In September 2015, the 193 member states of the United Nations unanimously adopted the 17 Sustainable Development Goals and the UN’s 169 targets to achieve real-world outcomes for some of the world’s most urgent problems by 2030. Vuyo Nogantshi delves into these goals and explains why they matter to investors.

The 2030 Agenda for Sustainable Development provides a blueprint for participating nations to work towards creating global peace and prosperity for the planet and its people. At the heart of this blueprint are the Sustainable Development Goals (SDGs), shown below, which can be clustered in three broad themes: economic, social and environmental. The SDGs call for the cooperation of a diverse set of stakeholders to address a number of pertinent issues, including climate action, affordable and clean energy, gender equality and responsible consumption and production.

The 17 SDGs

Source: United Nations Principles for Responsible Investment

Benefits of SDGs as an investment framework

Most asset management firms have a wide range of clients who hold varied views of which investment decisions and financial products are sustainable. The SDGs represent a common language and global consensus of the most important issues for society and can serve as a unification point for sustainable investing strategies. As simple exclusion strategies are increasingly viewed as lacking effectiveness for driving intentional positive change, the SDG investment framework can be a way to help shift capital away from unaligned companies. Many common exclusions, such as tobacco or weapons, naturally conflict with goals such as #3 (Good health and well-being) and #16 (Peace and justice and strong institutions) so become unlikely investment options.

On the flip side, the SDG framework helps identify sustainable industries and companies encouraging a shift of capital towards SDG-aligned businesses and contributing to positive change.

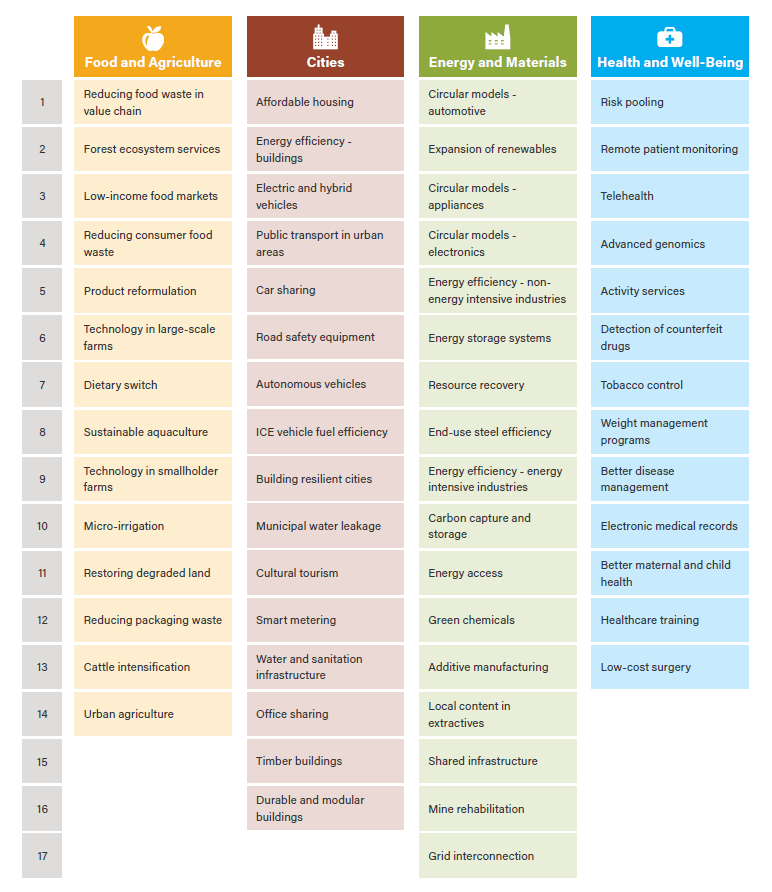

The four largest dimensions – ‘food and agriculture’, ‘cities’, ‘energy and materials’ and ‘health and well-being’ – represent the 60 biggest long-term market opportunities (see graphic below) related to the goals that increase positive impact as detailed in the Better Business, Better World report. Examples of companies in these categories that are already converting the opportunity and providing strong investor returns, while having SDG impact, include Beyond Meat, which addresses SDG goals #12 (Responsible consumption and production) and #15 (Life on land), and Tesla, which addresses #7 (Affordable and clean energy).

60 biggest market opportunities related to delivering the SDGs

Source: Better Business, Better World, Business & Sustainable Development Commission, January 2017

An SDG-aligned strategy can lower the risks of holding investments that end up on the wrong side of regulation, as governments worldwide are focusing on creating policies to help meet their SDG commitments. The UN Secretary-General has already made a call on global policymakers to price externalities into the economic and financial system. Explicit charges for the right to emit greenhouse gases or banning the use of particular materials that might be critical inputs for a company’s product could have a significant impact on corporate profits. At present, nine countries, including Japan and the UK, have legally binding net-zero emissions targets by 2050.

Although it is unclear how such laws will be enforced if not reached by 2050, there are already positive environmental impacts, such as the UK Court of Appeal’s decision that ruled Heathrow’s third runway expansion unlawful because it did not take climate commitments into account.

Engagement effectiveness with investee companies may also be improved as more asset owners and managers align with the SDGs and use the common language and goals to push concertedly for positive changes that support sustainable development. The SDGs help move engagement beyond traditional risk management and compliance issues (e.g., improving corporate governance), towards working with companies to create greater long-term value through SDG-aligned practices.

Getting started with SDG-aligned investing

Despite growing support of SDGs, there are some practical barriers as one cannot simply invest in the SDGs as they are neither an investment classification system nor a taxonomy. To begin, many institutional investors are exploring methods to map their existing portfolio holdings to SDGs in order to measure their net external impact. At a high level, doing this involves netting out the positive and negative impacts of companies per SDG and aggregating them.

Similar to the issue of greenwashing for environmental, social and governance (ESG) integration, the term “rainbow washing” is used to describe those with exaggerated claims of impact and support of SDGs. Asset owners need to assess the SDG claims of asset managers. Asset managers are tasked with identifying SDG-aligned companies to create strategies with high impact.

Once institutional investors build greater comfort with methodologies for mapping portfolio SDG impact and identifying SDG-aligned companies, it opens up the path to wider application of SDGs to investment decision-making. Globally, public pensions seem to be among the leaders who have expanded their analysis of a company’s ESG issues to include analysis of outcomes to society and the environment at a systemic level. Some already have substantial portions of their assets in SDG-related investments with stated targets for the future.

While we remain mindful of trends and their potential impact on asset prices, as well as the need to make a positive impact on the world, we remain bottom-up, as opposed to thematic, stock pickers. As bottom-up investors, we believe that forming a holistic assessment of a company remains a key component of the investing process, as many companies that may be considered SDG-friendly in some respects may fall short in others. Similarly, many companies viewed in a poor light through an SDG lens may be making a significant positive impact on society in other areas. In addition, when performing these assessments, our view is that investors need to remain mindful of valuation.

Growth drivers for SDG-aligned investing

Ultimately, the evolving preferences of end investors and members of pension plans, endowments or personal retail investments are driving the shift beyond traditional two-dimensional risk and return investing towards the third dimension of real-world impact. The SDGs are arguably the world’s most credible articulation of where investments to achieve this real-world impact should be directed.

Environmental changes and the resulting catastrophic events, such as the California and Australian wildfires, seem to raise interest in SDG-aligned and responsible investing and increase global support for climate action. Demand for measurement and reporting of real-world impact, alongside traditional financial metrics, is expected to continue to increase. These factors, among others, set the stage for a combination of impact investing and SDG-driven investments potentially being among big growth areas going forward. The United Nations Principles for Responsible Investment (PRI) is encouraging SDG-focused action among its members, so it would be surprising not to see these investments growing more prominent in the global investment community.

PRI areas of focus with regard to SDGs:

- Define and further develop the investment case for the SDGs

- Find synergies between the SDGs and investment objectives

- Develop innovative financial instruments to finance SDG-related objectives

- Measure impact and report on the SDGs

- Engage companies on improving transparency and practices related to the SDGs

- Encourage policymakers to create an enabling environment for investor action

- Work toward a more resilient financial system that better contributes to sustainable economic development.

SDGs and fiduciary duty

Finally, with regard to where SDG-aligned investing sits with fiduciary duty, the Fiduciary duty in the 21st century study by the PRI and UN made the case that sustainability is an important factor in the long-term success of a business. This effectively makes the consideration of sustainability important to upholding fiduciary duty. That said, the report also highlights a lack of clarity within prevailing definitions of fiduciary duty and responsible investing, especially in the US, and recommends policymakers and regulators clarify that paying attention to long-term factors, including ESG, in investment decision-making is part of fiduciary duty.

Similarly, the Global Impact Investing Network calls for regulators to clarify fiduciary duty specifically regarding social and environmental considerations. It also calls for tax incentives for impact investments and a regulatory environment that incentivises impact product development and impact measurement and reporting. The EU has already started doing the latter by way of the EU Taxonomy, setting specific technical thresholds around green activities that contribute to measurement and reporting. The EU is also requiring advisers to ask about sustainability preferences in the client fact-find that should help create an environment where there is growing demand for sustainability-oriented products. Similar policies should continue to develop across major investment markets as regulators, led by governments and their national SDG strategies, push to try to accelerate sustainable investment.