The end of February sees the tax year draw to a close – an opportune time to ensure that your tax affairs, and tax details, are up to date, and to consider taking full advantage of the government’s tax incentives, which encourage us to save. Carla Rossouw offers some practical tips.

Tax efficiency is a key aspect of a healthy financial plan. By making sure your tax affairs are in order, considering the tax implications of your investment decisions, and maximising the tax benefits on offer, you can improve your financial flexibility.

Make sure your tax affairs are in order

When you earn above a certain threshold, whether from an employer or through other sources of income, including your investments, you are required to register with the South African Revenue Service (SARS) and complete a tax return to report on your activities. However, SARS does not only get your information through your disclosures – your investment manager and other third parties are also obligated to share information with SARS, so that all your income is accounted for.

It is important to be aware that as of October 2022, SARS can automatically register you for personal income tax if they detect economic activity on your profile from the data third parties submitted to them.

If your tax affairs are considered not to be in order, SARS may view you as being non-compliant, which means you may be subject to administrative penalties until the issues are resolved. SARS currently only charges administrative penalties when you fail to submit a tax return on time, but other acts of non-compliance may also be subject to penalties in the future.

Tax has a significant impact on your investment return. … it is important to understand the tax advantages on offer and to make strategic choices …

Make sure your tax affairs are in order by following these four tips:

1. Check your tax status with SARS

From 1 December 2022, administrative penalties are charged if you have one or more outstanding tax returns from the 2007 tax year. SARS may collect these administrative penalties from appointed third parties, such as your employer and investment manager. Check your tax status with SARS as your first step to getting your house in order.

2. Update your tax details with product providers

Supply your tax details, such as your income tax number and country of tax residence, to your investment manager and other product providers – and make sure to update them if anything changes. This enables these parties to apply the correct interest and dividend withholding taxes to your investments, and ensures that they submit accurate information to SARS. This, in turn, will ensure that your tax return is prepopulated with the correct data for tax filing. As a taxpayer, you can now view third-party data certificates on your e-filing profile that financial services providers submitted to SARS.

SARS also needs to know whether you are a South African or non-South African tax resident as this impacts your tax liability in South Africa. Please see the “Cease to be a Resident” page on the SARS website for more information on how to inform SARS of changes to your tax residency status and the supporting documents that may be required. A registered tax practitioner or financial adviser can guide you through the implications of changes to your tax residency.

3. Monitor your annual capital gains tax exclusion

As an individual taxpayer you are required to submit a tax return for the tax year if your aggregate capital gains or losses exceed R40 000 for the tax year. The purpose of this R40 000 annual exclusion is to reduce compliance costs and simplify tax administration by keeping small gains and losses out of the tax system.

If you plan to withdraw from a long-term investment, it is useful to be aware of your aggregate capital gain and loss amount for the period, and to remember your reporting obligations.

4. Diarise important dates on the tax calendar

- 23 January 2023 was the deadline for provisional taxpayers to submit their tax returns. If you missed this deadline, submit your return as soon as possible to avoid penalties.

- 28 February is the end of the 2023 tax year. This is your deadline for maximising the tax benefits made available by the government to encourage us to save.

- July 2023 (the exact date is to be confirmed by SARS) is when the tax reporting season opens for non-provisional taxpayers.

Consider the tax implications of your investment decisions

Tax has a significant impact on your investment return. With so many products to choose from, it is important to understand the tax advantages on offer and to make strategic choices best suited to your needs and circumstances, either on your own, or with the help of a good, independent financial adviser.

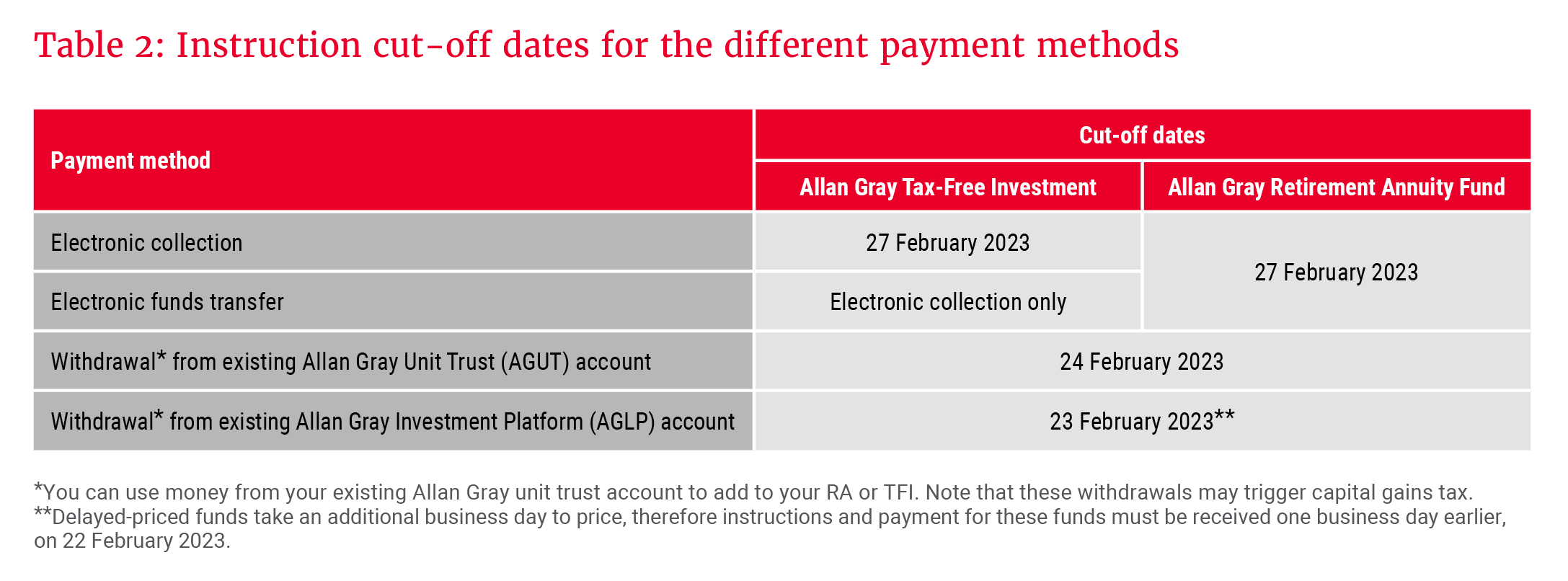

Of course, tax efficiency cannot be looked at in isolation – you also need to consider each product’s suitability and flexibility. Table 1 summarises the role of various investment products, along with their flexibility and tax rules.

Maximise tax benefits available through retirement funds and tax-free investments

While making your product choices, it is useful to hone in on the annual tax benefits available to you through your retirement fund and tax-free investment (TFI) account. These are outlined below, along with some answers to frequently asked questions related to these benefits.

1. Retirement funds

As shown in Table 1, a key benefit of investing for retirement using a retirement fund, such as a retirement annuity or an employer’s pension or provident fund, is the generous tax deduction the government provides for contributions, subject to a maximum of 27.5% of the greater of your taxable income or remuneration, with an annual ceiling of R350 000.

What happens if you overcontribute?

If you contribute more than the annual limit, your excess (non-deductible) contributions can benefit you in many ways throughout your lifetime. They can be used to increase the value of any tax-free lump sum you take from a retirement fund before or at retirement, or even on your death, if your beneficiaries choose to take their benefit as cash. They can also be used to reduce the taxable portion of the income you receive from your living annuity.

These excess contributions are carried over to the following tax years and are added to any contributions you make in those tax years, and they continue to be carried over until they are used – so the benefit is never lost.

As retirement fund contributions can reduce the amount of your taxable income for the tax year, contributing to a retirement fund may mean that you do not need to register as a provisional taxpayer, where you otherwise may have been required to do so. You are not required to register for provisional tax if you do not carry on a trade, or earn taxable income from interest or foreign dividends, or rental income from the letting of fixed property, or remuneration from an unregistered employer, which is in total less than R30 000 in a tax year.

Can you contribute to more than one retirement fund?

Yes. Even if you are a member of an employer’s pension or provident fund, you can still set up a retirement annuity (RA) to supplement your existing contributions. If it is a modern RA, like Allan Gray’s, you can stop and start your retirement annuity contributions whenever you want to, and the investment is held in your name (even if you get it through an employer).

How do you ensure you benefit from excess contributions?

To ensure you obtain the benefit from excess retirement fund contributions, you must declare all contributions in your income tax return each year. This means that you should submit a tax return if you made any retirement fund contributions, even if you otherwise may not have been required to submit a return (for example, if you earned below the tax threshold for the period). Retirement fund contributions made via your employer during the year will reflect on an IRP5 tax certificate, but if you contribute to an RA in your personal capacity, be sure to enter this amount in your return too.

… a key benefit of investing for retirement using a retirement fund … is the generous tax deduction the government provides for contributions …

After your tax return has been finalised, SARS issues you with a Notice of Assessment (ITA34) document, which contains a summary of your tax assessment for the tax year and includes the excess amount of contributions that SARS has on record for you at the time of filing. It is important that you compare this value with what you have on record. The total of your retirement fund contributions (to a retirement annuity, provident fund and/or pension fund) that is carried over will reflect next to the source code 4029 on your ITA34. If there is any discrepancy, you will need to engage with SARS.

2. Tax-free investment products

SARS allows individuals to invest a maximum of R36 000 per tax year and R500 000 per lifetime tax-free in a TFI. This is the total amount you can invest across product providers. You will incur a tax penalty of 40% on any amount over these contribution limits, so you need to keep track of how much you’re contributing to your tax-free investments each year. It is also important to note that any amount you withdraw can’t be recontributed, so you should avoid withdrawing from this product unless it is an emergency.

What happens if you move between product providers?

If you transferred between product providers during the tax year, both providers should issue you with a tax-free investment tax certificate (IT3(s)) reflecting the transferred amount. This is to ensure that SARS does not incorrectly recognise the transfer-in amount as a contribution, which may be subject to penalties if you made additional contributions during the tax year.

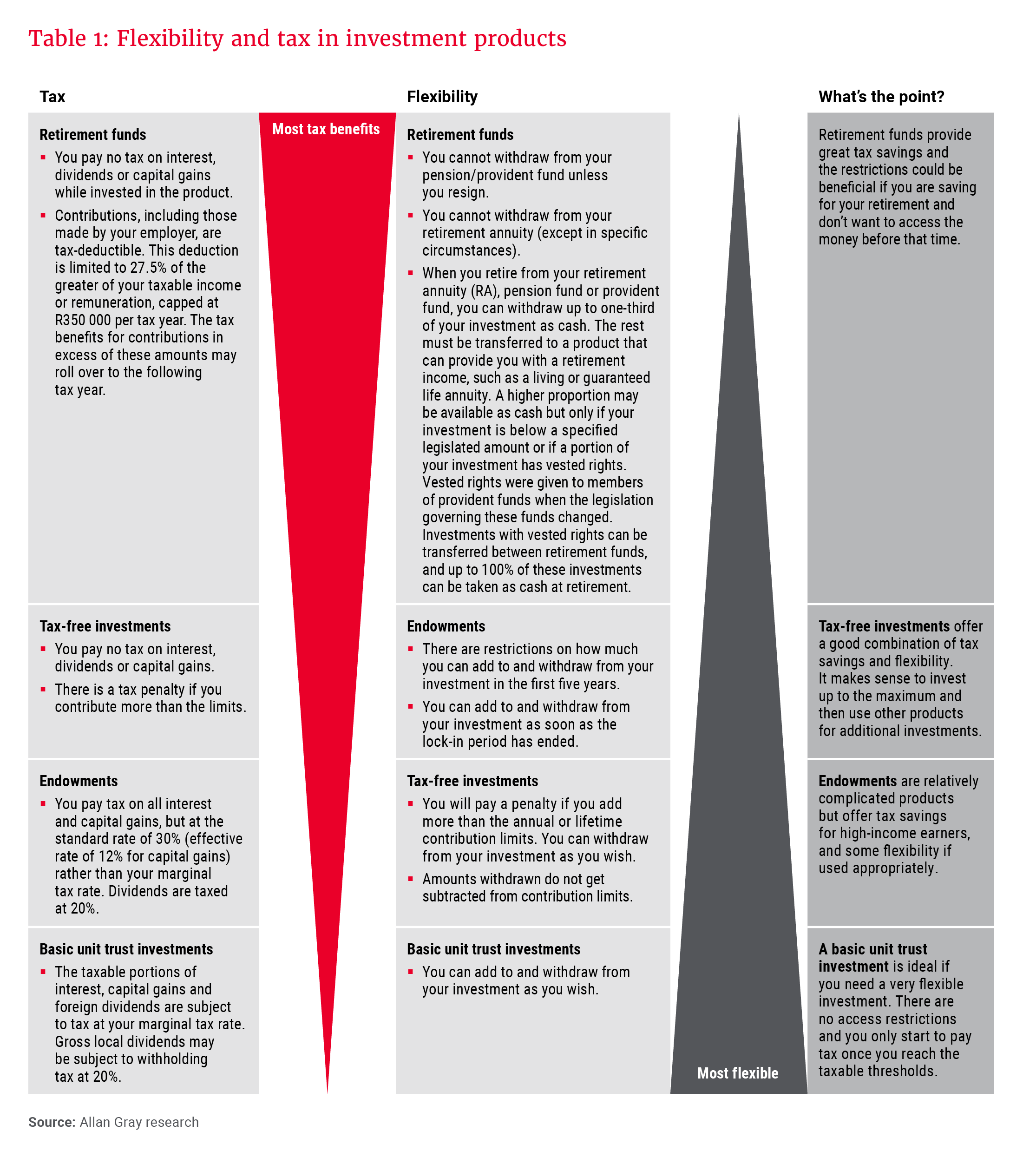

Deadlines for instructions

If you are planning to make use of the tax incentives for this tax year by starting a new RA or TFI, or by making an additional contribution to an existing account, please ensure we receive your instruction, supporting documents and payment well in advance of the 28 February 2023 deadline. The deadlines for payments are set out in Table 2.