In Quarterly Commentary 1, 2013 we wrote about retirement reform, discussing how the changes would affect existing and potential retirement fund members. Fast forward two years and most of the mooted changes have been delayed until at least 2016. But the delay in regulation is no reason to delay saving for retirement. The changes are positive, on the whole, and will make for a better, more well-rounded industry. Overall, Treasury wants us to save more and take less out along the way. Ultimately, this will lead to South Africans accumulating more retirement savings and thus enable smarter long-term choices when we retire.

Richard Carter discusses the benefits of saving for retirement through a modern unit trust-based retirement annuity fund, and how retirement annuities can be managed on a group basis to provide an excellent group savings solution for small to medium-sized businesses.

The 2015 Budget reminded us that retirement reform is an ongoing process, with several of the proposed changes potentially coming into effect on 1 March 2016 at the earliest.

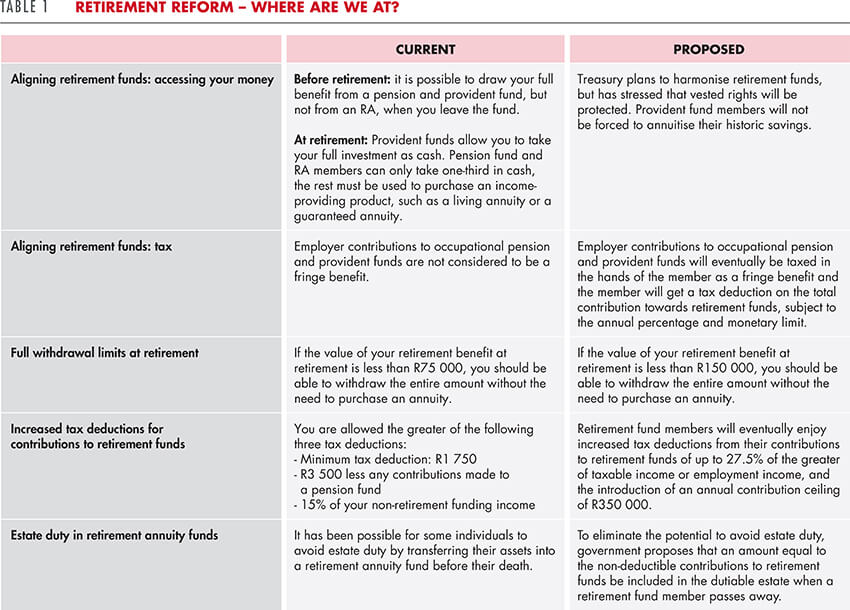

Table 1 outlines where we are at. Understandably, potential investors would rather have certainty before making investment commitments. Delaying saving while waiting for clarity is a bad idea. The importance of starting to save for retirement sooner rather than later cannot be underestimated. We can't get time back once we have spent it.

Accumulating enough capital to live comfortably in retirement is a daunting task for most people. To get this right you need to start investing early in life, keep putting aside enough on a regular basis, invest the money wisely and don't dip into your accumulated capital along the way. Getting any of these four ingredients wrong can undermine the end result. There has been uncertainty in the retirement landscape for some time, and we don't expect this to go away overnight. An investor who took a break from saving for the last two years could easily find themselves more than two years behind, as not only have they put aside less capital and missed out on market growth, but they have also set their level of consumption higher. For many of us, the more we spend now, the harder it will be to live off less in future.

YOU NEED TO START INVESTING EARLY, KEEP PUTTING ASIDE ENOUGH, INVEST THE MONEY WISELY AND DON'T DIP INTO ACCUMULATED CAPITAL

Take advantage of tax perks

The government encourages us to save for retirement by offering tax benefits for using approved retirement savings products, such as a retirement annuity fund (RA). RAs are effectively personal retirement funds that, because they aren't linked to your employer, go where you go. They give self-employed people a tax incentive to save for retirement, and are also an excellent way to increase retirement savings outside of your employer's pension or provident fund. In addition, RAs are already structured to enforce preservation and provide for an easy transition into a pension at retirement – which are key elements of the retirement reform proposals.

A solution for groups

If you are an employer, consider offering your staff an RA as a benefit. Employers who illustrate to their staff that they care about their futures by providing them with a retirement savings solution, along with investor education, are likely to see increased employee engagement. Happy, engaged employees are less likely to start looking for greener pastures.

In many ways Group RAs can be a better choice for employers and their employees than other retirement funding options, such as umbrella funds, which can have higher costs and time consuming administrative requirements.

An efficient group retirement annuity system allows employers, particularly those in small- to medium-sized businesses, the time to manage their businesses, while avoiding tedious administration requirements, all the while not detracting from the importance of retirement saving for their employees. Group systems also ensure that employees get all the benefits of an individually managed unit trust-based RA. These include:

- Tax advantages Contributions to an RA (within certain limits) are tax deductible, and the returns employees earn while invested in an RA are tax free. However, at retirement any cash lump sum taken will be taxed according to the retirement tax tables and the portion transferred to a pension-providing product will be taxed at the marginal tax rate.

- Investment control. Employees can choose the right unit trust to match their individual needs and circumstances. Keep in mind that, unlike a bank account, return is not guaranteed and may go up and down.

- Flexibility and portability. Employees can change their unit trust choice and their contribution amount, stop and restart contributions or add to their investment at any time, without fees or penalties. If an employee changes jobs, he/she can continue to contribute to their RA.

- Investment protection. An RA ensures that employees' retirement investments are kept for their retirement because they will not be able to access their RA investment until they turn 55, and neither can any potential creditors.

- Transparency, communication and education. Approaches to communication vary depending on the RA provider. At Allan Gray we believe it is essential to give members ownership and a sense of responsibility for their investment. Members can register for a login for our secure website, which allows them to monitor and manage their investment online. We also offer member training and education.

How do traditional employer retirement funds differ from modern unit trust-based RAs?

Unlike an RA, where anyone can invest in their own right, in traditional pension or provident funds, contributions are deducted from employees' pre-tax salary. Employees often have little control over their investment and when they leave their employer their membership of the fund ends.

Some employer funds give employees a specified retirement benefit – or pension – when they retire. These funds do not give members investment choice or control. In other funds, the benefit is not guaranteed and depends on how much is contributed and how well the investment performs. In these funds, members may be allowed some degree of investment choice.

In comparison, modern unit trust-based RAs simply wrap around a unit trust investment. Members decide how their money is invested (within legal limits), which means they have more control over their potential investment return than they would in traditional employers' retirement funds.

As an employer considering whether to go with a more traditional retirement fund, such as an umbrella pension fund, or a group RA, we think you should focus on three key points:

- Consider the investment options available. While many products give access to great investment managers, not all do, and you want to be sure that your employees' savings will be made to work as hard as possible by managers who are striving to deliver the best returns for the risk taken.

- Look at the costs and transparency of disclosure. The range of fees and charges of different products can be bewildering. Don't assume that the costs are similar in all retirement savings arrangements – they can be wildly different and these differences, compounded over a working lifetime, can be the difference between your employees enjoying a comfortable retirement or not having enough to live off.

- Bear in mind what happens to your employees' retirement savings if they exit your employment before retirement. In a conventional retirement fund employees have the opportunity to take all the accumulated savings. If they don't invest these wisely, they end up having to start saving for retirement all over again. By contrast, when they leave a group RA, their individual RAs go with them. While this means no access to cash at a time when some cash may be useful, the discipline of having a pot of money which will be there when you finally retire, empowers people to secure a better future.