The vast selection of fund managers and offshore unit trusts available globally makes offshore investing daunting even for more experienced investors and financial advisers. Offshore investment platforms go some way to narrowing down this choice, but investors still often make their selection without access to enough information about how the available funds compare against each other, and against other global managers.

Investors are encouraged to do their homework. Past performance is often an indicator of investment management skill, but if so, it is historic skill. Past performance always also includes an element of good or bad luck, especially over shorter periods. Whether or not you can expect a fund manager to deliver good future performance will depend on their philosophy, their investment processes and the quality of their people. A good basis upon which to pick a manager would be to look for one that applies a consistent investment philosophy throughout market cycles, that conducts a rational process to implement this philosophy and that has a proven team in place to implement this philosophy and process.

Without access to all this information, or if you lack the time and appetite to do the research yourself, it may help to consult independent fund ratings, but be sure to check that they are backed up by reliable research and evidence and a qualitative approach, that looks further than just past performance.

Adding to the information we offer to you

Our guided selection on the Allan Gray Offshore Platform is based on the views of independent financial advisers, which we test through an annual survey. All funds that are registered with the Financial Services Board (FSB) and that are of a minimum size for liquidity purposes can be voted in by advisers. We do not endorse or recommend any of the funds on our platforms except for those from the Allan Gray and Orbis group of companies. That said, we know that many investors and their advisers are looking for more information to help them compare similar funds and make their investment decisions and we have been looking for some time to find a high quality, unconflicted way to help. To fill this need, we have engaged the services of an independent, owner-managed financial services group, Fundhouse, to review and rate all of the funds on our Offshore Platform, including the Orbis and Allan Gray funds. We believe that this will help investors to assess whether or not their fund choice is appropriate in the long term.

Fundhouse’s ratings methodology

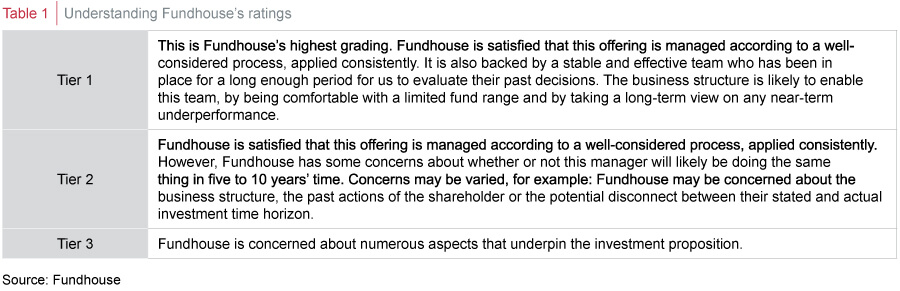

Fundhouse applies a bespoke qualitative approach to fund ratings. The team analyses each fund manager, looking at the business and shareholders, the investment edge and process, the experience of the team, their decision-making skills and past investment actions. They gather detailed evidence by engaging in face-to-face interviews with investment teams and conducting due diligences. Analysts gather as much information as possible to ensure that the evidence is relevant to future outcomes and not based on past returns. At the end of this process a rating is attributed to each fund (see Table 1 for an explanation of Fundhouse’s ratings).

Fundhouse will conduct ongoing annual fund manager reviews to ensure that managers are maintaining their ratings. This should help investors and their advisers maintain confidence in their decisions.

Benefits of fund ratings

Fund ratings performed by an independent party should give investors some comfort that their investment decision is based on fact rather than ‘gut feel’. From an adviser’s point of view, fund ratings are useful when putting together client advice records: all funds on our Offshore Platform will have research documents to back them up, available by a reasonably priced subscription directly with Fundhouse. Providing ratings is in keeping with international trends – in Australia, for example, only funds that have been rated and that pass muster are available for investments on retail platforms and in superannuation funds. In addition, providing ratings aids our alignment with the FSB’s initiative to promote Treating Customers Fairly (TCF) in the financial services industry.

The fund ratings will appear on our Offshore Platform fund list. Advisers who wish to read the detailed reports and evidence behind the ratings can do so by signing up for Fundhouse’s subscription-based Adviser Online portal.

Fundhouse Adviser Online

Fundhouse’s subscription-based online services provide you with content and tools, investment reviews, fund research and ratings, surveys and benchmarking specifically developed for financial advisers. For more information on Fundhouse Adviser Online, or to register for the Fundhouse Adviser Programme, please click here or log into your secure Allan Gray account and register via Adviser Services.

Allan Gray Proprietary Limited is an authorised financial services provider.