On various metrics, the valuations of South African banks have not recovered to pre-COVID-19 levels, suggesting there is value to be found. Of the Big 4, our clients currently own Standard Bank, FirstRand and Nedbank. Ghiete van Zyl discusses why Standard Bank is currently our favourite.

When we wrote about the banking sector in June 2020, in the depths of COVID-19, the combined market capitalisation for South Africa’s Big 4 banks, namely Standard Bank, FirstRand, Nedbank and ABSA, had roughly halved, as investors feared a prolonged recovery with years of lost earnings or, even worse, a permanent decline in the sector’s earnings power. Instead, earnings rebounded swiftly post 2020, supported by healthy loan growth, unexpectedly low credit losses, and higher interest margins resulting from steep interest rate hikes both locally and internationally. The Big 4’s aggregate trailing 12-month earnings are now 22% above pre-pandemic levels.

While we expect earnings growth to moderate following the post-COVID-19 recovery, we still see long-term value in the sector, with Standard Bank currently appearing among the top five holdings in the Allan Gray Equity Fund.

Understanding the investment case for Standard Bank

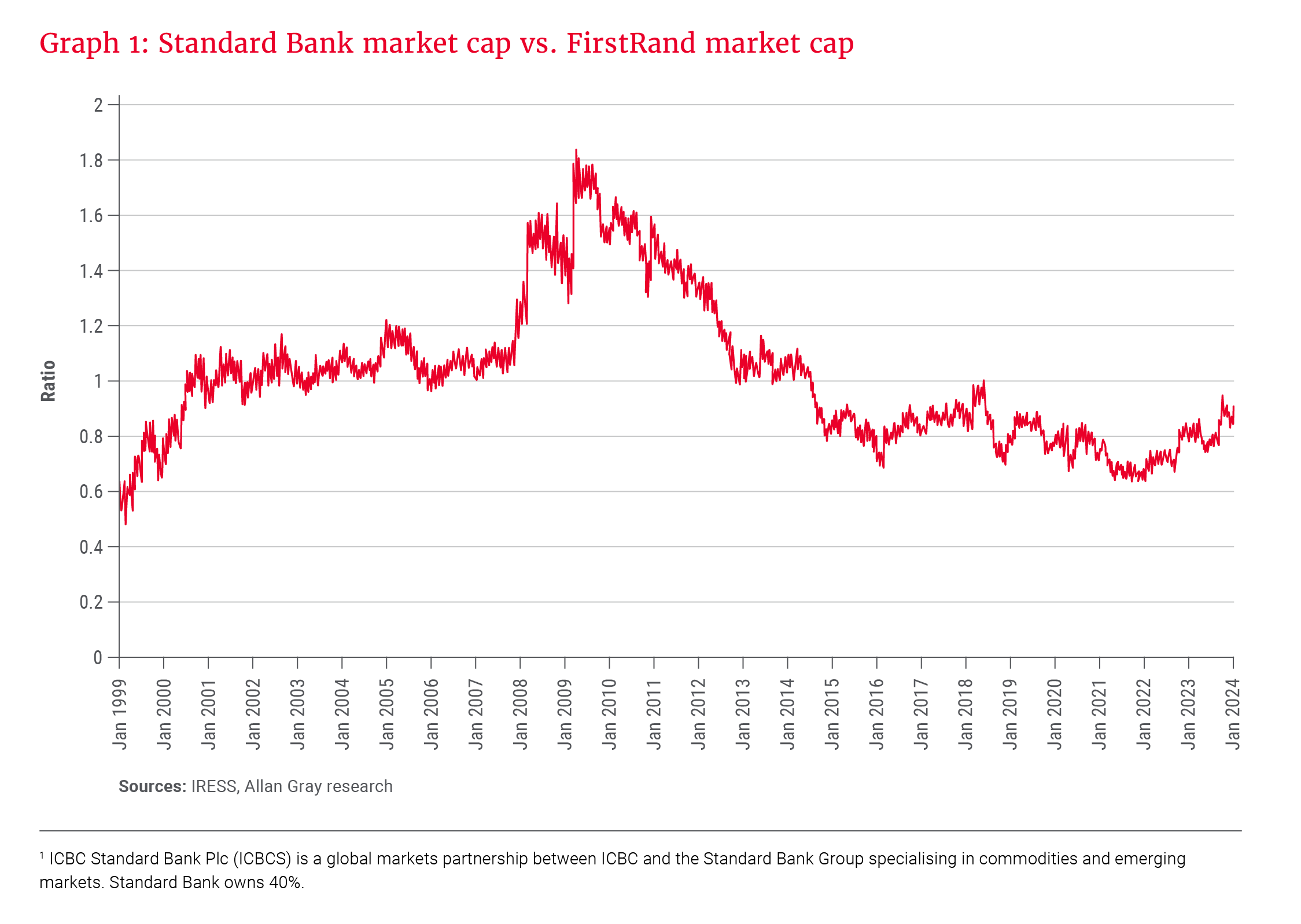

To understand our conviction in Standard Bank’s future, it is worth first looking at FirstRand’s past. Graph 1 shows Standard Bank’s market cap relative to that of FirstRand. Assuming shares in issue remain constant, an increase in the ratio indicates that Standard Bank’s share price has strengthened and/or FirstRand’s share price has weakened. Conversely, a downward slope in the ratio indicates a weakening of Standard Bank’s share price and/or a strengthening of FirstRand’s share price.

As shown in the graph, leading into the global financial crisis (GFC), FirstRand’s market cap was similar to that of Standard Bank, despite Standard Bank’s book value being 1.6 times that of FirstRand at the time. That is, FirstRand was trading at a premium to Standard Bank – the result of FirstRand’s history of superior returns compared to its peer.

FirstRand’s superior returns were, in part, achieved by risking a meaningful portion of the bank’s capital in proprietary trading and investment activities. These activities generated higher returns compared to client-centric activities, but at a higher risk. Following the onset of the GFC, these risks started to crystallise, and FirstRand suffered numerous large one-off losses, largely concentrated in its equity trading division and offshore debt and investment portfolios. These losses detracted almost 17% from the FirstRand Group’s aggregate headline earnings for the 2008 and 2009 financial years.

… we believe Standard Bank’s Africa operations will be a key differentiator over the long term …

Understandably, investor sentiment soured. FirstRand’s market cap fell more than 50%, which, coupled with better-than-expected performance of Standard Bank’s loan book, resulted in Standard Bank’s market cap increasing to 1.8 times that of FirstRand at the peak. Importantly, these failings provided the push FirstRand needed to re-evaluate its strategy and enact the necessary changes.

Has Standard Bank felt that same push?

We believe so. The pre-pandemic years saw Standard Bank struggle with an expensive and protracted overhaul of its core banking systems, a decline in its South African retail client base, and intense pressure on retail banking fees owing to Capitec disrupting the market. At the same time, Standard Bank bore its share of large losses suffered in ICBCS and, as the majority shareholder of Liberty, saw the Standard Bank Group’s returns dragged down by a marked deterioration in Liberty’s profitability.

Standard Bank has responded by leveraging its now-modernised banking systems to improve its offering to clients. This contributed to the more than 20% growth in its South African active client base over the past three years. In addition, Standard Bank has rationalised its costly branch and ATM networks by expanding its online banking capabilities and rolling out in-store kiosks, which can be run at a significantly lower cost, while still providing a touchpoint for clients.

Standard Bank addressed the deterioration of Liberty’s profitability by buying out minority shareholders in 2022. This allowed for the integration of the insurer into the Group, which bore significant capital optimisation benefits and should allow for more efficient scaling of the business, while also allowing it to offer customers a more valuable integrated service.

The biggest bank in Africa

In addition to addressing these challenges, Standard Bank continued to invest where it is strongest – in Africa. By the end of 2023, it had expanded its footprint to 540 branches spanning 19 sub-Saharan countries, excluding South Africa (ex-SA). In the majority of these countries, its local presence and pan-African capabilities have made Standard Bank the partner of choice for regional corporates and global multinationals alike, as evidenced by its spot among the top three banks (by deposit market share) in 10 out of the 19 Africa ex-SA markets in which it operates.

Its continued investment in Africa, coupled with the faster economic growth seen in many of these nations compared to South Africa, contributed to earnings from Standard Bank’s Africa operations growing at a compound annual rate of 19% over the past decade. Consequently, the Africa franchises’ contribution to the Group’s earnings grew from only 20% in 2013 to 44% in the first half of 2023.

Standard Bank’s pan-African presence has … helped it build the largest global markets business on the continent.

Importantly, banks often face greater risk in these faster-growing African economies – recently demonstrated by the devaluation of the Nigerian naira and three African sovereign defaults in as many years. This creates a valuable competitive moat for Standard Bank. While the diversity of Standard Bank’s portfolio allows it to absorb such shocks, the volatility of earnings in any one country would make it incredibly expensive for a competitor to try and replicate Standard Bank’s Africa footprint. Standard Bank’s established relationships and dominant market share in these countries would make it near impossible.

As such, we believe Standard Bank’s Africa operations will be a key differentiator over the long term despite the possibility of peaking interest margins, slower loan growth and currency devaluations presenting risks of a slowdown in Africa earnings growth over the short term.

Leading the pack in global markets

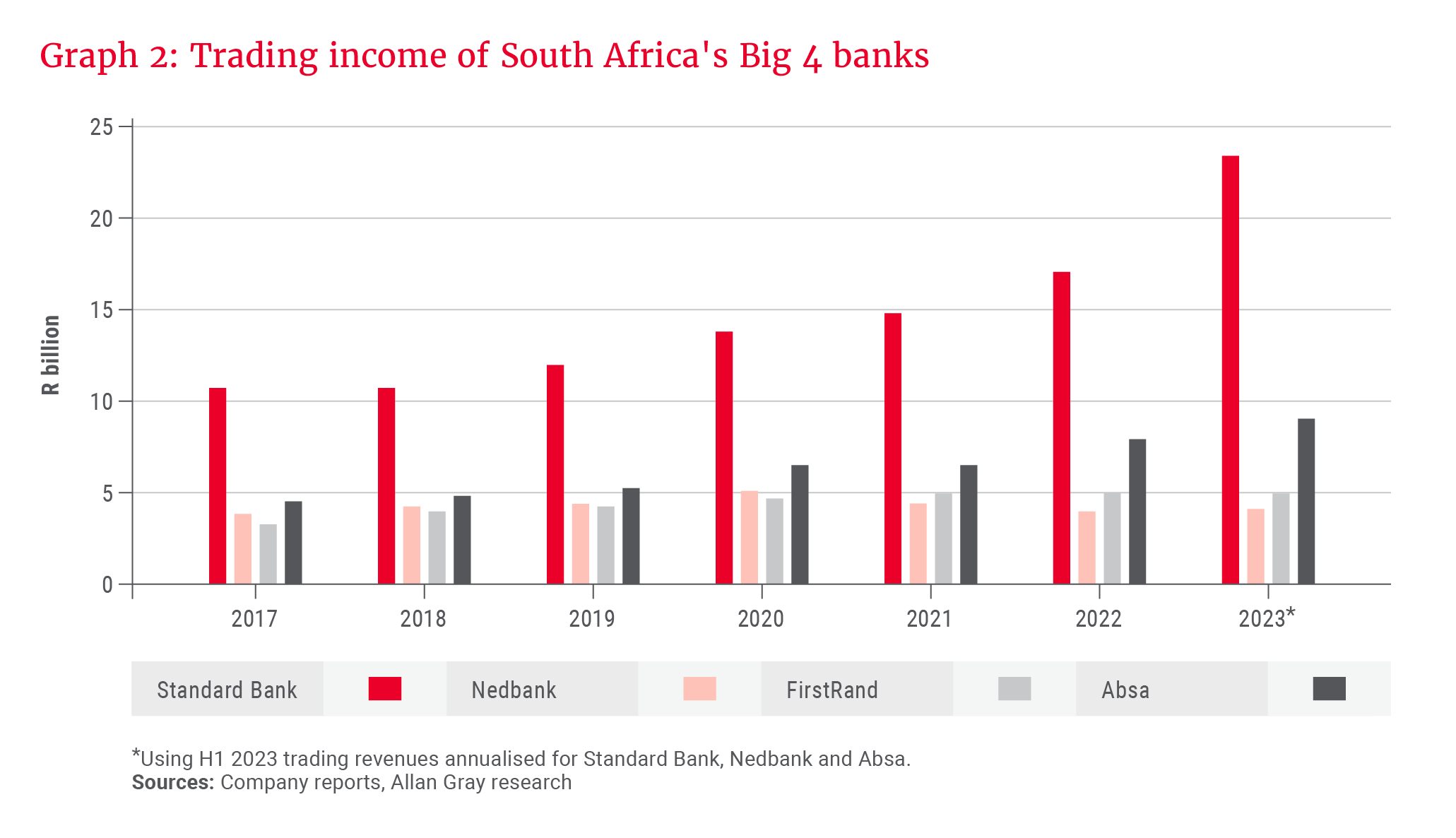

Standard Bank’s pan-African presence has also helped it build the largest global markets business on the continent. Since 2017, Standard Bank’s trading revenues have grown at a compound annual rate of 14% – double the average growth rate achieved by its peers – and as of June 2023, its trading revenues exceed those of Nedbank, FirstRand and Absa combined, as shown in Graph 2.

Despite this impressive growth, the market has been hesitant to place significant value on these revenues owing to fears surrounding their sustainability. These fears largely stem from 1) the risk arising from trading activities where the bank puts its own capital at risk, and 2) the fact that revenues generated on the back of clients’ trading activities tend to be strong in times of market volatility, but come down when volatility dissipates. While these fears are somewhat justified, they are arguably less so compared to those concerning Standard Bank’s peers.

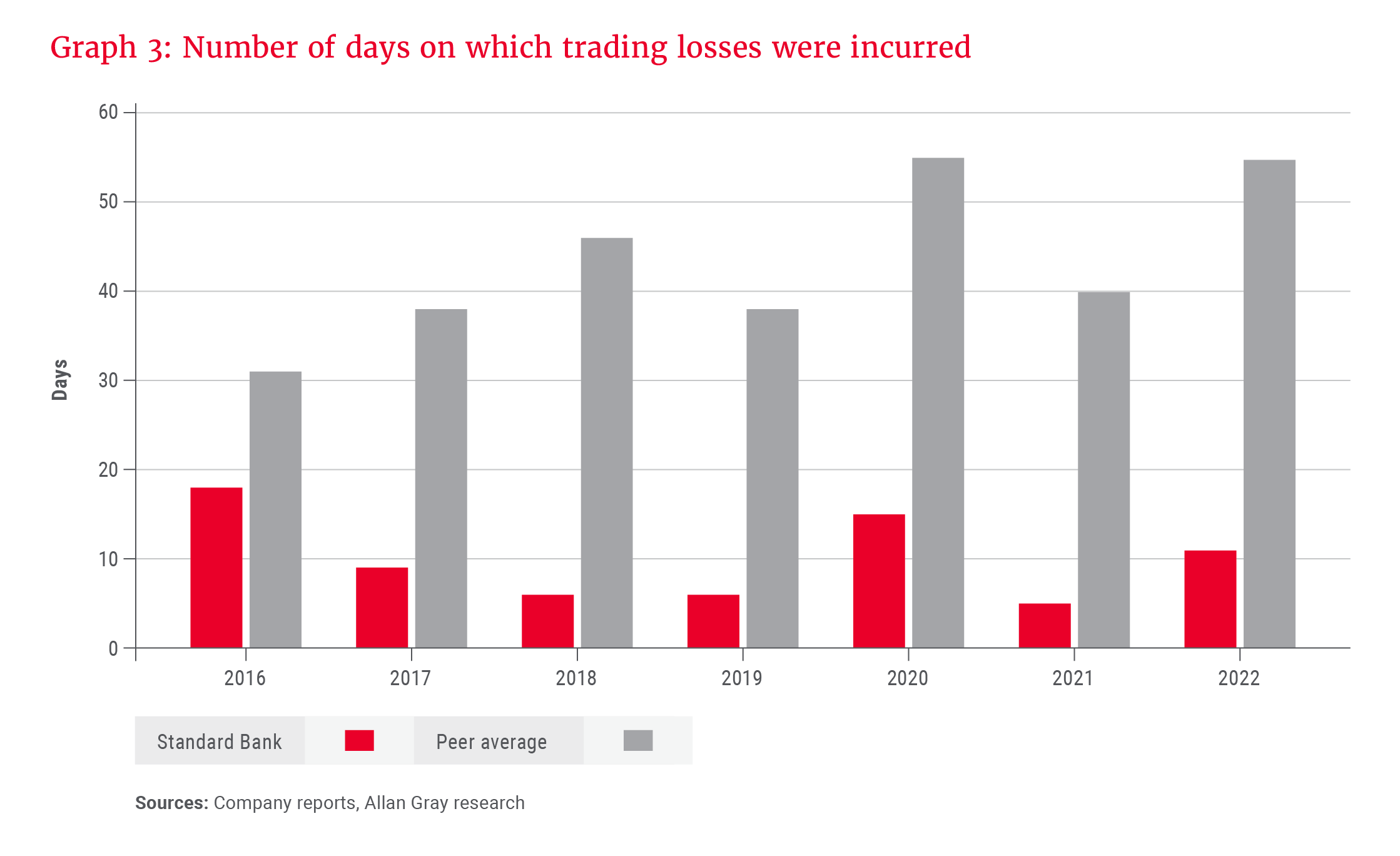

Graph 3 shows the number of days on which Standard Bank incurred trading losses compared to the average for its peers. Over the past five years, Standard Bank has experienced an average of 80% fewer loss days per year compared to the average for its peer group. This reflects the superior risk management in Standard Bank’s global markets business, enabled by the scale and diversity of its operations.

The franchises’ scale and diversity also support the longer-term sustainability of client-driven trading revenues by means of a virtuous cycle, since it enables Standard Bank to show better liquidity and pricing compared to its peers, thereby attracting more clients. Growing its market share further increases its scale and the competitive advantages that scale brings, which, in turn, supports additional market share gains.

… the combination of continued market share gains and superior risk management in Standard Bank’s global markets business should drive strong sustained growth over the long term.

This virtuous cycle is also supported by the fact that its peer-leading market share makes Standard Bank an employer of choice. The ability to attract top skills not only enables Standard Bank to offer clients a superior product, but also supports its superior risk management compared to its peers.

Despite the likelihood of a short-term decline in trading revenues if market volatility eases, the combination of continued market share gains and superior risk management in Standard Bank’s global markets business should drive strong sustained growth over the long term.

Standard Bank’s prospects

As value investors, we look for companies where market expectations mirror historic trends despite signs that the future may look different. We see these signs both in the progress Standard Bank has made in addressing the aforementioned challenges and the fact that the businesses in which it has superior growth prospects compared to its peers, including the Africa and global markets franchises, are making up an ever-larger part of the overall Group.

Standard Bank is trading on less than nine times our assessment of its normal earnings – well below its historic average. It is currently our top bank holding given the significant potential for outsized returns should our thesis prove correct.

Our clients are also invested in FirstRand and Nedbank.

Nedbank trades at a discount to both Standard Bank and FirstRand owing to its lower return on equity (ROE), concerns surrounding struggles in its retail franchise, above-average credit losses, and greater exposure to the impact of interest rate cuts compared to its peers. Trading on only 7.3 times trailing earnings and an 8.2% dividend yield, Nedbank’s current valuation more than compensates for these risks. Moreover, it ignores the likely upside to its current ROE from continued momentum in non-interest revenue growth and ongoing cost-efficiency gains in the retail franchise. Nedbank’s ROE should also benefit from a normalisation of credit losses should interest rates come down.

Conversely, FirstRand trades at a premium to the rest of the Big 4 owing to its peer-leading ROEs. The strength of its client franchises, coupled with its conservative management and accounting, gives us confidence that it should be able to sustain these ROEs even in a tough economic climate. The defensiveness of FirstRand’s earnings is also supported by its more limited exposure to the impact of interest rate cuts compared to its peers.

The only Big 4 bank not owned by our clients is Absa, where we see signs of an ongoing deterioration in its retail franchise. With limited self-help opportunities, we expect this trend to continue. The combination of a deteriorating retail franchise and higher credit losses stemming from Absa’s above-average risk appetite will weigh on Absa’s ability to generate investor returns.