Treasury’s decision to increase offshore investment limits for unit trusts, investment managers and long-term insurers is great news for savers and their diversification needs. Earl van Zyl explains the impact of these changes and how you can best take advantage of them.

This is a significant relaxation of exchange controls and great news for savers, and National Treasury should be commended

Commentary on the 2018 Budget has understandably been centred on the government’s decision to increase the VAT rate from 14% to 15% in an attempt to address South Africa’s fiscal challenges. Not much airtime has been given to another significant change: the increase in foreign exposure limits. National Treasury announced that the limits on foreign assets held on behalf of individual investors by institutions, such as retirement funds and long-term insurers, would be increased by five percentage points to a total of 30% offshore (plus 10% in Africa outside SA) for retirement funds and 40% offshore (plus 10% in Africa ex-SA) for long-term insurers and management companies of unit trusts. This is a significant relaxation of exchange controls and great news for savers, and National Treasury should be commended.

How do these changes impact investors?

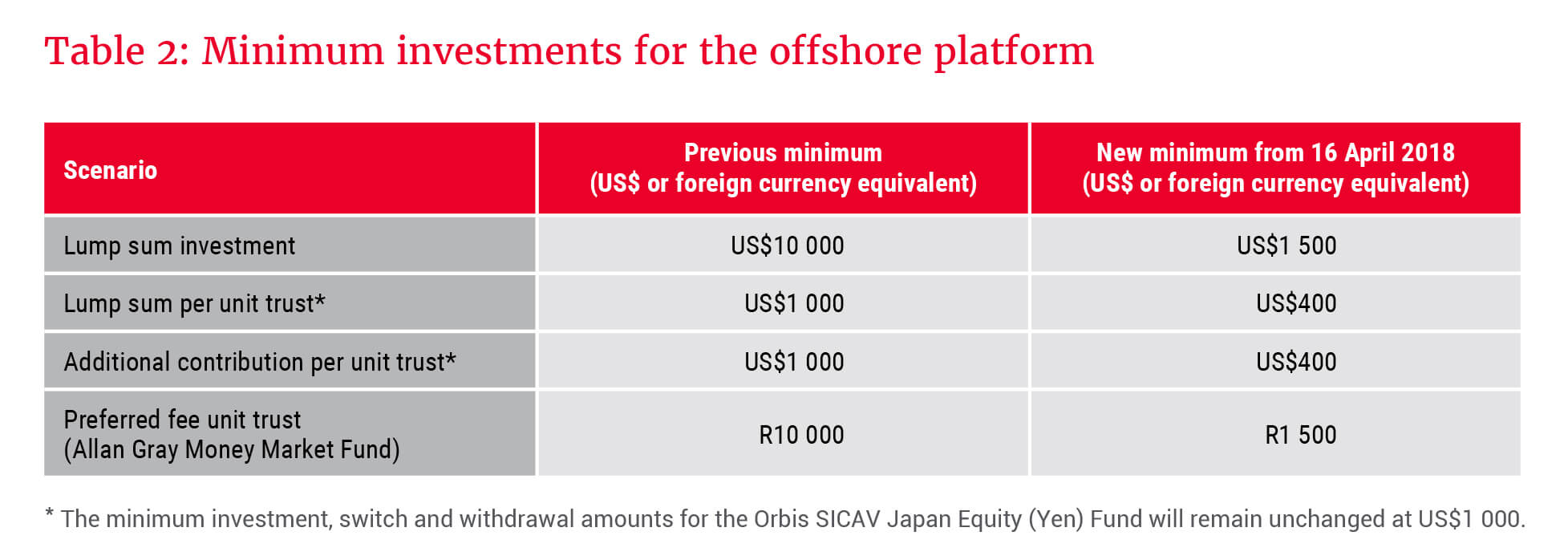

Some savvy investors have made use of the already-generous personal overseas investment allowances – R1 million annually without the need for SARS clearance and up to R10 million annually with SARS approval. These allowances have tended to benefit wealthy investors who can afford the higher minimum investment amounts and are prepared to deal with the extra complexity of buying offshore currency (As of 16 April, we reduced the minimum investment limits for our offshore platform). But by far the majority of SA investors hold their long-term savings as members of pension or retirement funds, in long-term insurance policies, or in a local unit trust account. Offshore controls at institutional level are a significant policy issue because they directly impact millions of pension fund members and everyday investors.

Regulation 28 of the Pension Funds Act limits the proportion that retirement fund members can allocate to investments considered higher risk. An effective limit of 75% applies to South African listed equities. These include a selection of international companies that happen to be listed on the Johannesburg Stock Exchange but are not inherently safer or more attractive on average than their global peers (consider Steinhoff). Yet overseas investments, including the very safe cash deposits held by retirement funds in overseas bank accounts, have until now been capped at 25%. The move to 30% is welcome and there are good arguments that it should be lifted further. It is interesting that the relatively rich retirement savers in very developed markets can invest their pensions all over the world, but pension fund members in South Africa, who have a much greater need to diversify away from the JSE’s limited share selection, are kept in check.

Some argue that we need the large pool of savings held in local pension funds to be invested in local businesses. They can draw confidence from the last 15 years of gradually relaxing foreign exchange controls, where money flowing from international investors has easily offset the investments made overseas by local retirement funds, with both benefiting from the diversification. The cost of capital on local markets has declined, the discipline of markets has helped us deal with governance issues in the public and private sector, and SA pension fund members have enjoyed returns well above inflation.

How should investors take advantage of the increase in offshore allowances?

As a retirement fund member, you may benefit from your fund or underlying unit trust reallocating some of their investments (for example a balanced unit trust held in your retirement annuity (RA), or a pension fund investing for its members), or you could act directly by allocating 5% more of your RA portfolio to a rand-denominated feeder fund.

For investors in linked insurance policies, such as living annuities, there are indirect benefits from the increased limits. Individual living annuitants currently may invest up to 100% of their living annuity offshore, subject to the insurer of the policy having sufficient offshore capacity (see text box). However, since living annuity investors tend to use Regulation 28-compliant unit trusts, the average living annuitant will likely experience an increase in their offshore allocation over time, assuming no change in their unit trust allocation.

Investors in Allan Gray’s Living Annuity and Endowment can invest up to 60% of their portfolio value in offshore assets through the unit trusts available on Allan Gray’s local investment platform.

Existing investors in these products whose offshore exposure exceeds this limit are able to maintain their current allocation, but may not increase it.

If you hold a basic local unit trust investment, not within an RA or insurance product, you will also benefit from the increased allocation. The portfolio managers of our Equity, Balanced and Stable funds, for example, have the option of allocating an additional 5% of assets offshore to Orbis, our offshore investment partner – and indeed, they are taking advantage of this opportunity.

our analysis suggests investors should hold between 30% and 50% of their total investment portfolio offshore

How much offshore exposure should you have, and how much risk should you take?

The answer to this question depends on, among other things, your objectives and investment time horizon, so it is difficult to give a single number that is appropriate for everyone. Depending on your household’s spending habits, our analysis suggests investors should hold between 30% and 50% of their total investment portfolio offshore.

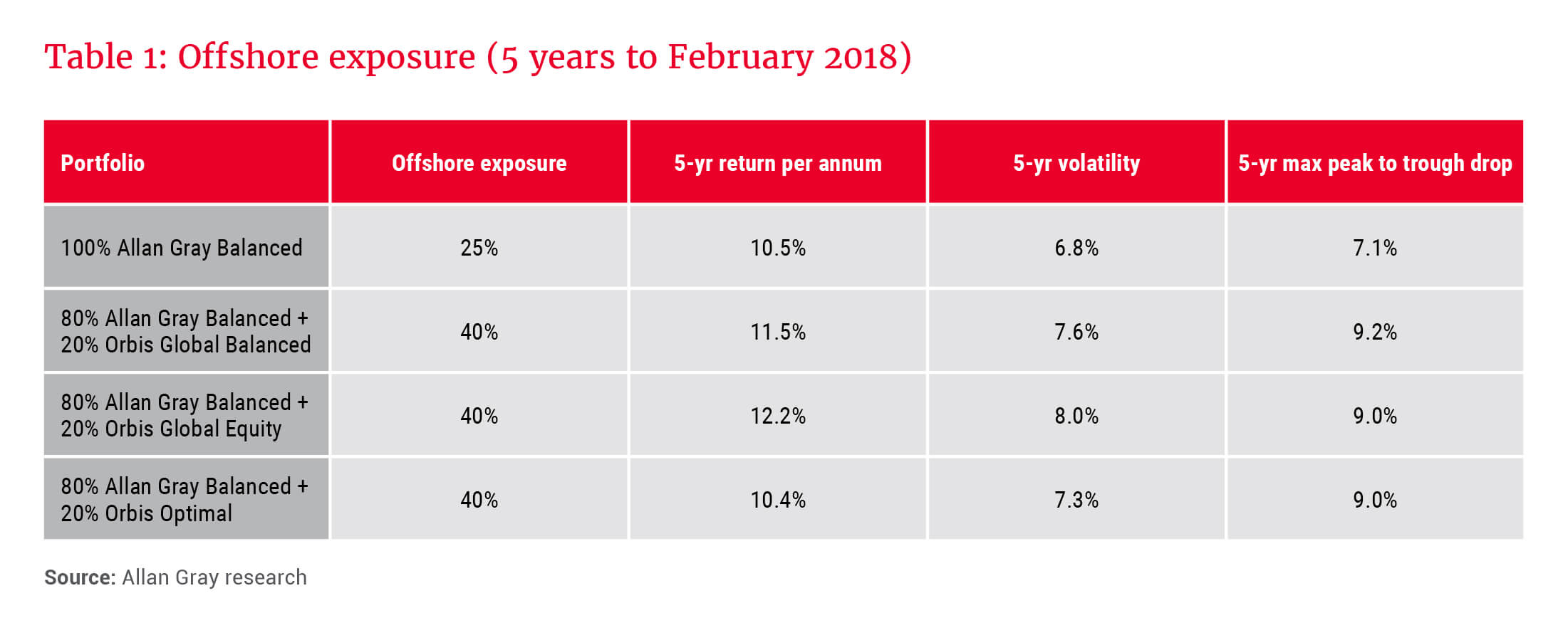

Table 1, based on the last five years, illustrates the trade-offs that an investor would need to make were they to consider using a fund managed by Orbis, our offshore partner, for this allocation. For simplicity we include only the Orbis Global Balanced, Global Equity and Global Optimal funds in the investor’s choice set.

The data in the table shows that over this period, there would have been a clear benefit from allocating to offshore assets beyond what an investor would expect from a local balanced fund mandate and, in the long run, we would also expect this to be the case. Whether investors should pick an offshore balanced fund, equity fund or absolute return fund, such as Orbis Optimal, depends on their appetite for risk and their long-term return goals. There are a number of funds in each of these categories available via our local and offshore platforms that investors can use to meet their objectives.

Assuming you would want an average of 40% of your overall portfolio to be in offshore assets, you would need to consider putting 15% into an offshore fund if you have 85% in a balanced fund which maximises the new offshore limits.

Long-term investing and offshore exposures

In summary, most investors will likely see their offshore exposure increase through the local solution unit trusts that they are invested in, to the extent that these funds are able to use the increased offshore limits. It is important to be aware of this when considering the overall composition of your portfolio. While local portfolio managers are likely to take advantage of this increased allowance, if you construct your own portfolios it is important to remember that how much you decide to take offshore, and your asset allocation, should be based on your own investment objectives, risk tolerance and personal circumstances. It’s also important to take a long-term view. A good, independent financial adviser can assist you in making decisions that are right for your circumstances.

Reduced minimums for the offshore investment platform

If you wish to invest directly in offshore funds, but prefer to use a local administrator rather than have to open accounts with several offshore managers in different jurisdictions, you can do so via a locally administered offshore investment platform, such as Allan Gray’s.

The Allan Gray offshore investment platform offers funds from a range of international investment managers. The platform can process instructions for several funds at the same time, sent to a single address, with local telephone lines for instructions and physical offices. You can invest or transfer cash or existing offshore investments to the platform without the need to repatriate them first. Our secure website (the same website through which you manage your other investments) offers easy reporting and online transacting.

As part of our ongoing drive to reduce the barriers to offshore investing, we have lowered the minimum investment amounts required to open and add to your account on the Allan Gray offshore investment platform, effective 16 April 2018. The new minimums are shown in Table 2.

How will the change impact switch and withdrawal instructions?

The minimum switch and withdrawal amount will change from US$1 000 to US$400 per unit trust. For partial switches and withdrawals, the remaining balance in each unit trust after the switch or withdrawal must be greater than US$400 (or foreign currency equivalent). If the remaining balance is below US$400, we will process a full switch or withdrawal.

Assistance with foreign exchanges administration services

We have negotiated with Incompass to offer you foreign exchange administration services at preferential rates. For each transaction where Incompass is required to process a transfer that is less than R50 000, they will charge a SWIFT fee of R250.