Mid-year IFA business and investment update

An erratic start to the year and defiant markets have given investors a lot to think about. In the local investment update Leonard Krüger makes the case against financial herding, while emphasising the importance of growth to an economy before Nazia Suleman introduces the Allan Gray Umbrella Retirement Fund. Matthew Spencer from Orbis gives us the global perspective that shows that old paradigms on managing downside risk are breaking down in a world of expensive financial assets.

Leonard Krüger

Leonard Krüger cautions against following the herd and looks at the state of the local economy.

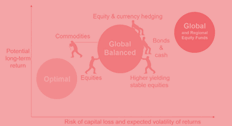

Matthew Spencer

Matthew Spencer talks about the global context and explains why the old 60% equity and 40% bond portfolio is no longer enough to minimise risk.

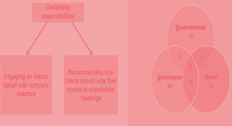

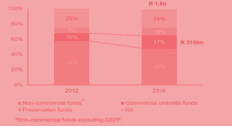

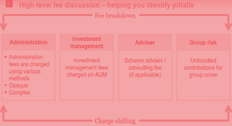

Nazia Suleman

Nazia Suleman introduces the Allan Gray Umbrella Retirement Fund and explains why we think it will help your business and your clients.