In his 1988 annual letter to shareholders, Warren Buffett wrote: ‘We have no idea how long the excesses will last, nor do we know what will change the attitudes of government, lender and buyer that fuel them. But we do know that the less the prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.’ He was referring here to Berkshire Hathaway’s arbitrage activities, but I believe that investors would do well to heed these words today.

Most investors admit to worrying about how the massive intervention by most governments and central banks will end. What will be the long-term costs of today’s runaway government spending and central bank balance sheet expansion? Many investors in South Africa are concerned about the poor performance of our productive industries, and they worry about how the declining trend can possibly be reversed in the face of rapidly rising electricity prices, poor educational outcomes and fractious labour relations. In light of Mr Buffett’s advice, does all of this worrying justify contrarian bullishness?

We argue not. We prefer to focus on what people are doing rather than on what they are saying. The distinction is important, because it seems that there is some disconnect between the two. US investor and author Howard Marks observed in his recent memo to Oaktree clients that ‘while few people are thinking bullish today, many are acting bullish.’

Proceed with caution

There are a number of objective measures indicating that despite a laundry list of worries, ‘Mr Market’ is today conducting his affairs with somewhat less prudence than perhaps he should.

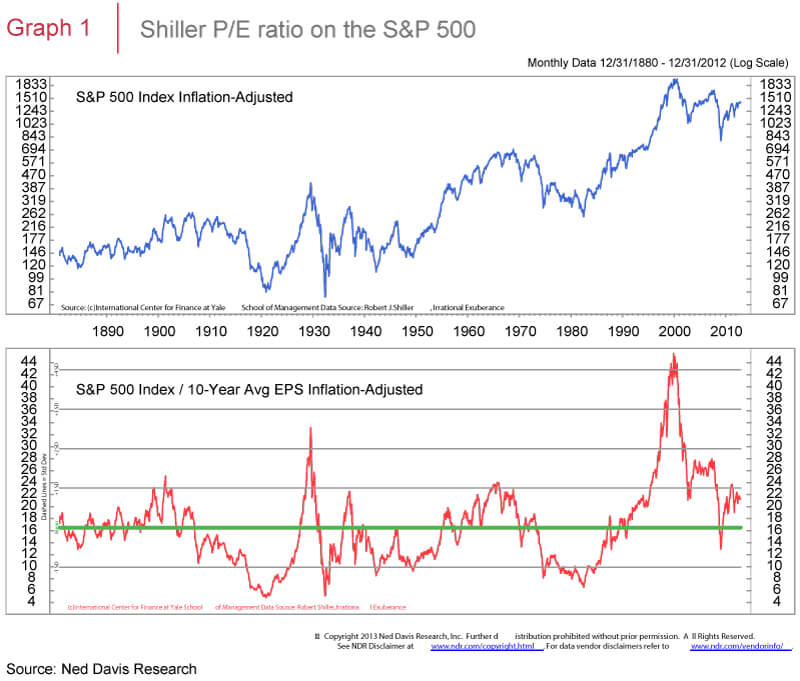

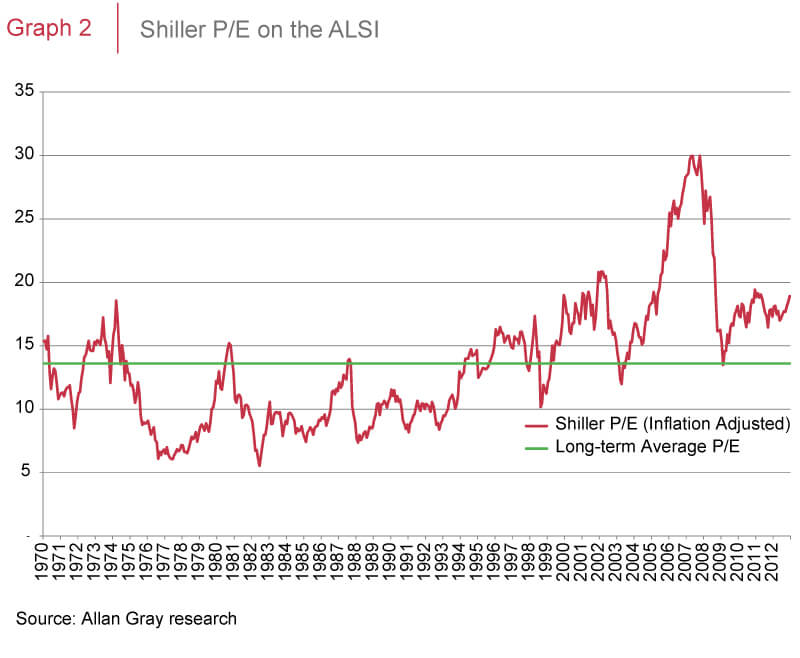

The inflation-adjusted ‘Shiller’ P/E ratio on the S&P500 is 22 compared to its long-term average of 16 (see Graph 1). The Shiller P/E measures the ratio of the S&P500 index to average annual profits over the preceding 10 years, and is thus used as an objective indicator of the multiple one is paying for ‘normal’ profits. The inflation-adjusted Shiller P/E ratio on the FTSE/JSE All Share Index (ALSI) is 19 compared to its long-term average of 14, as reflected in Graph 2. On this measure, equity valuations are higher than normal – indicating that we should be cautious, for the very reason that others are acting less cautiously.

The CBOE Volatility Index (VIX) is close to its lows over the last two decades. The VIX is a measure of investors’ expectations for future equity market volatility over the next 30 days, derived from the pricing of options contracts. The current low reading on the VIX suggests that investors are now almost as complacent as they were before the global financial crisis of 2007/08. The debt markets too are sending signals of slipping prudence: 2012 was a record year for the issuance of new high yield bonds in the US, and private equity firms are again using the aggressive leverage that they were using prior to the crisis. Yields on fixed income securities globally are very low.

These measures are affirmed by the record low reading on the Leuthold Group’s Monthly Risk Aversion Index (RAI), which was recently published in Bloomberg Businessweek. This is a composite indicator which combines various credit and swap spreads, commodity and currency prices, and relative asset returns ‘to offer a broad gauge of skittishness’.

Maintain your risk standards

These indicators all suggest that caution is called for if we are to follow Mr Buffett’s advice. But acting prudently while many around you are not is hard to do, because it can result in years like we just experienced in 2012 – years in which satisfactory absolute returns lag behind peer benchmarks. Investors should be careful not to unconsciously lower their risk standards in a chase for yield. Spells of short-term underperformance are the price one pays for long-term outperformance.

We believe that the current relatively conservative positioning of our portfolios is appropriate in light of current prices and is the best way to maximise long-term returns.

Allan Gray Proprietary Limited is an authorised financial services provider. The FTSE/JSE All Share Index is calculated by FTSE International Limited (‘FTSE’) in conjunction with the JSE Limited (‘JSE’) in accordance with standard criteria. The FTSE/JSE Africa Series is the proprietary information of FTSE and the JSE. All copyright subsisting in the FTSE/JSE All Share Index values and constituent lists vests in FTSE and the JSE jointly. All their rights are reserved.