If you have multiple sources of income, you must ensure that the correct tax rate is being applied by your employer and/or annuity provider – or you could be in for an unexpected tax bill when tax filing season arrives. Carla Rossouw explains.

Taxpayers with multiple sources of income are often surprised during the tax return filing season when the result of their assessment indicates that they owe money to the South African Revenue Service (SARS). Annuitants who earn income from different sources, which may include annuities from multiple providers and/or other income, such as a salary, rental income and interest income, can find themselves in this position. To avoid an unexpected tax bill, it is important to understand how your total tax liability is calculated.

How is it possible to end up with an unexpected tax bill?

Consider a taxpayer who earns a salary from their employer and draws an annuity income from their Allan Gray Living Annuity. Both the employer and Allan Gray are required to deduct Pay-As-You-Earn (PAYE) tax from the income they provide to the taxpayer and pay it over to SARS. The problem is that both parties only have sight of the income that they provide to the taxpayer, so they both apply the annual tax rebates when estimating the taxpayer’s tax liability (and these rebates are only meant to be applied once). They may also be applying the incorrect tax rate (i.e. too low a tax rate) since they do not have sight of the taxpayer’s total taxable income, and the aggregate of the taxpayer’s income may push them up to a higher tax bracket.

South African taxpayers pay income tax on their local and worldwide taxable income, which is all added together to determine their overall tax liability for the tax year. When the taxpayer in our example files their tax return, the result of the assessment is that they have a tax liability that exceeds the employees’ tax already withheld by their employer and Allan Gray during the year of assessment, and they owe money to SARS. Most taxpayers in this situation do not foresee the additional tax liability, since they assume the tax withheld by their employer and/or annuity provider will be sufficient. This creates an unexpected cash flow burden and tax debt, which can be avoided if managed upfront (see example below).

By deducting PAYE tax every month, the employer and Allan Gray are assisting the taxpayer to pay their tax liability, which is determined on assessment when they file their tax return, in advance. When the taxpayer has only one source of income, the total PAYE tax deducted monthly should be equal to the total tax liability calculated on assessment. Typically, this should result in no extra tax due on assessment. However, when the taxpayer has more than one source of income, like in our example, each income provider deducts the correct amount of PAYE tax on only the income they each pay. When all the sources of income are added together, and the correct tax rate is applied (and the rebates are applied only once), this may result in an additional amount of tax due on assessment.

In other words, the tax liability on your total taxable income from multiple sources may be much higher than the combined amount of PAYE tax which was withheld from each source of your income during the tax year.

Example

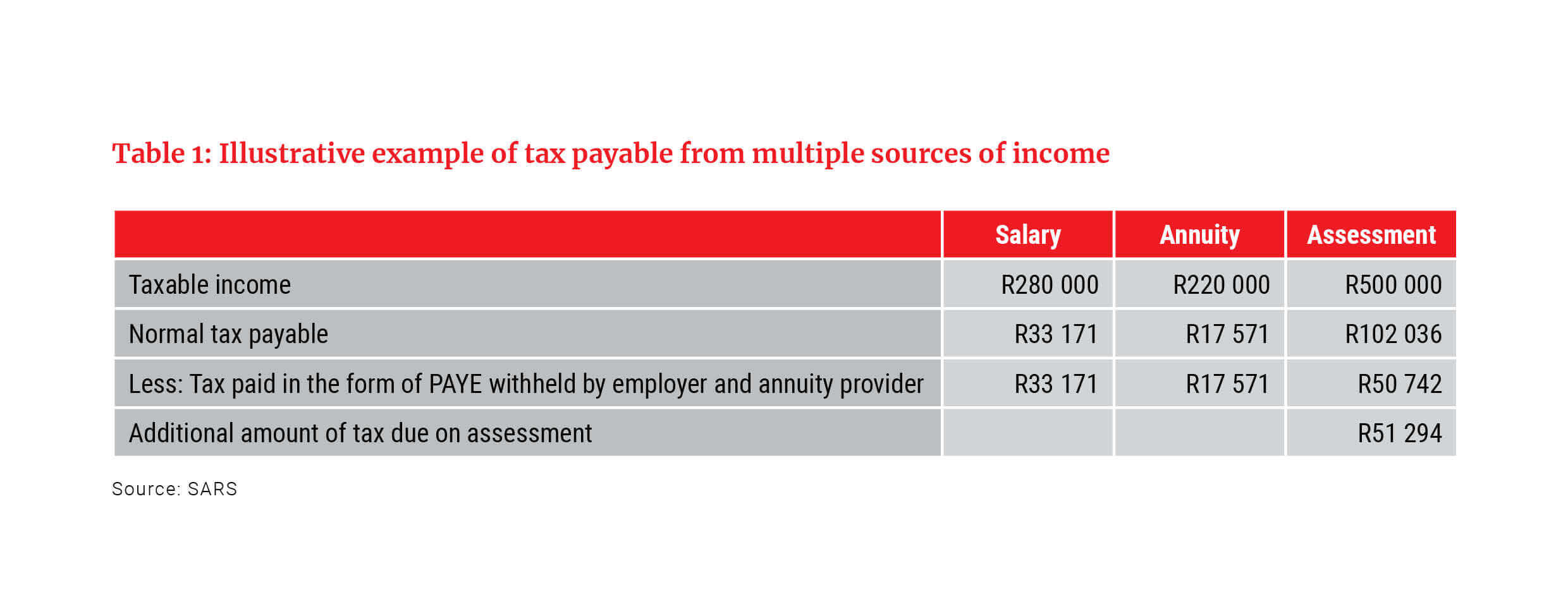

Table 1 gives an example of how the combined taxable income would be calculated in the case of a taxpayer who is 66 years old and received a salary of R280 000 plus an annuity of R220 000 during the 2020/2021 tax year.

As you can see, after submission of their annual income tax return, the total tax liability on assessment is significantly higher than the total PAYE that was (correctly) deducted by the employer and annuity provider during the year. This means the taxpayer owes SARS an additional amount on assessment because too little tax was deducted monthly by way of PAYE, as the employer and annuity provider did not have sight of the taxpayer’s total taxable income.

How to arrange for a voluntary additional PAYE deduction and avoid an unexpected tax bill

To help taxpayers who receive income from multiple sources avoid a surprise tax bill on assessment, the Income Tax Act allows you to make additional voluntary tax payments. The best way to manage this is to understand your total tax liability, taking your multiple income sources into account, which will enable you to calculate an appropriate tax rate. You can then ask your annuity provider to apply a higher marginal tax rate to your annuity income so that more PAYE is withheld from your income during the course of the tax year. This will help you avoid surprises when filing your tax return.

Follow these steps to enable Allan Gray to facilitate additional PAYE deductions from your Allan Gray Living Annuity income:

- Estimate your total taxable income for the current tax year by combining all your income, including salary and annuity income.

- Identify the preferable rate at which tax should be deducted, based on your combined estimated taxable income. The PAYE tax table sets out the rate at which tax should be withheld at the various combined taxable income levels.

- Request that Allan Gray (and your other income providers, if applicable) apply (as a minimum) the applicable rate at which to deduct PAYE tax from your annuity income (or other income). For example, if you have an employer paying you a salary and two annuity providers, then all three income providers should deduct tax at the same rate. To request that Allan Gray apply a higher tax rate to your living annuity income, please send us a signed instruction.

If you need help determining an appropriate tax rate, you should consult your financial adviser or tax practitioner.