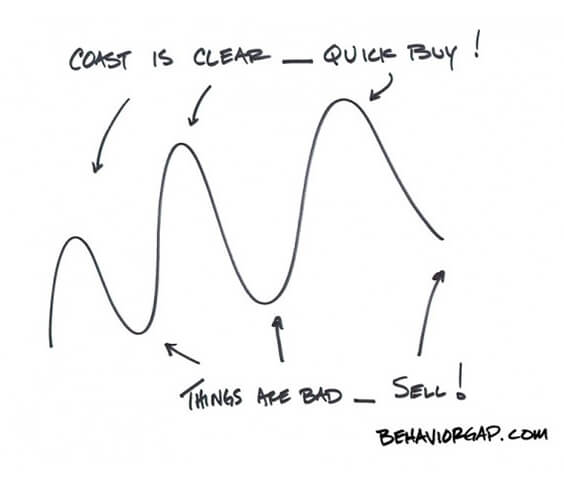

Most of us make the same mistake with our money over and over again: we buy high out of greed and sell low out of fear, despite knowing on an intellectual level that it is a very bad idea. We do this because we make investment decisions based on how we feel instead of what we know. This is natural, maybe even genetic: we run away from things that cause us pain, and we want more of the things that give us pleasure or safety.

Our offshore investment decisions are a case in point. We consistently behave counter intuitively. When offshore assets are cheap, we sell them. When local assets are expensive, we buy them. And on top of this, we seem to prefer buying foreign investments with our weak rand. This makes no sense - usually we rush to buy things on sale when they are cheaper, but when it comes to investments we seem to be more comfortable if they are more expensive.

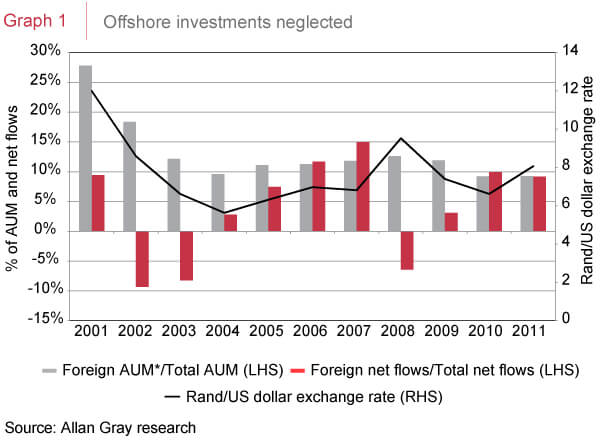

Graph 1 illustrates this behaviour, showing that South African investors have neglected foreign investments over the past decade. The grey bars represent the size of foreign assets under management (AUM) expressed as a percentage of the total savings pool. As you can see, foreign funds have become a smaller proportion of the total pool over the last 10 years, declining from 28% in 2001 to 9% in 2011, despite the fact that the rand has seen some of its strongest levels over this period.

Investing looking in the rear-view mirror

Although this trend can be explained partly by relative performance - in rand terms the South African market has outperformed world markets over the last 10 years, and one would expect funds invested locally to have grown faster than funds invested offshore - the size of flows into the offshore funds has been disproportionately small (illustrated by the red bars). Investors are likely basing their decisions on the outperformance of the last decade, disinvesting offshore investments just at a time when we believe offshore is looking most attractive. (See Ian Liddle’s piece in Quarterly Commentary 2, 2012 ‘How healthy is the South African economy?’).

Investors’ asset allocation decisions in 2008 provide another good example of poor investor behaviour. In the run up to the market peak in May 2008, investors allocated flows into funds with high equity exposure. Then, after the sharp correction that year, they switched into money market and other conservative funds. Think about this pattern for a minute. At the top of the market we can’t buy fast enough. At the bottom, we can’t sell fast enough. And we repeat that over and over until we’re broke. No wonder most people are unsatisfied with their investing experience.

To be clear, the solution is not to sell your offshore funds. It is not to buy local funds. The point is to recognise that, on average, investors tend to be very bad at timing the market. It makes far more sense to base investment decisions on what you need to reach your goals, and then stick with the plan even if you want to run when you sense you may get hurt.

By Carl Richards (guest writer) and Jeanette Marais, director of distribution and client service, Allan Gray

Allan Gray Proprietary Limited is an authorised financial services provider.