According to Ben Preston, from our offshore partner Orbis, Orbis and Allan Gray's strict adherence to our bottom-up research process keeps us focused on undervalued companies and ensures we do not spend too much time pontificating on broader investment trends. However, it is helpful to be aware of the drivers that influence market prices. Ben discusses one of the biggest investment trends of recent times - the huge and unprecedented decline in bond yields to today's low levels.

Central bank policy - a help or a hinderance?

Bond yields today are a far cry from conditions in the 1980s, when one could buy a US Treasury bond yielding about 15%. The subsequent return on those bonds has been fantastic - not only because of the high starting yield, but also because yields have come down, which means prices have gone up. This was driven initially by central banks getting high inflation under control, and more recently by their experiments with 'quantitative easing'. Bond investors have been richly rewarded over the last 30 years. Unfortunately, there is little chance of repeating that experience now: starting yields are just too low.

AT ORBIS, WE HAVE ALWAYS TAKEN THE VIEW THAT INVESTMENT RISK – THE RISK OF LOSING MONEY – COMES CHIEFLY FROM OVERPAYING.

For example, in March Japan issued a 10-year bond with a 0.6% annual coupon. For every JPY100 invested, a bondholder receives JPY0.6 per year for 10 years, plus the return of principal at the end of the period. Over the life of the bond, cash flows sum to a grand total of JPY106 - which means that, even if bond yields were to go to zero (for the first time in history) the total upside from owning that bond is just 6%.

According to the textbooks, owning a government bond is 'risk-free' and, in today's uncertain world, one can see why investors have been willing to pay a high price for safety. But is it really true to say there is no risk from holding such a bond? For instance, what would it take for this investment to lose 20% of its value? The answer is that yields would only have to rise to 3% - hardly high by historic standards. If yields climbed to 7.5%, just under the prevailing rate in South Africa today, the Japanese bond would lose about half its value.

What does any of this mean for stock markets?

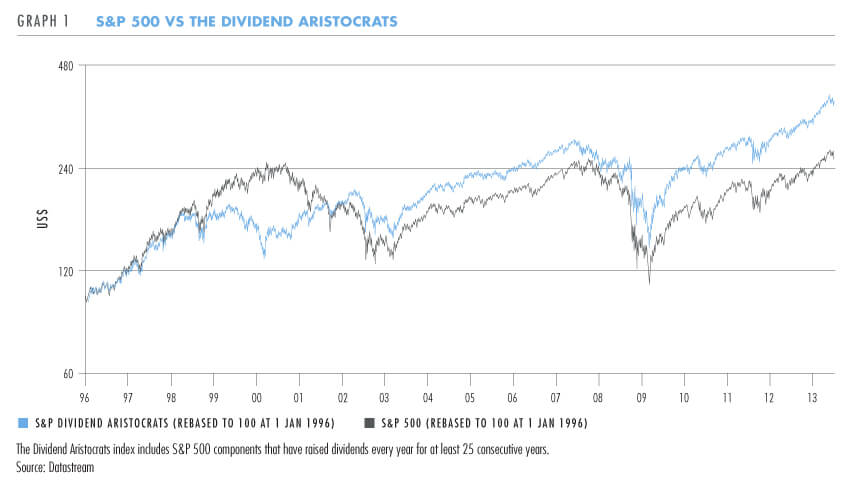

Given the low yields available on bonds, it is unsurprising that investors have sought other assets with bond-like characteristics. One class of investments that has done well is 'bond proxies': stocks with stable earnings and regular dividends. As an attractive alternative to bonds, such stocks have performed well. By way of illustration, consider the performance of the S&P 'dividend aristocrats' compared to the broader S&P 500, as shown in Graph 1. (A 'dividend aristocrat' is an S&P 500 component that increased its dividend every year for at least 25 consecutive years.)

For most of its history, the price return from the dividend aristocrats has been similar to that of the broader index - until the start of quantitative easing in 2009, that is. As bonds rallied, the dividend aristocrats joined in, driving prices to multi-year highs.

All else being equal, the higher the price, the lower the subsequent return. Just as we saw with the Japanese bond, an investment with predictable cash flows can still be risky if the price paid is too high.

Risk versus reward

Compared to bond proxies, we think other shares offer a more attractive balance of risk and reward. One example is NetEase, a Chinese online game developer. The company is a great business, and as internet penetration increases in China, NetEase should be a major beneficiary.

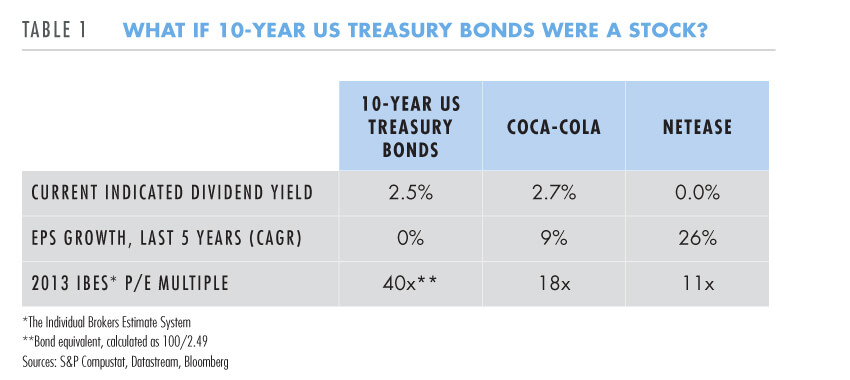

If we compare NetEase to a bond proxy like Coca-Cola, the latter offers more stable and predictable cash flows, and a regular dividend, but NetEase is growing much faster. The comparison becomes more interesting if we include bonds as an alternative. If 10-year bonds were a stock, their dividend would be the yield to maturity, and the growth rate would be zero because the coupon is the same every year. If we treat the coupon as 'earnings', the price-to-earnings (PE) ratio of a US Treasury Bond would be 40 times (see Table 1).

Viewed this way, Coca-Cola certainly looks more attractive than US Treasury bonds - it offers a higher dividend yield, potential for earnings growth, and trades at a lower earnings multiple. But NetEase looks better still. While it offers no dividend, that is more than made up for by an earnings growth rate far exceeding Coca-Cola's. Investors typically pay a higher multiple for faster growth, but in the scramble for stability, this has been turned on its head, and NetEase now trades for a lower multiple of earnings than Coca-Cola does.

In our view, buying a fast-growing company at a modest earnings multiple is a more attractive proposition than buying a stable one at a high multiple. This is reflected in the current positioning of the Orbis Global Equity Fund, which is underweight these bond-like shares. During the past few years, many of our favourite stocks have endured periods of underperformance as investors have bid bond proxies up to historic highs.

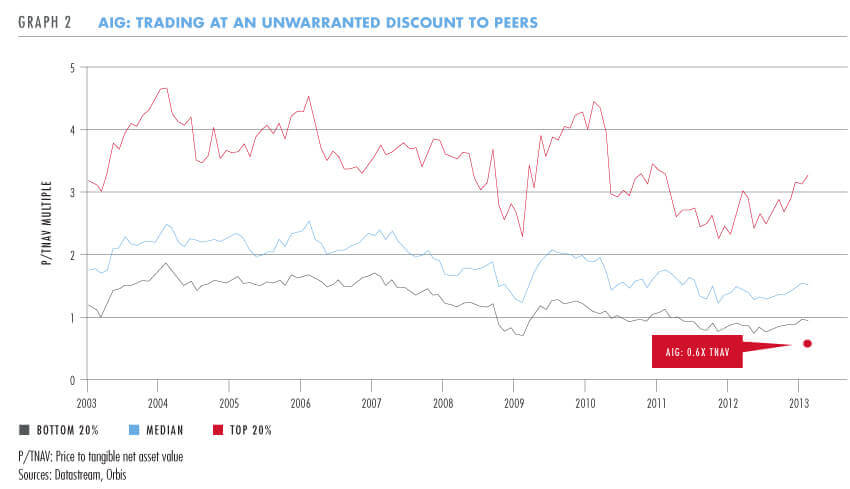

At the other end of the spectrum, there are stocks available at what we believe are more compelling prices. One example is US insurer AIG. Today, AIG's tangible net assets are worth about US$60 per share, and the company targets a return on equity of at least 10% over the long term. Should the company deliver, this would result in US$6 of earnings per share, giving an earnings yield of about 15% at current prices.

In a world looking for consistency and stability, it seems AIG has been widely overlooked. AIG's woes during the recent financial crisis have been very well documented, but we believe that it is a different company today, with a different management team and a different mix of businesses. Crucially, this does not appear to be reflected in the company's valuation.

Graph 2 looks at the price to tangible net asset value (TNAV) of US insurers. The average US insurer has historically commanded a premium to TNAV. Even the 20th percentile insurer - the 'top end of the bottom 20%', one might say - has typically traded around or above TNAV. AIG sits right at the bottom of the chart.

Why is the price so low?

Today, AIG's earnings are below where they should be. It may take a long time for the company's return on equity to reach management's 10% target, so the stock is of little interest to investors with a short time horizon. But over the long term, we believe AIG represents a compelling balance of risk and reward. Amid the stock market's current preference for stability, AIG's past reputation for instability counts against it. But we would caution investors not to confuse 'stability' with 'safety'. There is nothing wrong with stability of course. But no investment is safe, no matter how stable the underlying company, if you pay too much for it.

At Orbis, we have always taken the view that investment risk - the risk of losing money - comes chiefly from overpaying. While our approach is not always in sync with the market, history suggests that investment fashions come and go - whether it is high growth or high tech or high predictability. Following the investment fashion of the day may feel comfortable, but it is not conducive to generating superior long-term returns for our clients. We have learnt to be comfortable being uncomfortable.