With just 30% of assets invested in US shares versus 66% for the MSCI World Index, the Orbis Global Equity Fund’s current underweight to the US market is the largest in its history. Matthew Adams and Eric Marais, from our offshore partner Orbis, explore the Fund’s largest US holding and discuss how the investment landscape may change in the wake of the pandemic.

The Orbis Global Equity Fund’s current underweight to the US market is reminiscent of two similar occasions when its positioning differed substantially from its benchmark. One was at inception, when the Orbis Global Equity Fund (“the Fund”) had a 0% weight in Japan when that market was near its all-time peak and accounted for more than 40% of the benchmark, and the other was in 2000, when the Fund owned very few of the so-called TMT (technology, media and telecommunications) shares despite their 40% weight in the benchmark. As always, our portfolio positioning is driven by bottom-up decisions about individual businesses. But those decisions don’t take place in a vacuum; they are influenced by the hand we are dealt by the market, and we naturally gravitate to areas where the attractive opportunities appear most abundant.

In recent years – as in the two episodes mentioned previously – the stockpicking environment in the US has been characterised by rising aggregate valuations, surging liquidity, dwindling concern for risk, and increasing speculation. Some of the biggest winners in this environment have been disruptive technology platforms that offer a unique combination of rapid growth, high profitability, and near-immunity to the economic cycle. While we find these characteristics appealing – and we have owned some of these businesses at times – we have been increasingly uncomfortable with their valuations.

… we naturally gravitate to areas where the attractive opportunities appear most abundant.

Yet despite stiff valuation headwinds at the broader market level, some of our highest-conviction ideas have come from the US market, where we continue to own a number of businesses that we believe offer attractive long-term risk-adjusted returns. In particular, we have uncovered shares of businesses that are cyclical, but also competitively advantaged.

XPO: A cyclical business with attractive long-term growth prospects

XPO Logistics, a transportation and logistics company with operations in the US and Europe, has been one of the Fund’s largest holdings for many years. The business is run by chairman and CEO Bradley Jacobs, who effectively founded the company and built it into its current form through a series of acquisitions between 2011 and 2015. Jacobs owns approximately 18% of the company’s shares.

Over the years, we’ve gotten to know Jacobs well and have developed deep conviction in his strategic vision, operational skill, and capital allocation acumen. The most tangible evidence is XPO’s outperformance of 14% per annum versus the S&P 500 since Jacobs took the helm in 2011, not to mention his track record of success as the founder of several other businesses prior to XPO.

Despite the tremendous results that Jacobs and his team have delivered, in our view, XPO shares have often been significantly undervalued during our holding period. We believe the source of this persistent discount is primarily related to three interrelated factors: The company is complex, it carries a lot of debt, and – as long-standing Orbis clients will know – its share price has been volatile.

It was therefore welcome news at the end of 2020 when XPO announced its intent to spin off its contract logistics business into an independent public company called GXO Logistics, and to seek investment-grade credit ratings at both companies. We believe the implementation of this spin-off plan and subsequent deleveraging, in conjunction with steady execution and an attractive long-term earnings growth trajectory, creates a compelling long-term risk-adjusted return profile for our holding today in XPO. It can take time for spin-offs to ultimately influence a company’s valuation, but they can be an effective way to unlock hidden or underappreciated value.

After the spin-off, XPO will comprise the company’s transportation business, which is primarily focused on less-than-truckload (LTL) shipments in the US. That business accounts for about two-thirds of earnings before interest, taxes, depreciation and amortisation (EBITDA), with the remainder coming mostly from freight brokerage. As a simpler, pure-play transportation business – and one on its way to an investment-grade balance sheet – we believe XPO should be valued closer to its listed peers, which trade between approximately 14 and 16 times consensus estimates of 2022 EBITDA.

To put this in perspective, if we apply an even more conservative range of multiples – say 11-13 times EBITDA – to our range of estimates of what we think the business can earn next year, it would imply about US$100-US$120 per share in equity value if we assume XPO keeps all of the company’s current debt. The upper end of this range is in line with the share price as of March 31 – essentially giving XPO shareholders the GXO spin-off for free.

By owning individually attractive companies like XPO, we don’t need to bet on a regime change to find favourable risk-adjusted returns.

What will the GXO spin-off be worth? Despite a lack of comparable publicly traded peers, there is a long record of private market transactions for logistics assets in the 10-14 times EBITDA range. While such private transactions likely embed a degree of control premium, we believe GXO should command a premium, and both industry fundamentals and market conditions have developed favourably in recent years. In our view, GXO is a premier asset with attractive secular growth stemming from leading positions in areas like e-commerce and “reverse logistics”, i.e. processing merchandise returns. It is a high-return-on-capital business, aided by recurring revenue from long-term contracts with high renewal rates.

Applying the low end of the private valuation range to a conservative EBITDA estimate for GXO suggests that there could be additional value of approximately US$50-US$55 per share to be unlocked through the spin-off. Of course, GXO will face more uncertainty given the market’s lack of familiarity with contract logistics and fewer pure-play public peers, but we are enthusiastic about the business and pleased that we are able to remain long-term shareholders.

US investment landscape: Regime change?

While our conviction in XPO is driven by our bottom-up research, we also see reason for optimism about the relative return potential of XPO – and our other cyclical shares – when we consider the broader market and economic context. Large exogenous shocks have a way of changing the prevailing regime in unexpected but enduring ways, and the COVID-19 pandemic was nothing if not a shock to the global economy. The consequences of the global financial crisis (GFC) produced the low-growth, low-interest-rate environment of the last decade. It’s quite possible that the consequences of the pandemic will produce a very different market regime with different winners and losers over the next decade.

The market regime of the last decade in the US was a near-perfect confluence of conditions for the shares of the defensive growth businesses that we have largely avoided in recent years. Below-trend economic growth in the aftermath of the GFC created an earnings headwind for economically sensitive businesses which made the relative earnings growth of many disruptive growth businesses look unusually attractive by comparison; with real growth scarce, investors were willing to pay a large premium for it. At the same time, technology-driven productivity gains and the deflationary impact of globalisation, coupled with low economic growth, helped to keep inflation subdued. Finally, with low growth, low inflation, and aggressive central bank intervention, long-term interest rates were depressed to historically low levels, disproportionately benefiting long-duration assets such as the shares of richly priced growth companies.

As this regime became entrenched, relative valuations for such businesses, which started low, were steadily amplified by the circularity of the capital cycle. Growth managers outperformed, attracting new assets, spurring further buying of the same growth shares, pushing such shares ever higher. Conversely, value managers underperformed, leading to redemptions, additional selling, and further value share underperformance. This cycle was magnified by the steady movement of capital from active managers (disproportionately value managers) to passive managers, who in turn were required to buy more growth shares at inflated index weights.

Yet developments since the start of the pandemic offer the tantalising possibility that this regime may be changing. Consider, for example, that the pandemic unleashed the most extreme increase in US government spending since the Second World War – US$6tn of stimulus – with more likely on the way, given the prevailing political environment in Washington DC. The magnitude of this fiscal response is difficult to overstate and may well produce a period of unusually high economic growth in the coming years.

Even without these extraordinary measures, the “real” economy stands to benefit from accelerated vaccine deployment and the end of lockdowns, combined with enormous pent-up demand and the highest individual savings rate in decades.

Additionally, the combination of surging demand, limited supply of both labour and goods (labour shortages, tight inventories, and supply chain disruptions are already nearly universal themes among US companies), ongoing deglobalisation, and exceptionally loose monetary policy potentially sets the conditions for much higher inflation and interest rates. Such a development would be a significant headwind for richly priced growth shares.

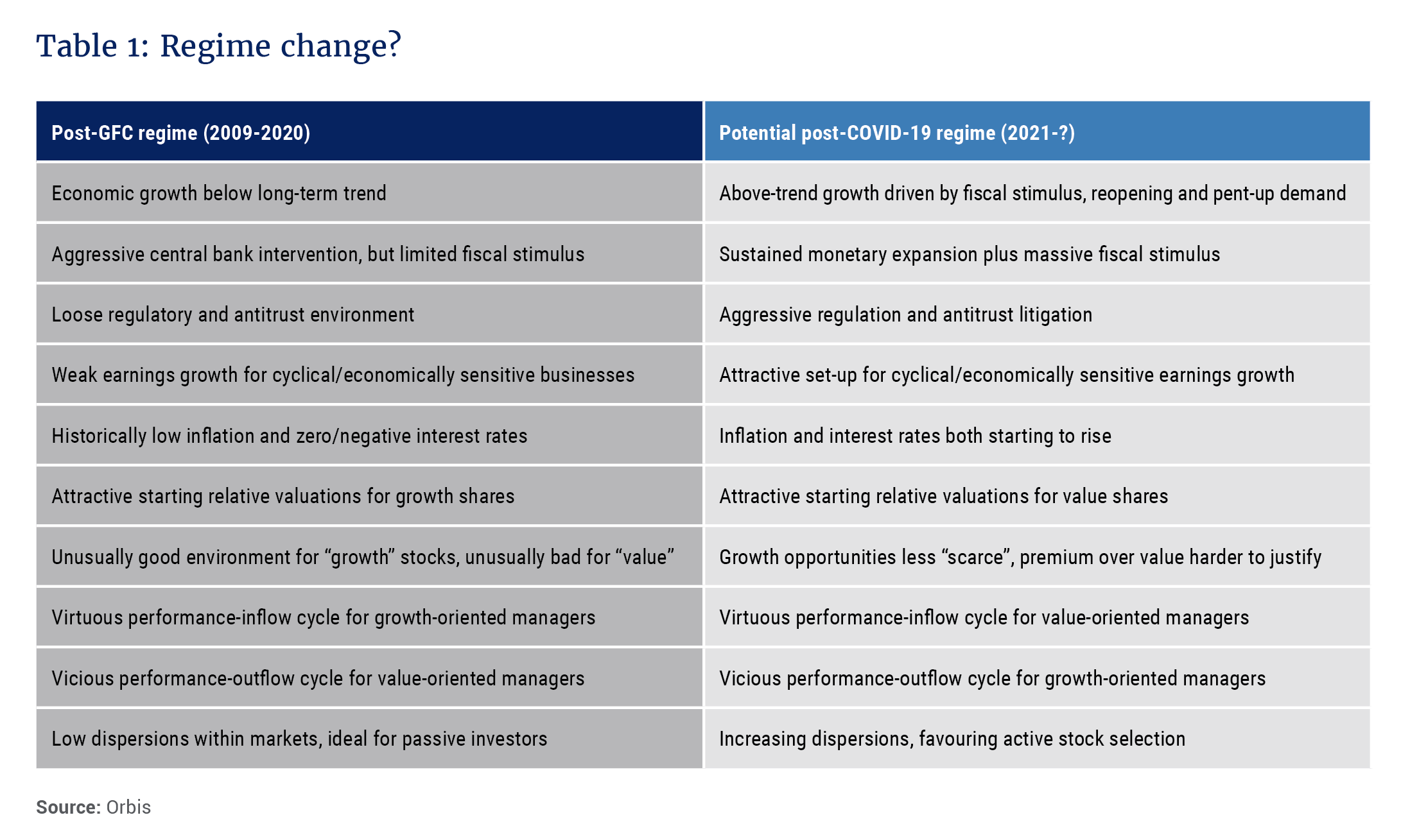

To be sure, we are less enthusiastic about the long-term consequences of this debt-funded, central bank-monetised spending binge, but the medium-term consequence is likely to be a period of increased economic activity – possibly the strongest in decades. Table 1 paints a picture of some of the ways in which the investment landscape in a post-pandemic world may differ from the one we’ve been accustomed to in the past 10 years or so.

While none of this is guaranteed to happen – and this is by no means a “forecast” on our part – it aligns well with developments in recent months. Some of the more encouraging data points include the recent rise in inflation expectations and real yields, and corresponding underperformance of growth shares relative to their value counterparts. This shift has also been a welcome development for the Fund’s performance.

Finding attractive opportunities in an expensive market

By owning individually attractive companies like XPO, we don’t need to bet on a regime change to find favourable risk-adjusted returns. But it is striking to consider how heavily many other investors appear to be betting on the current regime continuing indefinitely. For instance, approximately one-third of the S&P 500 by market cap now trade above 50 times normalised earnings, a level not seen outside of the TMT bubble.

If the developments just discussed indeed presage a regime shift, then the most highly valued shares would be particularly vulnerable. Globally, relative value spreads remain near historical extremes, and, despite the recent rise in yields, real yields remain significantly negative. From this starting point, even a modest increase in real interest rates could be devastating to the relative multiples of some defensive growth shares. A higher discount rate slightly reduces the present value of profits next year, but greatly reduces the value of profits next decade.

… we remain enthusiastic about the stockpicking potential within the US market.

A clear lesson from history is that big shifts can unfold dramatically, and it’s critical to avoid areas of the market that look most overvalued. At this stage of the cycle, we believe it’s less about trying to find the next Amazon and more about trying to avoid being left holding the next Pets.com. With wide valuation gaps, a potential shift away from the low-growth, low-inflation, low-yield, low-dispersion regime of the last decade, and with high-conviction ideas like XPO, we remain enthusiastic about the stockpicking potential within the US market.

US stocks may currently represent a relatively small portion of the Fund – a far cry from their weight in the World Index – but in our view, the handful of ideas that make up our allocation to the US are among our highest-conviction holdings anywhere in the world.