It is difficult to confront our mortality, but the fact is that we are all going to die one day and leave our loved ones behind. As a result, it is important to create a financial plan that makes provision for our dependants. Jaya Leibowitz discusses the tools and financial products that can help you to do this.

Overwhelmed by the idea of death, many investors overlook the importance of good estate planning when thinking about their broader financial plan. Failing to think about what will happen to our assets when we are gone can have dire consequences for our loved ones. When considering estate planning, it is important to understand the death claims process for each of your investment products and make sure that you have taken the necessary steps to make the process as easy as possible for those you will leave behind.

Our top tips for getting your affairs in order

- Keep your will up to date: Having a valid, up-to-date will is essential. Consult with a professional and ensure that you update your will every time there is a life-changing event, such as a marriage, the birth of a child or a death in the family.

- Keep your retirement fund nominees’ details up to date: This will enable the trustees to consider your wishes during their investigation into your circle of dependants at the time of your death.

- Keep the beneficiaries of your various policies up to date: Your living annuity and endowment fund and tax-free investment, if it is structured as a life policy, will generally require you to appoint beneficiaries. Make sure your beneficiary appointments are with your service provider to ensure that your intended beneficiaries receive speedy payment of their benefits.

- Plan for immediate needs: Your loved ones may have immediate financial needs, such as covering funeral costs, and may not be able to access your investments in time. It is important to plan for this appropriately.

- Talk to your beneficiaries, dependants and nominees: Half the task is creating a plan, but it is just as important that you share your plan with the people who need to know. Make sure that your loved ones know what will need to be done in the event of your death, to make the process as seamless as possible.

Start with your will

Having a valid will allows you to determine who inherits your assets after your death. You can draft and execute a will yourself or with the help of a professional, such as an attorney or financial adviser. Your will can be as simple or complicated as you need it to be, but it needs to comply with certain legal requirements in order to be valid.

If you die without a valid will in place, your assets will be distributed according to the Intestate Succession Act. This may result in your assets being inherited by people other than those you would like to leave those assets to. In addition, winding up your estate could take far longer and cost more.

It is recommended that you consult with a professional to assist you with drafting and executing a will, if possible. National Wills Week, taking place from 12 - 16 September 2022, enables South Africans to consult with an attorney, who will assist with the drafting of a will at no cost. For more information on National Wills Week, visit the Law Society of South Africa’s website.

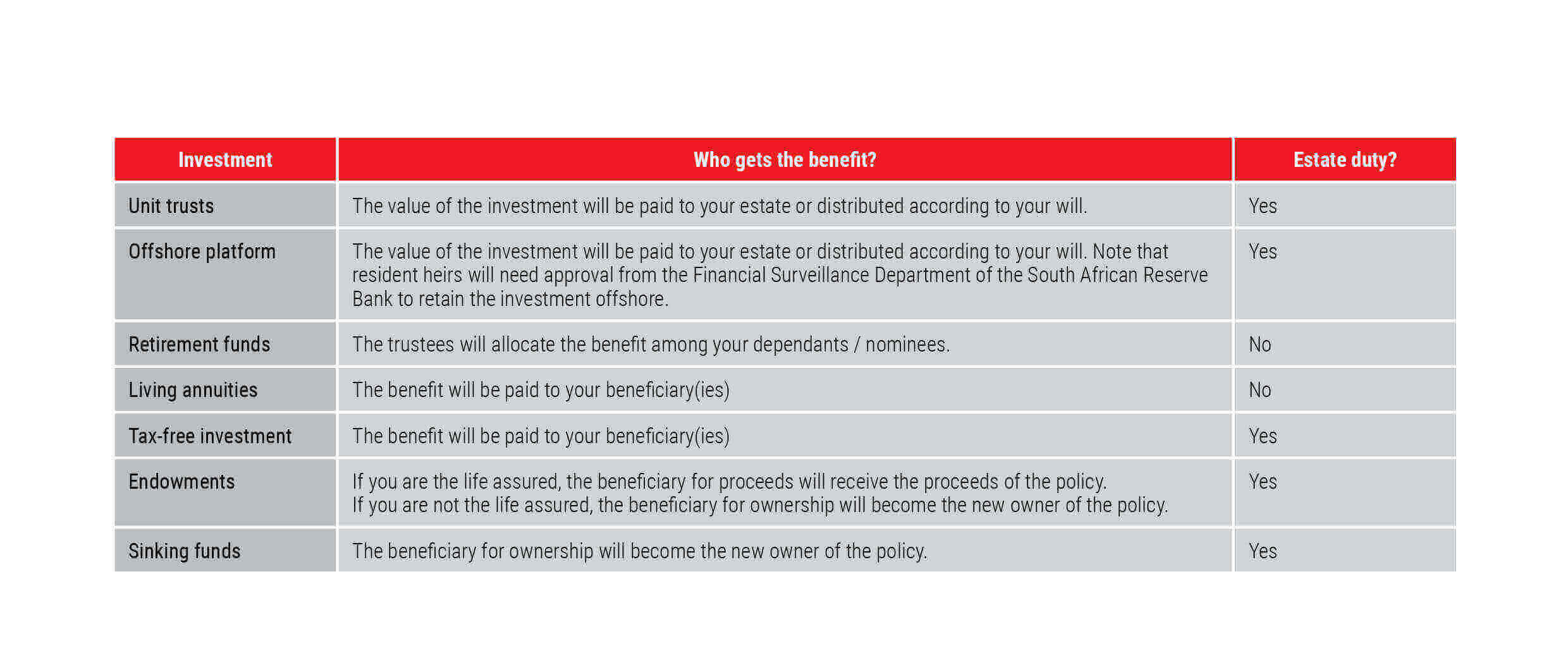

There are some financial investments, such as unit trusts, that must be dealt with in your will, but others, such as retirement funds, have different legal requirements. Knowing how to deal with each type of investment is important.

Investments that must be included in your will

Unit trusts

Investments in unit trusts (collective investment schemes) must be included in your will as they form part of your estate when you die. Your executor will then ensure they are distributed according to the instructions set out in your will.

Offshore investments

Foreign-currency investments via the Allan Gray Offshore Investment Platform (AGOS) should be included in your South African will but may also be included in a foreign will. If included in your South African will, your AGOS investment will not be subject to the administrative complications of estates law in offshore jurisdictions or require the appointment of a foreign executor, as is the case with many offshore-domiciled investments. Your South African executor will then ensure that your investment is distributed according to the instructions in your will.

Both unit trust and offshore investments will be included as property in your estate for the purposes of calculating estate duty.

Investments that do not need to be included in your will

Retirement funds: pension funds, provident funds, preservation funds and retirement annuity funds

If you die while you are a member of a retirement fund, the Pension Funds Act states that the trustees of the fund must determine how your benefit is to be distributed to your dependants and nominees. The trustees are required to:

- Identify and trace your dependants:

Dependants include spouses, children, anyone financially dependent on you at the time of your death, anyone entitled to maintenance and anyone who may have become financially dependent on you in the future. - Allocate the benefit among your dependants and nominees in an equitable manner:

You are entitled to nominate people who you would like to receive the benefit after your death. A nominee may be a dependant or someone who is not a dependant, such as a friend, sibling or parent. A nomination does not guarantee that the person will receive all, or a part, of the benefit, but it does mean that the nominee must be considered by the trustees when allocating the benefit. - Decide how the benefit will be paid:

The trustees may decide to pay the benefit directly to the beneficiary, to a beneficiary’s legal guardian or to a trust created for the benefit of the beneficiary. If your will provides for a testamentary trust to be created for the benefit of minor children and you would like your retirement fund benefit to be paid into the trust in the event of your death, you must submit this request to the administrator of your retirement fund in writing. The trustees of the fund will not be required to give effect to the request, but will take it into consideration when deciding on how to pay the benefit.

It is important to understand that this process can take time as the trustees have up to 12 months to identify and trace dependants and may need additional time to consider all the factors that are relevant for them to make a decision that is equitable.

Once the retirement fund benefit has been allocated by the trustees, the beneficiaries will be entitled to elect whether to:

- Transfer the benefit to a living or guaranteed life annuity, which will pay them an annuity income;

- Take the benefit as a cash lump sum, which may be taxed; or

- Take a combination of a cash lump sum and a living or guaranteed life annuity.

As these options have different tax consequences, it is always recommended that beneficiaries seek financial advice before making their decisions.

Subject to certain exceptions, retirement death benefits are not included as property in your estate for the purposes of calculating estate duty.

Living annuities

One of the key features of a living annuity is that your investment can be left to your beneficiaries. This contrasts to guaranteed life annuities that usually end when you die.

If you have a living annuity, you are entitled and encouraged to appoint beneficiaries, which may include a trust, to receive the benefit in the event of your death. Each beneficiary will be entitled to elect to:

- Transfer the benefit to a living or guaranteed life annuity in their own name, which will pay them an annuity income;

- Take the benefit as a cash lump sum, which may be taxed; or

- Take a combination of a cash lump sum and a living or guaranteed life annuity.

Again, these options have different tax consequences, so it is recommended that beneficiaries seek financial advice before making their decisions.

Subject to certain exceptions, a living annuity death benefit is not included as property in your estate for the purposes of calculating estate duty.

Tax-free investments

The Allan Gray TFI is different from some other TFI products because it is structured as a life policy, providing estate-planning advantages.

If you own an Allan Gray TFI, your appointed beneficiaries will receive the proceeds of your investment once Allan Gray has received confirmation of your death. As the proceeds do not have to be paid to your estate, your beneficiaries will receive the cash benefit without delay.

A TFI will be included as property in your estate for the purposes of calculating estate duty.

Endowments and sinking funds

Endowments and sinking funds are investment policies that cater for investors with a marginal income tax rate higher than 30%, and they are also useful for estate planning. These are quite complex products, in that they don’t necessarily come to an end when you die and are subject to various restrictions.

As the person investing in the Allan Gray Endowment, you will be known as the policyholder, or the owner of the investment. You must decide whether to appoint a life assured. When the last life assured dies, the endowment policy comes to an end. You can be the life assured, or you can appoint other people. The difference between an endowment and a sinking fund is that an endowment policy has a life assured, while a sinking fund policy does not. As a result, a sinking fund policy only comes to an end when the owner withdraws their entire investment.

There are two different types of beneficiaries that can be appointed on an endowment policy:

- Beneficiary for proceeds:

This beneficiary will receive the proceeds of the policy when the last life assured dies. The money in the endowment will be paid to the beneficiary directly in cash, avoiding any delays that may apply to the winding up of your estate. - Beneficiary for ownership:

Where the policyholder and the life assured are different people, the policyholder can nominate a beneficiary for ownership. If the policyholder dies, the beneficiary for ownership will become the new policyholder and will be able to access the investment immediately.

Since a sinking fund policy doesn’t have a life assured, only a beneficiary for ownership needs to be appointed.

Endowments and sinking funds will be included as property in your estate for the purposes of calculating estate duty.

Overview