Investing offshore has long been a way to diversify and grow one’s wealth. This is even more relevant today, as investors seek strategies that will safeguard their wealth in an uncertain world for generations to come. Offshore endowments can be a powerful tool to build this legacy.

An offshore endowment is an investment-linked, long-term product that is suitable for investors who want to diversify their portfolio across economies and regions outside South Africa, have a marginal tax rate of higher than 30% and require a product that offers tax efficiency and estate-planning benefits.

In recognition of the growing need for tax-efficient offshore investment products, we are pleased to introduce the Allan Gray Offshore Endowment. Our product is structured with maximum flexibility in mind, aiming to empower investors to access global markets and take advantage of international opportunities, while offering competitive pricing and familiar client service through our local team.

Below, we talk through some of the key features of offshore endowments in general and look at some of the benefits of the Allan Gray product.

What are the key features of an offshore endowment?

Tax efficiency

The effective capital gains tax (CGT) rate for an individual investing in an endowment (the “planholder”) is fixed at 12% (capital gains inclusion rate of 40%, which is taxed at a fixed rate of 30%) compared to a maximum effective tax rate of 18% for a marginal taxpayer on gains in a basic unit trust investment (capital gains inclusion rate of 40%, which is taxed at 45%). The product therefore becomes tax efficient when an individual investor’s marginal tax rate is higher than 30%. Different tax rates apply to companies and trusts. The calculation, deduction and payment of tax are taken care of by the life company that offers the product – which relieves the planholder from any reporting responsibility or liability for taxes on the investment.

Estate-planning benefits

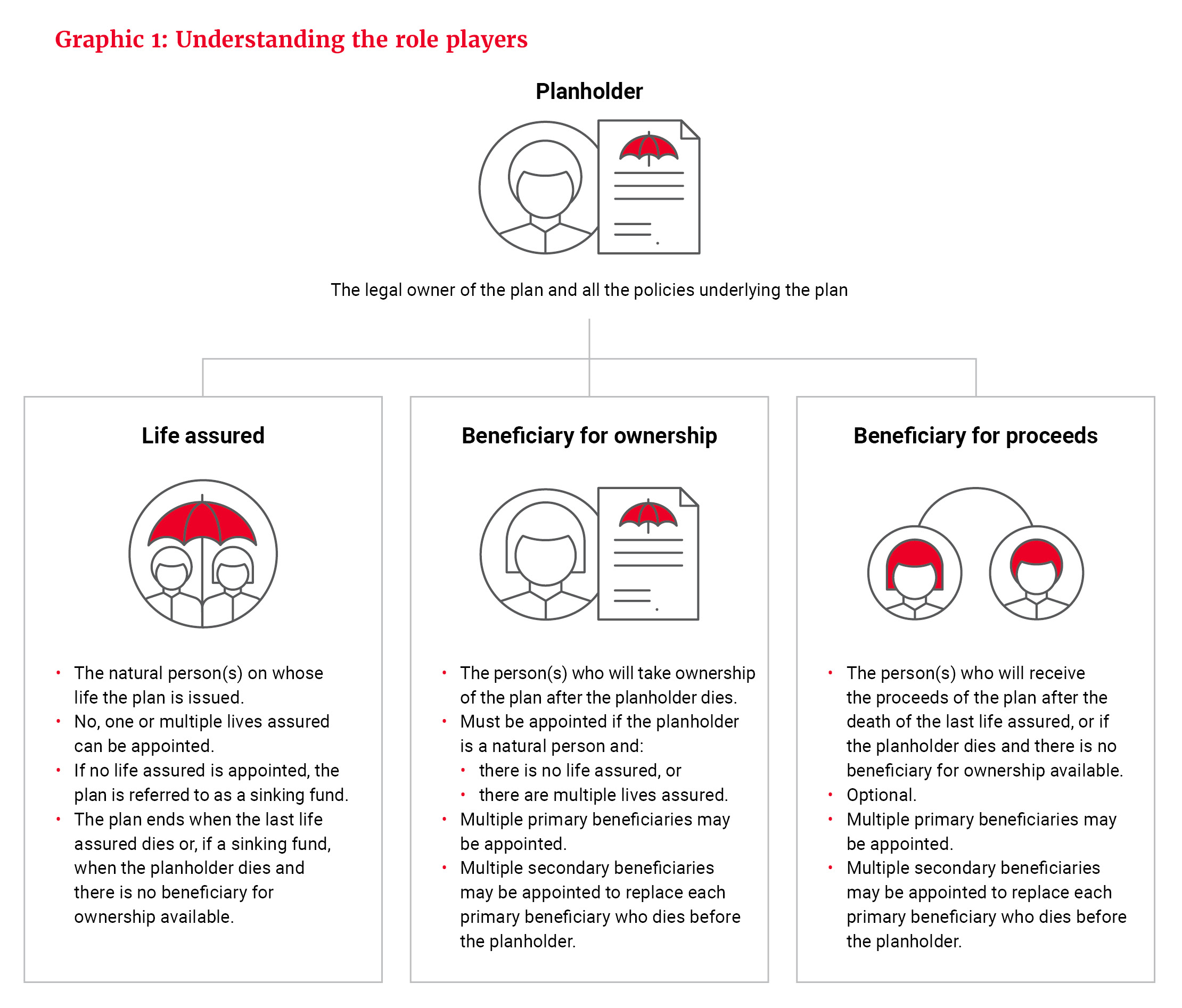

The product also offers estate-planning benefits, allowing for continuity and transfer of wealth on the death of the planholder. No offshore will is needed and, if beneficiaries are appointed (see Graphic 1), there will be no delay while the estate is being wound up as the investment can be paid out or transferred immediately. In addition, when a beneficiary becomes the new owner of the investment, they can make unrestricted withdrawals, provided the 120% rule is not triggered (the 120% rule is discussed in the “Liquidity” section).

Where beneficiaries are appointed, there are no executor fees on the value of the investment, although the investment will still form part of the deceased estate (subject to certain exemptions). Meanwhile, CGT will only be triggered when the investment is paid out, not when an appointed beneficiary takes ownership of the investment, provided that the beneficiary is classified in the same way as the original planholder was for tax purposes.

Creditor protection

If the planholder is a natural person and appoints a life assured, the total value of the investment will be protected against creditors during their lifetime, provided the endowment is issued on the life of the planholder or their spouse and has been in force for at least three years. To qualify for creditor protection on the death of the planholder, the surviving spouse, children, stepchildren or parent must benefit from the endowment on the planholder’s death.

Introducing the Allan Gray Offshore Endowment

The Allan Gray Offshore Endowment, made available by Allan Gray Life, Guernsey branch, offers South African resident investors a way to diversify their portfolios and ensure efficient wealth transfer for future generations. Residents of other countries can also invest but should obtain independent advice regarding the legal and tax implications beforehand.

The minimum new investment amount is US$25 000 (or the equivalent in EUR or GBP) or R400 000.

The Allan Gray Offshore Endowment has been designed to provide more flexibility than traditional endowment products – in addition to providing tax efficiencies and estate-planning benefits. The key features are described below.

Liquidity

The Allan Gray Offshore Endowment is structured as a single plan made up of multiple underlying policies, which allows for more liquidity than investing in a single policy. At inception, each plan will consist of 100 underlying policies. The planholder’s initial and subsequent contributions will be allocated equally to all policies underlying the plan, including in the case of subsequent contributions to policies from which a withdrawal has already been made.

Endowments are subject to a five-year restriction period, governed by legislation, during which planholders can only make one withdrawal from each policy underlying the plan, although it is important to note that one withdrawal can use up multiple policies. Once a withdrawal has been made from a policy, no further withdrawals can be made from that policy and any subsequent contributions allocated to that policy can also not be withdrawn until the restriction period ends.

The five-year restriction period can be extended if a planholder invests more over one year than 120% of their investments over either of the previous two years. This is known as the 120% rule. In terms of estate planning, it’s important for beneficiaries to note that contributions from the deceased owner are taken into account for purposes of the 120% rule.

All calculations will be performed in US dollars.

Competitive pricing

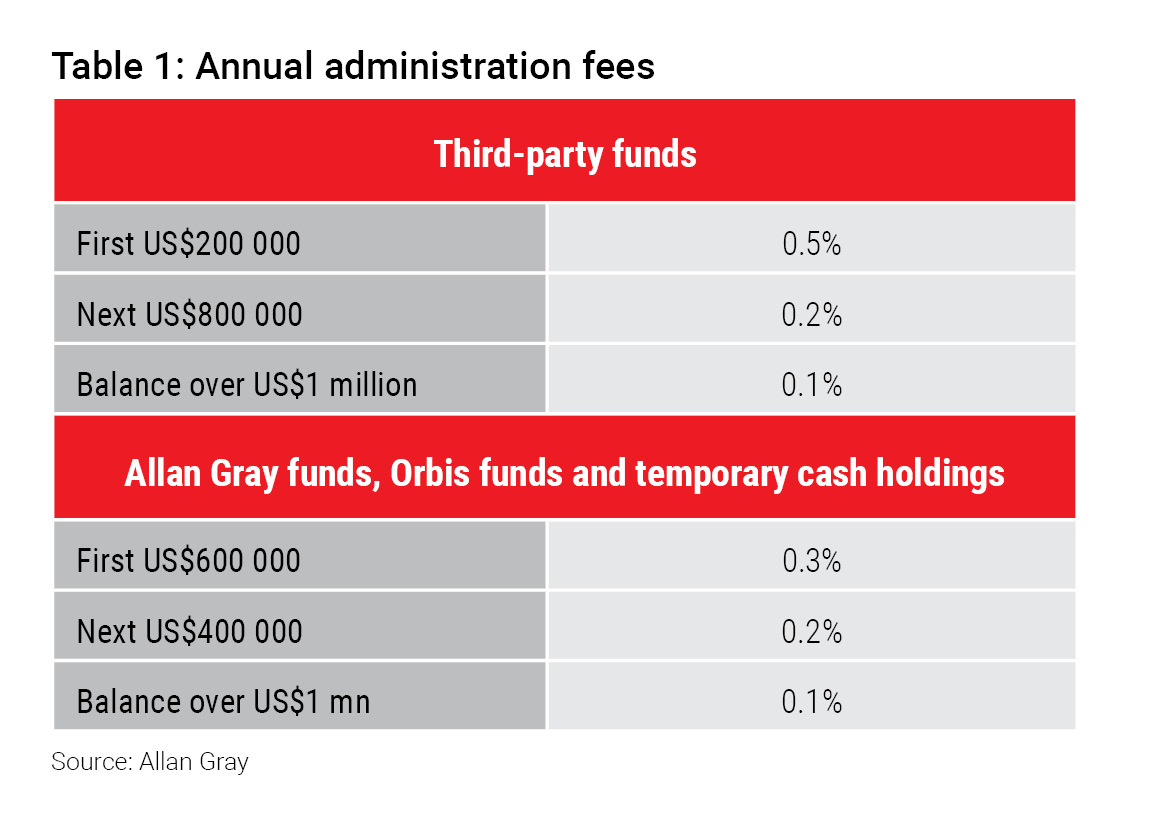

Some offshore endowments have drawn criticism for having opaque fee structures, usually consisting of multiple types of fees. The Allan Gray Offshore Endowment is competitively and transparently priced, with no VAT payable on administration fees. The annual administration fee percentage applicable to the Allan Gray Offshore Endowment is calculated monthly, using the average market value (in US dollars) for the month across all Allan Gray Local Investment Platform, Offshore Investment Platform and Offshore Endowment investments linked to the investor number. The annual administration fee percentages are shown in Table 1. You can also find a more detailed explanation, including examples here.

A range of offshore funds to choose from

Investment returns come from the underlying foreign currency funds that the planholder chooses. The Allan Gray Offshore Endowment offers a select list of foreign currency funds managed by offshore investment managers, including those managed by our offshore partner, Orbis.

See our Offshore Endowment Fund List or our website for more information about the funds that are available through Allan Gray Life, Guernsey branch.

Consistent client experience

Planholders have a local point of contact through the Allan Gray Client Service Centre, and new investments, additional contributions and switch instructions are captured and submitted online. The Allan Gray Offshore Endowment will reflect on Allan Gray Online alongside other local and offshore platform investments, thus presenting consolidated reporting. Although the Allan Gray Offshore Endowment is issued in US dollars, reporting is available in a preferred currency.

Policyholder protection

We have appointed an independent Guernsey-based trustee to safeguard the plan assets by holding them in trust to meet obligations to planholders. The assets are therefore not available to meet any other obligations of the company, for example to general creditors.

Easily transact in foreign currency

Contributions can be made in rands or foreign currency (US$, EUR or GBP). We can facilitate rand currency conversions via our authorised dealer at a preferential spread if planholders use their single discretionary allowance or have their own tax clearance to use the foreign investment allowance.

Various options available for continuity of the plan

The planholder can choose whether to appoint no, one or multiple lives assured. If no life assured is appointed, the plan is referred to as a “sinking fund”. A sinking fund does not qualify for creditor protection because no life assured is appointed. Multiple primary beneficiaries for ownership and beneficiaries for proceeds, as well as multiple secondary beneficiaries to replace each primary who dies before the planholder, can be appointed.

Need more details?

Our Allan Gray Offshore Endowment infographic offers a summary of the product, with full product information available via the Offshore Endowment page and the product brochure. Please refer to Understanding the various role players in an offshore endowment plan and Offshore Endowment role player scenarios for further details.

To help you understand the complexities of the product and to find out if an offshore endowment is suitable for your needs, we recommend you consult with a good, independent financial adviser.