Small- and mid-cap companies make up 16% of the FTSE/JSE All Share Index, but 25-30% of our clients' South African equity holdings. Although many of these shares are currently too small to be included in our top 10 holdings, they can still contribute significantly to our clients' investment returns. We exert considerable research effort on small- and mid-cap opportunities. Ian Liddle and analysts from his team provide an overview of some of our funds' current small- and mid-cap holdings.

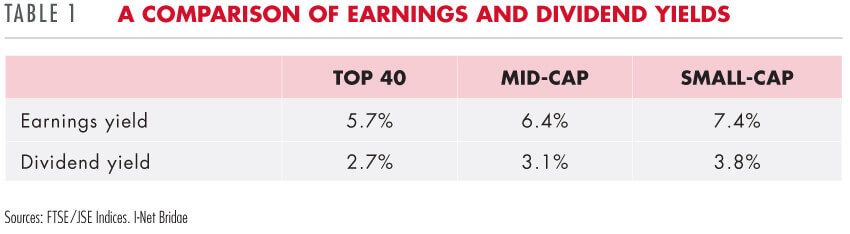

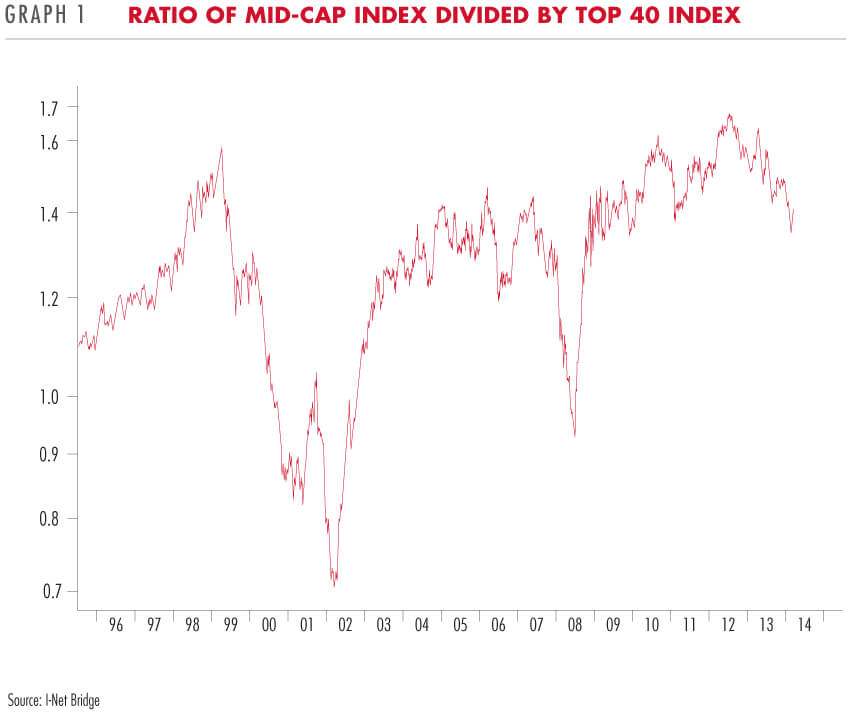

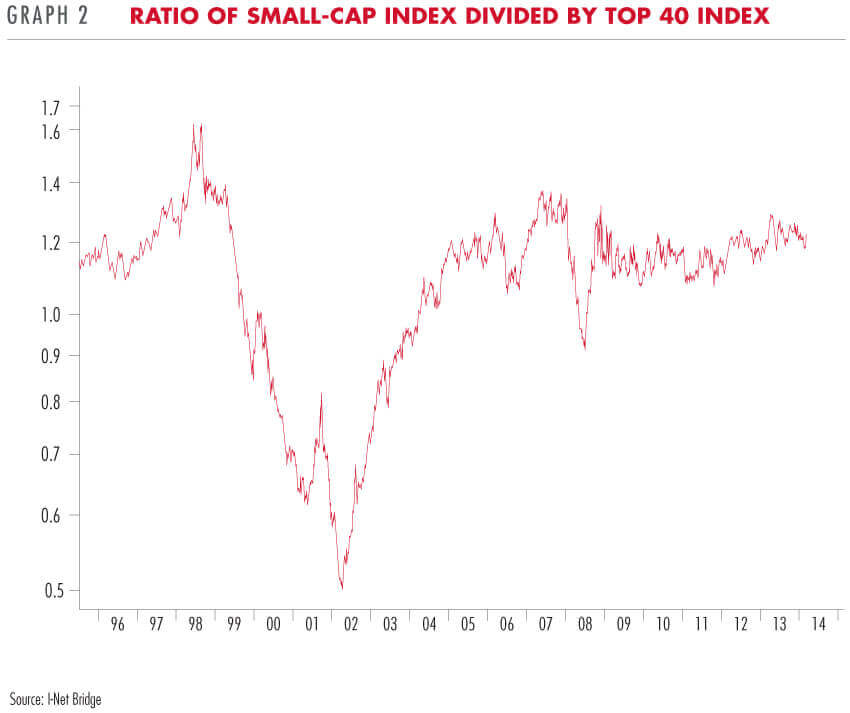

On a superficial inspection, South African small- and mid-cap shares currently offer marginally better value than the top 40 large capitalisation companies, as shown in Table 1. However, they certainly do not appear to be offering the same very attractive relative value that they were in 2001/2. After rebounding strongly from their lows in 2001/2, small- and mid-cap shares have performed broadly in line with the top 40 over the last nine years. See Graph 1 and Graph 2.

While these aggregate measures provide useful context, we do not use them to determine the current allocation of roughly 25-30% of our South African equity portfolios to small- and mid-cap stocks. Each small- or mid-cap share in our portfolios has been bought by an individually accountable portfolio manager after the share has passed through our research process.

While these shares may never make our top 10 holdings list by virtue of their small size, any one of them may have a significant impact on our equity alpha (performance relative to the benchmark) if it appreciates substantially. Of course, their collective impact could be even larger. We thus exert considerable research effort in searching for these 'diamonds in the rough'.

To give you a flavour of some of the opportunities we are currently identifying, each responsible analyst has written a brief synopsis of some of our current small-cap holdings.

Adcorp (Analyst: Birte Schneider)

Adcorp is South Africa's largest employment services group. The risk of a labour broking ban has been significantly reduced, although stricter regulation of casual labour hire practices is likely. The increasing administrative and regulatory burden and a global shift to master service providers favour large, sophisticated players with strong balance sheets, such as Adcorp. In addition to market share gains, economic and labour market uncertainty supports its South African business.

In recent years, Adcorp diversified its earnings stream through organic growth and acquisitions at reasonable valuations, particularly in the IT contracting sector. It now has operations in Africa, Australia and India. For the six months to August 2013, 21% of earnings before interest, tax, depreciation and amortisation (EBITDA) was generated outside South Africa, compared to 3% a year earlier. This segment is positioned for strong growth. Further upside potential is provided by its business process outsourcing and training operations, cost savings from outsourcing back office functions and taxation deductions for learnerships. The company is cash generative and trades at only 8.5x normalised earnings.

Blue Label Telecoms (Analyst: Victor Seanie)

With over 150 000 point of sale (POS) payment terminals, Blue Label Telecoms is South Africa's largest distributor of prepaid airtime and electricity. Its prepaid airtime distribution market share is approximately 40%, and the number of existing POS distribution points through which electricity is sold is expanding. It continues to add new prepaid products such as transport, sport and entertainment tickets and financial services to its distribution basket, with little additional capital investment.

Through its 45%-owned associate, Blue Label Mexico (68 000 POS terminals installed so far), Blue Label Telecoms is currently investing in POS terminals to replicate its South African prepaid product distribution model in Mexico. Similarly, the company is expanding its 130 000 POS terminal base in India and rolling out banking services to the unbanked.

SMALL- AND MID-CAP COMPANIES MAKE UP 16% OF THE FTSE/JSE ALL SHARE INDEX, BUT 25-30% OF OUR CLIENTS’ SOUTH AFRICAN EQUITY HOLDINGS

The group is led by an entrepreneurial management team with a significant shareholding in the business. The company is trading on a price to earnings (PE) multiple of 13 on earnings that include start-up losses in Mexico.

Clover (Analyst: Leonard Krüger)

Clover is truly a household name and chances are that one of its products is in your fridge at this very moment. Yet the company faced deep issues prior to 2010 as milk farming moved steadily to the coastal regions over the years, away from Clover's factories. This resulted in big cost pressures, as fuel prices increased and driving distances became ever greater.

Under project 'Blue Sky', the business has rectified these challenges and added capacity to deliver a wider range of products in future using its extensive distribution network. One such opportunity is yoghurt. Previously excluded from this product for historical reasons, Clover will re-enter the yoghurt market in 2015. Added to its portfolio, together with many other new innovative and chilled products, we believe Clover's margins and returns are still low for a business of this quality. At 13x historic earnings, in our opinion the long-term revenue and profit growth opportunity is not reflected in the share price.

Comair (Analyst: Leonard Krüger)

Airlines operate in a notoriously difficult industry as the number of domestic bankruptcies over the past decade would testify. Yet, despite fluctuating oil prices and a volatile rand exchange rate, Comair has built an enviable track record of unbroken profitability for over 60 years.

This has allowed the airline to continue investing in more fuel-efficient aeroplanes, to lead in local industry innovation (e.g. low-cost carrier kulula.com) and to implement enhanced information technology. With smarter and slicker systems, Comair today is better able to manage its inventory of unsold seats, increase revenue by selling more services like extra baggage or insurance, and potentially acting as a platform for other airlines to sell seats in South Africa (such as British Airways).

These investments place Comair at a substantial advantage over state-owned rival SAA and any would-be new entrant, by having lower operating costs and greater efficiency in management. The current PE multiple of 6x neither properly recognises the sustainability of this advantage, nor Comair's opportunity to make further improvements. It also ignores the potential for Comair to succeed in the various legal claims it has against SAA for uncompetitive practices.

KAP (Analyst: Ruan Stander)

At R3.75 for a KAP share, the market offers a top-quality industrial holding company on a 6.7% free cash flow yield, with free cash flow expected to grow strongly over the next 10 years. KAP's major holdings include Unitrans, PG Bison and Hosaf.

Supply chain and logistics solutions provider Unitrans has a great track record of growing profitably by offering reliable service in areas where it is critical. Who would want to save 1% on moving petroleum when everyone knows Unitrans does it safely?

PG Bison, South Africa's leading timber company, is fresh out of a successful restructuring that focuses the group on the most profitable areas in the timber value chain. The savings from these actions have been re-invested into new technology, the benefits of which will be seen for the first time in the next results.

WE EXERT CONSIDERABLE RESEARCH EFFORT IN SEARCHING FOR THESE ‘DIAMONDS IN THE ROUGH'

Hosaf is the country's only manufacturer of PET, the key ingredient used in plastic bottles. A growing market for plastic bottles offers attractive growth opportunities to this business.

Net1 UEPS Technologies (Analyst: Ian Liddle)

Since winning the national tender for the distribution of social grants, Net1 has registered nearly 22 million social grant beneficiaries and recorded their biometric data. The company is now responsible for paying over R9 billion rand every month to grant recipients on behalf of the South African government. Grant recipients are able to draw this monthly grant from Net1's cash payment points in rural areas, ATMs or from POS machines in retail stores. Net1's biometric verification technologies are already resulting in substantial savings for the government through reduction of fraud. These savings could amount to billions of rands per year. Although the company will have to re-tender for the national contract within the next four years, it will have a substantial competitive advantage over any potential competitor. Net1 is developing a formidable track record of successfully implementing reliable and robust technology, which comfortably handles millions of transactions, both on- and offline. Any new provider would have to make substantial investments in setup costs, which are now behind Net1.

Why is the share trading for just 7x forward earnings? The losing bidder in the national tender process (an Absa subsidiary) has challenged the outcome of the tender through the courts all the way to the Constitutional Court. Different judges have made conflicting rulings as the matter has progressed. This creates considerable uncertainty. It is possible that the Constitutional Court will make an extremely adverse ruling for Net1 (a final ruling is still outstanding at the time of writing), in which case the share will be a disappointing investment. But on a balance of probabilities (taking into account the vital role Net1 performs in distributing cash to needy South Africans), we believe Net1 is attractively priced. The risk of an adverse ruling is mitigated by limiting the position size in our clients' portfolios.