The valuation-based approach to investing used by Allan Gray and our offshore partner Orbis is often contrarian since the shares that are most attractively priced relative to intrinsic value are also often those that are least popular. Mahesh Cooper explains why being different at times to the crowd can make us appear risky to clients, yet it is exactly by being different that we are able to outperform over the long term, and able to do so with a lower risk of a permanent capital loss.

By definition, an index owns more of what has gone up and less of what has not. When markets move to extremes, this is reflected in the index with that particular sector or country representing a substantially larger portion of the index relative to history. Being a contrarian stock picker, Orbis, like Allan Gray, can choose what to buy and what to avoid in their funds. This bottom-up stock picking approach to building a portfolio allows Orbis to invest in the most attractive opportunities from a return-risk perspective, rather than focusing on, or anchoring to, that stock's weighting in the index.

How active is your manager?

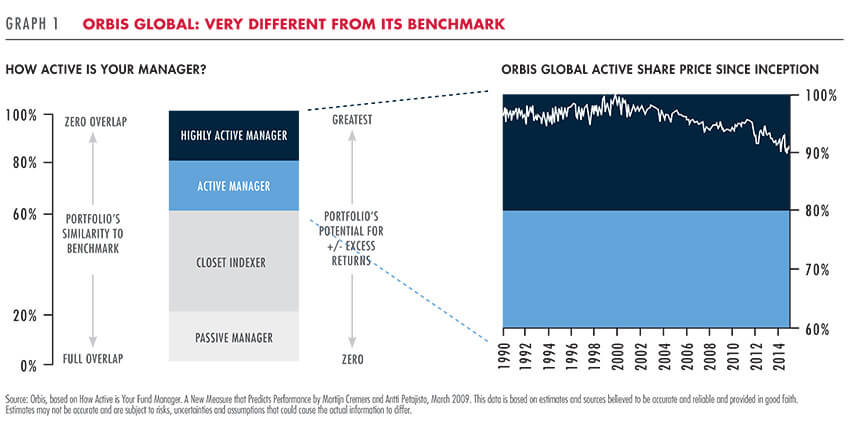

Active share is a measure which allows investors to compare how different a manager's portfolio is from the benchmark (Seema Dala wrote about this concept in Quarterly Commentary 3, 2014).

BEING A CONTRARIAN STOCK PICKER, ORBIS, LIKE ALLAN GRAY, CAN CHOOSE WHAT TO BUY AND WHAT TO AVOID IN THEIR FUNDS

A low active share implies that there is a substantial overlap between the portfolio and the benchmark. This means that the returns generated by such a portfolio will track the performance of the benchmark, before fees. Passive funds and index trackers have low active shares. Likewise a high active share means that the portfolio is very different from the benchmark, with very little overlap between the shares in the portfolio and those in the benchmark. This means that there is a high probability that the returns generated by high active share portfolios will be very different from the benchmark. As can be seen in Graph 1, it should be no surprise that a contrarian manager like Orbis has a very high active share. The active share is currently 91%, which means that only 9% of the Orbis Global Equity Fund mirrors what is invested in the benchmark. Importantly, Orbis does not target a particular active share. It is the result of their bottom-up stock picking process, coupled with a philosophy underpinned by investing with conviction that results in their equity funds having a high active share. Of course, while it may be easy to create a portfolio with a high active share (one could just buy shares that are different from the benchmark), it is more diffi cult to create a portfolio that is both different and will outperform the benchmark over time. As Howard Marks recently said, one must be 'different and better'. This requires the discipline of a tried and tested investment philosophy, as well as a rigorous investment process and the people to implement the philosophy.

What does a high active share look like in practice?

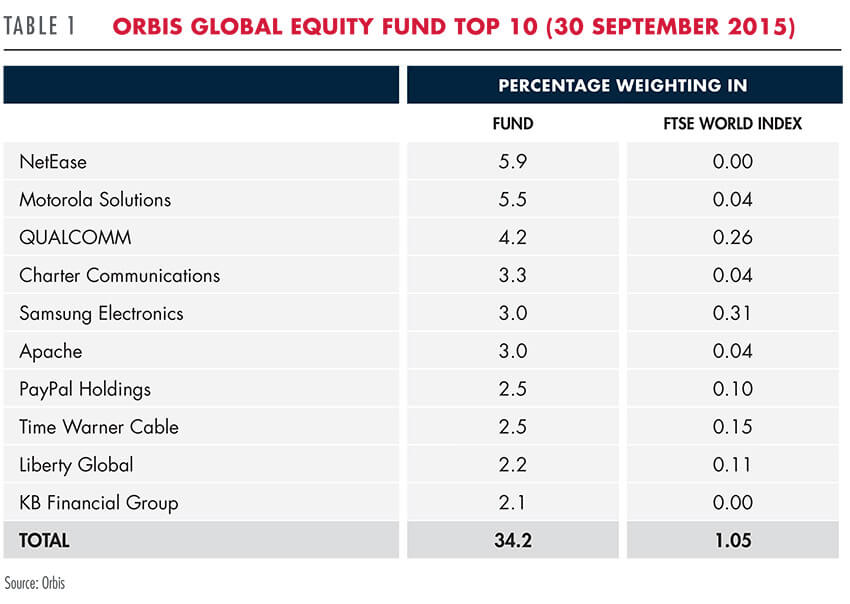

The extent to which the Orbis Global Equity Fund takes high conviction positions can be demonstrated by the top 10 shares (see Table 1). These shares make up 34.2% of the Fund. In contrast, these shares make up just 1.05% of the FTSE World Index. Orbis' holding in a stock is based on the attractiveness of the stock - not its weighting in the benchmark. Likewise, if we look at the top 10 of the FTSE World Index, as shown in Table 2, these shares make up 8.8% of the total benchmark, with Microsoft being the only common holding at 1.3% of the Orbis Global Equity Fund. This means that the Orbis Global Equity Fund is invested to deliver different performance from that of the benchmark over time. Different performance works both ways - there are times when the shares you own will do better than the benchmark and there are times when they will do worse. Over the short term, this relative performance can be very volatile.

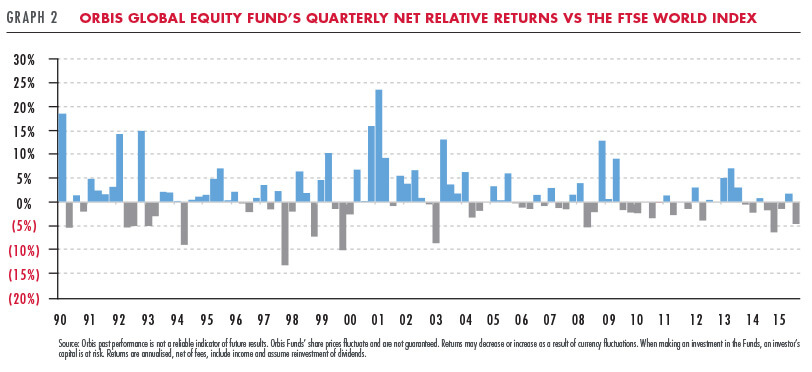

Graph 2 shows the 12-month rolling relative performance of the Orbis Global Equity Fund versus the FTSE World Index. The blue bars above the line represent periods during which the Orbis Global Equity Fund outperformed the benchmark, while the grey negative bars represent the periods in which the Fund underperformed the benchmark.

Over the long term, the Orbis Global Equity Fund has outperformed the World Index by 4.5% per annum, net of fees. We would all love for this long-term alpha to come in a straight line. Unfortunately, as the graph shows, it comes through periods of outperformance and periods of underperformance. This can be expected since the Fund can have very different holdings from the benchmark. These periods of underperformance can go on for an extended period of time and really try our clients' conviction to remain invested with us.

Looking ahead

To share our conviction, it is important to understand the nature of the opportunities that the Orbis analysts have identified and why they are excited about these both in absolute terms and in comparison to the broader index. In other words, why does Orbis think that the portfolio is not just different, but also better than those opportunities available in the benchmark?

Recent Orbis commentaries have covered the investment theses on some of their favourite names, including US telecommunications technology company Qualcomm, US payment systems company Paypal, Chinese e-commerce company JD.COM and multinational telecommunications company Motorola. In addition to covering these companies, the commentaries also refer to areas where we are seeing classic investor herding mentality. The Orbis Global Equity Fund commentary outlines the increasing dislocation in valuations between emerging and developed markets, which is being exacerbated by a one-directional trend in investor flows. Emerging markets are distinctly out of favour today, and investors are concerned about the inherent risks. We don't think you need to sacrifice quality when investing in emerging markets, and Orbis is finding selected, very attractively valued opportunities which are evidence of this. This quarter's Orbis Optimal commentary also elaborates on the attractiveness of the Orbis holdings relative to the index. Opportunities like Qualcomm offer better fundamentals at lower valuations than the popular shares in the index. Although it may feel safe to be in a crowd, it may not prove so safe in reality. While investors may be herding in one direction, in this case we believe that from a valuation perspective, it is safer to ‘be different' and go in the other.

Experience has shown us that identifying and investing in shares trading at a discount to a rigorous and rational estimate of intrinsic value has ultimately been well rewarded over the long term. Orbis and Allan Gray believe that if we stick to our investment philosophy, picking those shares which we think are attractive over the long term, which may be very different from the index, we will deliver long-term outperformance for our clients.