When magicians perform they often draw your eyes away from the simple sleight of hand or hidden trapdoor that makes the trick. This skill is called the prestige: without it, tricks often fail to captivate. Tricks can be entertaining but in the world of investing it is much better to rely on the mundane. Thandi Ngwane explains the wonderful but boring ‘magic’ of investing.

We are often asked by clients and prospective clients what the magic trick is that can turn a portion of your income into a comfortable retirement. It is hard to accept an extraordinary result by ordinary means. This desire is a fault in human behaviour that can have devastating consequences when it comes to saving for retirement: we rely too strongly on a ‘wing and a prayer’, when what we need is time and commitment.

Follow these five investment principles and give yourself the potential to experience the ‘magic’ first-hand.

1. Start with a plan

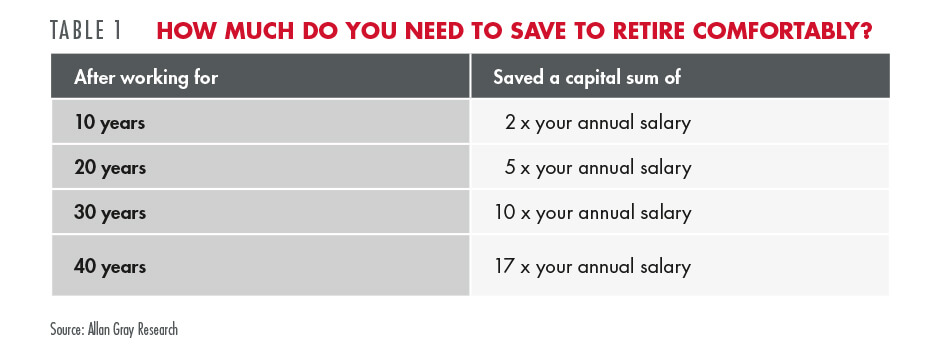

Set a goal that you can aim for. Here are some simple parameters: Based on a reasonable set of assumptions*, you should be aiming to have accumulated 17 times your final pre-retirement salary at retirement. If your spending or investment returns are very different to the assumptions, your circumstances may require less or significantly more. You can also check your progress along the way by looking at Table 1 below. You will note that the sum required to meet that goal accelerates as you approach retirement age, but most of the return at that stage will come from compounding.

*11% investment return, income required of 75% of final salary in retirement, 4% drawdown or income yield after retirement

2. Earn returns that are higher than inflation

To earn real returns you need to take some risk. Risk means investing in things with an uncertain outcome over the short term, which implies that the ride will not always be smooth. Even in a prudently managed portfolio, like the Allan Gray Balanced Fund, over one year your returns can sometimes move up and down quite dramatically. The key is not to be shaken out by an adverse period. If you take a long-term approach and look at returns over three and five-year periods, short-term ups and downs tend to smooth out over time.

3. Avoid switching, which involves predicting what you think will happen in the future

A similar exercise is done by goalkeepers defending a penalty. The conventional wisdom is that you need to guess which way the penalty taker will kick the ball and then leap with conviction in that direction. A study done at the University of Negev showed that this method only worked 20% of the time, but taking a wait-and-see approach by standing in the centre and seeing which way the ball goes increases penalty saves to 33%. But keepers are most motivated to avoid the worst-case scenario: looking like they did nothing while a goal was scored.

In the same way when we are confronted by uncertain markets we have a bias for action. It is difficult to stay consistent and do nothing in a down market – but often this is the best thing to do as switching (i.e. selling out of one investment to buy another) can destroy value. It should not be more important to seem like you have done something than it is to get results in the long term. Doing too much can be your undoing.

4. Diversify - in a meaningful way

The metaphor often used when talking about diversification is to avoid putting all your eggs in one basket. Some investors take this to mean that you need to spread your investments across many different unit trusts. This can work if you are invested in different assets or if the unit trusts are managed in a different way from one another. The metaphor breaks down when you invest in many similar unit trusts. When you invest in the Allan Gray Balanced Fund you have exposure to more than 100 holdings in different asset classes, i.e. it is very well diversified. Investing in multiple balanced funds won’t necessarily give you greater diversification, it will simply spread your investment more finely, potentially meaning that you get no better than average market returns while paying higher fees.

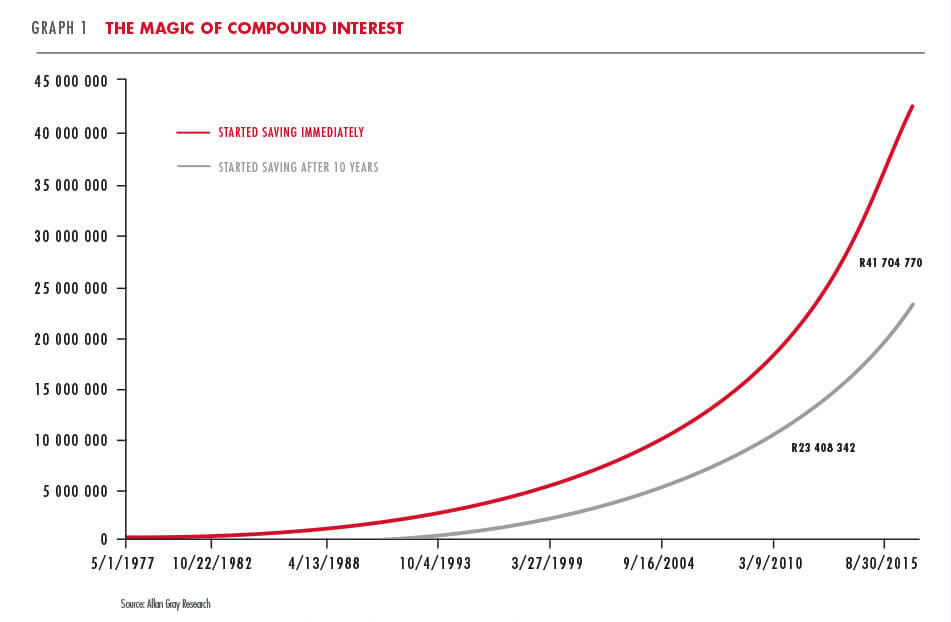

5. Start as soon as you can

Many of us act as though skipping retirement savings for the first 10 years has minimal consequences. In Graph 1 the grey line shows investors starting to save after 10 years of working and contributing 15% of their salary, based on a starting salary of R20 000, increasing by inflation every year, with an investment return of 11%. The red line shows investors who earn the same, but started contributing from their first pay cheque. The difference illustrates the magic of compound interest, the key ingredient of which is time. Missing those first few years of saving can result in losing almost half of the returns you may get. Even if you have not started yet, the best time to start is still now. These tips seem basic, but implementing them consistently is not easy. As much as we crave a magical solution, pulling a comfortable retirement out of the hat is more about simple and steady than pulling off a grand trick.