Whether you want to save for your retirement, a child’s education or an overseas trip, starting now can significantly reduce the cost of reaching your goals. Shaun Duddy, senior manager in the Product Development team, discusses the cost of delaying your saving and investment journey.

Each month that you put off saving in favour of spending either increases the amount that you will have to save in the remaining months, or pushes out the date at which you will reach your goal. Starting to save earlier allows you to extract maximum benefit from the power of compounding. Choosing to invest when you start to put money aside often leads to concerns about the ‘right time’ to invest; the right time is now. You can’t get time back once you’ve spent it.

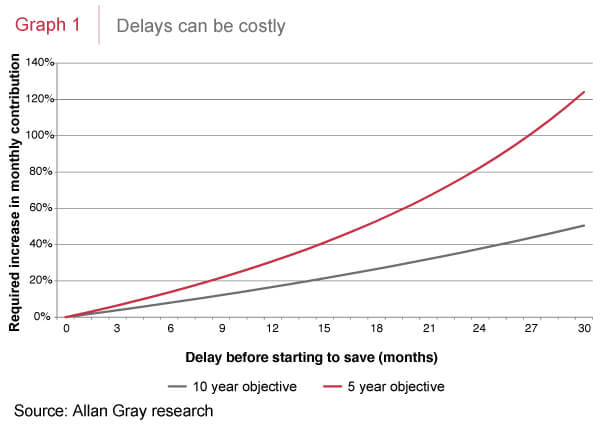

Graph 1 shows that if investments are returning 9% per year and you need to meet your objective in 10 years’ time, delaying saving for just 18 months will increase the amount you need to save per month by more than 25%. With less time on your hands, the cost of a delayed start is naturally even more pronounced. The red line on the graph illustrates that when your timeframe is five years, an 18-month delay results in more than a 50% increase in the amount required per month of saving.

Time in the market versus timing the market

It is true that you receive better value for money if you invest after the market has fallen, rather than at its peak. However, this does not mean that you should put off saving if you are unsure what the market is going to do next. In all but the most extreme situations, the cost of putting off saving exceeds the benefit of starting at the bottom. This is because even money that has decreased in value is a better contribution to a long-term objective than money that has been spent on short-term gratification.

Adopt a long-term approach

A key step when planning is choosing your investment based on your risk profile and priorities and then staying invested to reap the benefits. You may be tempted to time the market by investing into a money market fund for the first few months of saving and then switching into another fund, for example an equity fund, when you believe the market looks more attractive.

Although you may be able to make some gains by starting in this way, if these first contributions are a small percentage of your total contributions, the overall effect at the end of the investment term is likely to be small. This small benefit comes at the cost of having to carefully research and monitor the market and a selection of funds and then making a call when you believe the time is right. However, with no crystal ball available, you run the risk of mis-timing the market and benefiting even less from your strategy.

More dangerous is an ongoing strategy of trying to time the market. Switching can significantly detract from value and in discretionary investments, switching can trigger capital gains tax. Once you have chosen an investment, your ability to make the most of it depends on whether you are able to remain committed for long enough to benefit from the potential returns, ride out the inevitable short-term ups and downs and allow the power of compound interest to increase the value of your money.