Orbis is intending to make various changes to its fee structure which includes the creation of a mechanism to invest performance fees it earns when times are good, so that it can refund clients in times of underperformance. This is unique in South Africa and is aimed at better aligning Orbis’ interests with those of its clients. Tamryn Lamb outlines the key changes, as well as some additional changes we are introducing in parallel.

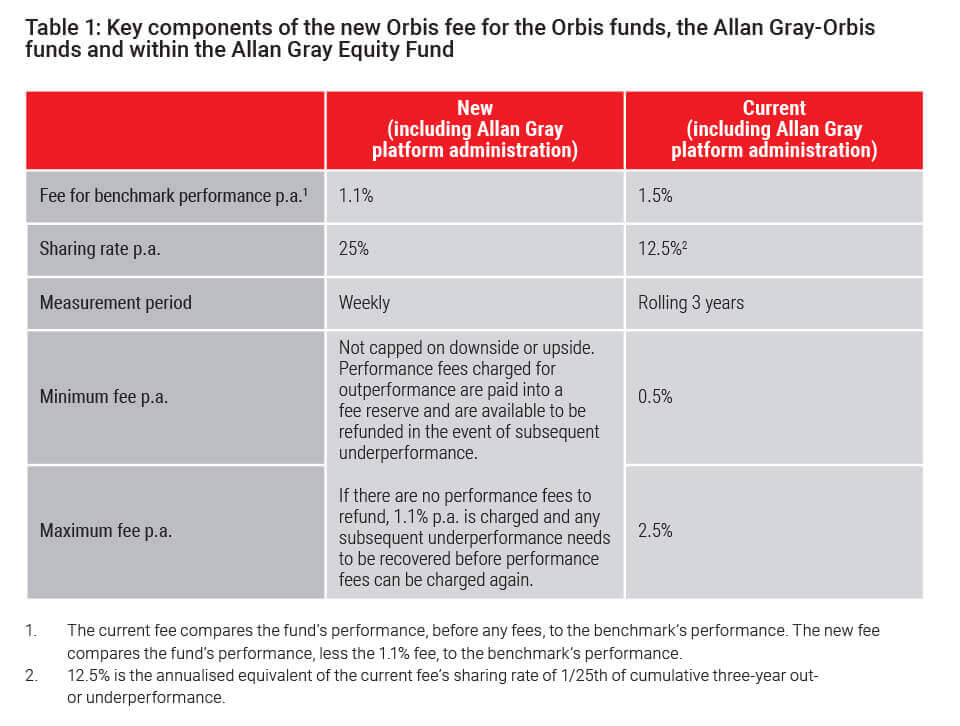

We continually review our fee structures, modifying and improving them when appropriate, to ensure that clients pay fees that are reasonable given the value added (or not added) on their behalf over the long term. The key changes that Orbis intends to implement will involve materially lowering the fee at benchmark performance and making the fee more reactive to short-term performance. These changes, combined with the introduction of a refundable reserve fee structure (see point 2 below), result in a meaningful improvement in the overall fee structure and a reduction at all levels of outperformance less than 6% per annum (before fees, assuming a performance fee refund is available).

What are the key changes?

1. Lower fees for benchmark performance

The fee for benchmark performance in the Orbis funds will reduce from 1.5% p.a. to 1.1% p.a. (including administration fees). We believe this results in a better alignment of interests with clients and serves to transfer more of the risk from the client to Orbis at low to zero outperformance.

2. Introducing a refundable fee reserve (“the fee reserve”) to the Orbis funds, the Allan Gray-Orbis funds and within the Allan Gray Equity Fund

One of the more meaningful changes to the fee structure, is that a new element called a “fee reserve” will be introduced. The purpose of the fee reserve is to give the funds the ability to refund performance fees that were previously charged for outperformance, if there is subsequent underperformance. This means Orbis will only earn performance fees where outperformance is sustained over a longer period. This fee reserve is described below.

In addition, the current three-year measurement period will be reduced to a shorter, weekly measurement period. The new fees will have a higher – but fully – symmetrical sharing rate of 25%. This means that the new fee will be more reactive to performance over shorter-term periods.

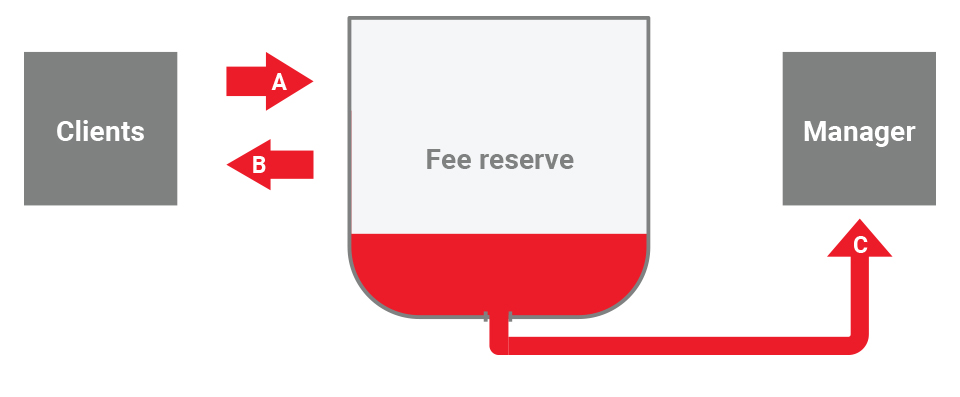

A and B – Flows between clients and the fee reserve

If a fund outperforms its benchmark (after deducting the benchmark fee of 1.1%), 25% of the outperformance is paid into the fee reserve at an uncapped rate, which is invested in the same fund. If the fund subsequently underperforms its benchmark (after deducting the benchmark fee of 1.1%), fees equal to 25% of the underperformance are refunded to clients from the fee reserve, again at an uncapped rate.

If the fee reserve balance falls to zero, the fund will continue to charge its benchmark fee of 1.1%, however any subsequent underperformance will need to be fully recovered before any further performance fees can be charged. This is similar to a high watermark principle.

C – Flows from the fee reserve to the manager

Fees will flow from the fee reserve to Orbis at a rate of one-third per year. In addition, the maximum fee that Orbis can be paid from the fee reserve each year is 2.5% of the fund’s net asset value in the fee class. Therefore, it will take at least three years for performance fees paid into the fee reserve to be paid fully to Orbis, if they are not used to refund clients.

In addition to the benefits of the new fee, Orbis will also ensure that investors will still benefit from any fee reduction that they would have experienced under the current fee structure as a result of Orbis’ performance over the three years before implementing the new fee.

3. Introducing a new fee for the offshore component of the Allan Gray Balanced and Stable Funds and a reduced fee for the Allan Gray Tax-Free Balanced Fund

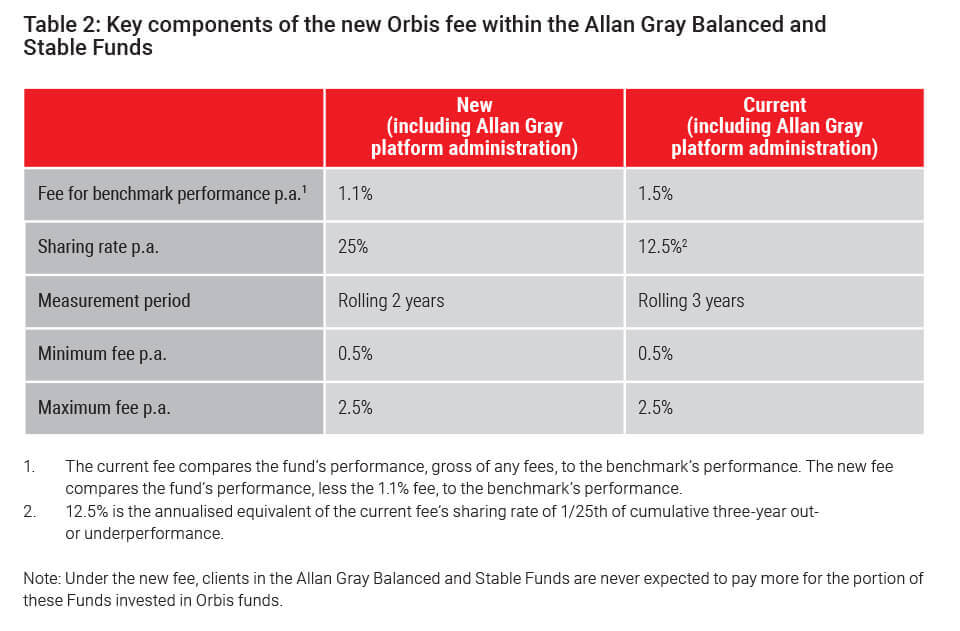

While very similar in principle, the structure of the new Orbis fees will be slightly different for the offshore component of the Allan Gray Balanced and Stable Funds. The key objectives referred to above are the same, i.e. lower fees for benchmark performance, a higher sharing rate and more reactive fees. However, to align with the local fee structures, the fees within the Allan Gray Balanced and Stable Funds will continue to have a maximum and minimum level and will have a two-year rolling period structure.

The Allan Gray Tax-Free Balanced Fund will receive a reduced fixed fee of 1.5%, from 1.7%.

Benchmark changes

Together with the above changes, Orbis will be changing some of the funds’ benchmarks. The Orbis Global Equity Fund’s benchmark will change from the FTSE World Index to the MSCI World Index, and both the Orbis Global Equity Fund and the Orbis SICAV Japan Equity (Yen) Fund benchmarks will change from gross to net of withholding tax on dividends benchmarks.

When the funds were launched, the FTSE World Index was the most representative benchmark for the investable universe of global equities and was also the more prevalent benchmark among global equity managers. However, the MSCI World Index has now become a much more widely used benchmark by global equity managers. The change from gross to net dividends reinvested also better reflects the fact that clients would typically be subject to dividend withholding taxes, both in the funds and if invested in the securities that constitute the benchmarks.

Allan Gray-Orbis Global Fund of Funds converting to Allan Gray-Orbis Global Balanced Feeder Fund

Allan Gray intends to convert the Allan Gray-Orbis Global Fund of Funds to the Allan Gray-Orbis Global Balanced Feeder Fund. We will need to ballot clients to vote on this proposed change.

The Allan Gray-Orbis Global Fund of Funds (the “Fund”) was launched in 2004 with the objective of creating a rand-denominated, global high equity, multi-asset solution. This mandate was achieved by investing in a combination of Orbis equity and absolute return funds (i.e. the Orbis Optimal Funds) available at the time.

Orbis subsequently launched the Orbis SICAV Global Balanced Fund in 2013 and, over time, the allocation to this Fund within the Allan Gray-Orbis Global Fund of Funds has been increasing – it currently comprises approximately 75% of the Fund. Going forward, Allan Gray intends to allocate the assets in the Fund solely to the Orbis SICAV Global Balanced Fund, which requires that the Fund be converted from a fund of funds (which can invest in multiple underlying funds with maximum exposure of 75% to any one fund) to a feeder fund (which can invest in only one underlying fund).

This will effectively transfer the asset allocation duties to Orbis, and we believe that they are well equipped to assume this responsibility, given that they are already responsible for picking the underlying assets and have successfully developed a track record in asset allocation. This change will not change the Fund’s investment objective or investment philosophy.

Allan Gray Offshore Platform administration fee

We will be introducing clean classes of the Orbis funds for the Allan Gray Offshore Platform, i.e. there will no longer be an administration fee component included in the investment management fees – administration will be charged for separately by the offshore platform. The clean benchmark fee will therefore be 0.8% instead of 1.1% (i.e. a 0.3% clean discount).

To complement Orbis’ fee changes, we will also be introducing a new tiered administration fee that only applies to Orbis and Allan Gray funds on the offshore platform (i.e. Allan Gray Africa, Frontier and Australia funds).

The administration fee will be 0.3% (excl. VAT) for the first US$1.2m (or foreign currency equivalent) and 0.2% (excl. VAT) thereafter, based on a client’s total assets invested on the Allan Gray Offshore Platform. The current administration fee is 0.5% (excl. VAT) for the first US$400 000 (or foreign currency equivalent) and 0.2% (excl. VAT) thereafter, based on a client’s total assets invested on the Allan Gray Offshore Platform. The current administration fee will remain for third-party funds on the offshore platform.

The total fee clients will pay on the offshore platform (i.e. for investment management and administration) is therefore dependent on their total assets invested on the offshore platform.

Implementation

Subject to Luxembourg, Bermuda and South African regulatory approval, we intend to implement the changes detailed above in Q4 of 2019.