The Allan Gray Stable Fund was launched in July 2000 and joins our two other flagship unit trusts to have crossed the quarter-century mark, the Allan Gray Equity and Balanced funds. Managing money for this length of time requires unwavering discipline and focus. Radhesen Naidoo and Danielle Nissen reflect on our Stable Fund’s history, its objectives, and why it remains relevant in today’s uncertain landscape.

A 25-year period of investing is a long time. To put this into context, if we cast our minds back 25 years, it was the beginning of the new millennium, we had just filed away Y2K crisis preparation plans, and we still watched the SABC news for world updates. Mission: Impossible 2 was the highest-grossing film of 2000 (unbelievably, the eighth instalment was released this year), and technology investments were the fashion – as they are today.

The late 1990s witnessed unprecedented volatility in global markets, driven by events like the Asian financial crisis and the dotcom bubble. Investors were pessimistic about stock markets, having experienced significant declines in South African shares during 1998, and in 2000, the US technology darlings started to come off their highs, fuelling further fears. Allan Gray identified a growing need for a unit trust that would prioritise capital preservation while delivering real returns over the long term, and so the Allan Gray Stable Fund was born.

How does our Stable Fund achieve its dual objectives?

Our Stable Fund’s dual objectives have remained unchanged since its inception: It aims to produce a superior long-term return to what investors can earn from a South African bank deposit, while seeking to minimise the risk of capital loss over any two-year period.

… the Fund has done a stellar job on its promise to protect client capital over any two-year period, and delivered positive returns.

Back in 2000, this was an innovative approach to investing. Ordinarily, more risk-averse investors would have deposited their capital with a bank or in a money market fund. Our Stable Fund aimed to solve a conundrum for investors seeking to preserve their capital, but not wanting to completely miss out on the upside from stock markets.

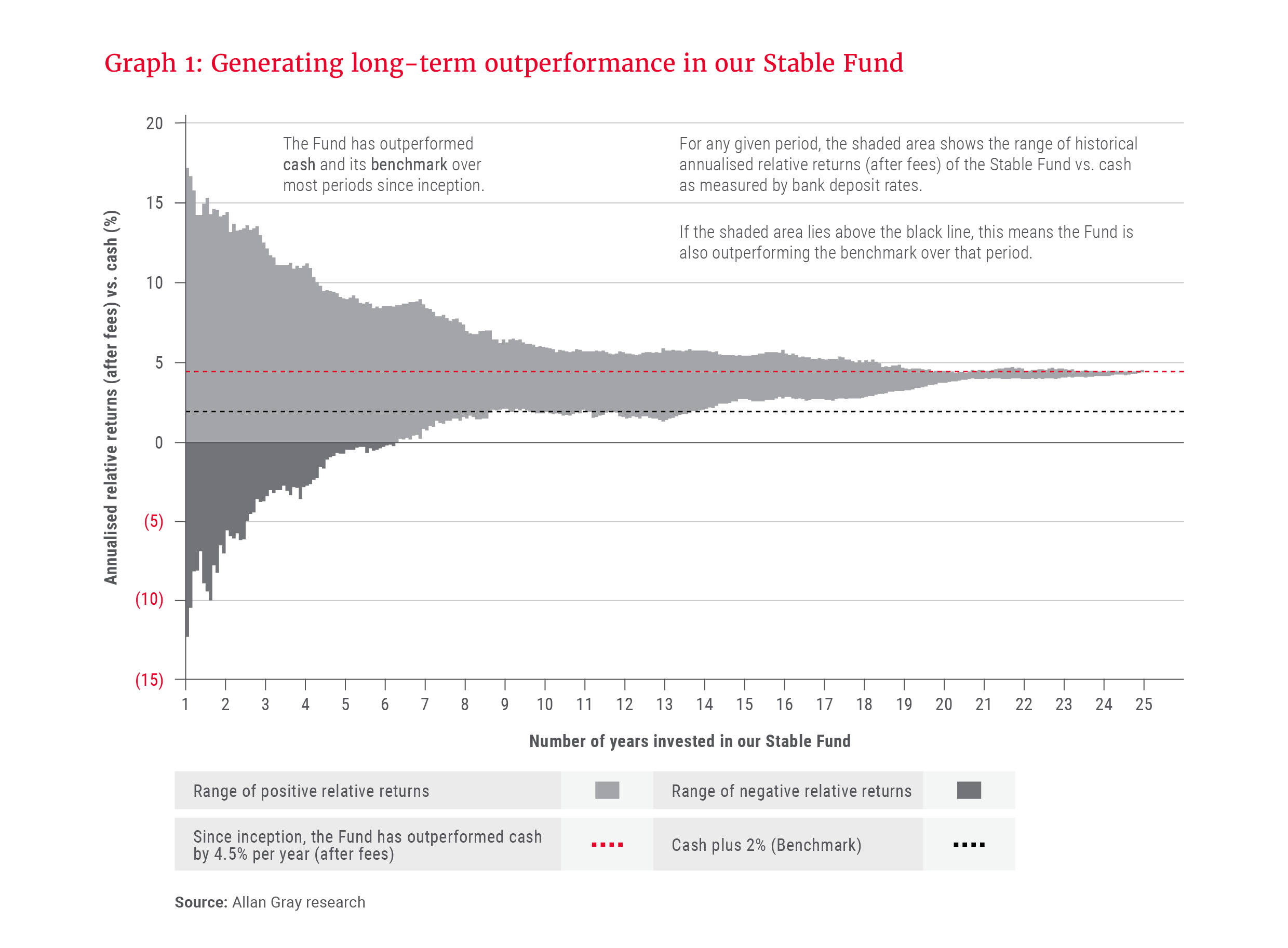

Graphs 1 and 2 analyse how the Fund has delivered on these objectives over time. Graph 1 shows the range of annualised relative returns (after fees) versus cash over any given period to 30 June 2025. Simply put, the light and dark grey shaded areas reflect how much more or less the Fund earned per year compared to bank deposits. As the number of years invested in the Fund increases, the range of outcomes reduces. This means that the chances of an investor outperforming the benchmark, and generating real returns, increase the longer they remain in the Fund.

As represented by the red dotted line, the Fund has outperformed cash by 4.5% per year (after fees) since inception. As represented by the light grey shaded area, the Fund has outperformed cash and its benchmark (indicated by the shaded area above the black dotted line) over most time periods. This is evidence of real capital growth.

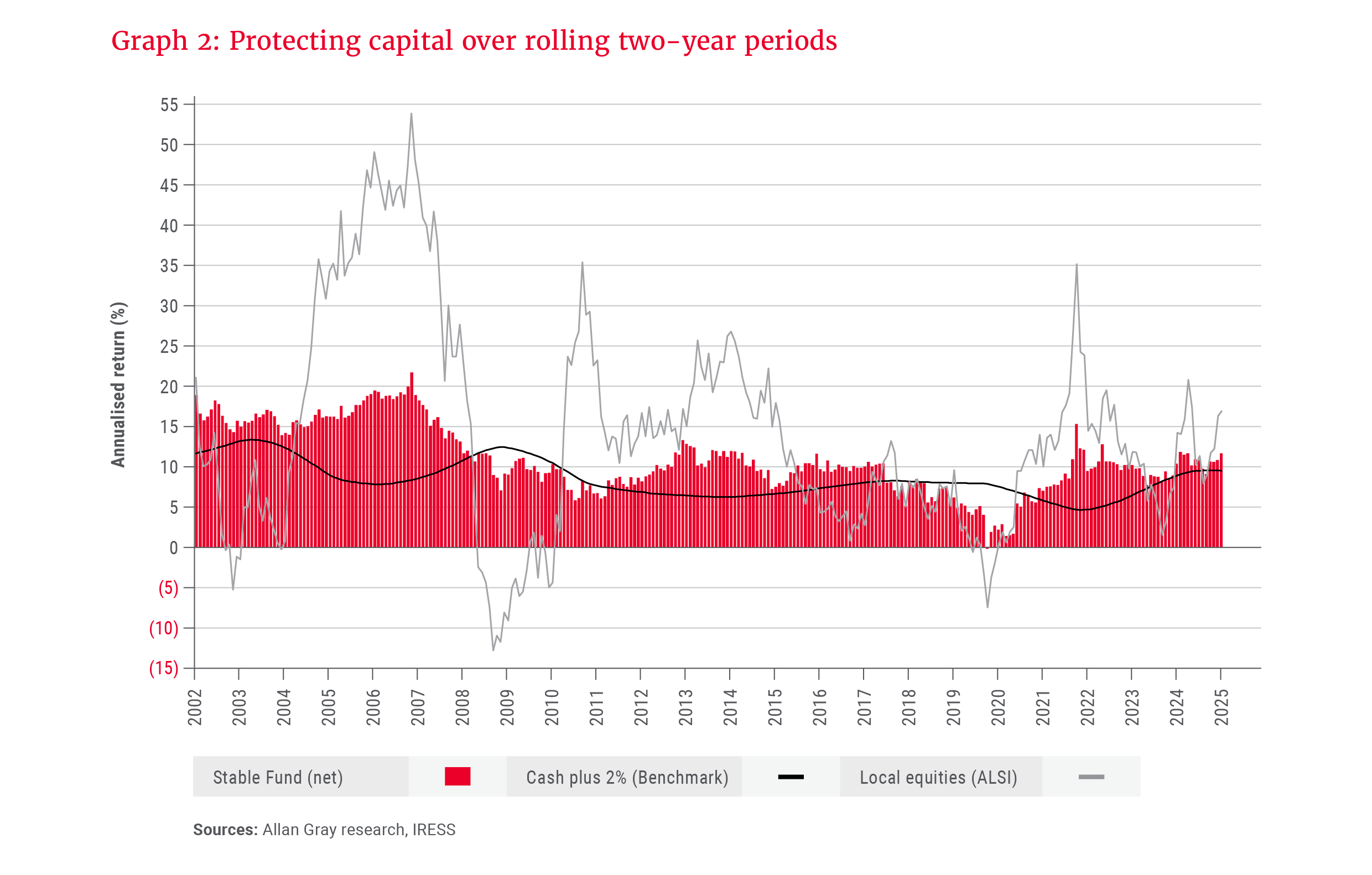

Outperforming over the long term is important, but investors in the Fund wish to see their capital protected. Graph 2 illustrates the rolling two-year returns of the Fund (the red bars) versus those of the South African stock market (represented by the FTSE/JSE All Share Index (ALSI), illustrated by the light grey line) and the Fund’s benchmark (illustrated by the black line). As shown, the Fund has done a stellar job on its promise to protect client capital over any two-year period, and delivered positive returns.

While the stock market is very volatile (as illustrated by the light grey line), the Fund has flexibility to invest a limited amount in stock markets. This has helped our investors grow their wealth ahead of a typical money market product. Over the Fund’s history, when stock market returns have been weak or negative, the Fund has protected investors; the early 2000s, the global financial crisis in 2008, and Nenegate in 2015/2016 are clear examples. Conversely, during periods of equity market strength – between 2004 and 2008, and 2010 and 2015 – the Fund has benefited and generated returns well ahead of its benchmark.

The process of protecting clients during stock market downturns, but participating in the upside, underpins the Allan Gray investment philosophy. Our investment process focuses on determining the underlying value of an asset, investing in it when it is below this value, and selling it when it reaches our estimate of its true worth. We are obsessed with the downside risk – the risk of permanently losing our clients’ money. The main way to avoid this, in our view, is not to overpay for an asset at the outset. This approach has benefited our clients through various investment cycles across all our funds.

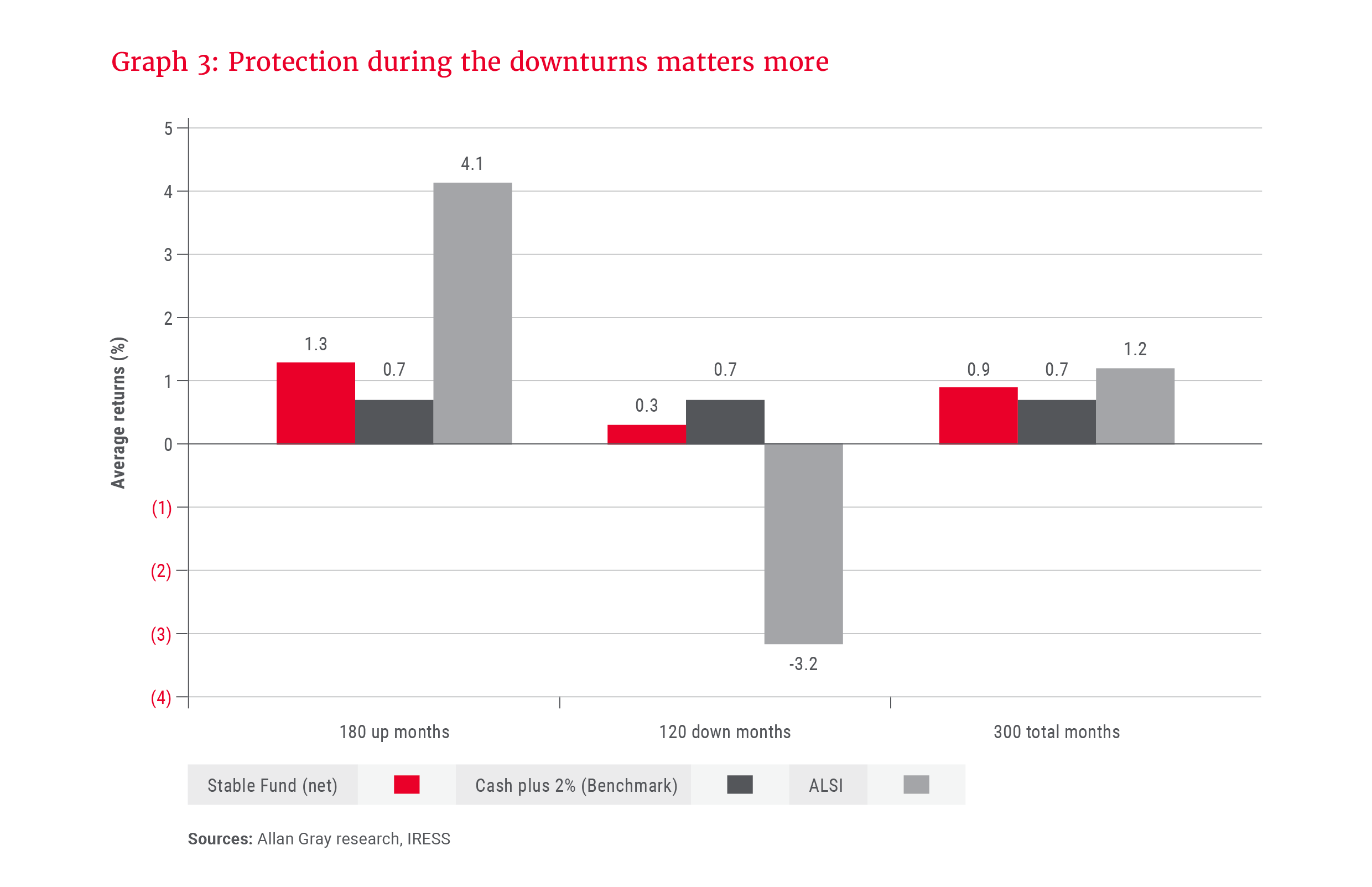

Graph 3 shows the average monthly returns of the Fund during months when the ALSI delivered a positive return and during months when the ALSI delivered a negative return over the last 25 years. On average, the Fund generated a lower return than the ALSI during positive months; however, we would expect this over the long term, given the Fund’s objectives, and are therefore not worried about this outcome. The critical feature is what happened when markets were negative: The Fund, on average, generated positive returns. In other words, the Fund can capture a healthy portion of the overall market return, with substantially lower downside risk over the long term. This resolute focus on preventing capital loss is at the core of our philosophy because when you lose money, it is very hard to simply catch up.

Optimising returns through a dynamic approach

To achieve its dual objectives, the Fund can invest in the full range of available asset classes. This is particularly relevant in periods when any one asset class fails to deliver. We have the flexibility to have little or no exposure to stock markets when we believe the share prices on offer are too rich, but we can increase our exposure to up to 40% when share prices are cheaper.

The Fund has always maintained a significant allocation in fixed income assets as part of its design to protect client capital. Over the Fund’s history, offshore investment limits have gradually increased, and currently, we are allowed up to 45%. This provides more flexibility and levers to pull, but we are mindful of the additional volatility offshore exposure brings, including the risk of exchange rate fluctuations.

Navigating between different asset classes to capture the upside and equally avoid the downside requires a disciplined process. A core strength of our investment approach is that we build our asset allocation funds from the bottom up, and every investment is competing for a place in the portfolio. Simplistically, this means we start by looking at individual shares and comparing how attractive they are versus cash, bonds, commodities and foreign investments.

Our Stable Fund continues to be a popular option for investors seeking stability in turbulent markets …

We recognise that every asset class offers a different risk and reward. We typically put our clients’ capital to work in riskier assets, such as equities, when investor expectations are low, which lowers the risk of loss. Investor expectations tend to be low during times of uncertainty, and when the prices of shares are depressed. Conversely, we retreat into safer assets when investor expectations are too high, which increases the risk of loss. This typically happens when optimism abounds, pushing prices beyond what the fundamentals suggest are fair prices.

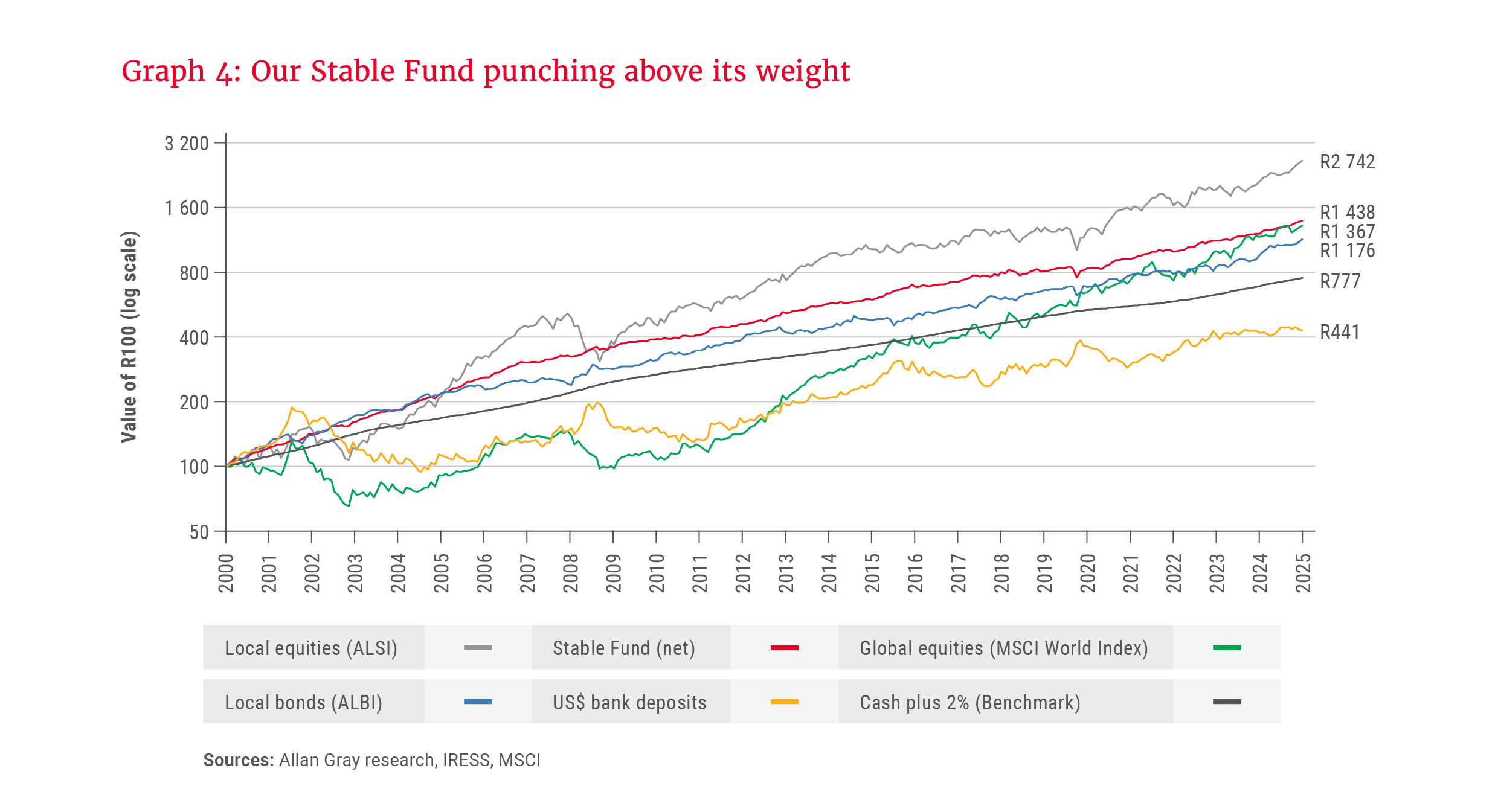

This approach has yielded results for our Stable Fund over time. Perhaps surprisingly, the Fund has outperformed most of the underlying asset classes in which it can invest (as measured by various benchmark indices), except for South African equities, as shown in Graph 4. Of course, the middle of 2000 coincided with one of the worst entry points in global equity markets. This highlights an important aspect that underpins our investment philosophy: It’s the price you pay that matters. If you had invested in global equities in July 2000 and tracked the world market, you would still be slightly behind, despite the roaring success of the US market over the past 10 to 15 years.

Foreign investments, though, have been an important contributor to the Fund’s success. We have been fortunate to have an offshore partner, Orbis, with whom we share a founder, owner and investment approach. Our Stable Fund holds a large portion of its offshore investments in a range of Orbis funds that have generated stellar returns, particularly during times of market uncertainty. In addition, since 2023, the Allan Gray portfolio managers have managed offshore assets directly from Cape Town, with a core goal of selecting investments that augment the Fund’s objectives.

Looking ahead to the next 25 years

One way to understand the longevity of funds is to consider the history of all investable unit trust products. According to data from the Association for Savings & Investment South Africa (ASISA), there are only 80 funds focused on managing South African assets with a history longer than 25 years among the just over 1 700 funds that currently exist. There are many more which no longer exist, due to the competitive nature of the industry. This is an incredible testament to how difficult it is to manage money over long periods of time.

Today, the Allan Gray Stable Fund has over R50bn in assets under management, and its purpose and objectives remain the same. The Fund has also been managed by multiple generations of investment teams, which further proves that, while teams change, our underlying philosophy endures.

Our Stable Fund continues to be a popular option for investors seeking stability in turbulent markets, making it an ideal choice for retirees, conservative savers, and those seeking to diversify their portfolios with a less volatile option. While no one knows what will happen over the next 25 years, we continue to believe there will always be a need for an option that balances minimising the risk of loss over the short term and striving for real capital growth over the long term.

Explore more insights from our Q2 2025 Quarterly Commentary:

- 2025 Q2 Comments from the Chief Operating Officer by Mahesh Cooper

- Rebuilding the global monetary order with bricks of gold by Umar-Farooq Kagee

- Crouching tiger, hidden value by Andrew McGregor

- Orbis Global Equity: Discipline in the face of volatility by Adam R. Karr

- How to think about beneficiary nominations for your retirement funds by Ian Barow

- Three questions to evaluate your investment manager by Nomi Bodlani

To view our latest Quarterly Commentary or browse previous editions, click here.