The US market has long represented a safe haven for many investors, although the tide may finally be turning. Adam R. Karr, president and portfolio manager at our offshore partner, Orbis, unpacks how things have shifted over the last six months and touches on how the Orbis Global Equity Strategy is positioned to deliver lasting value in the face of uncertainty.

Whiplash struck early in 2025. Policy and geopolitical shocks arrived in rapid-fire succession. Washington slapped 25% tariffs on Canada and Mexico, hiked Beijing’s to 145%, and on 2 April declared “Liberation Day”, adding a 10% duty on every import. Elon Musk’s much-hyped Department of Government Efficiency (DOGE) pledged US$2tn in cuts; then he folded as Congress debated a “One Big Beautiful Bill” to add trillions. Before markets could exhale, Israel’s mid-June strikes on Iran’s nuclear sites, followed by retaliatory missile fire, sent crude higher and rattled nerves.

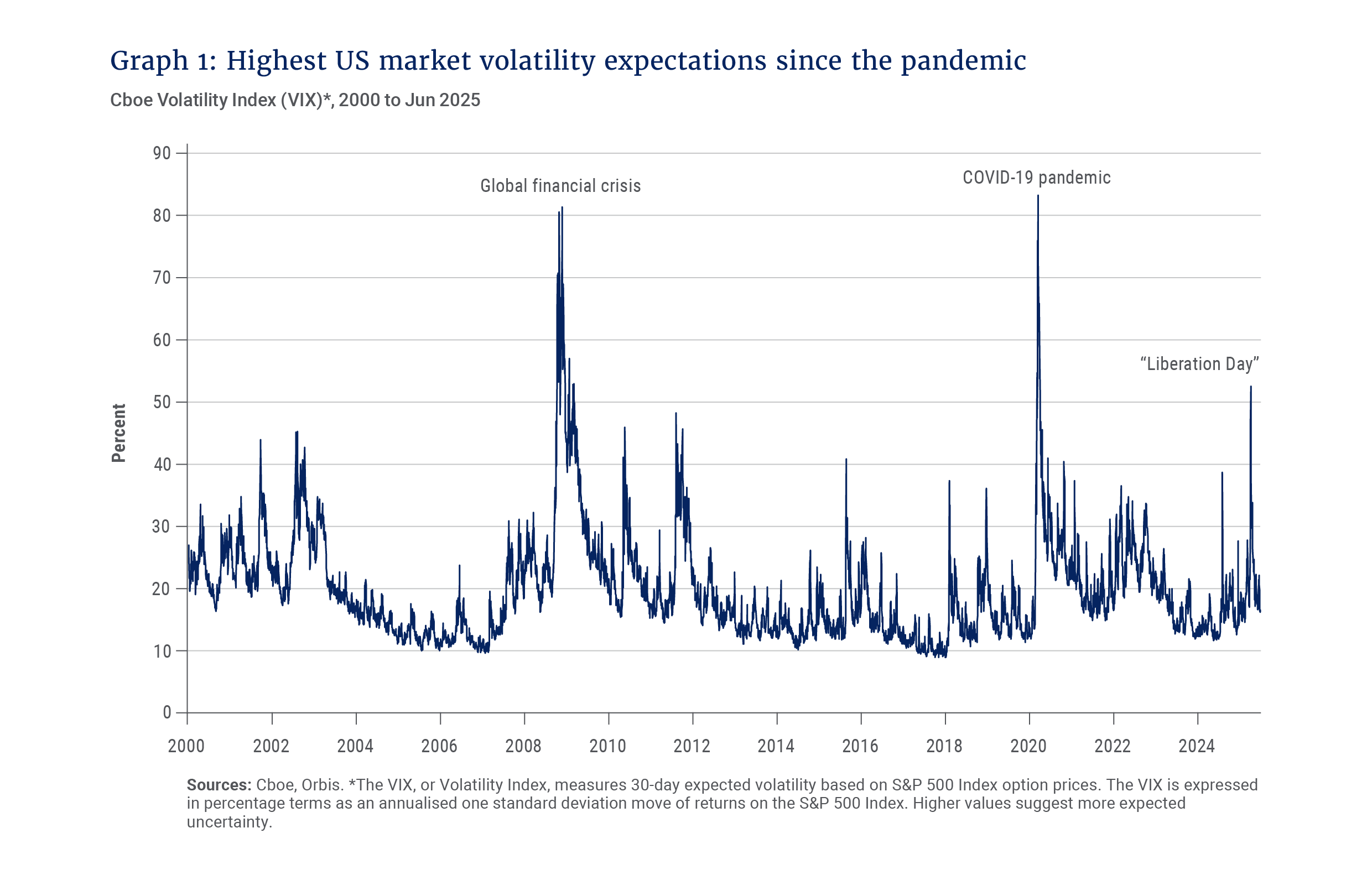

Markets buckled early on – yet many indices closed the half-year at record highs. Between mid-February and early April, the S&P 500 sank nearly 20% peak to trough, and volatility spiked to levels seen only twice in the past 25 years. See Graph 1. Bonds rallied; the yen, pound and Swiss franc all strengthened against the dollar, and gold surged, up more than 25% year to date.

Against that backdrop, it has been gratifying to see our Global Equity Strategy return 22% year to date, outperforming the MSCI All Country World Index (World Index) net of fees by 11% on an asset-weighted basis. Just as important, our drawdowns were shallower during the bouts of market stress.

Volatility and adaptability

When I last wrote in January, the S&P 500 had raced 25% higher in 2024, capping an extraordinary 15-year stretch of roughly 14% annualised returns since the global financial crisis. We suspected that pace couldn’t endure, but we didn’t know when or how it might end. And while Trump 2.0 promised to “shake things up”, the form of that creative destruction was impossible to map. With a risk appetite that rivals that of George Soros, President Trump proved it.

The larger the divide between market price and intrinsic value, the greater the scope for us to convert insight into alpha.

Six months later, policy shockwaves have been fierce, yet the World Index still closed the half-year up 10%. That’s respectable in calm seas and remarkable amid today’s swells. The February-to-April sell-off was a blunt reminder that American exceptionalism has limits: The United States is still home to many of the world’s most innovative and well-managed companies, but its reputation as a haven of political stability and free trade has been dented. Investors who stay fully anchored to US equities could find the tide has turned faster than they expected. And complacency can be costly, especially when safe havens stop acting safe.

Shifting landscape: A new age of mercantilism

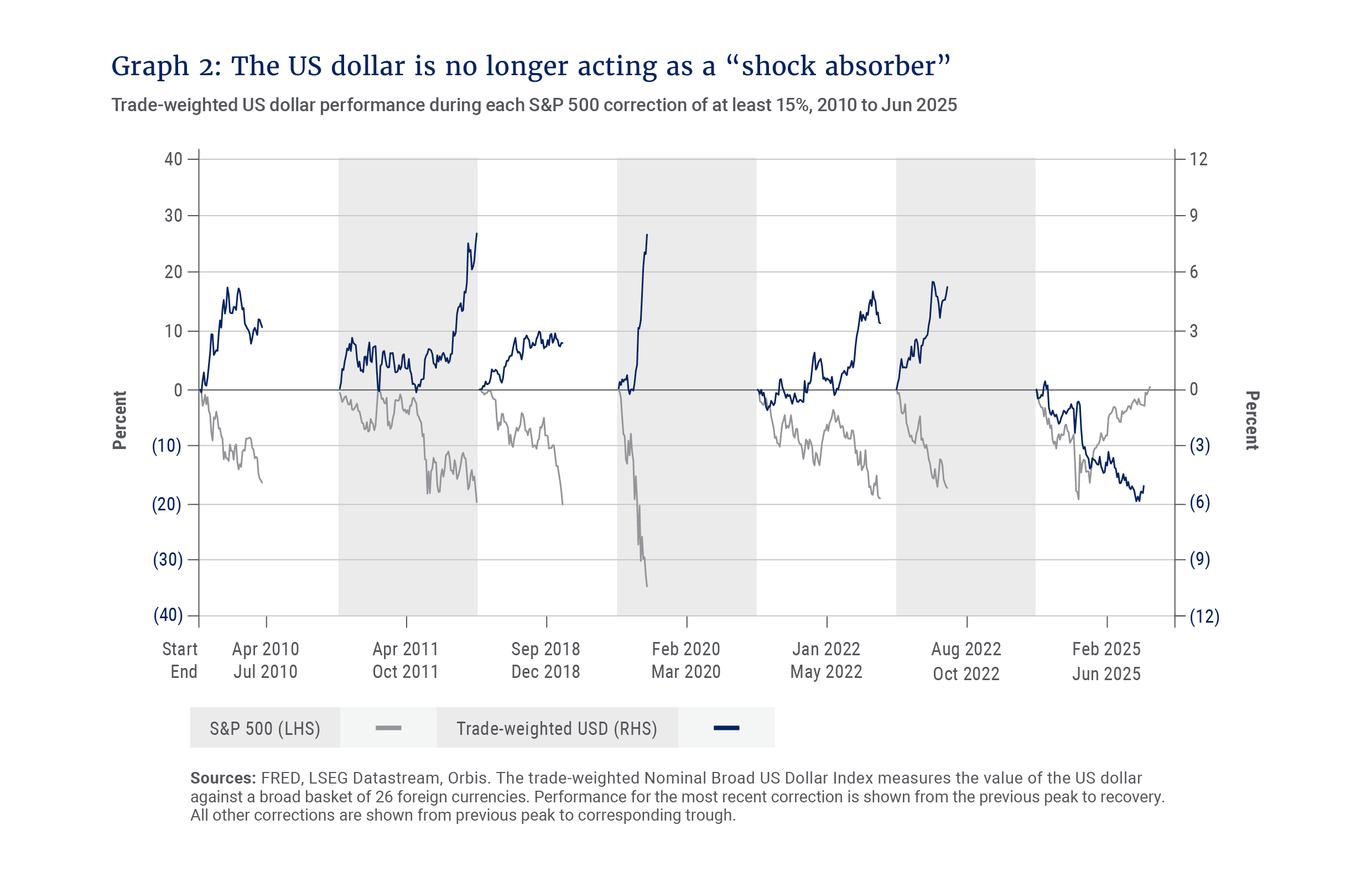

Graph 2 speaks volumes – perhaps the market’s first warning that the landscape is transforming. In every S&P 500 correction exceeding 15% since 2010, the trade-weighted US dollar has appreciated. Until now. Treasuries, long the market’s go-to shock absorber, also failed to rally. When both of the market’s most trusted risk-off havens break a long pattern, the old playbook may no longer apply.

One force reshaping the landscape is a shift from globalisation towards a more mercantilist era. How far that pendulum will swing is uncertain, but the motion is clear. Tariffs, targeted industrial policies and security-driven trade rules are redirecting capital flows. In the process, they turn yesterday’s disinflationary tailwinds into potential inflationary headwinds that squeeze margins and valuations. If these policies gather speed, the terrain will shift further; if they stall, the adjustment may be milder. In any case, we believe the current shift is strong enough that portfolios should be built to weather either scenario.

Economic historian Russell Napier argues that our current challenges stem from three persistent imbalances: Asia’s surpluses, the West’s twin deficits and a “dollar-centric non-system” that kept money cheap while global debt exploded. Correcting these imbalances, he contends, will usher in “national capitalism”, a policy mix in which governments steer their savings towards domestic priorities through capital controls and other forms of financial repression. Such measures are likely to divert capital away from the US and favour real, inflation-protected assets and shorter-duration cash flows, not the duration-heavy bonds and frothy tech stocks that thrived in the prior regime.

During the sharpest sell-offs this year, the portfolio outperformed, helping preserve your capital amid the turbulence.

Portfolios concentrated in last-decade winners are looking more vulnerable to us. US equity valuations remain elevated even as the tailwinds that supported them – abundant liquidity, steady margin expansion, and persistent index flows – may be less certain. History suggests that market leadership rarely survives a regime shift, so investors may want to prepare for that hand-off rather than assume yesterday’s champions will dominate the next cycle.

Diversification and resilience

A deliberate underweight to US equities once felt like swimming against the tide, but it proved invaluable this year. Entering 2025, our Global Equity Strategy held just 55% in US stocks versus 67% for the World Index. During the sharpest sell-offs this year, the portfolio outperformed, helping preserve your capital amid the turbulence. A powerful style shift helped as well: Value shares beat growth by the widest margin in almost 25 years – fertile ground for our price-disciplined approach.

Currency diversification also made a difference. We manage currency exposure with one objective: protecting your long-term purchasing power. Given the fiscal and external imbalances discussed earlier, we view the dollar as a less reliable store of value in the long run. Heading into the year, the Strategy’s US dollar exposure was about 12% below the World Index. Our largest currency overweight is the Japanese yen, whose risk-reward profile improves as Japan finally emerges from deflation.

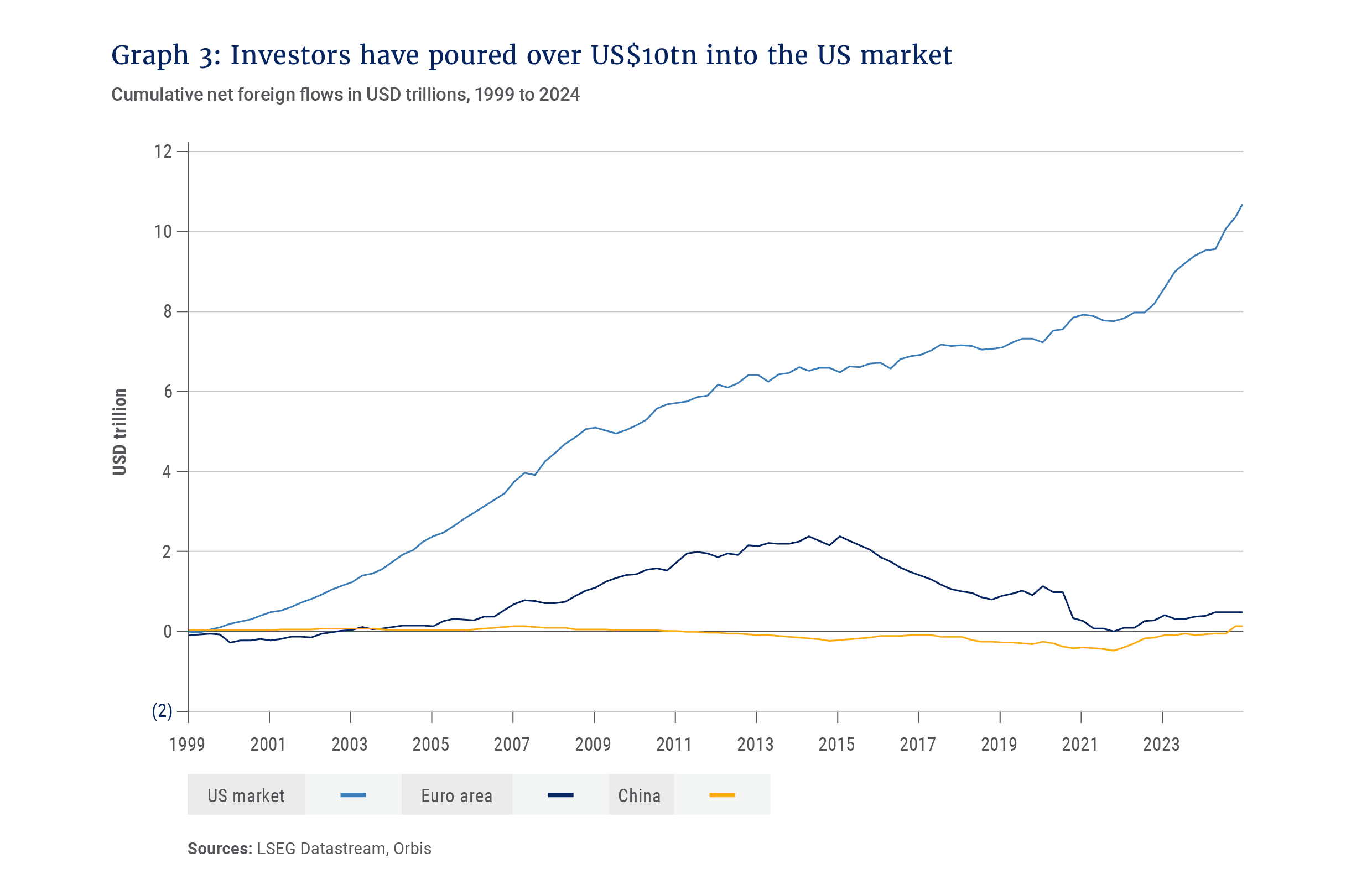

Make no mistake, the United States still offers compelling opportunities, though selectivity is crucial. Roughly 40% of the portfolio is in US stocks, anchored by high-conviction holdings that continue to generate idiosyncratic alpha. Even so, we remain meaningfully underweight versus a concentrated benchmark. Valuation remains our compass, and today it points to attractive risk-adjusted prospects abroad. For global allocators already sitting on a 70% US weight, the next dollar is less likely to pursue the same crowded trade, especially with so many imbalances now in plain view. Graph 3 illustrates the extent of flows into the US market between 1999 and 2024.

Thanks to our diversified positioning at the start of the year, we have avoided wholesale portfolio surgery. But we have hardly been idle. We re-examined every holding given shifting tariff policy, especially for tariff-sensitive and cyclical names, while hunting for quality companies – the proverbial babies thrown out with the bathwater amid the volatility. There haven’t been as many of the latter as we’d like, yet we have added a few, including Mitsubishi Estate, one of the largest real estate developers in Japan, and Bruker Corporation, which manufactures high-performance scientific instruments and develops high-value analytical and diagnostic solutions in scientific fields.

This year we have leaned even harder into resilience, favouring businesses with durable franchises purchased at undemanding prices – a combination that tends to hold its ground when markets turn “saucy”. Examples include Steris, a leading global provider of products and services that support patient care with an emphasis on infection prevention, retailer Tesco and oil and gas company Shell. We are also uncovering value in markets such as Brazil and Japan, where subdued expectations leave ample room for positive surprises.

… we meet volatility with anticipation, not dread, confident that disciplined stockpicking can turn today’s turbulence into lasting value for you.

In aggregate, the Global Equity Strategy looks nothing like its benchmark. The World Index’s 10 largest stocks trade at roughly 30 times forward earnings, while our 10 largest positions trade nearer to 18 times. That valuation gap gives us a margin of safety that should serve you well, particularly as the market has only started to rotate leadership.

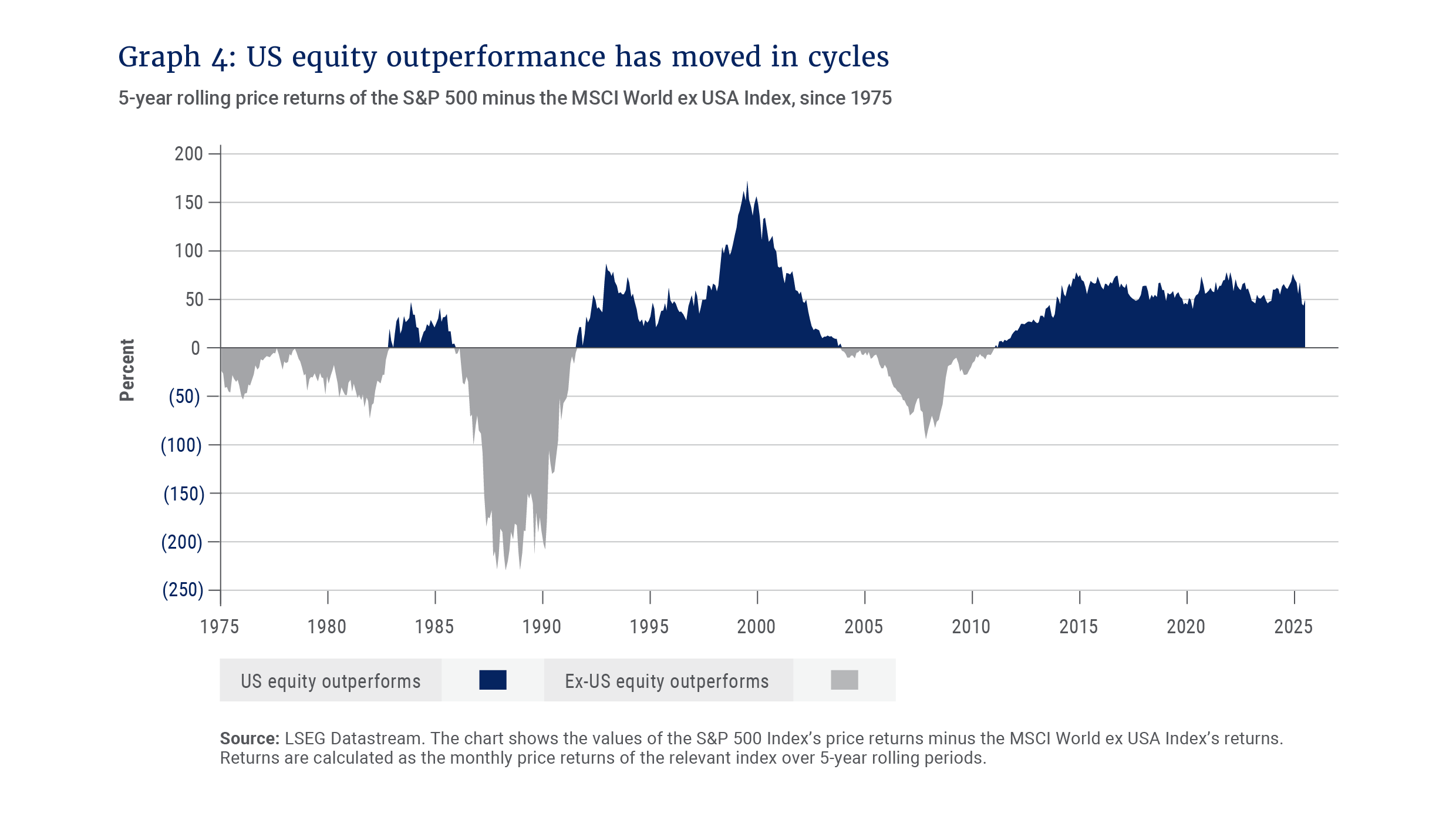

Considering that US equity outperformance is cyclical (see Graph 4), we recognise that renewed enthusiasm for US equities could make our positioning look premature. More importantly, we see the larger systemic risk in passive indices. Both US and global benchmarks trade at rich valuations and are dominated by a small cadre of US megacaps. Passive ownership today therefore delivers neither true diversification nor true resilience. Given this imbalance, we believe asset allocators should actively explore ways to temper their benchmark exposure, restoring some balance across regions, sectors and currencies.

Those same imbalances create fertile hunting ground for active stockpickers. Our investment team roams the world looking for mispriced businesses and has historically thrived when wide valuation gaps begin to normalise. The larger the divide between market price and intrinsic value, the greater the scope for us to convert insight into alpha.

Closing

Headlines buzz with worries, from tariffs and geopolitics to AI’s dizzying pace, but our compass remains unchanged: We seek enduring businesses priced well below their long-term worth. As American educator-turned-inspirational-author William Arthur Ward is often credited with saying: “The pessimist complains about the wind; the optimist expects it to change; the realist adjusts the sails.” Guided by that realism, we meet volatility with anticipation, not dread, confident that disciplined stockpicking can turn today’s turbulence into lasting value for you.

Explore more insights from our Q2 2025 Quarterly Commentary:

- 2025 Q2 Comments from the Chief Operating Officer by Mahesh Cooper

- Allan Gray Stable Fund: Celebrating a quarter of a century by Radhesen Naidoo and Danielle Nissen

- Rebuilding the global monetary order with bricks of gold by Umar-Farooq Kagee

- Crouching tiger, hidden value by Andrew McGregor

- How to think about beneficiary nominations for your retirement funds by Ian Barow

- Three questions to evaluate your investment manager by Nomi Bodlani

To view our latest Quarterly Commentary or browse previous editions, click here.