The probability that the world is moving into an environment of higher inflation is increasing. An inflationary environment requires investors to think differently about their asset allocation. At a recent investment update webinar, our chief investment officer, Duncan Artus, examined the relative attractiveness of bonds and South African equities and explained how we are positioned for long-term returns using practical examples. Watch the 20-minute recording of the webinar or read the summary below. You can also enjoy the Q&A from the event here. You can download the presentation slides here.

The investing world could look quite different over the next 10 years, characterised by higher inflation and interest rates (not at extreme levels, just higher). While we are bottom-up investors, we must be cognisant of the environment in which we invest so that we can be on the right side of long-term trends, especially in the asset allocation funds.

What are the signs today that things could be changing?

- US two- and 10-year break-even rates are moving towards 16-year highs.

- Energy prices, which have since retraced somewhat, spiked in response to an increase in demand.

- Short-term rates spiked in developed markets as they priced in a faster rate rising cycle.

South Africa is a small open economy that is materially affected by global trends and our stock market has a heavy weighting to commodity shares, Chinese growth and multinationals. We need to pay attention to the signs.

So, what does this mean for local investors?

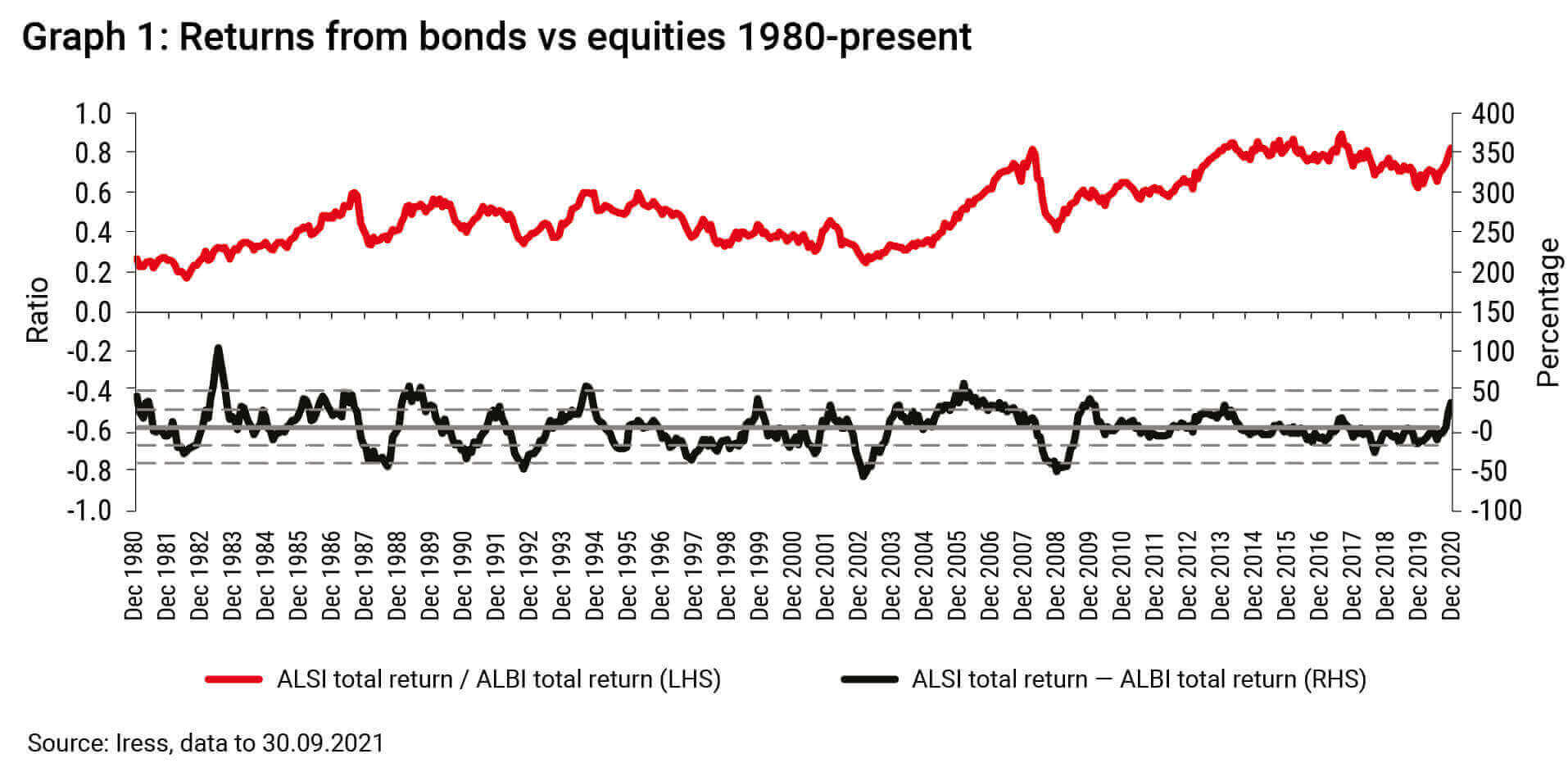

Fixed income funds remain popular, and one can understand this given the real rates that have been on offer over the last while – but a degree of caution is advisable. Looking at the relative returns of the FTSE/JSE All Share Index (ALSI) and the FTSE/JSE All Bond Index (ALBI) since 1980, the ALSI has returned approximately four times the return of the ALBI, as shown in Graph 1. However, it is important to note that the ALSI has underperformed for significant periods in between: It is not a slam dunk to have a consistently high weighting to equities.

Sentiment is affected by the recent past. Over the last three and five years, the Capped Swix has underperformed the ALBI. Over 10 years, the outperformance of equities is not significant. Over one year, equities have significantly outperformed. Rather than be swayed by sentiment, investors should focus on their long-term goals and position their portfolios appropriately.

Taking a closer look at bonds

One of the reasons we have high real yields in South Africa is the continued issuance by the government. The one-year rate of change in issuance has been consistently high since the global financial crisis. The government is having to pay up to get the market to absorb the continued supply. At the same time, the growth in private sector borrowing has been anaemic and recently turned negative – worrying for the economy.

Taking a closer look at equities

It is hard to think about the spot multiple for the overall market given the significant increase in real earnings. This may seem strange during a pandemic, but the commodity producers’ earnings have exploded due to higher prices. In addition, many financial and industrial companies have made strong earnings recoveries.

Despite higher valuations, South African equities look very depressed relative to the S&P 500. But this is true of almost all markets. As highlighted by our colleagues at Orbis, the US market, bar a few exceptions, has been the only place to be invested over the medium term. A higher rate world should favour SA equities, which are more value-like in nature compared to the large growth tech shares, which dominate the US market.

How does this translate in our portfolios?

Looking at our asset allocation in the Allan Gray Balanced Fund, we own five times more SA equities than bonds. The better relative performance from our local equities has been driven by the shares outside of the “Big 4” (Naspers, Richemont, Anglo American and BHP), finally playing some catch-up after significant underperformance over the last five years. The medium-term performance gap remains wide.

We have not looked too clever over the long term with our view that iron ore was trading above its fundamentals, but the price has corrected significantly over the last few months. This has assisted our overweight positions in Glencore and Sasol versus BHP and Anglos – which derive a material amount of their profit from iron ore. In our view, the market may be underestimating the Chinese government’s goal to improve the quality of the country’s economic growth, as opposed to growth at all costs, which will likely involve less investment in property.

Recent performance has been helped by the return to form of some of the laggards, including Old Mutual and Remgro. Looking specifically at Remgro, we have seen a few deals to unlock the discount to its intrinsic value. Last year saw the unbundling of Rand Merchant Bank holdings (RMH) and FirstRand. Recently, we have seen the announcement by Rand Merchant Investments (RMI) that it will unbundle its holdings in Discovery and Momentum, leaving OUTsurance in the listed vehicle. We hope that Remgro then unbundles the Discovery and Momentum shares it receives to Remgro shareholders. In addition, we know that Heineken has made an offer for Distell – with the result that Remgro will now be a minority shareholder in the much larger combined Distell and Heineken business.

AB InBev is another position we have been slowly accumulating as this holding reduces our exposure to China and the local economy. Sentiment towards the company has been poor, and it has significantly underperformed a share like Richemont, where sentiment has been very much the opposite.

Keeping an eye on the COVID-19 situation

One key area we are watching is the COVID-19 situation in the UK. The announcement of vaccines and the opening up to normal life in countries such as the UK with high vaccination rates have been key drivers of positive sentiment. Despite very high levels of cases, hospitalisations and deaths remain low. For now. This sentiment can be seen in many of the local hospitality and leisure shares, such as Sun International, which is up around 50%.

Change and uncertainty are constants we have to get used to in investing. Consistently following our investment philosophy and process and being guided by rationality helps to keep us from wavering. Investors are encouraged to do the same.