The current disparity in markets, both locally and offshore, is creating an opportunity for bottom-up investors like ourselves to generate meaningful returns, but one needs to be discerning. During a recent Zoom webinar, Jacques Plaut discussed where we and our offshore partner, Orbis, are currently finding value. Watch the 28-minute recording and read the key takeouts below. You can also download the slides here.

Key takeouts

There is currently a huge disconnect between asset prices and incomes. The ratio of US stock market capitalisation to GDP has never been this high. And it is not just shares: House prices and commodity prices are also increasing much faster than incomes, and fears of inflation are on the rise. Danger signs abound, particularly in the US market, and we believe caution is key.

What are the danger signs?

- Valuations are expensive: It has been a good decade for stocks. If you invested US$100 10 years ago in the MSCI World Index, you would have US$300 today. However, this average hides the fact that a handful of large US stocks have done well, but the performance of the rest has been mediocre.

- A flurry of IPOs: Another danger sign for the US market is that there is lots of money being raised in initial public offerings (IPOs), a classic sign of exuberance. Nearly US$200bn was raised last year, and we are already close to that number so far this year.

- Excessive demand from retail investors: Towards the end of last year, there was so much demand from retail investors to buy stocks and options that many brokerages could not cope, and they suffered outages.

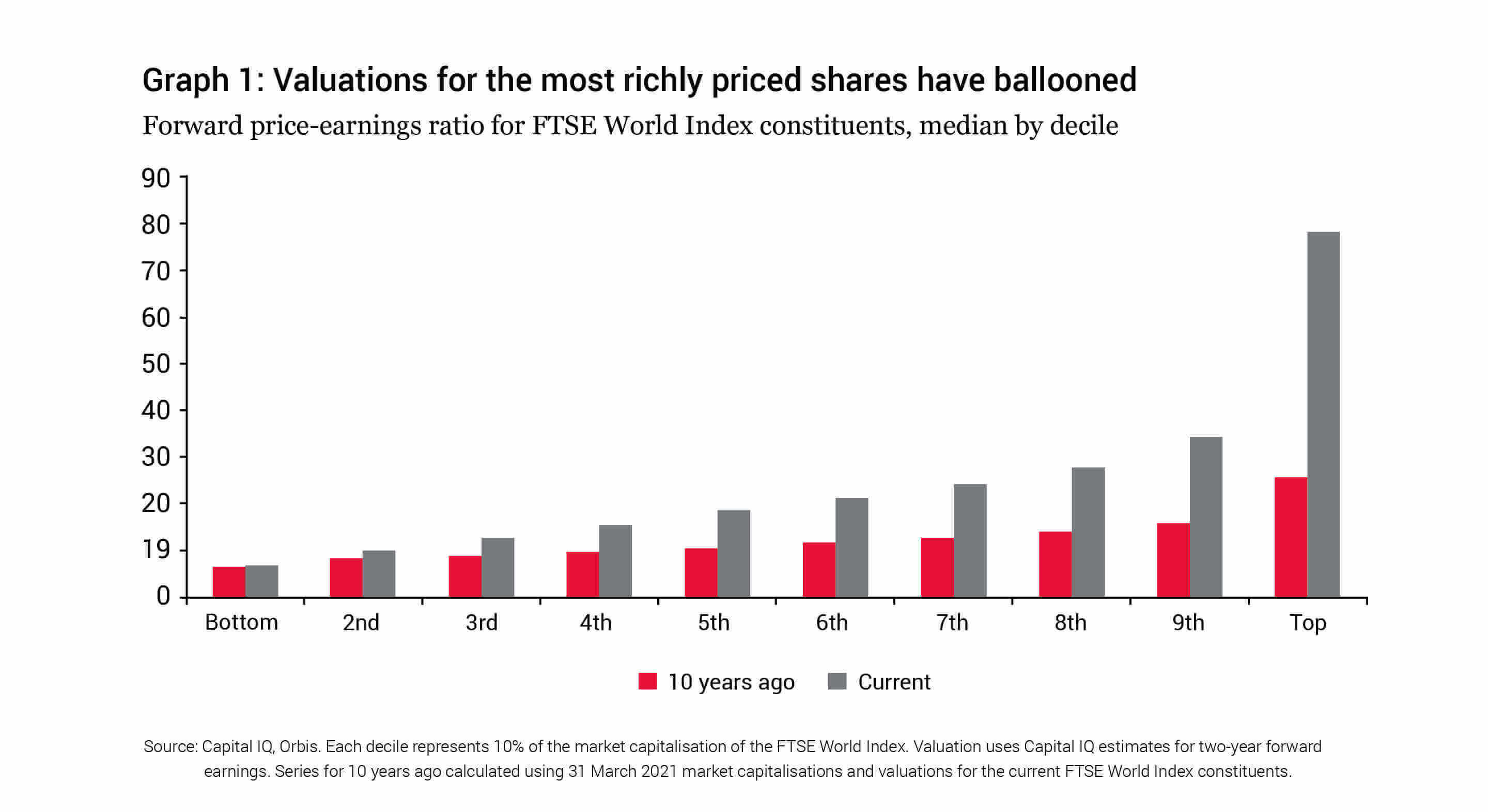

To emphasise these points, Graph 1 shows that a decade ago, the cheapest stocks were trading on about six times earnings and the most expensive stocks were trading on about 25 times earnings, as shown by the red bars. Today, the cheapest stocks are still trading on six times earnings, but the most expensive ones are trading on nearly 80 times earnings (see the grey bars). It is partly this multiple expansion which has driven the overall market higher.

The question is, are these shares trading on 80 times earnings all overvalued and destined to go down? Not necessarily. A lot of the shares in this bucket are high-quality companies that are growing very fast, and it is notoriously difficult to value a fast-growing company. We look at companies in this bucket, but it isn’t our natural hunting ground. In our view, the biggest risk investors face is overpaying and if the expected growth doesn’t materialise, you can lose a lot of money. However, some will undoubtedly work out and do very well for investors.

What do we do in this environment?

In this environment, we continue to do what we have always done: Buy shares for less than they are worth. We try to understand how companies make money, calculate their normal earnings power and free cash flow, and value them based on their ability to pay dividends in the future. We think there is still an edge available in the market by focusing on intrinsic value. We continue to follow the same investment philosophy, which we share with our offshore partner, Orbis, and which has proven to deliver results through different market cycles.

Finding value offshore

While the average global share is expensive, the dispersion is also very high relative to history. The Orbis portfolio looks very different from the benchmark: 68% of the Orbis Global Equity Fund is invested in sectors that make up 11% of the MSCI World Index. Orbis sees good potential for outperformance: Compared with the benchmark, their stocks are on lower price-to-earnings multiples and are growing faster.

Orbis is underweight the US and is finding more value in emerging markets than in developed markets, with stocks like NetEase, China’s second-largest gaming company after Tencent, which is trading on 20 times core earnings, but growing fast. Another example is Taiwan Semiconductor, the world’s largest semiconductor foundry. The reason there is a global chip shortage, is because it is hard to manufacture them. This is Taiwan Semiconductor’s moat, and it is very valuable for shareholders.

Meanwhile, in developed markets, Orbis is finding value in some companies that are perhaps a bit more cyclical than average, but where valuations look promising. One example is Mitsubishi, the Japanese conglomerate that does everything from mining to sushi and is trading on six times normal earnings. Another is BMW, which is trading at less than book value. People are currently only interested in electric car manufacturer Tesla. However, we doubt Tesla will have 80% market share in 2030. BMW has its own plans for electric cars. They should have a good year, as they haven’t been caught out by the global chip shortage like the other car manufacturers.

Finding value locally

Similar to the US, in South Africa a handful of shares have boosted the overall return of the FTSE/JSE All Share Index (ALSI). Over the last 10 years, for example, Naspers has delivered a return of 20% per year in dollars. Paper and packaging company Mondi has delivered 15%, Capitec Bank 17%, luxury goods company Richemont 7%. All have contributed to the overall returns.

But there is the other side of the coin: Investors in PPC, which used to be seen as a very high-quality cement company, have lost nearly all their money. Energy and chemical company Sasol, clothing retailer Truworths, telecommunications company MTN, and property investment company Hyprop have all halved in dollars over the last decade. Shares like investment holding company Remgro, retailer Shoprite, and Growthpoint Properties were all seen as blue-chip shares 10 years ago and have underperformed massively. This shows why it is so hard to identify so-called “high-quality companies”. And overpaying, even for a high-quality company, leads to poor returns.

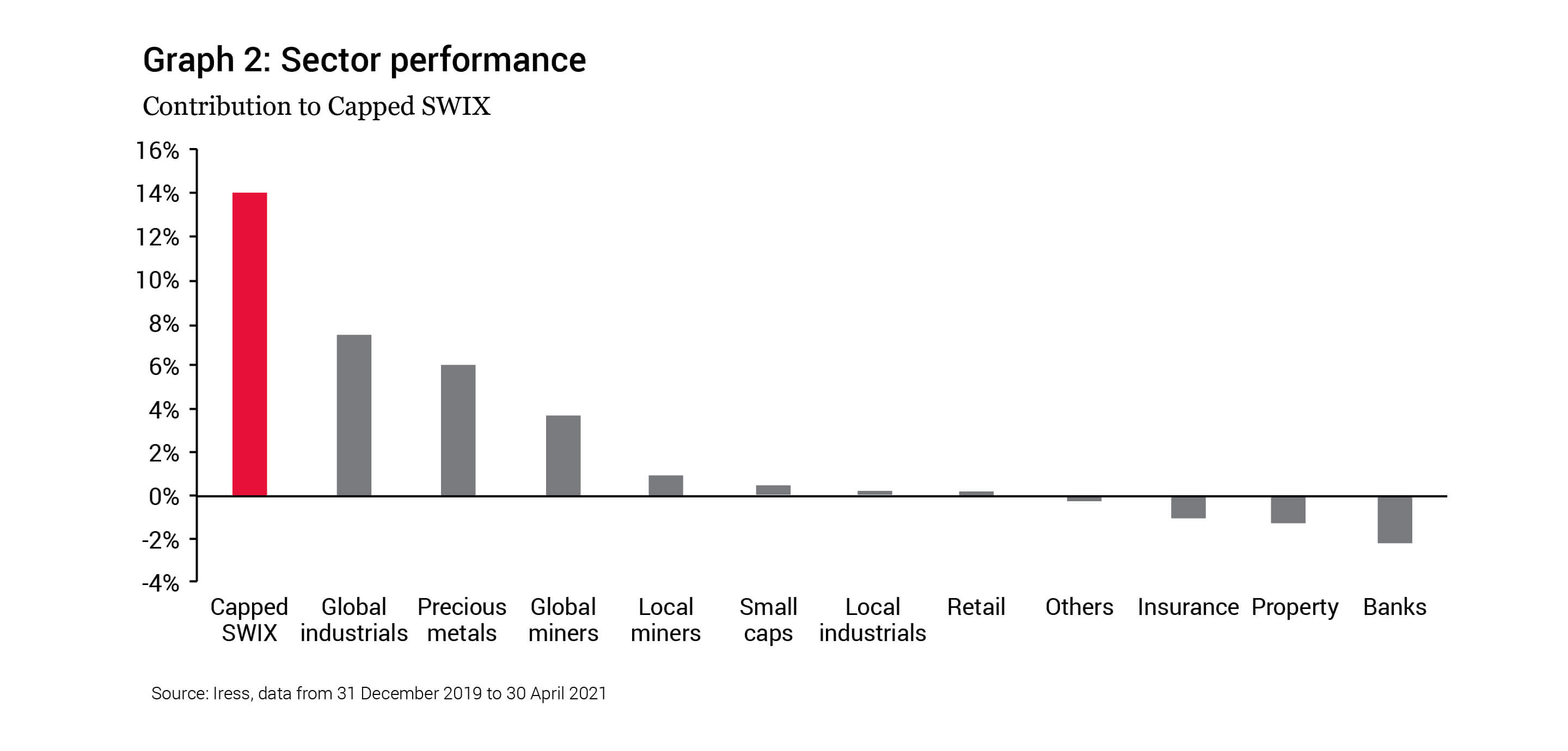

It can be difficult to get a true sense of overall market performance because the ALSI is dominated by Naspers and Prosus. The Capped Shareholder Weighted All Share Index (Capped SWIX) caps weightings to reduce concentration risk and is more representative of what South African managers own, and therefore provides a more balanced view. Graph 2 shows the overall return since the beginning of 2020 and gives you a good idea of how various sectors have come through the COVID-19 crisis. It also shows what you needed to get right over the past 16 months. The sectors in the middle either haven’t moved a lot or are too small to have an impact on overall returns. The sectors on the edges are important and contribute to or detract from returns: If you had a big overweight position in banks, it would have hurt your performance over this period. And if you were underweight global industrials or precious metals, these too would have detracted.

Performance review

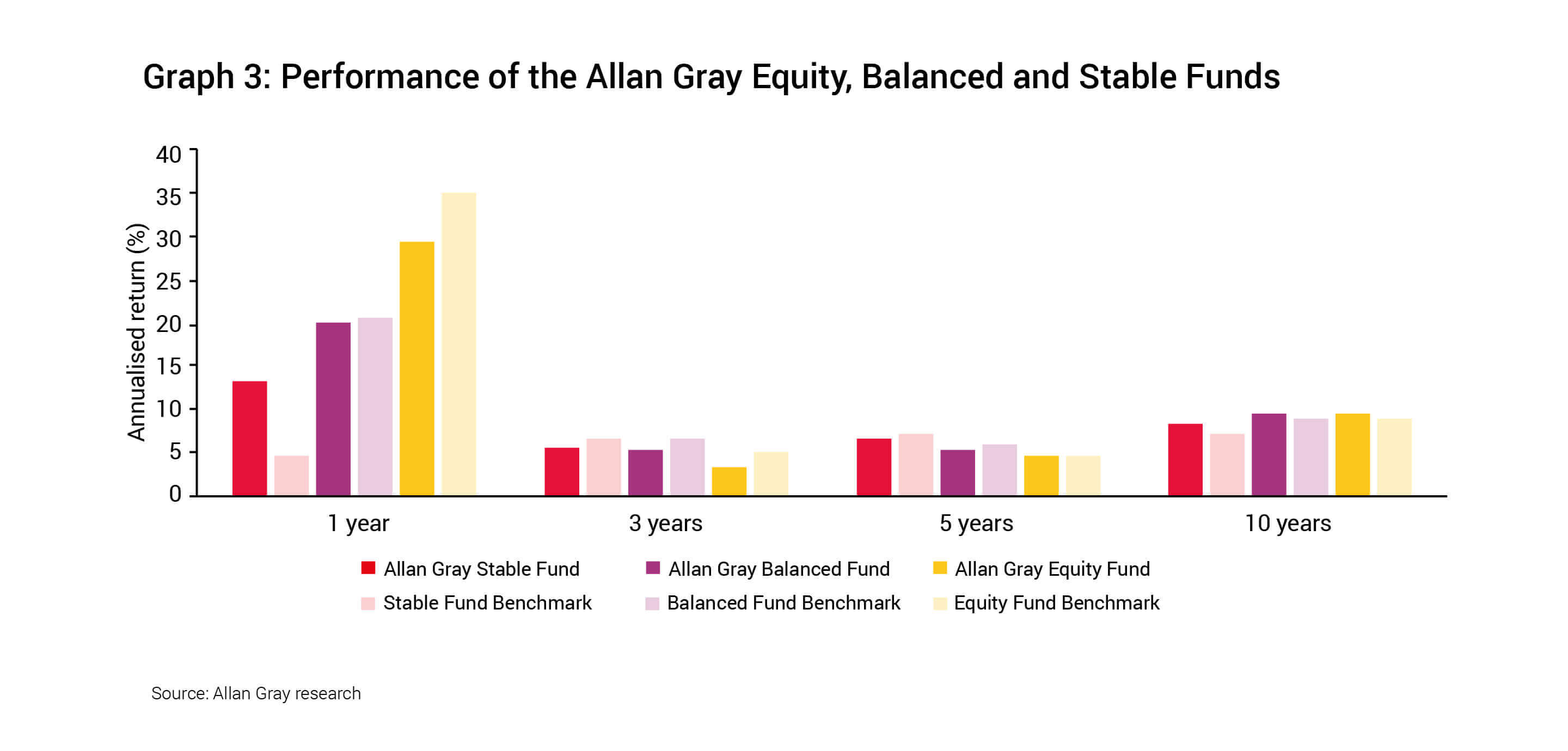

Our flagship funds have all delivered excellent absolute returns over the past year but, other than Stable, have underperformed relative to their benchmarks. The single biggest reason for the relative underperformance, is our position in British American Tobacco (BTI). BTI is a cheap share whose price has fallen, but we are still confident in the value of the business. Our intrinsic value for BTI has not gone down, presenting a buying opportunity.

Over three years, performance has been disappointing, as shown in Graph 3. Key reasons for this include:

- Orbis’ shares have underperformed

- Our foreign equity exposure was too low

- We were underweight iron ore

- A number of SA Inc shares in the portfolio have done very poorly, including Remgro, Old Mutual, KAP, and Life Healthcare

We think that most of these decisions will be proven right over the long term, but of course there is no guarantee.

The above decisions detracted from performance. Contributors to performance over the past three years include avoiding telecommunications company MTN, retailer Shoprite, and most of the property sector. Meanwhile, owning Royal Bafokeng Platinum, and the Zambezi Platinum preference shares issued by Northam Platinum, have also been good decisions.

Graph 4 shows the top 10 local and foreign equity holdings in the Equity, Balanced and Stable funds. We think these shares are all trading at attractive prices and that you should get good returns from them going forward.

The key message: Even though the overall market has given you a reasonable return in dollars, this still represents an average which often overshadows underlying opportunities. There are in fact many shares which have delivered a poor return and may appear unattractive. In our view, this is where one can look for value. The price you pay matters.

To watch a recording of the Q&A panel from the Allan Gray and Orbis investment updates event, click here.