Since its debut as a video console maker in 1983, Nintendo has been viewed as a cyclical company, subject to the unpredictable boom-bust rhythm of its hardware releases. However, we saw something different, signs of a quiet transformation. Behind the headlines of each new console launch, Nintendo has been building recurring revenues and unlocking its intellectual property (IP), the keys to predictable earnings growth – exactly the kind of overlooked opportunity our contrarian, bottom-up approach seeks to find. Andy Chiguri explains.

Nintendo’s “cyclical” legacy

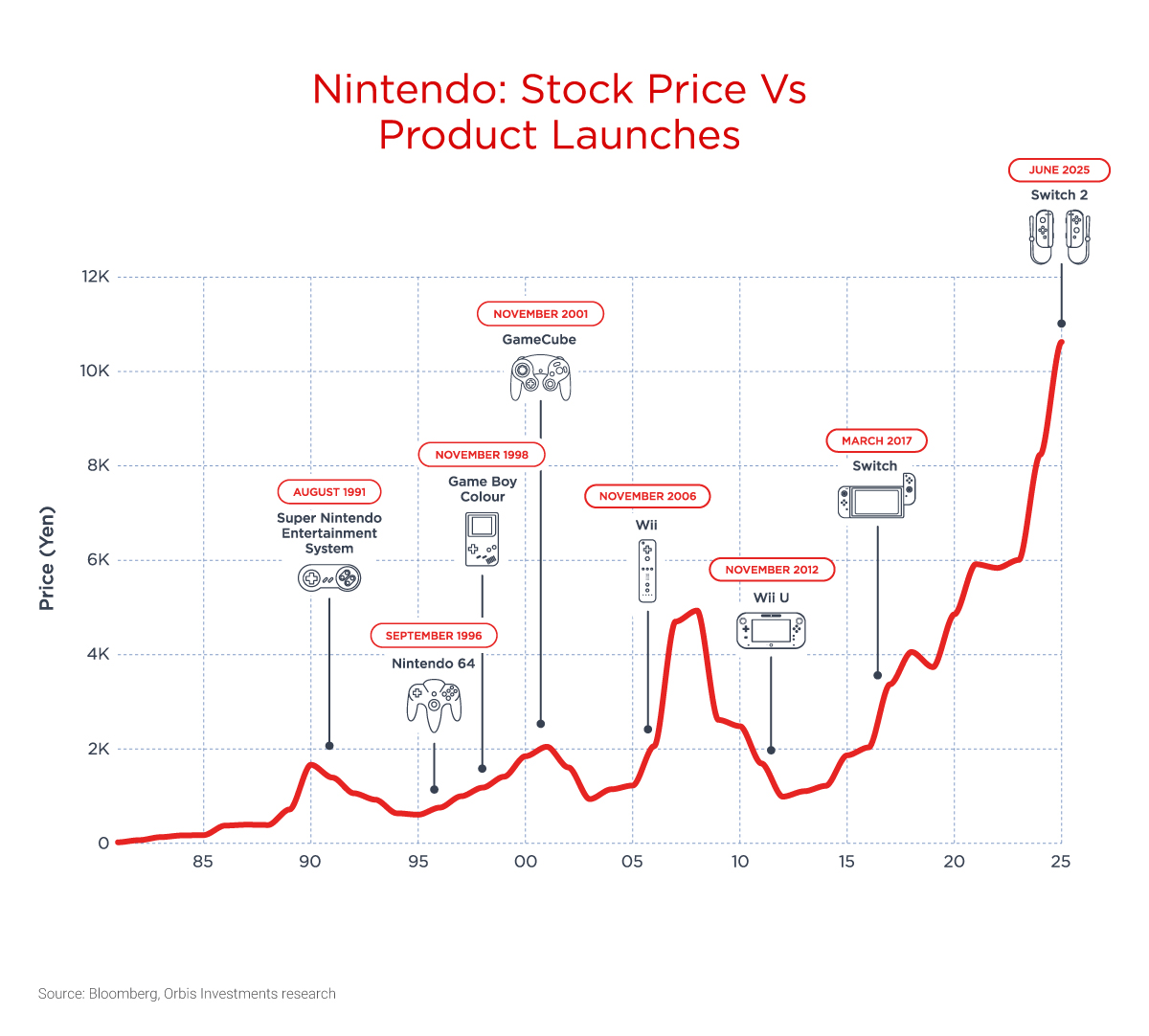

The Japanese gaming giant is no stranger to cycles. Investors have long fretted about its dependence on hardware. The boom-bust rhythm of console releases and the fickle nature of consumer tech could make share price evaluation frustrating. Indeed, Nintendo’s share price has historically moved in tandem with its hardware cycles.

Following the wildly successful release of the Wii, Nintendo’s share price peaked in the late 2000s. The Wii’s successor, the Wii U, released in 2012, was a flop, and Nintendo’s stock fell by 80% over five years from its previous high. In 2017, Nintendo had another hit on its hands with the release of the Switch. But in recent years, as the Switch has started to look a little long-in-the-tooth, scepticism crept in about what might come next. That scepticism, in part, stemmed from the fact each of Nintendo’s previous new console releases involved radical reinvention, leaving investors unsure of its commercial fate. In the past, new hardware meant that third-party developers had to rebuild their programming skills on unfamiliar hardware. Perhaps most importantly, Nintendo never seemed capable of holding onto its present audience, as the company did not have the infrastructure to bridge users from one platform to the next. For instance, gamers were generally unable to carry over their existing libraries to the next generation console.

In addition, Nintendo’s historical conservatism, especially its reluctance to fully leverage its powerful IP, has also done little to inspire long-term confidence. At times, it has felt as if Nintendo has left money on the table, choosing to protect its characters rather than promote them.

At face value, these criticisms are understandable. But what if the risk profile is changing? What if the business model is evolving in a way that makes it more durable and less exposed to the traditional cycle?

Breaking the cycle: a console designed for longevity

Nintendo’s last console, the Switch, was a resounding success with over 150 million units sold – and is now the second best-selling home console of all time. But that very success has become part of the challenge. With hardware sales slowing and operating profits down 47% year-on-year, it’s tempting to conclude that Nintendo has again peaked in earnings potential with recovery some years away in the foggy future. However, the Switch cycle has far outlasted its predecessors, and the console has sold relatively well, despite being almost a decade old. The reasons for this longevity are worth understanding because they suggest a revolutionary change in Nintendo’s business potential.

Enter the Switch 2. Unlike past hardware transitions, which often involved dramatic shifts and development hurdles, the next-generation device is an evolution rather than a revolution. With backward compatibility, standardised components and improved performance, Switch 2 eases the transition for users and developers alike.

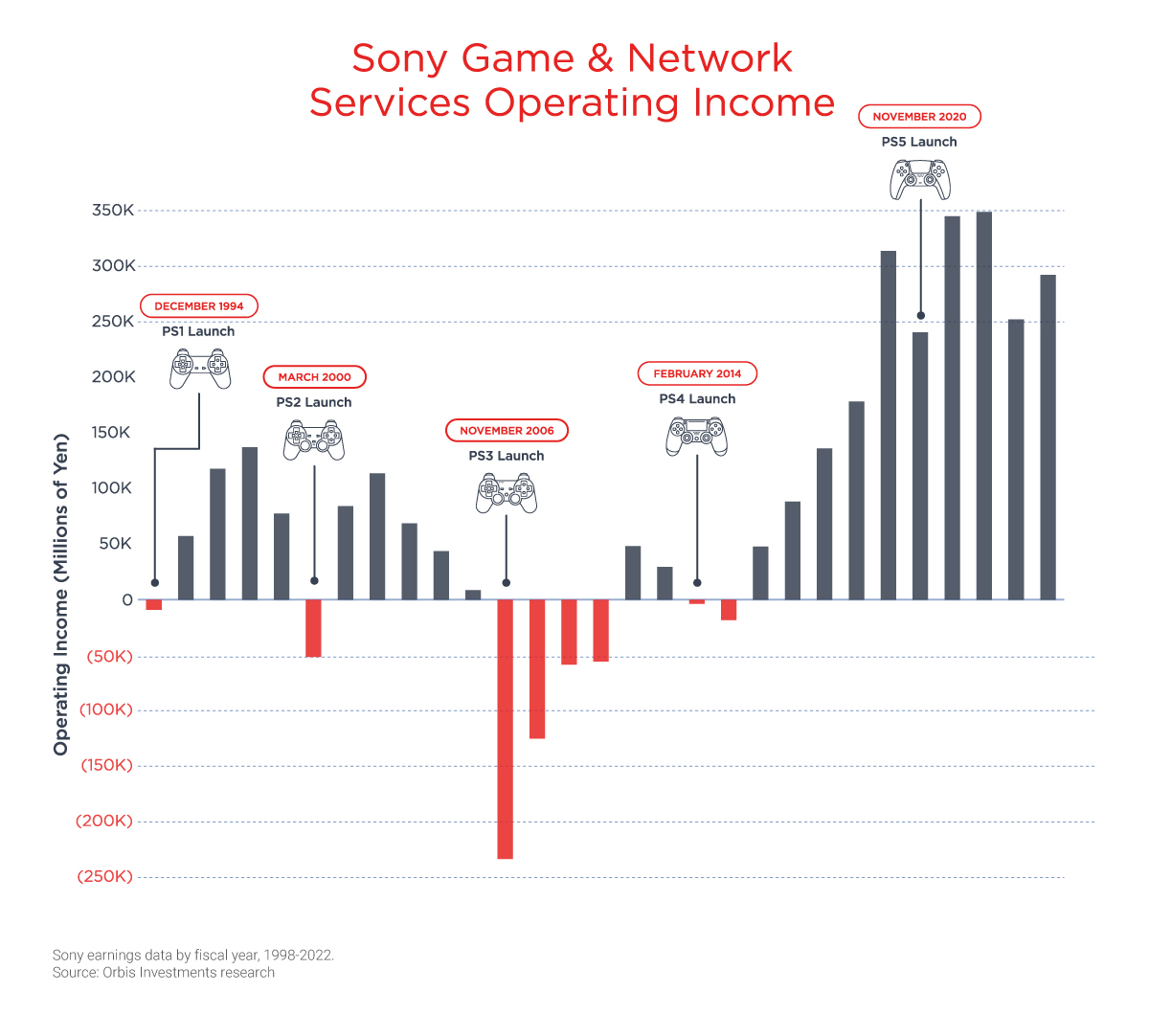

This isn't just good news for customer adoption – it’s strategically important. Standardisation lowers development costs and encourages third-party support. Higher performance could enable the Switch 2 to support more technically demanding titles, previously confined to PlayStation or Xbox. For Nintendo, this may help extend the lifecycle of the platform, reduce earnings volatility, and open up new monetisation avenues. One only needs to look at how Sony has achieved this with PlayStation between PS4 and PS5 to see it in practice.

That said, expectations for the Switch 2 are high, and if it underdelivers – either in consumer reception or developer traction – the share price could face renewed pressure.

Digital growth: extending its business moat

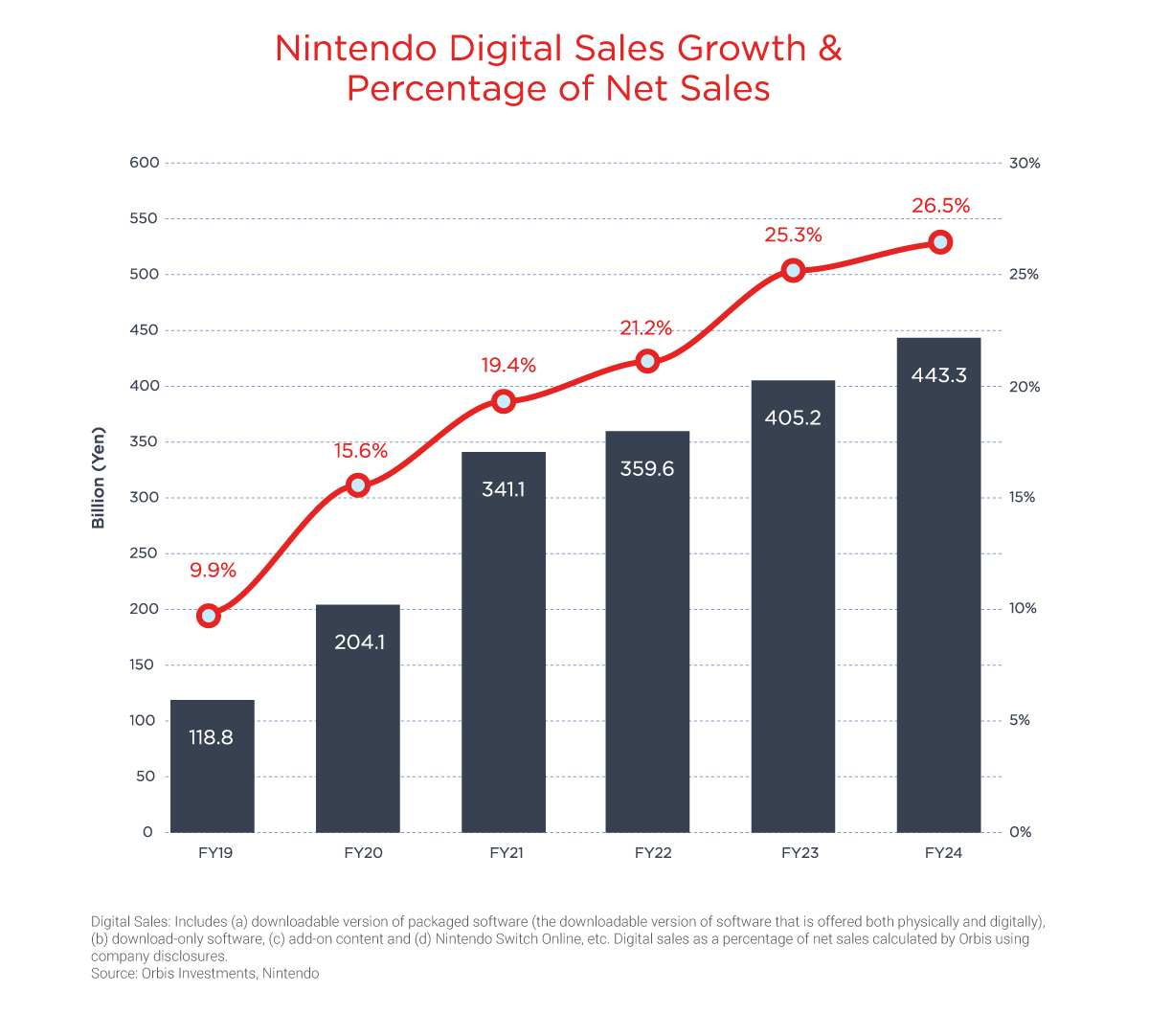

Nintendo’s digital strategy is also maturing. Historically reliant on physical cartridges and boxed games, the company is now seeing growing contributions from digital downloads, online subscriptions and add-on content.

Digital sales typically bring higher margins and greater control over distribution. They also enable monetisation of the back catalogue and ongoing content updates. Subscriptions, particularly 'Nintendo Switch Online', offer high-margin, recurring revenue with largely fixed costs. As the user base grows, so too should profitability.

Still, Nintendo’s digital features lag behind those of Sony and Microsoft. While this leaves room for improvement, it also represents a risk if the company fails to close the gap.

Unlocking the value of IP: from games to global franchises

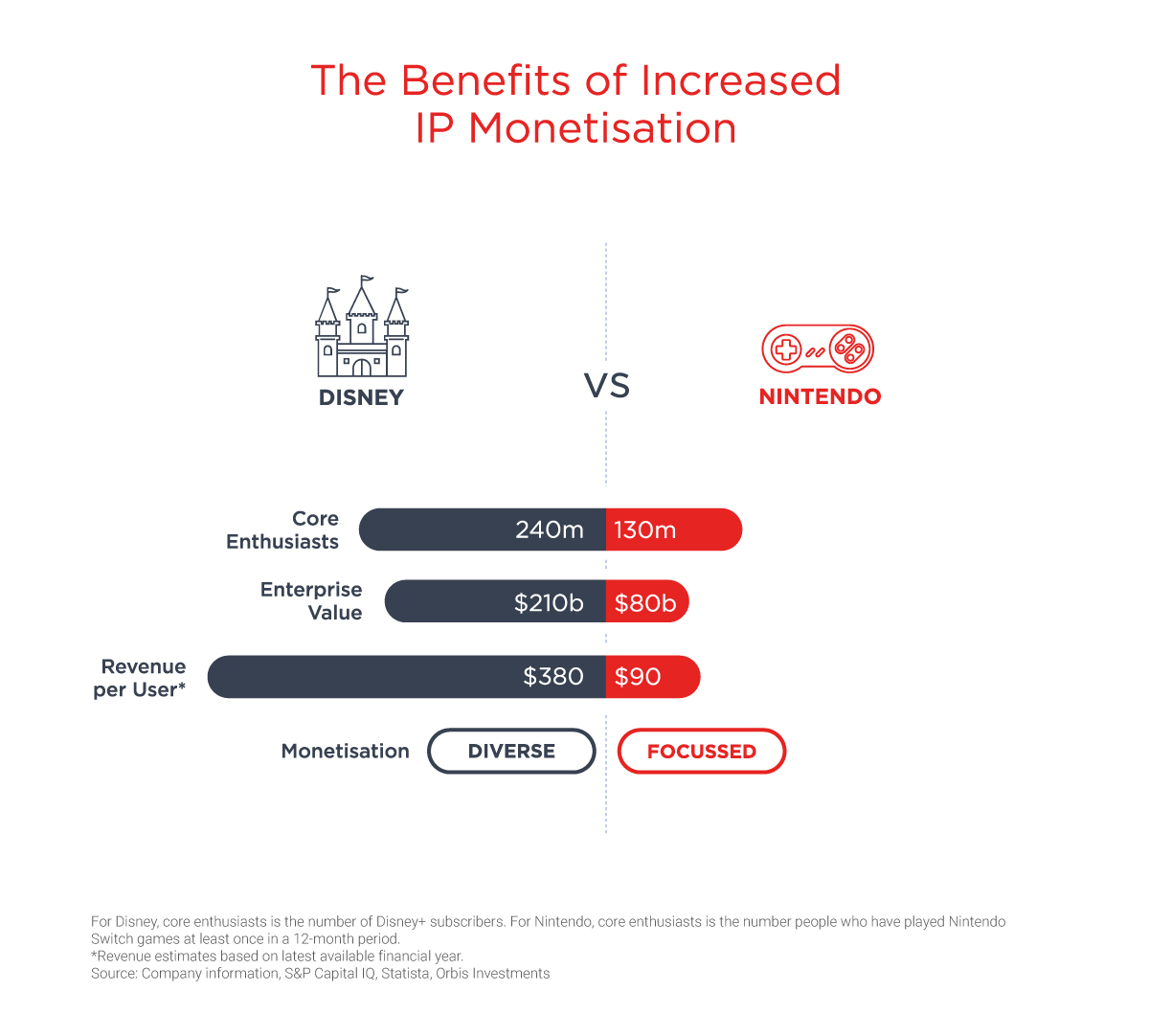

Nintendo has always had the characters. What’s changed is the company’s willingness to let those characters move beyond the console and generate returns in the process. The blockbuster Super Mario Bros. movie in 2023 brought in over US$1.36 billion at the box office – not just a commercial hit, but a cultural one. One of Nintendo’s strengths is the emotional connection fans feel with its IP. That connection, nurtured carefully over decades, is now becoming a monetisation engine with far more torque than before.

Yet for all its IP strength, Nintendo generates less than a fifth of the revenue of peers like Disney, despite a similarly devoted fan base. That gap highlights both the opportunity and the execution challenge. A Zelda film is in the pipeline, and the company continues to license IP to Universal theme parks. Every successful film, ride or crossover event reinforces the brand, deepens emotional connection, and drives customers back to the console.

The investment case: asymmetry in plain sight

At around 27x forward earnings, Nintendo’s valuation is above the global average, and not obviously cheap. Yet we believe Nintendo’s prospects are far better than average. It holds significant net cash, owns some of the most recognisable entertainment franchises in the world, and is steadily expanding into higher-margin, recurring revenue streams.

In our view, the market hasn’t fully priced in a future where Nintendo looks more like a recurring-revenue platform or diversified media house. That transition won’t happen overnight, but Nintendo seems to be doing everything to become such a business. If it achieves its goals, the upside could be meaningful.

This sets up a potentially attractive risk-reward profile. If Nintendo simply maintains its user base and improves monetisation steadily, it could deliver solid shareholder returns. But if its ecosystem model takes root and the Switch 2 is well received, the business’s earnings power could rise meaningfully.

Of course, nothing is guaranteed. A disappointing console launch, strategic stumbles, or a return to overly cautious IP management could stall momentum. The digital transformation is still a work in progress, and competitors aren’t standing still.

But from where we sit, these risks are broadly priced in – and the longer-term opportunity, if realised, could prove substantial.