Orbis has been going through a period of painful underperformance. Jonathan Brodie reminds investors what Orbis is trying to achieve, examines performance over the short and long term, looks at what has driven performance and weighs up the prospects from here. He also touches on the changes Orbis is making to its fees.

At Orbis, our mission is to empower clients by enhancing their savings and wealth over time. That means delivering better returns than our clients could get by tracking the market averages. But better returns are necessarily different returns, and to deliver different returns than the market, our portfolios must look very different to the market. Building and sticking with these portfolios requires a contrarian mindset: taking an independent view, then being willing to follow the conclusions of our research even when they differ from the market consensus. This contrarian mindset is essential because of the cruel irony of investment markets: The more you behave like everyone else, and the more comfortable this makes you feel, the riskier it is.

It is just as essential to pair this contrarian mindset with a long-term perspective, because disagreements with the market can take years to resolve. That inevitably leads to periods of underperformance for highly active managers. We are no stranger to these. Since its inception, the Orbis Global Equity Fund (the Fund) has lagged world stock markets by more than 10% on eight previous occasions. Tough periods are a feature, not a bug, of our approach.

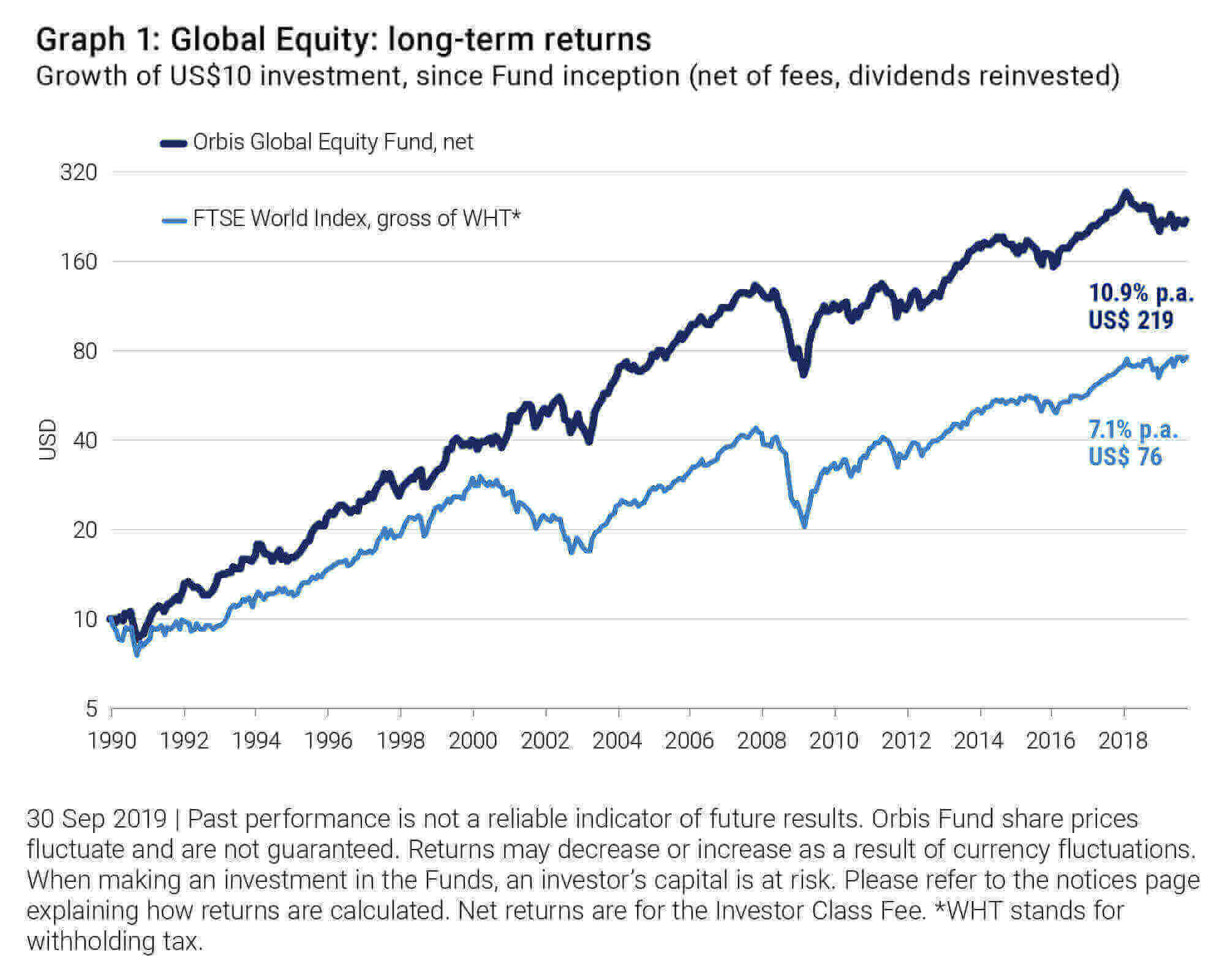

The good news is that the market rewards patience. Graph 1 shows that Orbis’ long-term performance has been pleasing, with the Fund returning 10.9% per year after fees compared to 7.1% for the benchmark. While performance has not come in a straight line, the Fund has generated real wealth for investors.

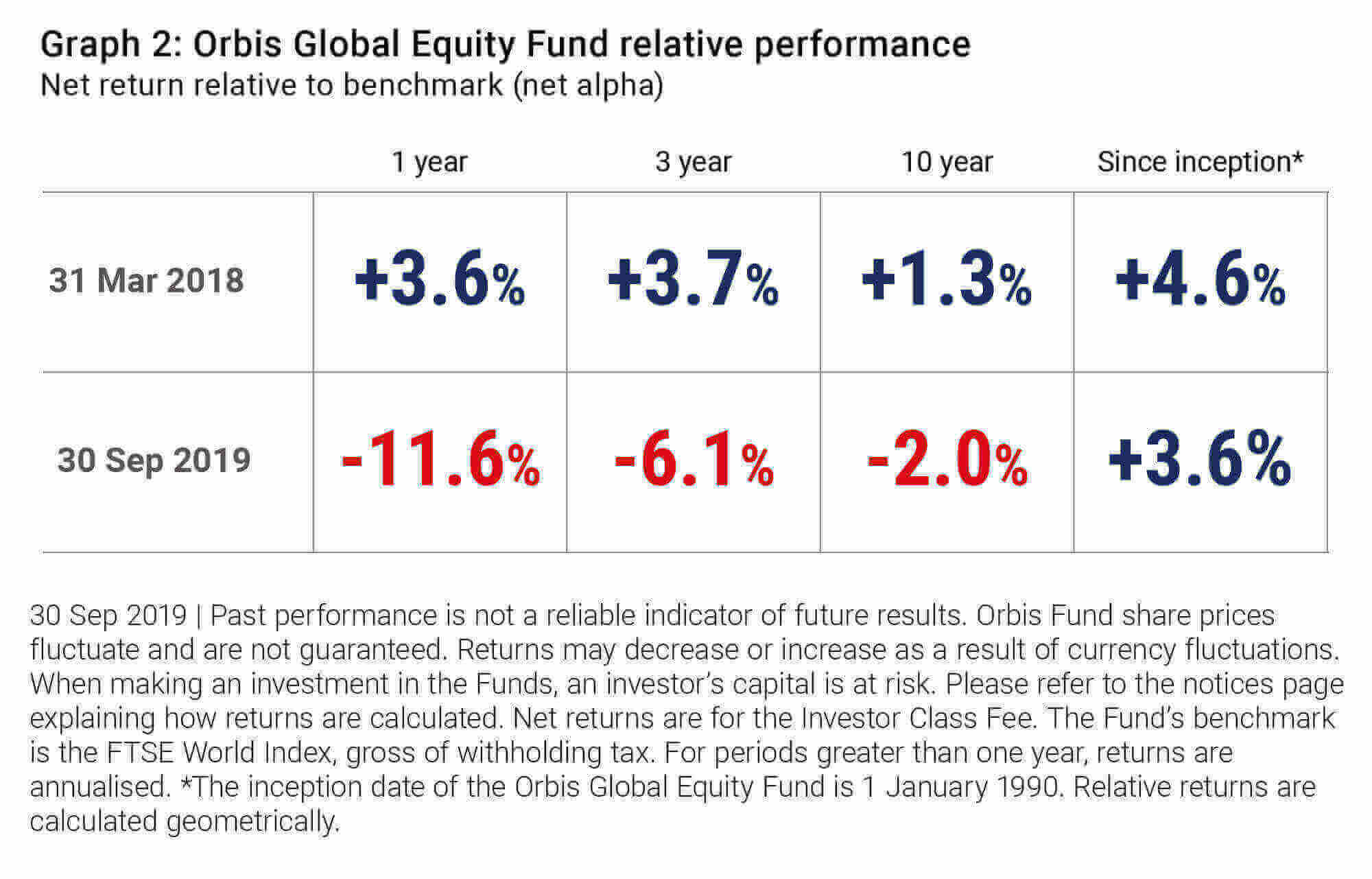

Looking at more recent returns paints a painful picture, with recent underperformance dragging down even the 10-year performance number. See Graph 2. Note that these are relative returns – how much we beat or lagged the index – not the absolute returns, which for the three- and 10-year periods remain positive (at 3.8% and 6.9% net of fees, respectively.)

Recent results: Understanding detractors

Periods of underperformance are inevitable for all active managers and the last 18 months have certainly been tough for our clients. We have struggled to find many attractively priced companies among the mega cap and low volatility shares whose performance has led the market recently. Compounding this, a number of our favoured holdings have recently experienced company-specific setbacks. Disappointingly, in certain cases we had misjudged a company and in others an unexpected event occurred which changed the circumstances. In these scenarios, the prudent decision, in our view was to sell our position to protect our clients from further losses. Encouragingly though, in the majority of cases, we believe the company-specific setbacks are temporary and allowed us to increase our investment in these companies. As our founder, Allan Gray, often says: “A temporarily adverse environment for a good company can create a great long-term buying opportunity.”

But it’s not just losers that affect the Fund’s overall returns – winners have an impact, too.

Recent results: A lack of winners

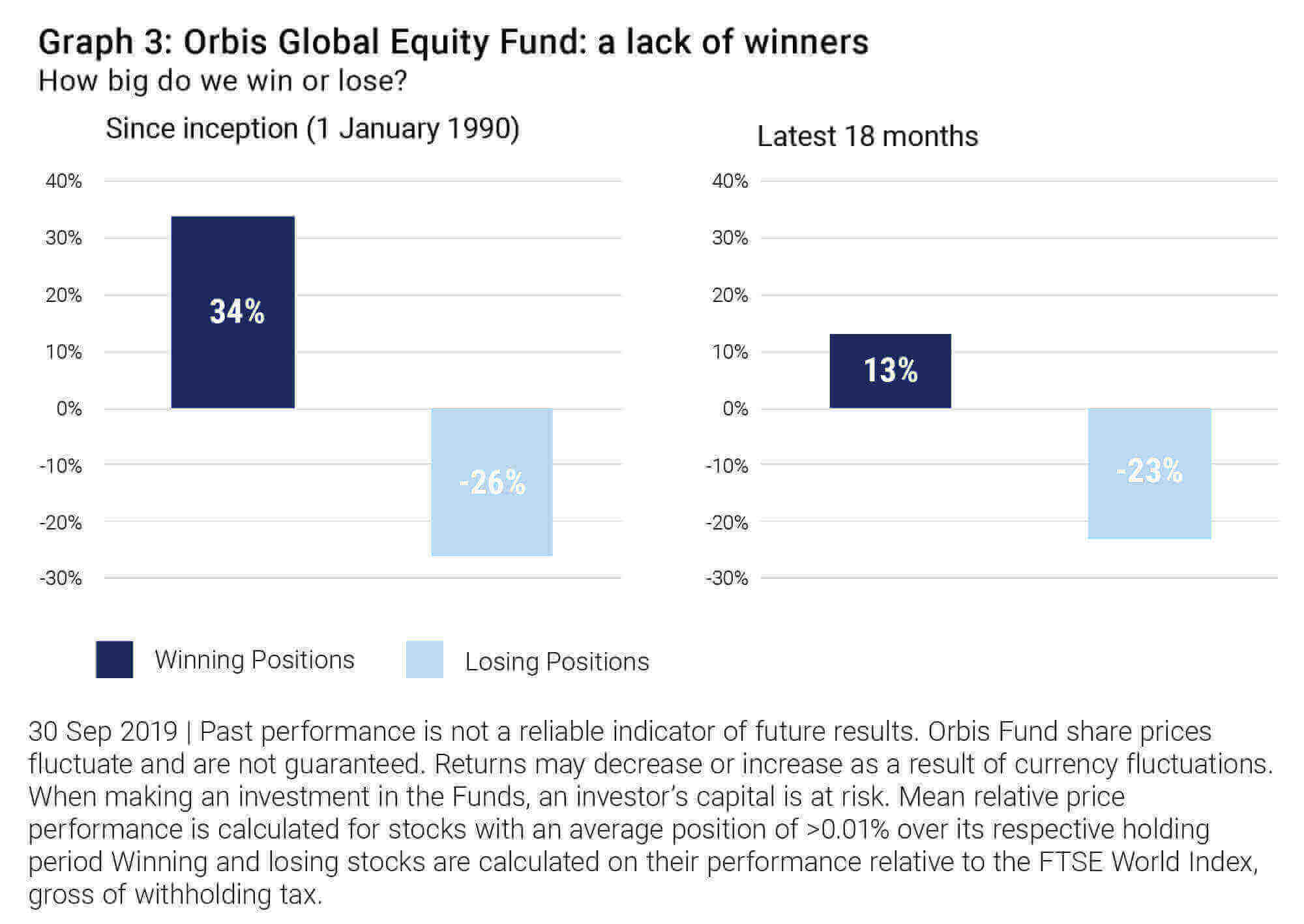

Perhaps surprisingly, our losers have not been bigger than normal during this period. A bigger factor has been the magnitude of our winners, which has been significantly below average. Graph 3 shows that our losers over the past 18 months have lost roughly around the same as our losers since inception. But the winners over the last 18 months have underwhelmed, adding only 13%, far less than our historic average.

Within the Fund, those have been the drivers of performance. More than our fair share of losers, some of which were mistakes, but many of which we still find highly attractive. At the same time, our winners have not punched at their usual strength.

Value vs doubt

Relative performance always has two sides. If one asset is underperforming, something somewhere must be outperforming. So what things have been performing well? Lately, the trend has been clear. Large companies perceived as predictable have done incredibly well, driven largely by ever-increasing valuations. At the same time, “value” stocks – which trade at low prices relative to earnings and net assets – have lagged.

At Orbis, we aren’t textbook value investors, but there are similarities between a value philosophy and our fundamental, long-term and contrarian philosophy. So, are valuation-based approaches to investment dead? In short: “No”. History has shown that, driven by human nature, investors tend to overshoot; growth fades and struggles subside. Such swings in sentiment offer opportunity to those willing to take a different view and who can remain patient through uncomfortable periods. Brett Moshal and Michael Heap look at this in detail in our Q3 2019 Quarterly Commentary article.

Buying good companies at a discount

For the most part, we are finding opportunities in situations where the market is extrapolating short-term concerns or uncertainty into perpetuity. That provides an opportunity for long-term investors to lean against the pessimism.

One exciting area is the Fund’s exposure to the Chinese technology sector, and internet company NetEase. The market value of the firm is some US$33bn. We believe the gaming business alone could be worth nearly double this within four years with the other businesses as potential further upside. And while the stock tends to be volatile whenever the US-China trade war is in the headlines, the company’s significant net cash position provides some fundamental support.

Stability is not safety

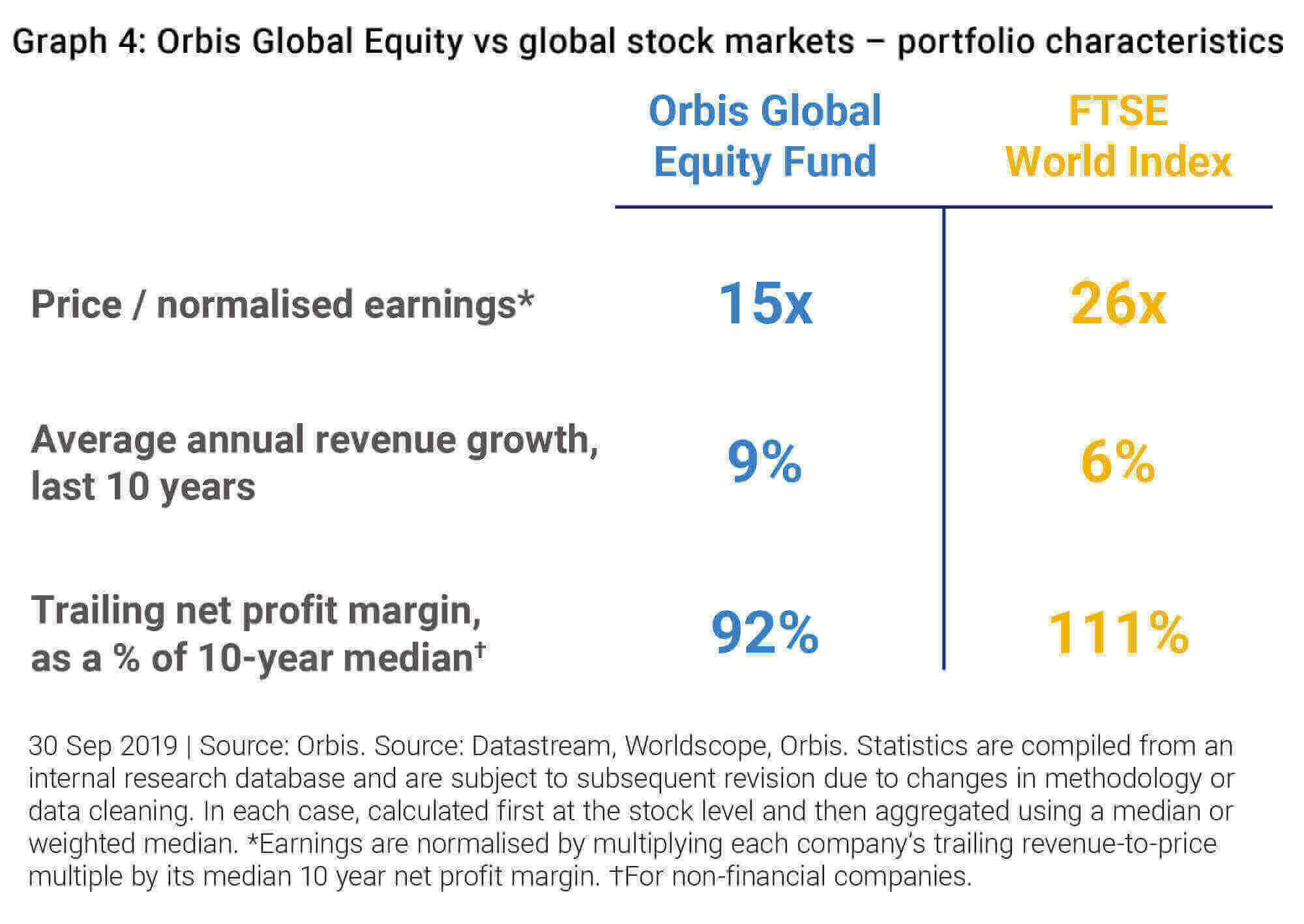

While we are excited about some of the opportunities we’ve found, we’re also pleased to be avoiding areas of the market that look particularly expensive. One example is defensive, low-volatility shares like Coca-Cola, McDonald’s, and Nestlé. The hunt for yield and stability has led to some extreme valuations, with many of these “bond proxies” trading at over 30 times earnings, despite meagre revenue growth over the last 10 years. Over the same period, debt levels for many of these companies have increased. Rather than overpaying for slowing, increasingly leveraged “safe” shares, we’d prefer to underpay for good businesses when investor expectations are nice and low.

A very different portfolio

In short, we are excited about the prospects for our holdings. In aggregate, the average stock held in the Fund is meaningfully cheaper than the FTSE World Index and has better fundamentals. Graph 4 shows the valuation contrasts between the Orbis holdings and the Index as a whole. Remember you can’t buy what is popular and do well indefinitely.

Strong foundations

Historically, some of our most rewarding decisions have come after uncomfortable periods for our clients. Going against the herd is not easy, but our job is to maximise long-term outperformance rather than do what is comfortable. In this pursuit, our interests are tightly aligned with those of our clients.

During tough times, the performance numbers of a good manager experiencing temporary adversity can look identical to those of an unskilled manager. It is then even more important to look at the firm’s overall philosophy to distinguish between them, rather than recent returns. We have a cohesive set of principles that underpins the firm and everything we do. For example, our private ownership structure enables us to pursue a long-term philosophy, and our individual accountability enables us to be contrarian. Importantly, we work tirelessly to make sure our interests are aligned with those of our clients, particularly when it comes to fees. In our view, fees are more than a way of charging, they are a way of aligning interests. The way our fees are structured ensures that our pace of growth is in both clients’ and our interests.

Changes to the Orbis fee structure

Pending various regulatory approvals, we intend to implement fee changes early in 2020 and you will receive additional communication soon. But these are the key principles:

- The new fee structure will lead to lower fees in most circumstances.

- The new fee has a unique mechanism which will allow us to refund previously paid performance fees during periods of underperformance.

- Orbis and its employees cannot thrive unless and until our clients do.

We remain partners in success, not adversaries in failure.