The Minister of Finance announced amendments to tax and other legislation that may affect investors. These changes are discussed in detail below and, unless otherwise indicated, will come into effect on 1 March 2017.

INCOME TAX

Individuals and special trusts

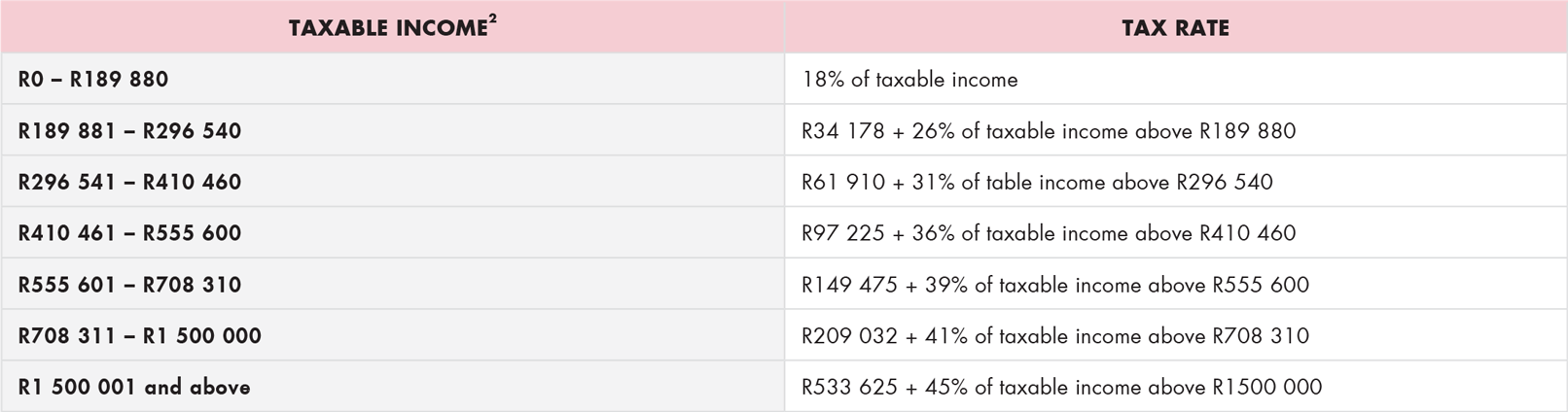

A new top bracket has been introduced for personal income tax - individuals’ taxable income above R1.5 million per year will be taxed at 45%. Previously, the top bracket of 41% was set at R701 301. The new top marginal income tax bracket is accompanied by partial relief for bracket creep. The personal income tax rates for the 2017/2018 tax year are listed below.

Companies and trusts

The income tax rate for companies has remained unchanged at 28%, while the income tax rate for trusts (other than special trusts) has increased to 45%.

TAX THRESHOLDS

Tax thresholds have increased to:

- R75 750 for taxpayers younger than 65

- R117 300 for taxpayers aged 65 to below 75

- R131 150 for taxpayers aged 75 and older

REBATES

The primary rebate (deductible from tax payable) has increased to R13 635 per year for all individuals.

The secondary and tertiary rebates have increased to:

- R7 479 for taxpayers aged 65 and older

- R2 493 for taxpayers aged 75 and older

INTEREST EXEMPTIONS

Interest exemptions have remained unchanged at:

- R23 800 per annum for individuals younger than 65 years

- R34 500 per annum for individuals 65 years and older

MEDICAL TAX CREDITS

Monthly tax credits for medical scheme contributions will increase from:

- R286 to R303 per month for the person who pays the contributions and the first dependant on the medical scheme

- R192 to R204 per month for each additional dependant

INTEREST WITHHOLDING TAX AND DIVIDEND WITHHOLDING TAX

Interest Withholding Tax (IWT) on interest from a South African source payable to non-residents has remained unchanged at 15%. Interest is exempt if payable by any sphere of the South African government, a bank or if the debt is listed on a recognised exchange.

Dividend Withholding Tax (DWT) on dividends paid by resident companies and by non-resident companies for shares listed on the JSE has increased from 15% to 20%, effective 22 February 2017. The exemption and rates for inbound foreign dividends have also been adjusted in line with the new local DWT rate, resulting in a maximum effective rate of 20%.

TAX-FREE SAVINGS ACCOUNTS

The annual limit on contributions to tax-free savings accounts has increased from R30 000 to R33 000.

RETIREMENT LUMP SUM TAXATION

At retirement

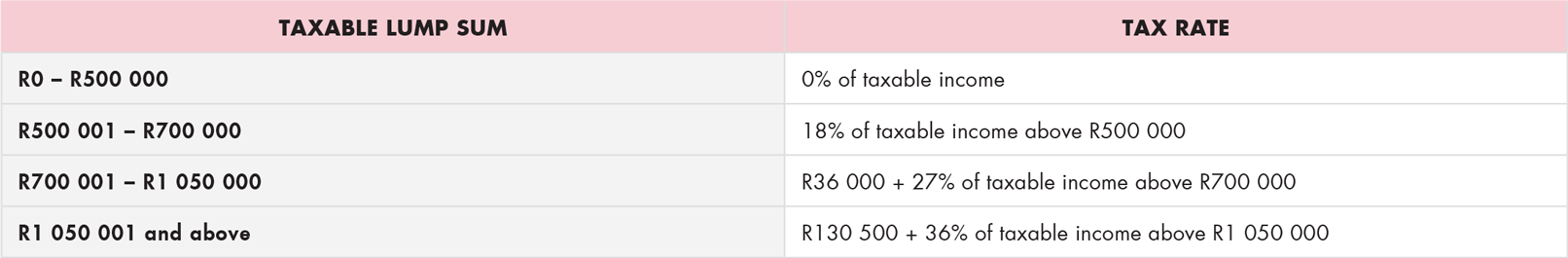

The retirement lump sum tax table is unchanged. The table below illustrates how retirement lump sums will be taxed.

Pre-retirement

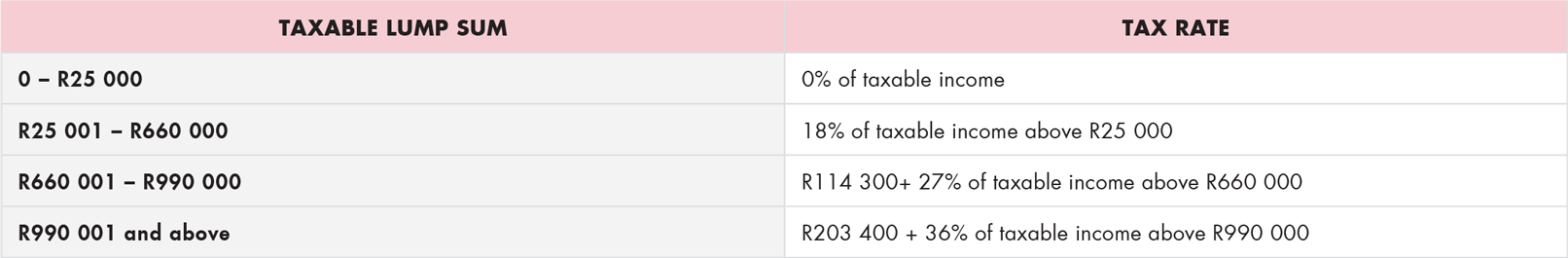

The pre-retirement lump sum withdrawal tax table is unchanged. The table below illustrates how lump sum withdrawals will be taxed.

CAPITAL GAINS TAX

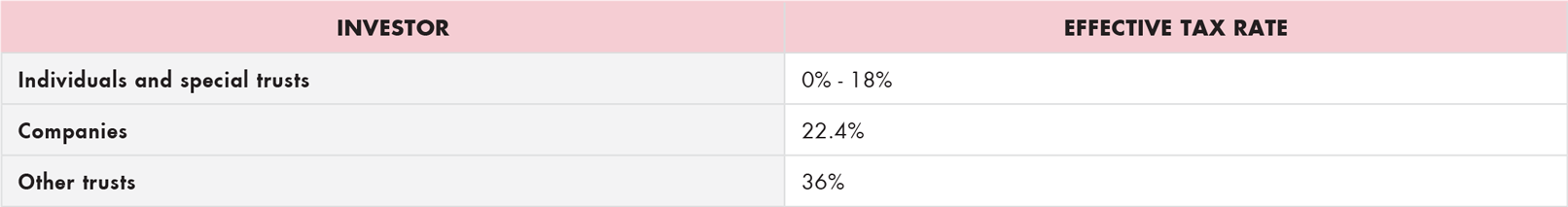

The capital gains tax inclusion rate for individuals and special trusts is unchanged at 40%, and for other taxpayers at 80%. The table below illustrates the effective tax rates for individuals, companies and trusts.

The annual exclusion for a capital gain or loss granted to individuals and special trusts is unchanged at R40 000.

VALUE-ADDED TAX (VAT)

VAT is unchanged at 14% on the supply of goods and services provided by registered vendors. Government will look to expand the VAT base in 2018/2019. This will be subject to consultation leading up to the 2018 Budget.