The recent sharp declines in global stock markets following US President Donald Trump’s declaration of “Liberation Day”, and the volatility that ensued, have rekindled investor anxieties reminiscent of past crises, such as the global financial crisis and the COVID-19 pandemic. Stephan Bernard reflects on past events and offers investors some context for investing through volatility, given this period of heightened uncertainty is likely far from over.

In unpredictable times, history offers valuable perspectives. During the global disruption caused by COVID-19 in early 2020, investors questioned the wisdom of drawing lessons from past downturns, given the novel nature of the crisis. At that time, market declines were rapid and severe, comparable only to the Great Depression in their immediacy. Asset classes moved in unison, providing few safe havens. Investors wanted out of equities, but there were few places to go.

While severe downturns naturally evoke fears of permanent damage, history shows that markets eventually rebound, often robustly.

Yet, despite genuine fears of systemic economic breakdown, markets eventually stabilised, rewarding those who stayed the course.

Avoid making fear-driven decisions

Reflecting on 2008’s global financial crisis, veteran investor Howard Marks highlighted a critical investment insight in his investment memo of 9 April 2025. To paraphrase: Predicting an end-of-world scenario is inherently speculative and, ultimately, counterproductive. While severe downturns naturally evoke fears of permanent damage, history shows that markets eventually rebound, often robustly. This doesn’t imply that disruption requires no response, but rather that investors should avoid making fear-driven decisions.

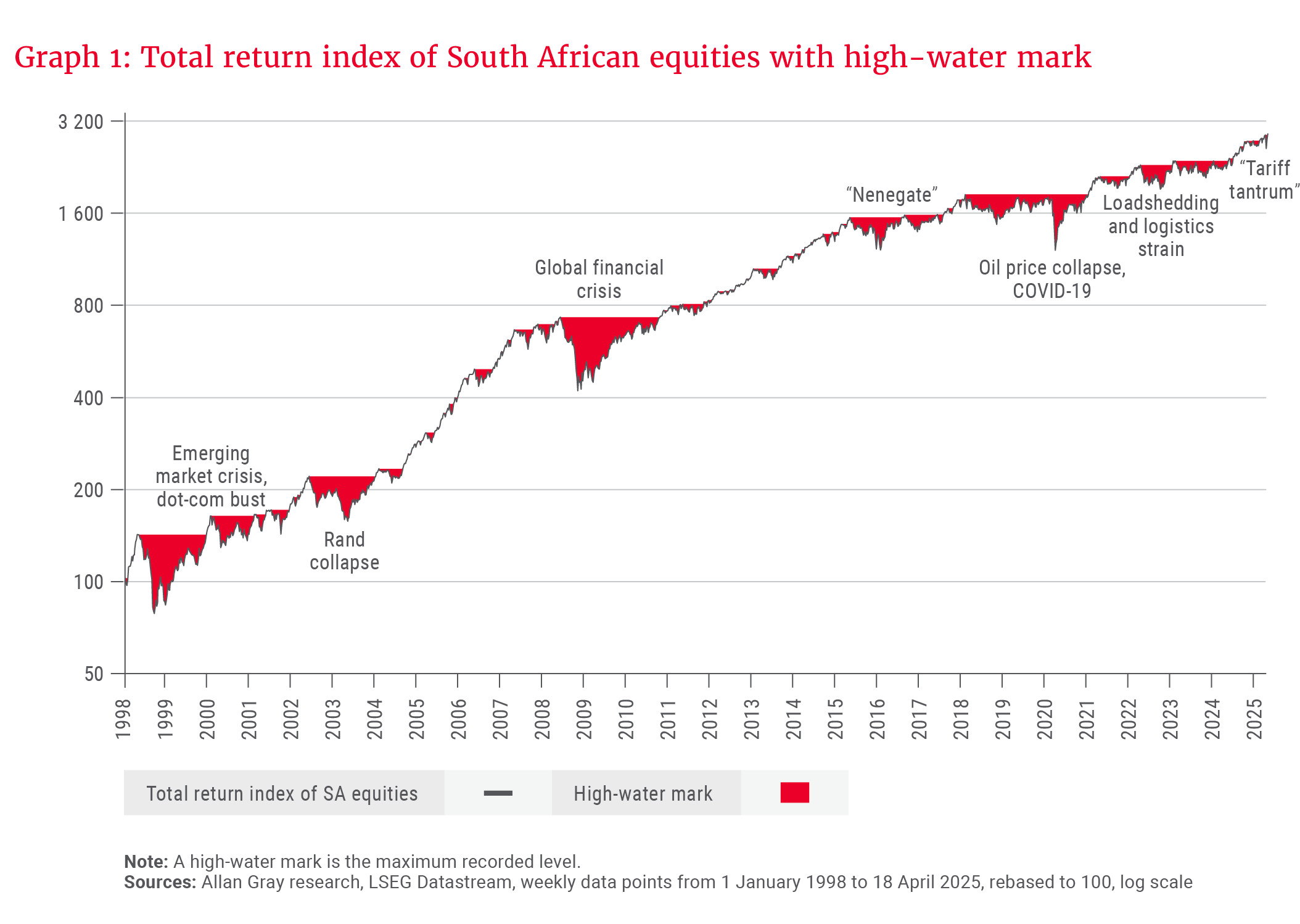

Graph 1 shows the total return index of South African equities, highlighting market drawdowns since the dot-com bubble of the late 1990s. During every crisis, the prevailing pessimism following significant market declines makes attractive prospective returns feel highly unlikely. And yet, over time, the market rises to surpass the previous high-water mark (the red areas). Hard as it may feel, remaining invested through periods of volatility and uncertainty, and not giving in to the temptation to follow the herd to perceived safety, ensures participation in recoveries, which are important drivers of long-term returns.

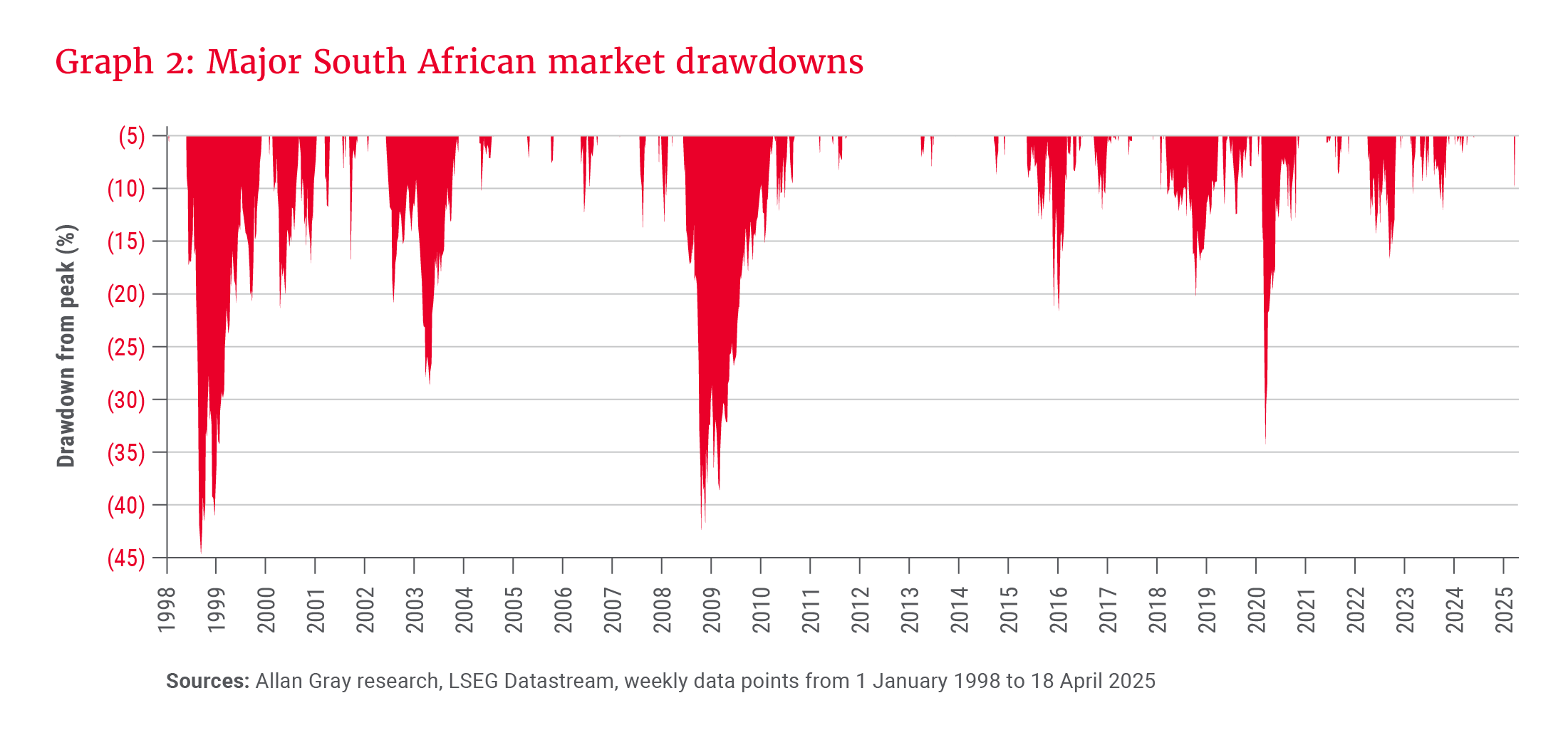

The sell-off in April 2025, as reflected by the 11% drawdown in the South African equity market, was not particularly severe, considering the high base established by the strong performance of local equities throughout 2024 and the first quarter of 2025. While news flow might suggest otherwise, the drawdown was also not exceptionally large relative to history, as shown in Graph 2, and a reasonably swift recovery occurred. However, considerable uncertainty remains.

The risk of a potential trade war raises concerns that significant market disruption, muted global growth and elevated inflation may still lie ahead. We are likely still in for a bumpy ride.

Key objective: Protecting your capital

Overestimating the probability or the extent of losses during market turbulence can lead you astray. To obtain a realistic view, put current events, and your associated discomfort, into perspective by looking at how your investments have responded to similar events over time.

… the Allan Gray funds have typically held up well during weaker market periods, outperforming peers in down months on average …

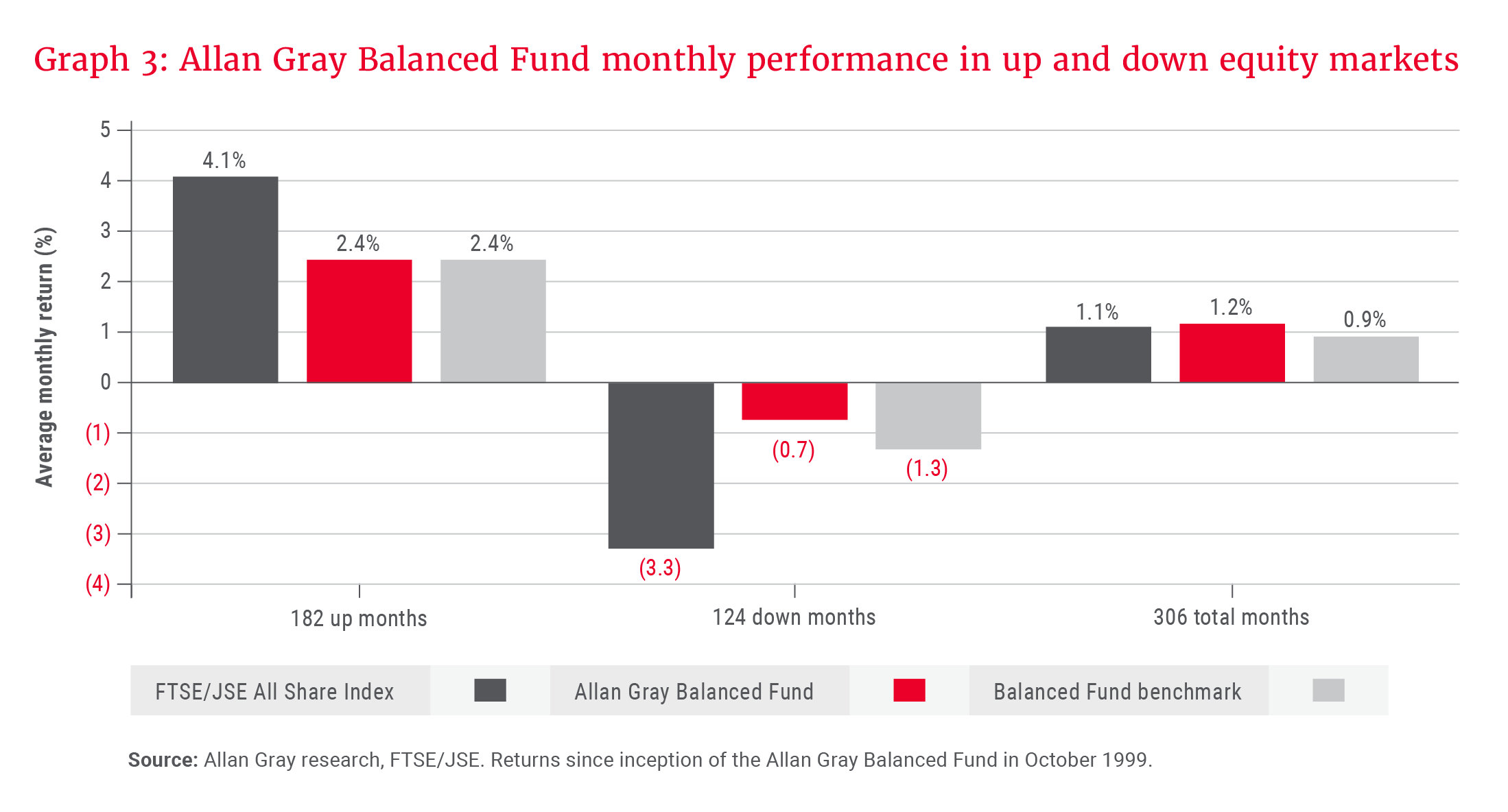

Although past performance is no guarantee of future performance, the Allan Gray funds have typically held up well during weaker market periods, outperforming peers in down months on average, while delivering returns broadly in line with peers during strong months. This is consistent with our approach of avoiding permanent capital loss through disciplined, valuation-based investing.

Over time, the benefit of limiting losses in weaker markets (down months) compounds meaningfully, as illustrated in Graph 3. Viewed across all months since inception in 1999, the Allan Gray Balanced Fund outperformed the average of its peers and achieved returns in line with equities, as represented by the FTSE/JSE All Share Index, despite taking on significantly less risk through diversification across asset classes.

As Nick Curtin explained in his article in our previous Quarterly Commentary, In safe hands with the Allan Gray Balanced Fund, our investment philosophy of only investing in assets where there is a significant margin of safety built into the valuation – i.e. a significant gap between the share price and what we believe the share is worth – and our obsession with trying to avoid the risk of permanent capital loss entirely mean that there is a built-in risk-management anchor to everything we do. It is endemic to how we think about investing.

What to do with this information

As markets continue to be rattled by tariff disputes and compounded by local political uncertainty, you may be confronted with the temptation to switch into lower-risk assets, or to disinvest. If you find yourself on the verge of making a panicked decision to safeguard your investment, reflect on whether your personal circumstances, investment goals or time horizon has changed. If not, it may be better not to react. History continues to reinforce the lesson that long-term value is created by investing into uncertainty and remaining invested through it.

It is important to remain focused on your long-term investment strategy. If you have outsourced your asset allocation decisions to us by investing in the Allan Gray Balanced Fund, you can sleep a little easier during periods of volatility, like we are currently living through, knowing we are carefully thinking about the relative attractiveness across all asset classes in the Fund, on your behalf. Allan Gray and Orbis’ investment teams are committed to navigating this environment on your behalf by seeking opportunities that are attractively priced, yet underpinned by sound fundamentals.

Explore more insights from our Q1 2025 Quarterly Commentary:

- 2025 Q1 Comments from the Chief Operating Officer by Mahesh Cooper

- Tariffs: The stealth tax by Sandy McGregor

- A gear shift in electric vehicles? by Raine Adams

- Orbis Global Balanced: Defensively positioned to deliver long-term returns by Alec Cutler and Rob Perrone

- Allan Gray Orbis Foundation: 20 years of purpose-driven impact by Nontobeko Mabizela

- A phased approach to your retirement journey by Nshalati Hlungwane

To view our latest Quarterly Commentary or browse previous editions, click here.