The rise of environmental, social and governance (ESG) considerations in asset management has resulted in a proliferation of new product offerings, initiatives, and rating systems. Given the pace and volume of change, it can be difficult for investors to separate the fundamentals from the fads. Raine Adams unpacks some of the complexities below.

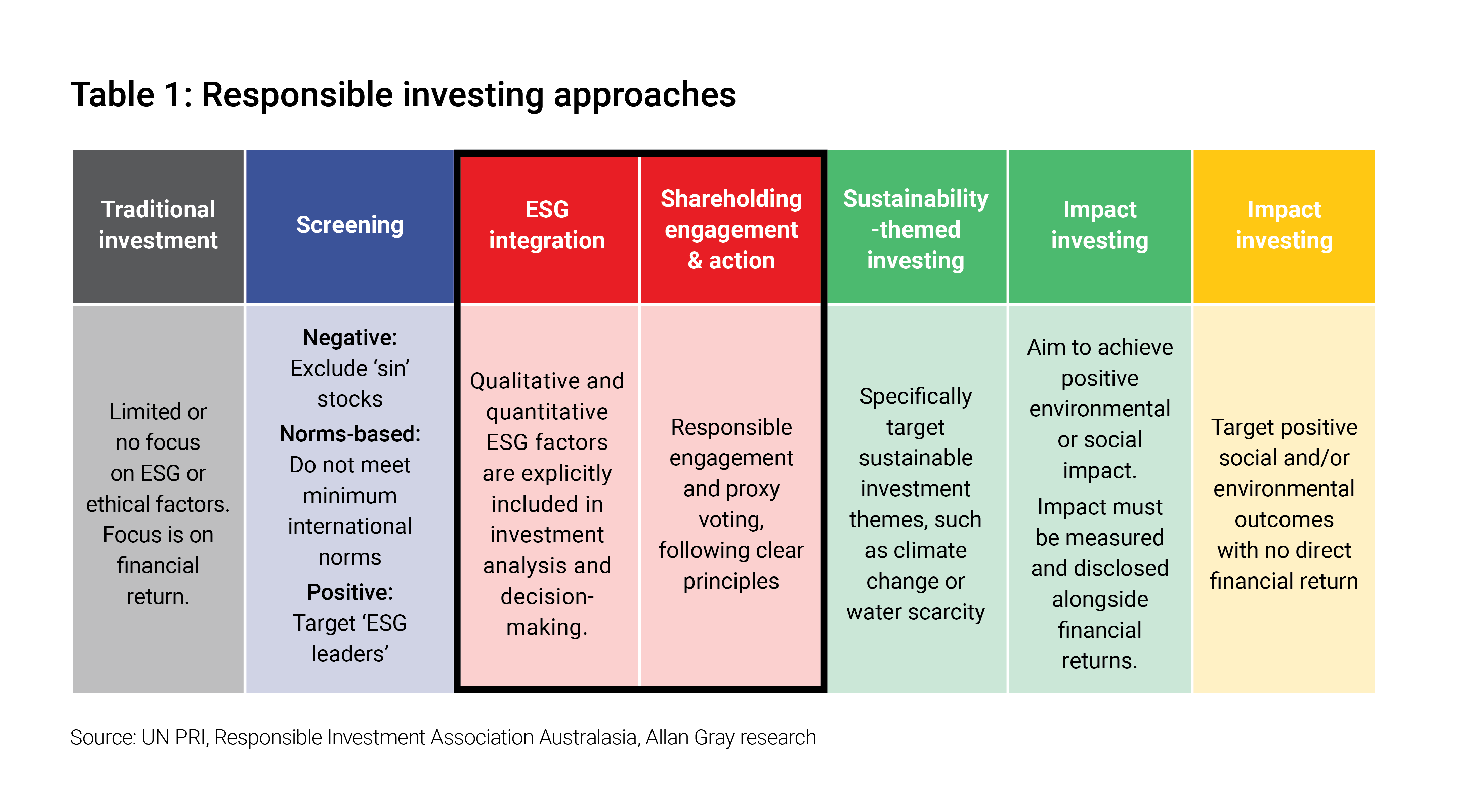

There are multiple responsible investing strategies that may be used by asset managers - these span the spectrum between traditional investing and philanthropy.

What is responsible investing and what does it mean to us at Allan Gray?

ESG-focused investment products have grown significantly over the past few years. At Allan Gray, we do not offer negative screening or focused “ethical” responsible investment funds, which screen out certain sectors and stocks that are deemed unethical, such as tobacco, alcohol, gambling and fossil fuels. There are several reasons for this.

Firstly, given that we represent a broad range of clients, choosing a one-size-fits-all ethical fund is tricky. Globally, there has been a substantial focus on environmental considerations, particularly climate change, but when evaluating companies’ ESG impacts holistically, the assessment of ethics can become much more subjective than one may initially assume. For example, what about a mining company that has a harmful environmental impact but is mining metals necessary for the energy transition and providing substantial employment? Tobacco is often excluded because of its addictive nature and accompanying severe health impacts, but what about technology stocks such as social media and gaming platforms? Addiction to these platforms has become commonplace and has a detrimental impact on affected users’ physical and mental health and productivity. What about companies operating in countries with questionable political regimes? Where do we draw the line on all of the above?

Secondly, given that the JSE accounts for less than 1% of the global investment universe, we worry about limiting the local opportunity set.

Thirdly, we believe in taking a balanced approach, recognising that, unfortunately, there are often trade-offs that need to be made between environmental, social and governance considerations. Tackling climate change is a critical global priority, but in a developing country such as South Africa, the need to address social issues, like socioeconomic inequality and transformation, cannot be ignored. We seek to evaluate these factors as holistically as possible, and the answers are not always so clear-cut as to simply disinvest. These issues are also all dynamic, meaning that moving parts need to be continuously monitored post-investment.

Finally, we do not believe that divestment is always the solution to the problem. In the case of fossil fuel assets, for example, it simply shifts the shares from one hand to another (to shareholders who may be focused only on returns as opposed to sustainability), leaving the climate no better off.

For these reasons, we favour the responsible investment strategies of ESG integration and engagement across all our clients’ funds. We spend a significant amount of time qualitatively assessing a company’s ESG risks and opportunities, trying to distill which of these factors are most material. When material, we quantify these in the company valuation, either explicitly (for example, forecasting the impact of a future proposed carbon tax) or by discounting the company’s valuation where the costs are uncertain, but we can conclude that the company faces greater risk in the future than it did in the past. Similarly, we consider companies that may benefit from ESG tailwinds, such as certain commodity producers that are likely to be favoured by the markets as the global energy transition shifts metals demand. When it comes to engagements, we believe in quality, not quantity, ensuring that our ESG engagements are underpinned by detailed, high-quality research.

What are we thinking about when it comes to ESG?

Society is undeniably changing. People are becoming more conscious of their environmental impact, as well as the environmental and social impact of the products and services they use. As investors on behalf of our clients, we must be responsive to these changes; for example, we should consider factors like company transparency and traceability in supply chains.

While the above is positive, we have some concerns around potential unintended consequences when it comes to the ESG movement currently taking the investment industry by storm. For example, initiatives encouraging fossil fuel divestment have resulted in some companies unbundling their ‘dirty’ assets or selling them to relieve themselves of this ESG pressure, often to a private company that is subject to far fewer disclosure requirements than its listed counterpart. In these cases, production is of course not halted; in fact, in some cases it has been substantially increased post-sale, as the acquiror seeks to maximise their profit. Similarly, in the United States, the number of oil rigs operated by private operators surpassed those of listed companies for the first time in 2021. While listed companies have been subject to huge ESG pressure not to invest in further supply, the reality is that, while demand persists, there will always be someone willing to fill the gap. We therefore think that it is more constructive to engage with listed companies on responsibly managing their fossil fuel assets. Glencore, for instance, has committed to keeping its coal assets but winding them down responsibly over time, while using their substantial cash generation in the interim to invest in its future facing commodity basket, including copper, cobalt, nickel and zinc. We are comfortable with this approach.

ESG initiatives, including investor climate initiatives and engagements, are often carried out in pockets, applying pressure on companies and sectors unevenly. Again, instead of achieving solutions, this uneven pressure may have the unintended consequence of simply creating distortions. The focus on listed oil majors such as BP, Shell, Total and Exxon is a good case in point: These companies face a huge amount of ESG scrutiny, activism and litigation, but are only responsible for 13% of global oil production. On the other hand, national oil companies (NOCs) produce over half of the world’s oil supply. Not only are NOCs subject to less environmental scrutiny and litigation, but they are also controlled by governments whose political and social regimes often raise real red flags. The Russia-Ukraine conflict has demonstrated that these red flags can quickly escalate into crises that have ramifications for the whole world and should thus not be ignored. It is therefore important to balance the energy transition, which we support, with energy security and the management of growing geopolitical risks.

We have also spent a lot of time looking into ESG rating and data providers. Research from multiple institutions shows a low correlation between the ESG scores that these providers assign to companies, demonstrating the complexity and nuanced nature of ESG evaluations. While this is not a problem in itself – asset managers also have differing views on the investment case for companies – the issue is when clients view one provider’s ESG scores as a perfect proxy for ESG performance, when it is simply one organisation’s assessment of such. We believe it is impossible to convey all the complexities of ESG in one final score. There are benefits to using external ESG data and rating providers for ESG data collation; however, we continue to favour an in-house approach when it comes to integrating ESG into our investment research and decision-making.

How are we advancing ESG at Allan Gray?

We strive for a carefully considered, balanced and meaningful approach to ESG.

Some of our recent and ongoing process improvements include:

- Increasing the number of analysts on our ESG team, which is housed within the investment team.

- Introducing quarterly ESG reports: These address key thematic issues, such as benchmarking the incorporation of ESG factors into executive remuneration across sectors.

- Rolling out ESG ‘deep dive’ assessments for our clients’ top 20 holdings. These provide granular assessments across multiple E, S and G sub-categories, relevant to both the company’s sector and individual complexities.

- Developing remuneration assessment frameworks to enhance our evaluation of company’s remuneration policies and implementation thereof.

- Increased communication with our sister companies, Orbis and Allan Gray Australia, on ESG matters. This includes two quarterly meetings on ESG in the investment case and ESG in regulation and reporting, respectively, as well as climate-focused quarterly meetings.

- Increased reporting to our Board of Directors. We now produce four reports per annum for our Board sub-committees. This provides valuable independent input and oversight to our team.

Our objective is that, even where clients may disagree with our conclusions, as is expected when tackling such complex topics, they are able to find some reassurance in the breadth and depth of our ESG research and assessments.