Recently companies in Australia that have grown their earnings and paid large dividends have been well rewarded. But is this sustainable?

Since 2009, the Australian stock market has handsomely rewarded companies that have been able to grow their earnings and pay large dividends in the process. This is unsurprising. A company’s value today is simply the present value of all the future dividends that investors will receive from owning that company. The company’s ability to pay dividends is a function of its earnings. Therefore earnings and dividends are critical to any fundamental investor’s assessment of company value.

Be clear on where growth is coming from

The market’s insatiable appetite for companies with growing earnings and dividend streams has blinded many investors to the way in which this growth is delivered. The low interest rate environment in Australia has led to companies funding a greater proportion of their assets with very low-cost debt and increasing the proportion of earnings paid out to shareholders in the form of dividends.

This method may be an easy way to deliver the growth that the market desires, but it is not a very sustainable way. It creates a short-term sugar hit in the form of increased earnings and, in this market, an even higher share price (which in turn usually leads to higher executive remuneration, a convenient coincidence). The trade-off is potentially lower future earnings (should interest rates increase) and significantly higher business risk from elevated levels of debt.

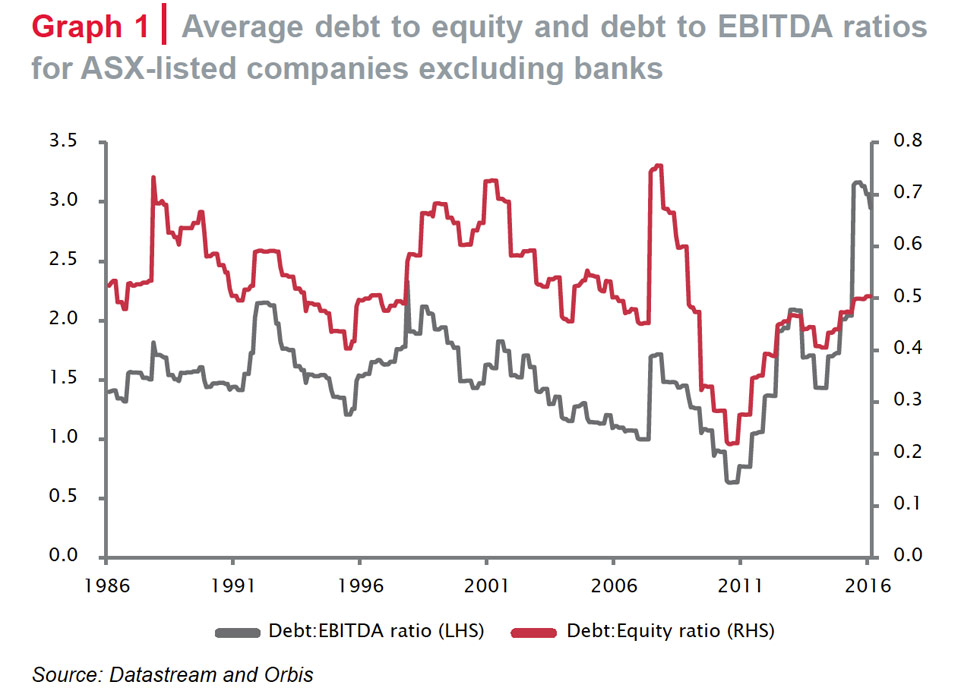

Graph 1 shows the average debt to equity and debt to EBITDA (earnings before interest, tax, depreciation and amortisation) ratios for Australian Stock Exchange (ASX)-listed companies excluding banks (which are highly indebted and thus skew the numbers). These metrics are widely accepted measures used to assess balance sheet strength.

Although current levels of gearing (as measured by the debt to equity ratio) are considerably below their all-time highs, they are well up on the lows of the last few years. The reduction in corporate earnings since 2011 (primarily from the resource-exposed companies), combined with this increased level of debt, has contributed to the recent spike in the debt to EBITDA ratio. In both cases, the current trajectory is not sustainable and companies are becoming increasingly exposed to the potential threat of rising interest rates.

The current extended cycle of low interest rates has led to an element of complacency in assessing the business risks attached to elevated levels of company gearing. As a result, the attractiveness of lowly-geared companies appears to be underappreciated today. Some may consider our approach old-fashioned, but we’re much more attracted to companies whose management teams don’t rely on increasing capital structure risk to generate ‘increased’ value for shareholders.

How to access Allan Gray Australia funds

Allan Gray Australia manages two funds. The Allan Gray Australia Equity Fund actively invests in selected Australian shares that offer long-term value. It takes advantage of Allan Gray’s contrarian approach and is suitable for investors who are comfortable with market fluctuations and can take a long-term view and remain invested for more than five years in exchange for potentially superior returns.

Cautious investors looking for investment exposure to Australia, who want to reduce their risk to equities, should consider the Allan Gray Australia Opportunity Fund. It aims to outperform the Reserve Bank of Australia cash rate over the long term with less volatility than the stock market by blending cash investments with select equity opportunities. It is lower risk, but still offers exposure to growth via strategic holdings of select shares when the equity market offers value.

Both the Allan Gray Australia Equity Fund and the Allan Gray Australia Opportunity Fund are available via the Allan Gray Offshore Investment Platform and have been approved by the FSB for marketing to South African investors.