EXECUTIVE SUMMARY: Investors who give their money to professional managers to invest still wish to remain informed about what their managers are thinking and how therefore they are investing their money. Jonathan Brodie and Trevor Black, from our offshore partner Orbis, look at the best way to do this and what pitfalls you should avoid.

For macro-orientated managers, look at their portfolio weightings relative to the index.

Some managers take a 'top-down' or macro-orientated approach to investing. In other words, they focus on economic data, variables and trends before deciding on countries and sectors and only then analyse specific shares in which to invest. To understand these managers' views, it is customary to look at their 'active bets' or how their portfolios are weighted relative to the index.

This approach can lead to some misunderstanding if the manager is a 'bottom-up' stock picker, such as Orbis. As a bottom-up stock picker, we focus our time and attention on understanding individual companies, with the belief that, at any time, there will be some that are undervalued and have the potential to outperform regardless of the overall sector, economy or country in which they operate.

The key to our views lies in understanding our investment process

The way to remain informed about our views is to understand and appreciate the process by which Orbis selects businesses, rather than focus on any particular stance relative to the index. Doing this is a distraction.

We search for businesses we believe we can buy at a significant discount to their intrinsic value. In industry jargon, we are 'benchmark unaware'. This means we do not look at benchmark holdings or base our investment decisions on taking views relative to the benchmark. Due to this approach, our individual stock picks determine our country weightings, rather than a particular view on the country from where the stock comes. We run a focused portfolio so any over- or underweight positions are often the result of a relative handful of holdings in selected companies.

This is why top-down measures of sector or regional exposures of our portfolio can be very distracting as they bear no relationship to our investment approach.

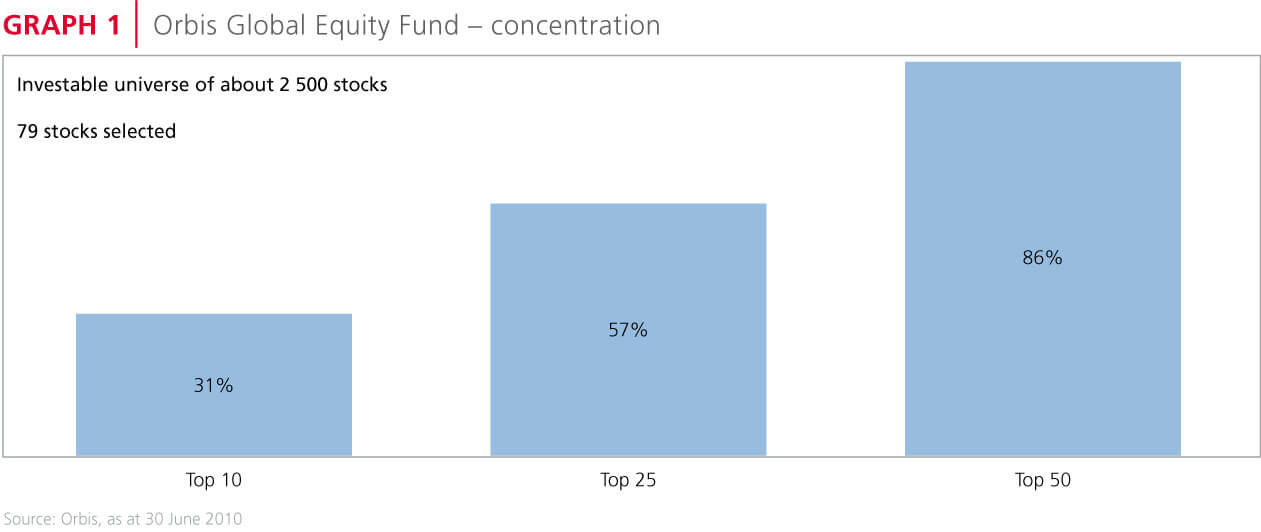

Graph 1 shows that Orbis typically has about 30% to 40% of the portfolio in the Top 10 holdings. In a global context, given the size of the investable universe, this is very concentrated. For example, at the end of June 2010, we held 79 companies out of a possible 2 500 stocks (after screening for size and liquidity) in our primary research universe. This means we have positions in only 3% of the stocks in our potential universe and our Top 50 positions account for about 86% of the portfolio.

Our regional and country exposure is driven by a very modest number of holdings because the portfolio is concentrated

While we hold 41% of the portfolio in US stocks, the exposure is from only 25 companies out of well over 1 000 US stocks in our purchase universe. Where we hold 18% of the portfolio in Japan, this exposure is from only holding 14 companies out of a purchase universe of about 250. When you combine a focused portfolio with our contrarian views and the conviction to stand by those views, our portfolios can deviate from their benchmarks, often quite substantially.

How regional weightings can be distracting

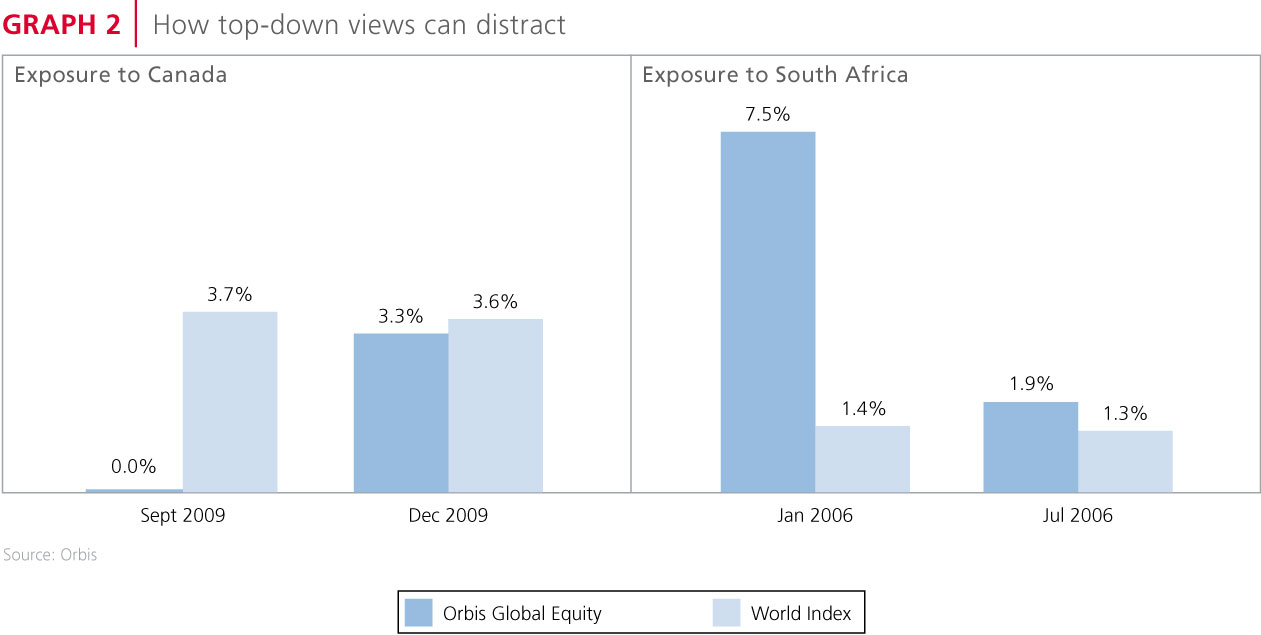

Graph 2 shows the exposure of the Orbis Global Equity Fund and the World Index to Canada and South Africa at two different times. On the left, the Orbis Global Equity Fund had no exposure to Canada in September last year. Three months later, it looks like our views on Canada are more neutral than bearish. On the right, we look at Orbis' exposure to South Africa in January 2006 and then six months later. In this case, it appears as if Orbis was initially very bullish on South Africa and that this changed to being close to neutral.

In both cases, the interpretation of the apparent 'move to neutral' in terms of country views would be incorrect. In each case, this movement was company specific, and because of just one stock. In Canada last year, we bought RIM (Research In Motion). In South Africa in 2006, we sold Sasol.

Sasol, which needs no introduction in South Africa, had quadrupled while we owned it. Meanwhile, unusually low valuations had emerged in a handful of high-quality US companies like Cisco. The sale of our Sasol shares shifted the Fund's country exposure, but this was due to the competitive process for investment capital, not a top-down view that drove our decision. (Note that this was in 2006. Prices and values have since moved and Allan Gray is again seeing value in Sasol.)

RIM manufactures the Blackberry handheld device as well as integrated back-end software and services that support multiple wireless standards. The market feels uncertain about RIM's consumer business because Apple's iPhone dominates and other viable competitors such as Motorola's DROID are entering the space. In focusing on this, we feel the market has been missing an opportunity. We believe that RIM's business should be valued by disaggregating the franchise into two components:

- The enterprise business and

- The consumer business

The enterprise business is a great business, returning more than 30% on invested capital with a very defensible moat. It is a 'need to have', not a 'nice to have' efficiency tool for knowledge workers. RIM provides a highly scalable, reliable, and secure messaging service that is 'always-on' which differentiates it from its competitors and makes it exceptionally difficult to replicate. Switching costs are high and RIM's network dramatically reduces the bandwidth telecom carriers require, which makes it a valuable infrastructure partner to those carriers.

When we bought the stock, it was trading at less than what we believed to be a conservative valuation for just the enterprise business, which effectively gives us the company's global consumer business for free. While Apple is better than RIM in the US consumer market, RIM's dominance in the enterprise arena and opportunity in the global consumer space are, in our assessment, not appreciated by the market.

The enterprise business represents a great margin of safety. The multiple that the stock is now trading at (about 9x our estimate of February 11 earnings) seems to ignore the global growth potential of the company.

BY HOLDING A FOCUSED PORTFOLIO...,WE BELIEVE WE CAN GENERATE VALUE OVER TIME

As ever, it is worth noting that historically only about 60% of our stock picks have outperformed the market, so we highlight RIM merely as an example within the portfolio. The key point is that our research has convinced us that it is priced below what it is worth, and by holding a focused portfolio of these ideas, we believe we can generate value over time.

Orbis analysts do not offer views on macro trends, we focus on understanding businesses and building focused portfolios

So when asking an Orbis analyst how they are thinking, the answer is unlikely to concentrate on the difficult macroeconomic conundrums that plague investors today. While we remain very cognisant of the fact that the businesses we analyse operate in, and are subject to, the vagaries of macroeconomic cycles, we spend the majority of our time focusing on the individual factors (which we believe can be analysed with a greater degree of certainty) which drive the long-term intrinsic values. We build our portfolio in a focused, bottom-up way and apply a consistent philosophy over different cycles. Ultimately, we believe the story is in the stocks.