The South African Reserve Bank (SARB) has confirmed that the offshore limit for life companies, including Allan Gray Life, has been set at 45% for all investments outside of South Africa. We are therefore revising our offshore restrictions for Allan Gray Living Annuity, Endowment and Tax-Free Investment accounts to 45% (from 40% outside of Africa previously), effective immediately.

How will this affect your investments?

Effective immediately, you will be able to invest up to 45% of your Allan Gray Living Annuity, Endowment or Tax-Free Investment account’s total investment allocation into offshore assets. This restriction will be managed based on each account’s overall offshore allocation, considering the offshore allocation in each underlying unit trust.

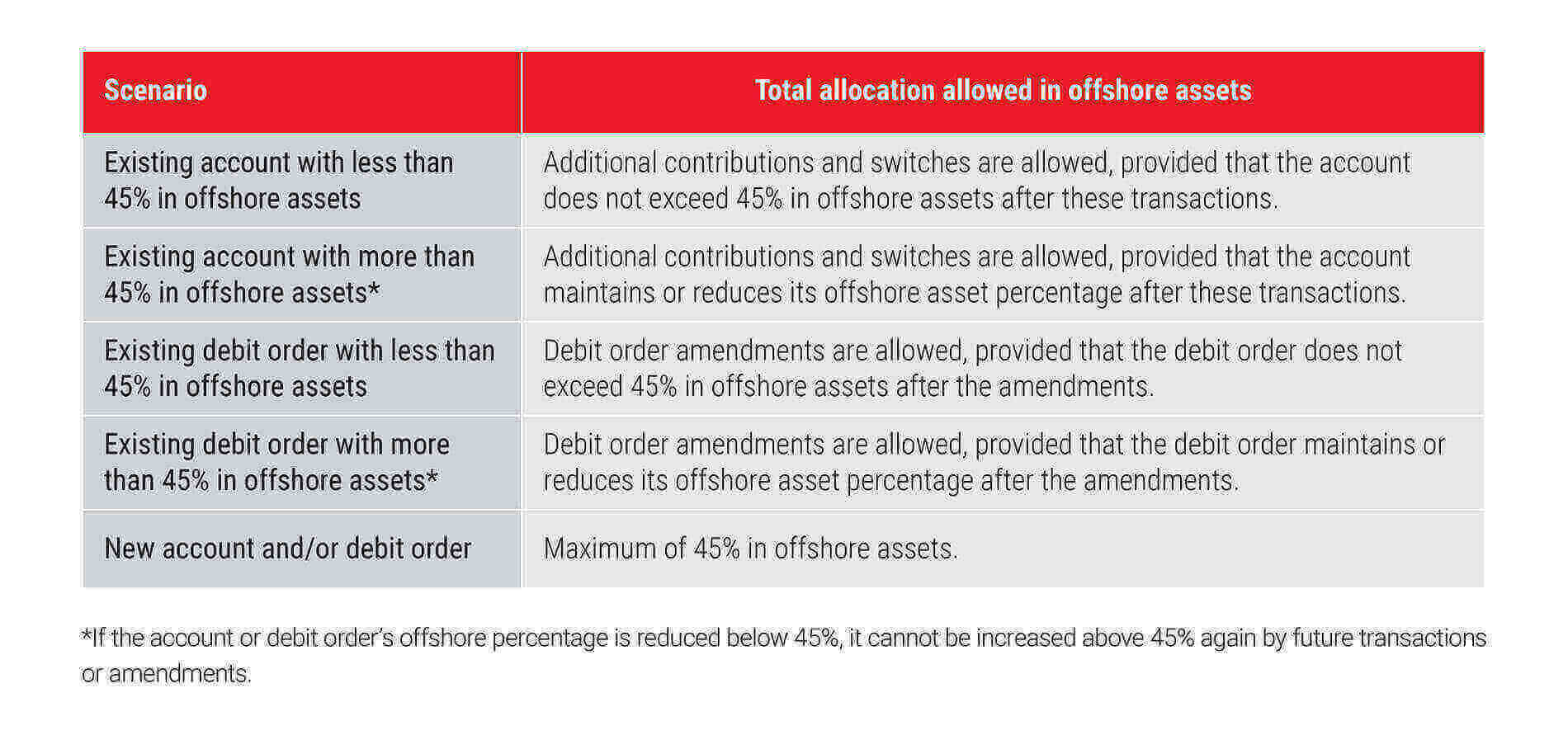

If you have less than 45% allocated to offshore assets, you are able to invest up to a maximum of 45%. However, if you have already reached or exceeded the 45% restriction, you are able to maintain or reduce, but not increase, your allocation to offshore assets. You are also able to transact (additional contributions, switches and debit orders), provided that your accounts comply with the restrictions after each transaction. Allocation to offshore assets for Allan Gray Living Annuity, Endowment and Tax-Free Investment accounts will be restricted as outlined in the table below.

How to determine your allocations to offshore

Allocations to offshore assets for new investments, additional contributions, debit orders and switches will continue to be automatically validated when transacting via Allan Gray Online. Our Excel-based offshore allocation calculator will also continue to be available to determine your allocation to offshore assets.

Why are there restrictions in place?

Allan Gray Life is subject to exchange control regulations issued by the SARB. These regulations place limits on the allowable offshore exposure by institutional investors. To ensure compliance with these regulations, we are required to carefully manage Allan Gray Life’s overall offshore exposure. We will continue to review the offshore limits on an ongoing basis and communicate adjustments based on Allan Gray Life’s available offshore capacity.