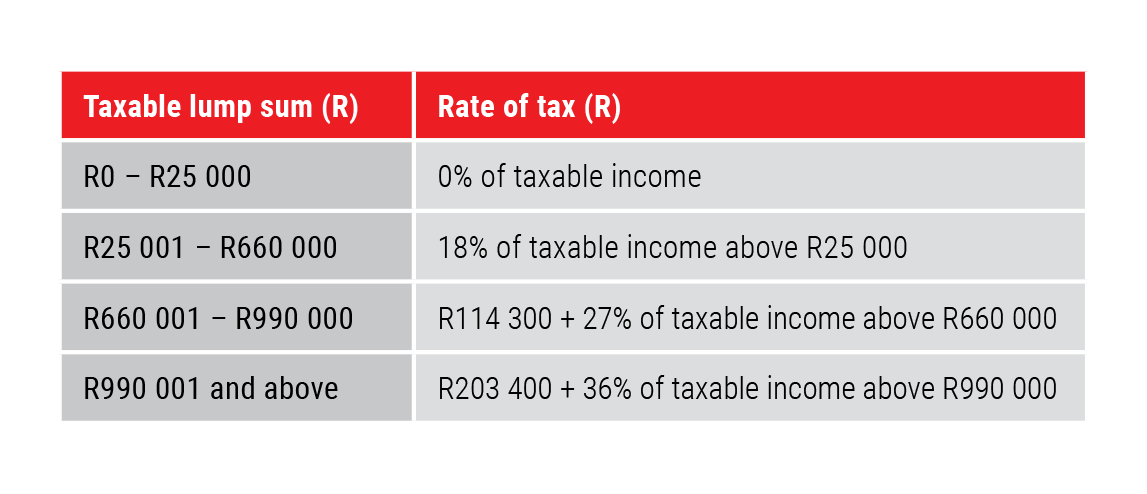

Pre-retirement

The first R25 000 of a pre-retirement lump sum withdrawal remains tax-free. The table below illustrates how withdrawal lump sums will be taxed:

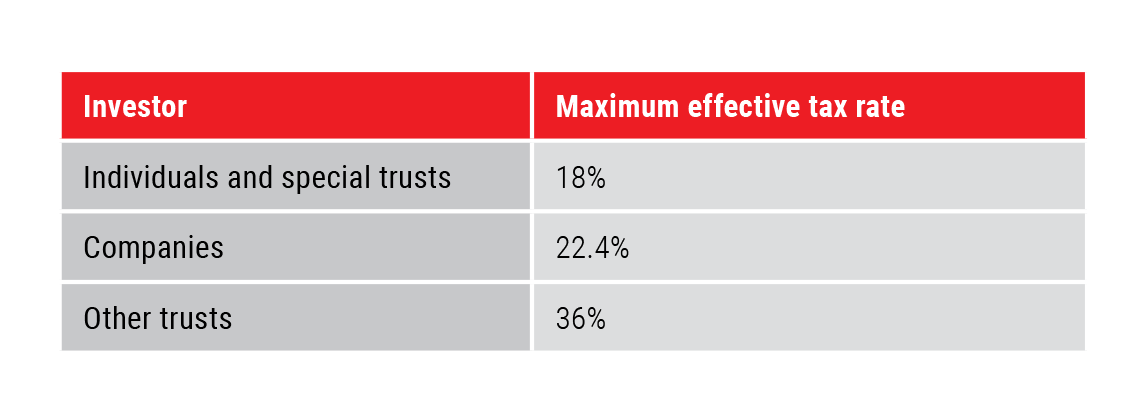

Capital gains tax (CGT)

The capital gains tax inclusion rate for individuals and special trusts remains at 40%, and for other taxpayers at 80%.

The annual exclusion for a capital gain or loss granted to individuals and special trusts remains at R40 000. The exclusion granted to individuals remains R300 000 in the year of death.

Value-added tax (VAT)

VAT is charged on the supply of goods and services provided by registered vendors. It remains at 15%.

Estate duty

Estate duty is levied on property of residents and South African property of non-residents, less allowable deductions. The duty is levied on the dutiable value of an estate at a rate of 20% on the first R30 million and at a rate of 25% above R30 million.

A basic deduction of R3.5 million is allowed in the determination of an estate’s liability for estate duty.

Donations tax

Donations tax is payable at a flat rate on the value of property disposed of by donation. It is levied at a flat rate of 20% on the value of property donated, while any donations exceeding R30 million in one tax year will be taxed at a rate of 25%.

The first R100 000 of property donated in each year by an individual is, however, exempt from donations tax. This amount remains unchanged from last year.

Additional tax proposals for the 2020 legislative cycle

Retirement fund reform

Government and the National Economic Development and Labour Council have agreed to proceed with retirement reform related to the harmonisation of all retirement benefits, including provident funds.

Withdrawing retirement funds upon emigration

Individuals are currently able to withdraw funds from their pension preservation fund, provident preservation fund and retirement annuity fund when they emigrate for exchange control purposes through the South African Reserve Bank. The concept of emigration as recognised by the Reserve Bank will be phased out and it is proposed that the trigger for individuals to withdraw these funds be reviewed. Any resulting amendments will come into effect on 1 March 2021.

Tax and exchange control treatment of individuals

Government wants to encourage all South Africans working abroad to maintain their ties to the country. Consequently, the concept of emigration will be phased out by 1 March 2021. The intention is to allow individuals who work abroad more flexibility, provided funds are legitimately sourced and the individual is in good standing with the South African Revenue Service.