Like Allan Gray, Orbis has a limited range of funds which it believes addresses the needs of most investors. New funds are only introduced after very careful consideration and only after ensuring they meet a substantial client need. On 1 January 2013, Orbis launched a new, global multi-asset fund – the Orbis Global Balanced Fund. The Fund has recently been registered for marketing in South Africa and is now available via the Allan Gray offshore platform.

How does the Fund fit in with the other Orbis funds?

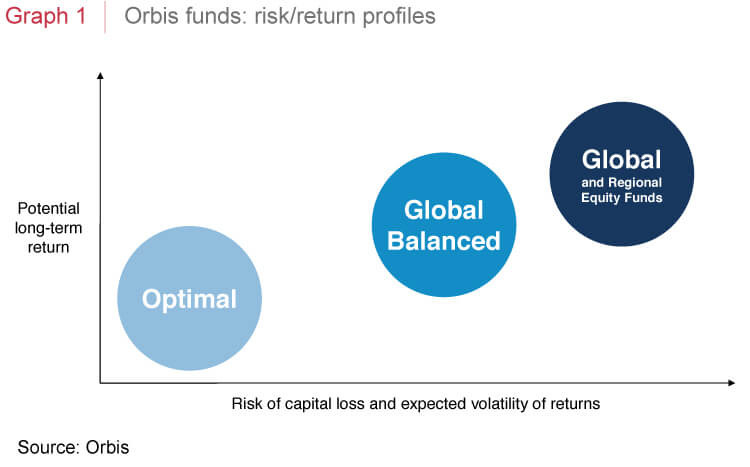

Since the Orbis funds were launched in 1990, Orbis has served clients with a small range of funds split between long-only equity strategies, and lower risk absolute return strategies which substantially hedge stock market exposure. Over the past few years clients have increasingly called for a fund that occupies the space in between these two, in other words, a fund that seeks long-term capital appreciation but with less volatility and risk of loss than a long-only equity fund. To satisfy this need, Orbis recently launched the Orbis Global Balanced Fund, beginning its track record in January 2013.

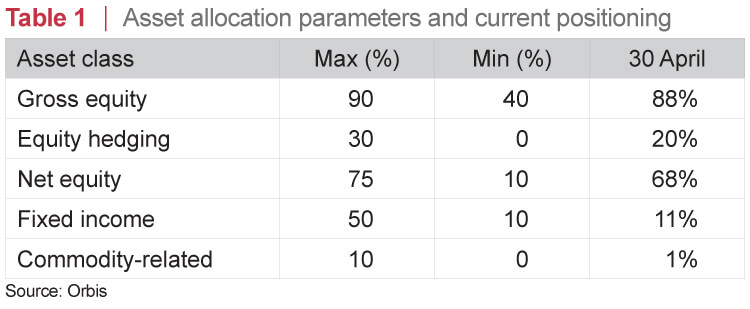

The Fund has the flexibility necessary to deliver on its mandate over the very long term, and in all kinds of market environments. As shown in Table 1, Global Balanced can have ample exposure to equities, variable exposure to fixed income, and the ability to invest in commodity-linked instruments. The Fund can also adjust its equity and currency exposures using hedging.

As with all Orbis funds, the positioning of Global Balanced – including the percentage of the portfolio that is allocated across the various asset classes – is driven from the bottom up, drawing on Orbis’ fundamental research process and capital allocation capabilities. The portfolio is likely to include many of the same shares that Orbis analysts recommend for the Global Equity strategy. However, importantly, Global Balanced also has the latitude to invest in higher-yielding and more stable shares if they appear to offer a more appropriate balance of risk and reward, given the Fund’s objective, which is to balance appreciation of capital, income generation and risk of loss with a diversified global portfolio.

By combining this bottom-up process with Orbis’ asset allocation views, the risk and return profile of Global Balanced is likely to sit somewhere between that of Orbis Global and Orbis Optimal, as shown in Graph 1.

How has Global Balanced performed so far?

Since inception, the Fund has returned 19.9% versus 12.2% for its benchmark (which is the 60% MSCI World/40% JPM Government Bond Index). While the performance is pleasing, five quarters does not make a track record, and we would caution against drawing any firm conclusions given such a short history. The Fund delivered higher returns than its benchmark with roughly the same level of volatility. On both risk and volatility measures, Global Balanced fell between Global and Optimal.

Current positioning

When Orbis launched the Fund, fixed income had enjoyed a multi-decade long bull market. Unsurprisingly, the Orbis analysts found few attractive opportunities in bonds – particularly government bonds. As such, the Fund started with the minimum 10% target allocation to fixed income, with most of that allocation held in cash or short-term corporate bonds. While fixed income performed poorly in 2013, Orbis continues to find better alternatives in equities, either in the form of higher-yielding and strongly cash-generative equities or in more cyclical shares, whose contribution to portfolio risk can be reduced with stock-market hedging.

Global bond investors are, however, not just confined to investing in government debt offering low or negative real yields. As contrarian investors, Orbis and Allan Gray tend to find opportunities where markets are being overly pessimistic. Often this pessimism extends across the capital structure of companies, including both equity and debt securities. Since inception, the Fund has owned short-term bonds from the likes of Vodafone and travel agent Thomas Cook, and longer-dated options from aluminium company Alcoa and telecommunications company Sprint.

Over the long term the mix of assets that will best fulfil the Fund’s mandate is expected to evolve alongside the opportunity set. Today, it is selected equities and associated market hedging, bond-like preferred shares and a small allocation to bonds and cash. In the future, it may be that fixed income merits a higher share of the portfolio. What will remain constant, however, is Orbis’ focus on finding securities which trade at a discount to intrinsic value, and from there building a portfolio which balances capital appreciation, risk of loss and income generation.

For more information about the Fund, please refer to the fund factsheet.

Returns are net of fees, include income and assume reinvestment of dividends. While we have endeavoured to ensure the accuracy of the information herein, such information is not guaranteed as to accuracy or completeness. Collective Investment Schemes (CIS) are generally medium to long-term investments. The value of participatory interests may go down as well as up and past performance is not a reliable indicator of future results. Fluctuations or movements in exchange rates may cause the value of underlying international investments to go up or down. CIS are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available on request from Allan Gray Unit Trust Management (RF) Proprietary Limited, a member of the Association for Savings & Investments SA. Commission and incentives may be paid by investors to third parties and if so, would be included in the overall costs. The Fund is priced weekly. Figures quoted are for the periods indicated for a $10 investment, using NAV-NAV prices, with income distributions reinvested. Performance is quoted in US dollar currency terms. A prospectus is available on request from Allan Gray Unit Trust Management (RF) Proprietary Limited. Certain capitalised terms are defined in the Prospectus. Allan Gray Investment Services Proprietary Limited is an authorised financial services provider.