With doom and gloom pervading locally, and the world economy slowing, you may be feeling like the safest place for your money is under your mattress. This is never a winning strategy. Negativity can blind us from seeing opportunity. Duncan Artus gives some context on the current environment.

The local macroeconomic outlook and sentiment have deteriorated significantly over the past 12 to 18 months. Business and consumer confidence in South Africa are decisively negative, and the slowing global economy, plagued by the US/China trade war and geopolitical issues, is adding to the woes. Many investors are understandably seeking out safe-haven assets like cash.

History has shown that future equity investment returns are uncorrelated with current cash returns and economic growth, both in South Africa and the rest of the world, and periods such as these are typically followed by recovery. The good thing about uncertain environments is that investors tend to act emotionally; this can present opportunities to pick up assets at reduced prices.

A tough five-year period

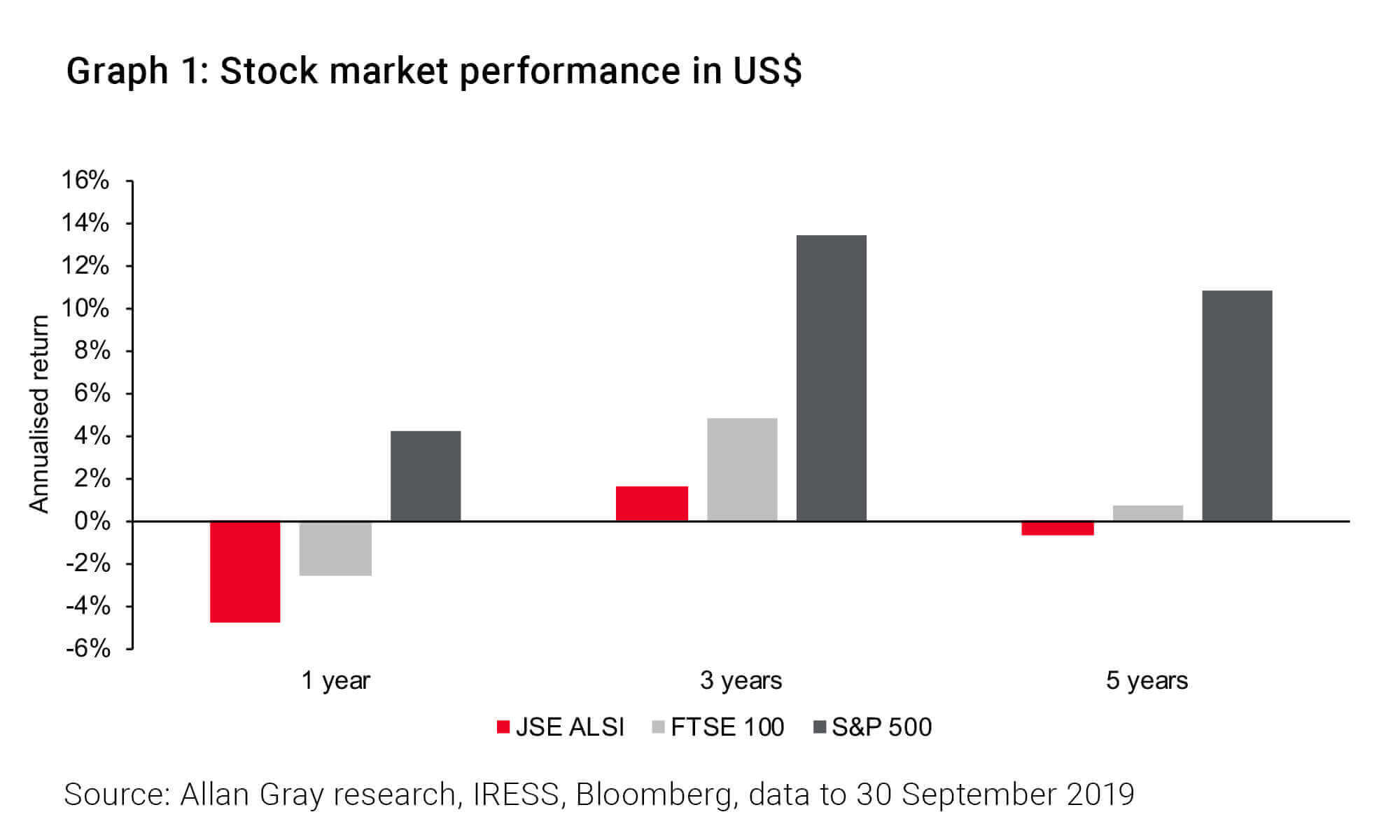

Returns from local investments over the last five years have been incredibly disappointing compared to global markets, with the FTSE/JSE All Share Index (ALSI) significantly underperforming in US dollar terms. In fact, over this period, the best place to have been invested would have been the US, as shown in Graph 1. However, looking at longer-term periods, South Africa has kept pace, and over 20 years actually performed better than its global counterparts due to the low starting point in 1998 / 1999.

An extremely narrow market

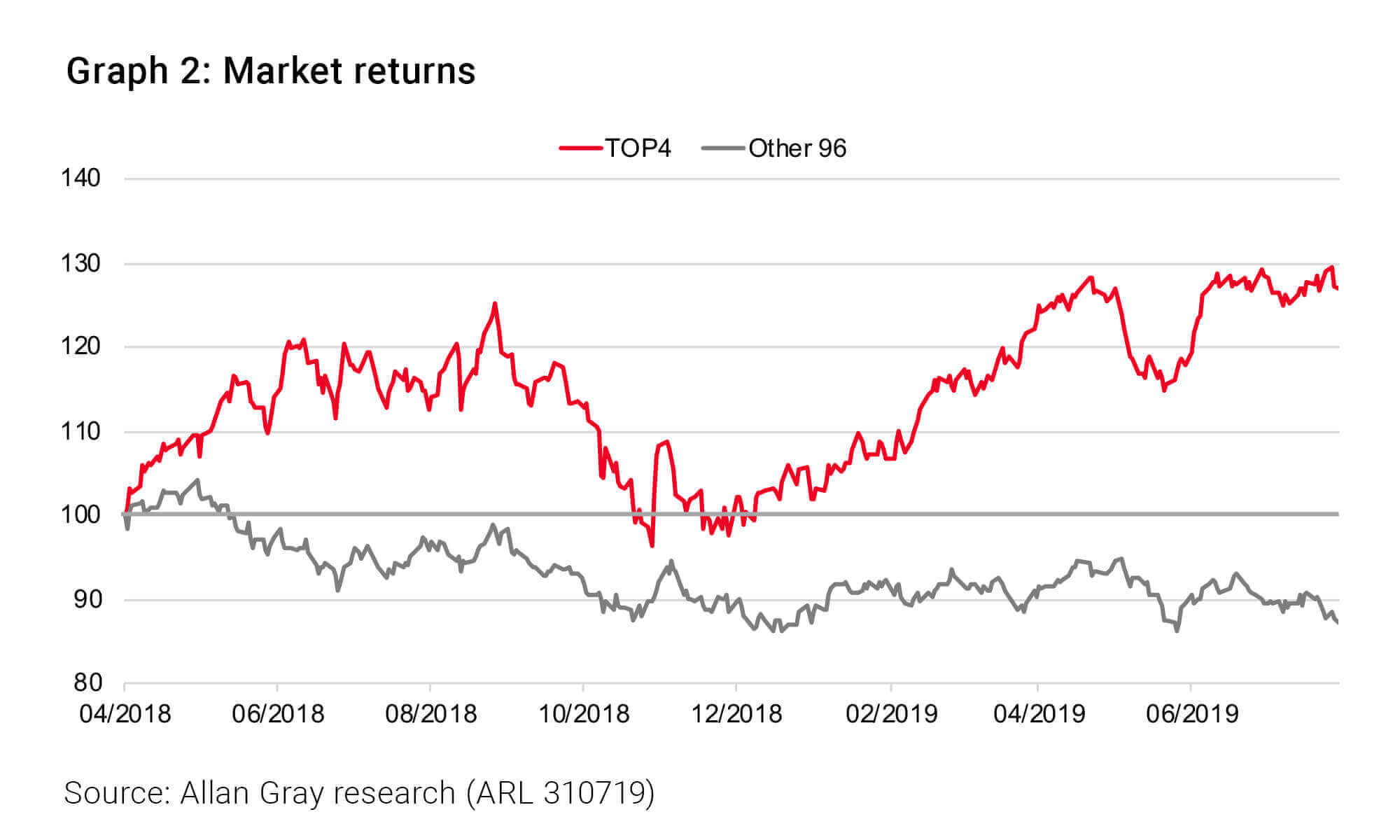

Emerging market equities are currently depressed compared to the S&P500, and South Africa, which makes up 7% of the Emerging Markets Index, is no exception. The market is also extremely narrow, with a handful of shares driving the index returns.

As you can see from Graph 2, there has been a big discrepancy in return of the top 4 companies on the ALSI, compared to the rest of the top 100. In fact, if you were not invested in Naspers, Richemont, BHP or Anglo American over the past year, it would have been difficult to outperform the index. It has been a tough environment for active managers in general – and a period of disappointing investment returns from Allan Gray portfolios.

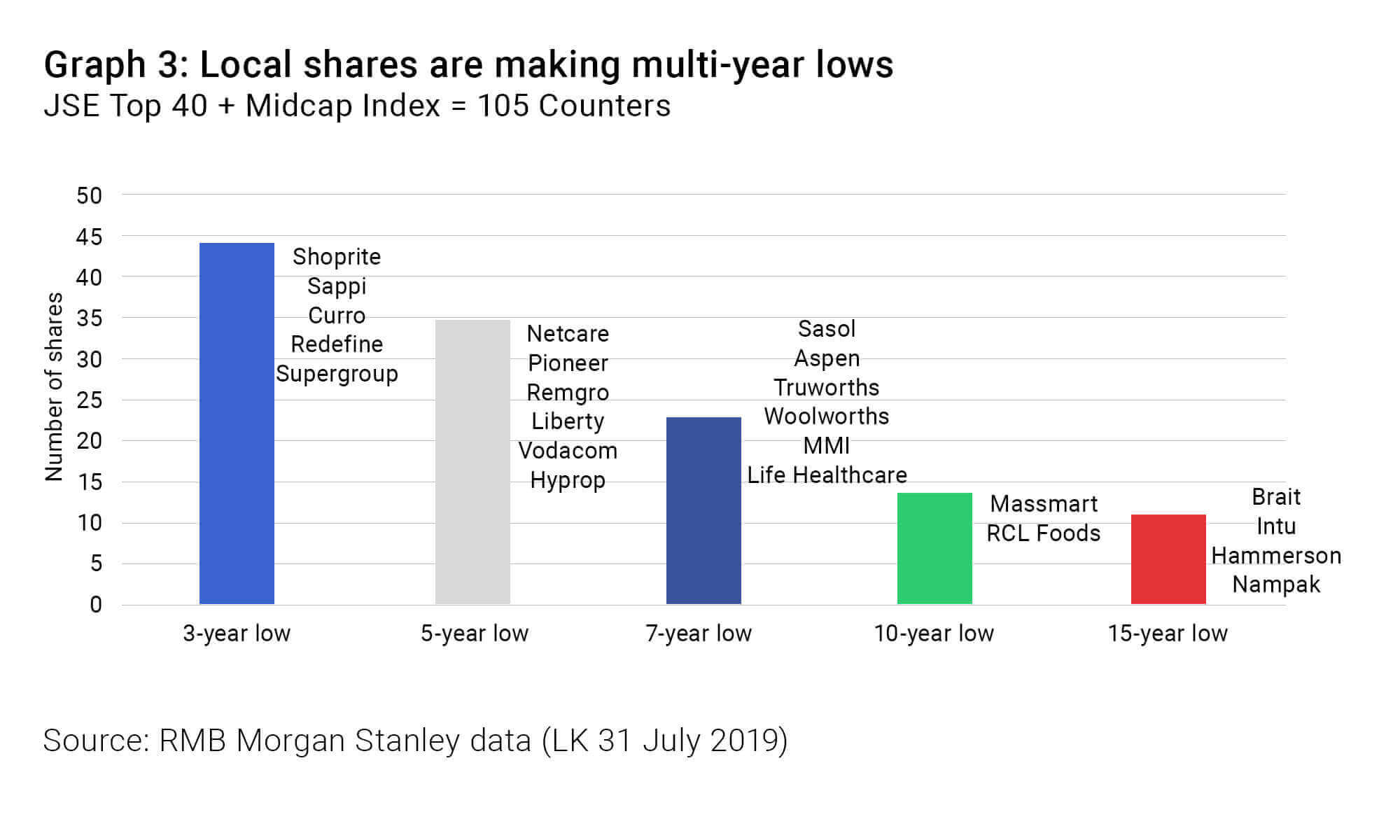

But opportunities tend to arise when the mood is depressed. Many shares on the local market are currently at multi-year lows, as shown in Graph 3. Our investment team today is finding more opportunities to work on than we have in many years.

Positioned for multiple outcomes

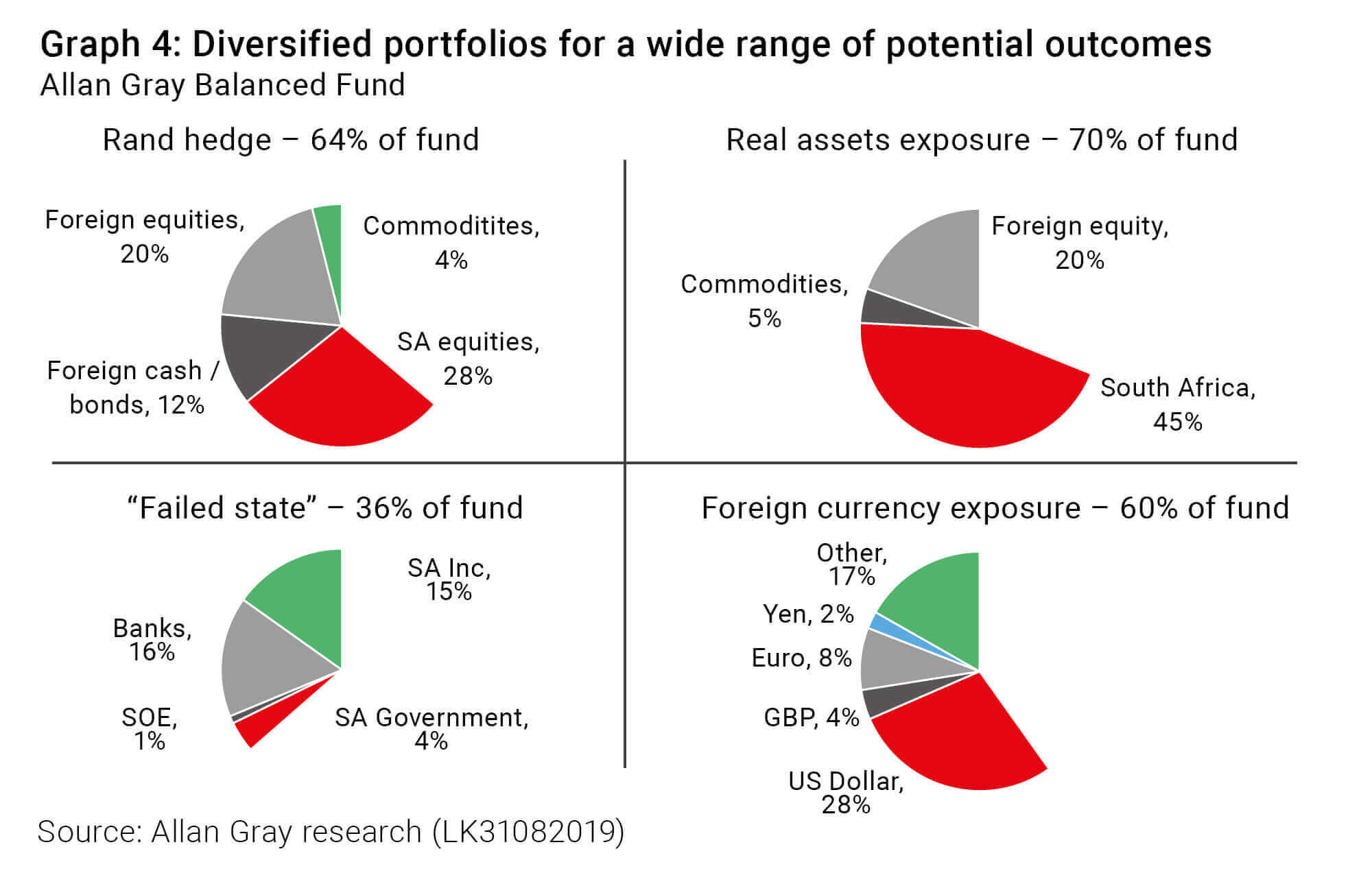

The Allan Gray asset allocation funds reflect this view. We acknowledge the future is uncertain and that a wide range of potential outcomes is possible. Building well-diversified portfolios, from the bottom up, that can deliver returns and protect investors from potential negative outcomes, is a core part of our portfolio construction efforts. This is illustrated in Graph 4, which shows how the Allan Gray Balanced Fund (the Fund) is positioned to mitigate various risks:

- Severe rand depreciation: Mitigated by holding rand hedge assets and ensuring the portfolio is exposed to a range of foreign currencies

Two-thirds of the portfolio is currently invested in assets that should benefit from rand weakness – i.e. the 30% held offshore and in South African listed businesses that earn their profits offshore. Even though the portfolio is denominated in rands, about 60% of the Fund is exposed to a diversified range of foreign currencies.

- Unexpected bouts of inflation eroding the real value of investments: Mitigated by holding real assets

Over the long term, cash presents risk, with the key risk being the inability to keep up with inflation. You need real assets to protect against inflation, and 70% of the Fund is invested in real assets.

- A catastrophic decline in the SA economy and the government’s ability to finance itself: Mitigated by careful local asset allocation

The governance and financial challenges in South Africa are well known, as the country desperately hangs on to its investment grade rating. We look carefully for good value opportunities on the local market but are cognisant of the associated risks.

Investing through the cycles

We believe a well-diversified portfolio has many levers to rely on in pursuit of long-term returns, in multiple scenarios, as long as a fair price was paid for those assets to begin with. We continue to work hard to structure the portfolio to protect and grow your capital in these unsettling times.