In the spirit of tax season, Carla Rossouw, tax lead at Allan Gray, discusses how investors can make their money work harder using tax breaks. This is always important, but even more so given the past two pandemic years. With the pressure of increasing fuel prices, inflation and the cost of living, every rand put away for one’s future self counts.

Tax efficiency is a key aspect of a healthy financial plan, yet many investors fail to take tax into account when looking at how they can maximise their future investment returns.

By considering the tax implications of your financial decisions and incorporating retirement funds and tax-free investments into your long-term investment strategies, you can improve your chances of retiring comfortably and increase the amount of financial flexibility you have before and at the point of retirement.

Investors must make their money work harder and using the tax breaks is one way to do so. Remember, if you don’t make use of them each year, you forfeit them, so it’s a good idea to familiarise yourself with what’s on offer.

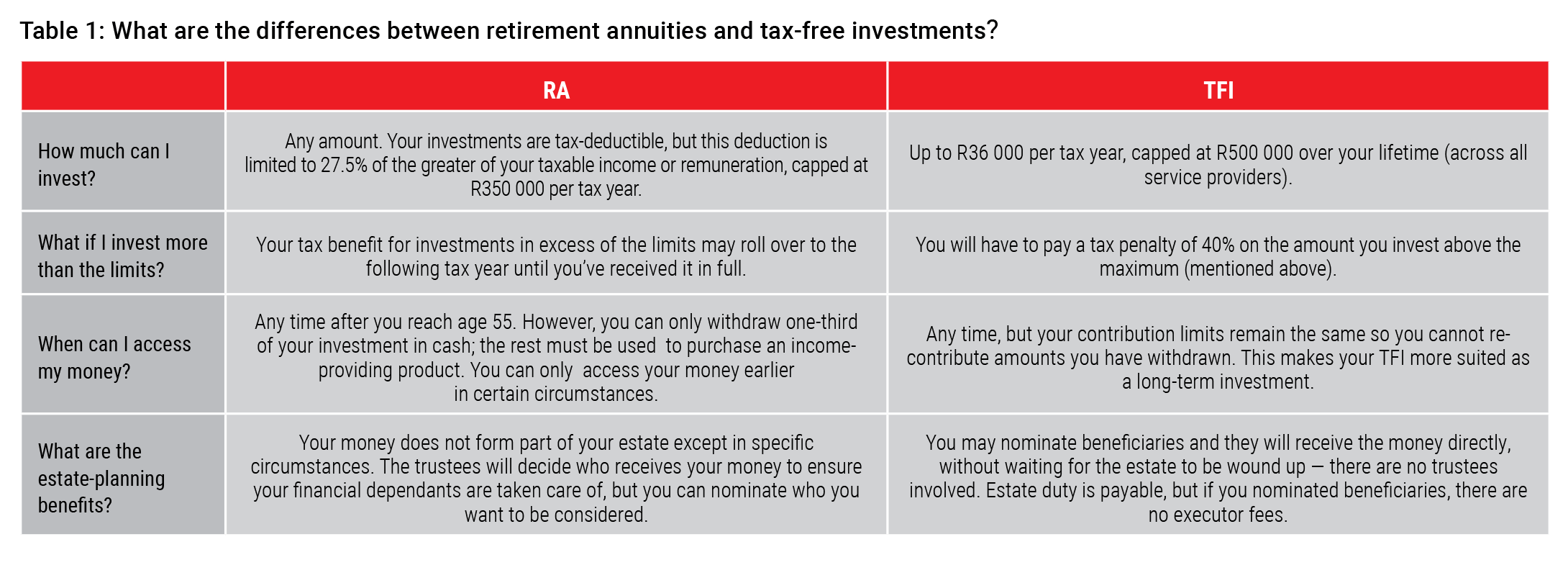

While there are tax benefits associated with both retirement annuities and tax-free investments, the benefits are structured differently, and the product rules are quite distinct. Depending on your goals and objectives, there may be a place for both products in your investment portfolio. A good independent financial adviser can help you decide what products are best for your circumstances.

Understanding retirement annuities

While pension and provident funds are made available through an employer, either through their own fund or an umbrella, a retirement annuity (RA) is a product that investors can hold in their own personal capacity. RAs are not linked to employment and are a good mechanism for saving for retirement for those who are self-employed or those looking to supplement their employer's arrangement.

The government allows you to get a tax deduction on the money you invest up to an annual amount of 27.5% of the greater of taxable income or remuneration (capped at R350 000 annually). However, if you invest more than this, you can still get the tax benefit in the future.

You pay no tax on the interest, capital gains or dividends you earn while invested. In addition, when you die, a retirement annuity doesn’t form part of your estate (except for excess retirement fund contributions used on death to reduce the taxable portion of a cash lump sum taken by your beneficiaries), so there are estate duty advantages too.

You must be able to live with the restrictions: You can only access your money when you retire (after age 55). In addition, you can only take one-third of the amount as a cash lump sum. The rest must be used to purchase an income-bearing product in retirement, such as a living or guaranteed life annuity.

Talking about tax-free investments

A tax-free investment (TFI), on the other hand, is a great way to boost your savings and invest over the long term. Although you invest with after-tax money, you pay no tax on the interest, capital gains or dividends you earn, or on any withdrawals you make. The true benefit of a TFI is felt over the long term as tax-free returns compound.

SARS allows taxpayers to save a maximum of R36 000 per year and R500 000 in your lifetime tax-free if you invest in a TFI. There are, however, tax implications for overcontributing to a TFI: You will incur a tax penalty of 40% on any amount over the contribution limit. This applies when you file your tax return, so you need to keep track of how much you’re contributing each year to your tax-free investments. It is also important to note that any amount that you withdraw during the tax year can’t be recontributed.

Many investors prefer TFIs because of their flexibility. You can access your investment at any point in time. However, your contributions are made with after-tax money, which means they are not tax-deductible. While your tax-free investment forms part of your estate, if it is structured as a life policy, the investment can be paid to your beneficiaries immediately and there are no executor fees.

The right vehicle for the right objective

In weighing up the advantages and disadvantages of RAs and TFIs, investors need to ask themselves which one is best suited to their needs.

Retirement funds offer tax savings now i.e., you pay less tax now because you make contributions with earnings on which you have not paid tax, but you will pay tax when you eventually retire and draw an income. In return, there are rigid legal restrictions on withdrawing your money. Apart from deferring tax in a retirement fund, an additional tax saving comes from paying a lower average tax rate on the benefits withdrawn from your retirement fund at and after retirement, versus the tax saved on contributions. The first R500 000 lump sum you take at retirement is currently tax-free (importantly, this amount includes all previous taxable lump sums received from any other retirement fund or an employer as a severance benefit).

Tax-free investment accounts offer less tax savings and are capped at a lower amount but are less restrictive – they allow you to take your money out at any time.

Table 1 summarises the key differences between the two products. It is not necessarily an either/or decision; depending on your needs, objectives and available disposable income, you could consider investing in both products to increase your tax-free benefits. From a retirement savings perspective, in most cases, retirement funds offer the best tax deal. However, you need to be able to live with the restrictions. For long-term discretionary investments, it probably makes sense to put your first R36 000 into a TFI. Remember, however, that you will need to be disciplined and resist the temptation of withdrawing from your TFI account to enjoy the long-term compounding benefits.

An independent financial adviser can help you craft a financial plan that leverages the various incentives to maximise your long-term returns. They will also help you stay on course as you set out to achieve your long-term financial goals.

The current tax year will come to an end on Monday, 28 February 2022.

If you would like to make additional contributions to your Allan Gray Retirement Annuity or Tax-Free Investment before the end of the current tax year to take advantage of the tax-related benefits these financial products offer, you will need to submit an investment instruction and ensure that the funds reflect in our bank account by no later than 14:00 on Friday, 25 February 2022.