From Jungle Oats at breakfast to Mrs Ball’s chutney in bobotie, Tiger Brands is ubiquitous in the lives of South Africans. Founded in 1921 as Tiger Oats, Tiger Brands has become one of the largest consumer brand companies on the African continent. Andrew McGregor tells this long-term, home-grown success story.

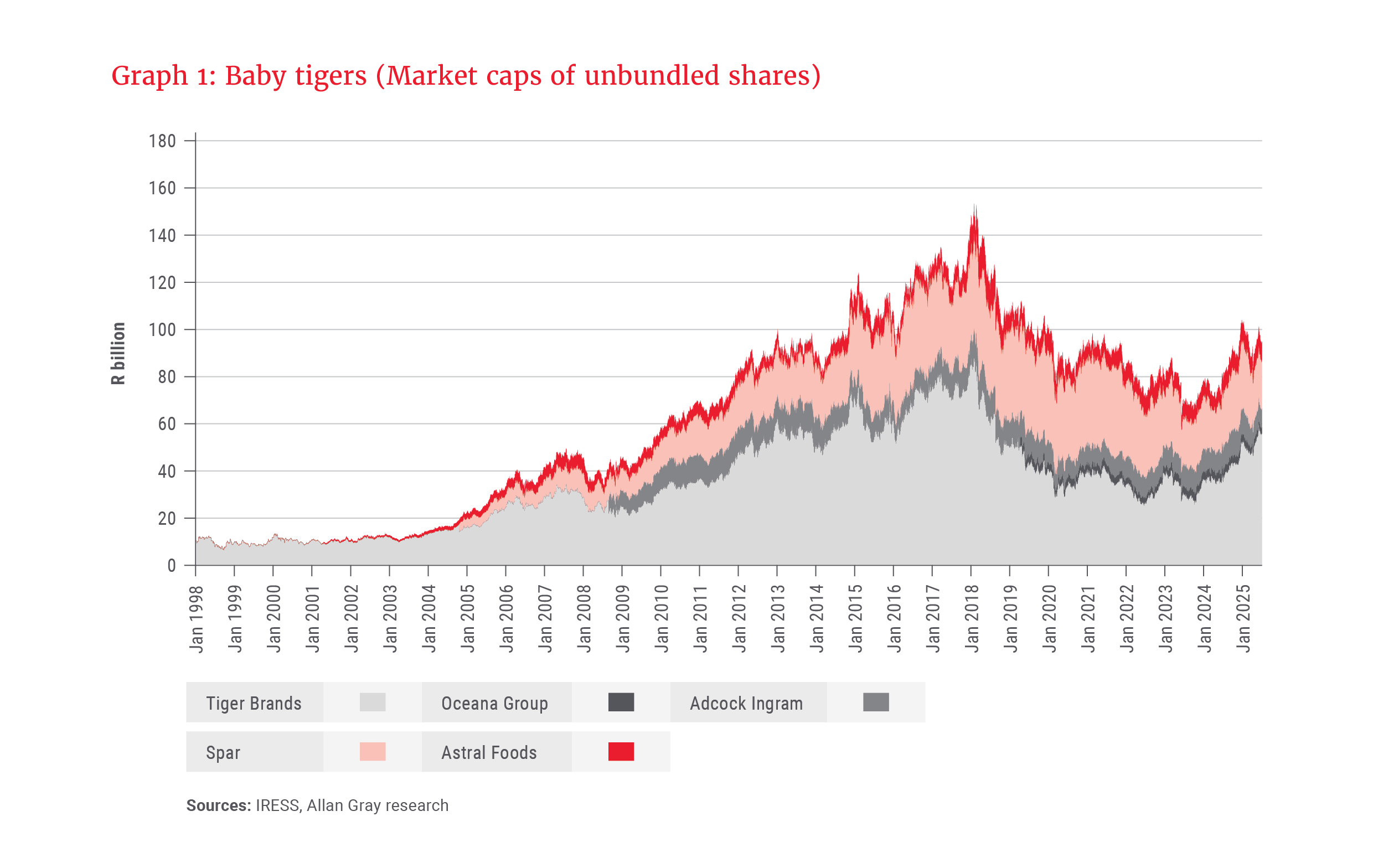

The influence of Tiger Brands (or “the Tiger”, as it is affectionately known in investment circles) on the South African economy extends further than its own brands. If you go back in time a few decades, you will note that there are several large businesses that have fallen under the Tiger’s sphere of influence at some point or another, including Astral Foods, Oceana Group, Adcock Ingram and Spar. If you add up the market capitalisations of just these four businesses, as shown in Graph 1, you will get roughly 70% of the Tiger’s own market capitalisation (as at 30 June 2025).

When reading our copy of Tiger Oats’s 1972 annual report, you will find notes which appear to be from the young Allan Gray, a passage about the new state-of-the-art Randfontein mill and its imported Swiss machinery (which is currently in the process of being sold by Tiger Brands, as the business isn’t profitable anymore), and a list of all the businesses that the company operated back then. However, you will find no mention of Tigers’ biggest brand today: Albany. That is because it didn’t exist.

Becoming the breadwinner

Albany is the largest bread brand in the country – although its history is far shorter than that of the company. Back in the 1970s, Tiger Oats and National Milling Co. bought 36 bakeries across the country to form what is now known as Albany Bakeries. The familiar red rhombus logo wouldn’t make an appearance until the late 1990s, when management remodelled the business after Warburtons in the United Kingdom (and lightly plagiarised their logo).

At that time, the bakery business was struggling due to industry-wide overcapacity, but as the economy strengthened after 2002, Albany became Tigers’ powerhouse. From 2003 to 2013, revenue from milling and baking doubled and profit margins trebled. Milling and baking went from 14% of Tigers’ profit in 2003 to a whopping 45% in 2013. Unfortunately for Tigers, this historic run would soon come to an end.

Overbaked?

Between 2012 and 2018, the cookie began to crumble, starting with the forays into Africa failing in a spectacular fashion. Tigers’ stake in Nigeria’s Dangote Flour Mills, for instance, which was purchased for R1.6bn, was eventually sold for a symbolic US$1. Bread margins stepped down a bit, and the groceries business started losing share when the business pushed price too hard.

… we believe there is strong evidence of the turnaround strategy working at Tiger Brands …

In late 2017, just a few years short of Tigers’ centenary, it all fell apart. An outbreak of listeria was traced back to a Tiger Brands processed meat facility. It is unclear whether this was coincidence or a symptom of a greater issue, but what was true was that price had been pushed too far, plants hadn’t been maintained properly, management had become complacent and had lost focus, and competition had ramped up significantly.

Between financial year 2017 and 2023, the Tiger languished as six of the 12 reported operating segments had double-digit declines in operating profit. The profit from its largest segment, bakeries, fell by two-thirds; the groceries business profit nearly halved. Group earnings went nowhere, and the share price fell from a high of R470 to a low of R136. It certainly appeared as if the Tiger had been tamed.

A new recipe

In late 2023, Tiger Brands put out an announcement that surprised just about everyone, sending the price of the share up 11% on the day. Tjaart Kruger, a man who was partly to blame for the Tiger’s downfall due to his successful leadership of Premier, a key bakery competitor, was taking up the helm at Tigers.

The Tiger had the man; all it needed was a plan. The following is what they came up with:

Step 1: Simplify the management structure

The existing matrix structure, which works for some of the larger multinational companies, was scrapped in favour of a federated model. This was done to remove a layer of management (and the associated costs) and to get the managers to be more in touch with their business units.

Step 2: Get the basics right

When you are running a bakery, every cent per loaf matters. That means you need to make sure you are maintaining your bakeries to avoid downtime, and that when you do get around to planning maintenance, you don’t do it at 7 am when the oven is supposed to be baking bread for the trucks that are coming to pick them up at 9 am.

Step 3: Focus on the winners

Identify which brands and products are doing well and put capital behind them. For Tigers, these are the well-known brands such as Albany, Tastic, All Gold, Crosse & Blackwell, Purity and Doom. The laggards have been many of the personal care products, which struggle to compete with the likes of L’Oréal and Procter & Gamble, but also Beacon’s chocolate business, which trails Nestlé and Cadbury and has struggled to remain profitable.

Step 4: Fix the culture

Peter Drucker is attributed with claiming that “culture eats strategy for breakfast”. We think both are important, but good culture begets good strategy, not the other way around. When employees don’t care about a business, managers are fighting an uphill battle on execution. Conversely, when employees start caring about the business, managers will find that execution becomes a lot easier.

How do we know the plan will work?

In truth, we don’t know if the plan will work, however, we can assess the reasonability of the plan, and we can monitor outcomes.

What is interesting about the Tiger Brands case study is that previous plans were reasonable (we have documented evidence of their plans going back more than a decade), but execution was noticeably absent. Kruger and his team, on the other hand, score top marks for execution. The baroque management structure was collapsed within four months. They have managed to improve the output of bakeries while reducing costs at the same time by simply fixing the maintenance regimen. Stock-keeping units in the grocery business have been rationalised, and lagging businesses have been, or are in the process of being sold.

… with the share having returned 110% since Kruger took over, it is a story we are watching closely.

It is difficult to assess the success of changes to culture without being an employee, however, one interesting anecdote that came out of the last results call was that, apparently, people are now starting to phone Tigers for a job. It should be an indicator of a good company culture returning when people want to work for that company.

If the turnaround proceeds as planned, it is very likely that there is hidden value in the Tiger that is not currently being priced in. Volumes will return, margins will improve, and earnings will be returned to shareholders. It is the simplest recipe for a good investment. We just need to monitor their progress. As clients of Allan Gray hold a substantial portion of Tiger Brands’ shares, that means we engage with the company at the board level to make sure that management is aligned with shareholders, and at the executive level to ask difficult questions and make sure that they are following through on their commitments.

Overall, we believe there is strong evidence of the turnaround strategy working at Tiger Brands, and with the share having returned 110% since Kruger took over, it is a story we are watching closely.

Explore more insights from our Q2 2025 Quarterly Commentary:

- 2025 Q2 Comments from the Chief Operating Officer by Mahesh Cooper

- Allan Gray Stable Fund: Celebrating a quarter of a century by Radhesen Naidoo and Danielle Nissen

- Rebuilding the global monetary order with bricks of gold by Umar-Farooq Kagee

- Orbis Global Equity: Discipline in the face of volatility by Adam R. Karr

- How to think about beneficiary nominations for your retirement funds by Ian Barow

- Three questions to evaluate your investment manager by Nomi Bodlani

To view our latest Quarterly Commentary or browse previous editions, click here.